Finance

How To Get Cash With Capital One Credit Card

Modified: March 1, 2024

Looking to get cash with your Capital One credit card? Learn how to do it with our finance guide and start maximizing your benefits today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Have you ever found yourself in a situation where you need quick access to cash, but don’t want to deal with the hassle of applying for a loan or withdrawing from your savings account? If so, you’ll be glad to know that your Capital One credit card can come to the rescue. While most people think of credit cards as a way to make purchases, they can also be used to get cash when needed – through a process known as a cash advance.

A cash advance is a convenient way to get quick access to funds using your credit card. With a Capital One credit card, you can withdraw cash from an ATM or even get cash directly from a bank teller. This allows you to have immediate access to money for emergencies, unexpected expenses, or any other situation where cash is necessary.

In this article, we will delve into the details of how to obtain a cash advance on your Capital One credit card. We will explore the process of requesting a cash advance, discuss the fees and interest rates associated with it, and provide alternatives to cash advances. By the end, you’ll have a clear understanding of how to use your Capital One credit card to get cash when you need it most.

Understanding Cash Advances

A cash advance is a financial transaction that allows you to borrow money against your credit card’s available credit line. Unlike making a purchase with your credit card, where you are essentially borrowing money and paying it back later, a cash advance involves borrowing actual cash. This means that the amount you withdraw will be added to your credit card balance and will accrue interest immediately.

One important thing to note is that cash advances usually have a higher interest rate compared to regular credit card purchases. This is because the lender assumes a higher risk when providing cash rather than a tangible product or service. Therefore, it’s important to be aware of the interest rate associated with cash advances and factor it into your repayment plans.

It’s also worth noting that cash advances typically have a separate credit limit or cash advance limit, which may be lower than your overall credit limit. This means that you can only borrow up to a certain amount as a cash advance, regardless of your available credit limit.

Cash advances can be obtained in different ways. Most commonly, you can withdraw cash from an ATM using your credit card and a Personal Identification Number (PIN) assigned by your card issuer. Some credit cards also allow you to obtain cash directly from a bank teller. However, it’s important to note that not all ATMs or banks accept credit card cash advances, so it’s a good idea to check with your card issuer or look for ATMs displaying the “cash advance” option.

While cash advances provide convenient access to quick cash, it’s important to use them responsibly and only when necessary, as the associated fees and interest rates can add up quickly. Understanding the terms and conditions of your cash advances is crucial to avoid any surprises when it comes to repayment.

How to Request a Cash Advance

Requesting a cash advance with your Capital One credit card is a relatively simple process. Here are the steps you need to follow:

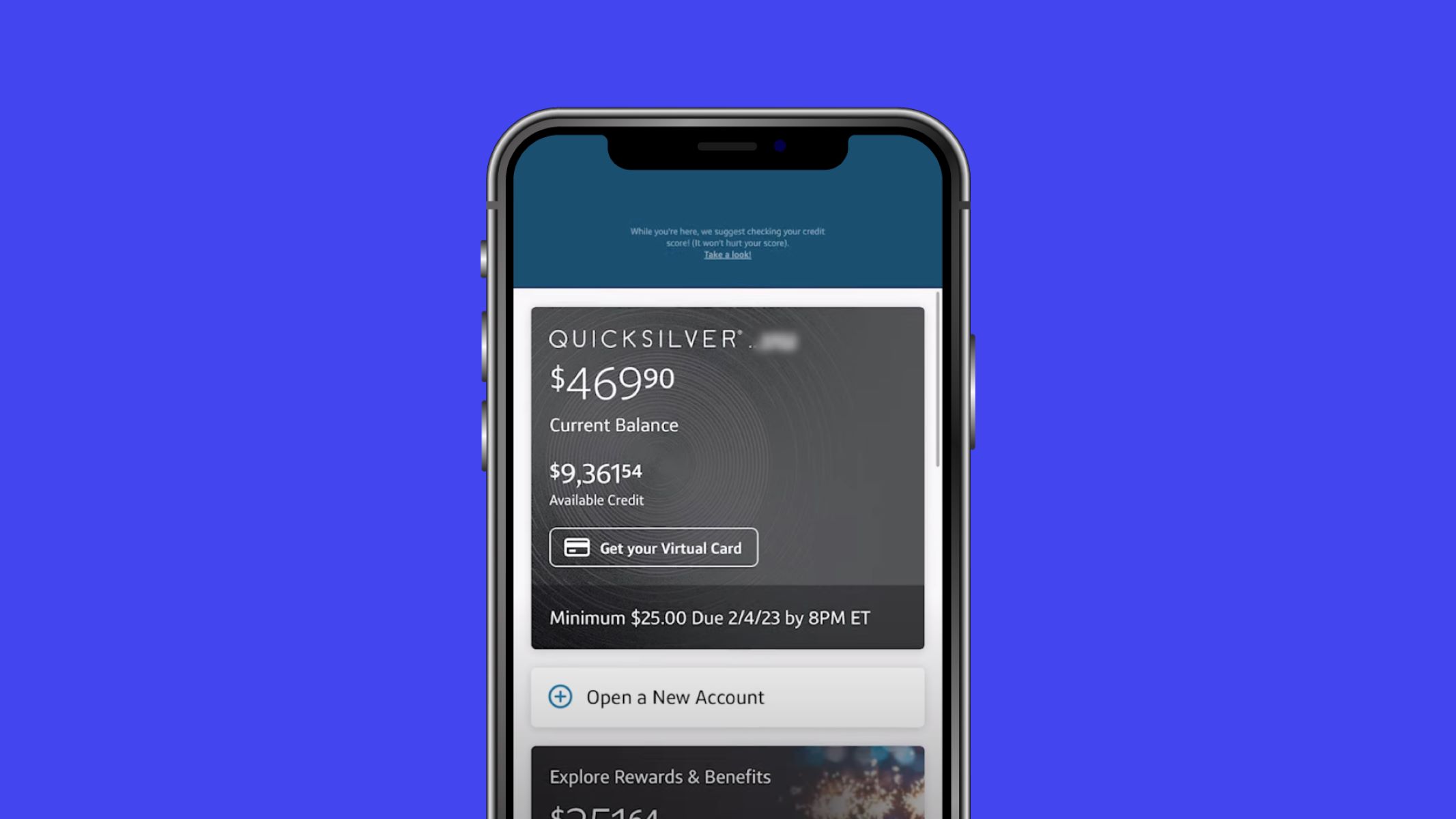

- Check your available credit limit: Before requesting a cash advance, make sure you have enough available credit on your Capital One credit card. You can check your available credit limit through your online account or by contacting Capital One’s customer service.

- Choose the method of obtaining cash: Decide how you want to obtain your cash advance. You can either withdraw cash from an ATM using your credit card and PIN, or you can visit a bank and request a cash advance from a teller.

- Locate an ATM or bank: If you plan to withdraw cash from an ATM, find a machine that accepts credit card cash advances. Look for ATMs displaying the “cash advance” option or consult the card issuer’s website for a list of eligible ATMs. Alternatively, if you prefer to visit a bank teller, find a local branch of your bank where you can request a cash advance.

- Verify your account and identity: At the ATM, insert your Capital One credit card, enter your PIN, and follow the prompts on the screen to request a cash advance. If you are at a bank, present your credit card and valid identification to the teller and let them know you would like to request a cash advance.

- Specify the amount: Once your account and identity have been verified, you will need to specify the amount of cash you would like to withdraw. Take into consideration any fees and interest rates associated with the cash advance, as they will affect your total balance.

- Accept the terms and conditions: Before the cash is dispensed or handed to you, you may be required to review and accept the terms and conditions associated with the cash advance. Make sure to read them carefully and ask the teller or ATM for clarification if needed.

- Collect your cash and receipt: Once you have completed the necessary steps, collect your cash from the ATM or the teller. It’s always a good idea to request a receipt to keep track of the transaction and have a record for your own reference.

Remember, requesting a cash advance is effectively borrowing money that will accrue interest from the moment it is withdrawn. It’s important to have a clear plan for repaying the cash advance to avoid accumulating excessive debt and interest charges.

Cash Advance Fees and Interest Rates

When requesting a cash advance on your Capital One credit card, it’s important to be aware of the fees and interest rates associated with this service. Cash advances typically carry higher fees and interest rates compared to regular credit card purchases. Here’s what you need to know:

1. Cash Advance Fee: Most credit cards, including Capital One, charge a cash advance fee, which is a percentage of the total amount you withdraw. This fee is typically around 3% to 5% of the cash advance amount, with a minimum fee set by the card issuer. For example, if you withdraw $500 as a cash advance and your credit card charges a 5% fee, you will incur a $25 fee for the transaction.

2. ATM Fee: In addition to the cash advance fee, some ATMs may charge a separate fee for using their machine to withdraw cash. This fee is determined by the ATM owner and is separate from the cash advance fee charged by your credit card issuer. Make sure to check for any additional ATM fees before proceeding with the cash advance.

3. Interest Rates: Cash advances also come with higher interest rates compared to regular credit card purchases. While the interest rate for purchases may range from 15% to 25% APR, cash advances often have a higher APR, typically ranging from 25% to 30% or more. It’s important to understand that interest on cash advances begins accruing immediately, meaning you will start paying interest on the withdrawn amount from the day of the transaction.

4. Grace Period: Unlike regular credit card purchases, cash advances do not usually have a grace period. This means that the interest on the cash advance amount starts accruing right away and continues to accumulate until the balance is paid off in full. It’s important to consider this when planning your repayment strategy to minimize interest charges.

5. Payment Allocation: When you make a payment towards your credit card balance, the card issuer may allocate your payment towards the lower interest rate balances first, such as regular purchases, rather than the higher interest rate balances, such as cash advances. This can result in more interest accruing on the cash advance balance until the lower interest balances are paid off. It’s important to understand your card issuer’s payment allocation policy to effectively manage your cash advance and minimize interest charges.

Overall, it’s essential to consider all the fees and interest rates associated with cash advances before requesting one on your Capital One credit card. Although cash advances can provide immediate access to funds, it’s important to use them sparingly and repay them as quickly as possible to avoid accumulating unnecessary debt and high interest charges.

Repaying Your Cash Advance

After you have obtained a cash advance on your Capital One credit card, it’s crucial to have a repayment plan in place to avoid unnecessary interest charges and potential financial strain. Here are some key points to consider when repaying your cash advance:

1. Minimum Payments: Like any other credit card balance, your cash advance balance will require a minimum monthly payment. This minimum payment typically includes a percentage of the total balance, plus any interest charges and fees. It’s important to make at least the minimum payment by the due date to avoid late payment fees and damage to your credit score.

2. Paying more than the minimum: While the minimum payment keeps your account in good standing, paying only the minimum will result in a more extended repayment period and higher overall interest charges. Ideally, you should aim to pay more than the minimum payment each month to reduce your cash advance balance more quickly and save on interest.

3. Prioritize high-interest balances: If you have multiple balances on your credit card, such as purchases and cash advances, consider prioritizing the repayment of the higher interest balance. This will help minimize the interest charges accrued over time. Check with your card issuer to understand how payments are allocated and ensure that your extra payments are applied to the cash advance balance.

4. Avoid cash advance interest charges: Interest on cash advances typically starts accruing immediately after the transaction. To minimize interest charges, aim to repay your cash advance as soon as possible. If you have the means, consider repaying the entire cash advance balance in a single payment to avoid any additional interest charges.

5. Create a repayment schedule: To stay organized and on track with your cash advance repayment, create a repayment schedule or budget that outlines your goals and the amounts you plan to repay each month. This will help you stay focused and motivated to pay off the balance efficiently.

6. Avoid cash advances in the future: While cash advances can provide immediate access to funds, they come with higher fees and interest rates compared to regular credit card purchases. It’s generally advisable to explore alternative options like using your savings, seeking financial assistance, or considering a personal loan before resorting to a cash advance.

Remember, the key to successfully repaying your cash advance is to be proactive and disciplined with your payments. By making consistent and timely payments, you can clear your cash advance balance and get back on track with a healthier credit card balance.

Benefits and Considerations of Using a Capital One Credit Card for Cash Advances

Using a Capital One credit card for cash advances can offer several benefits and conveniences, but it’s essential to consider certain factors before deciding to utilize this service. Let’s explore the benefits and considerations of using a Capital One credit card for cash advances:

1. Convenience: Having access to cash through your credit card can be incredibly convenient, especially in emergency situations where you need immediate funds. Whether you need to cover a medical expense, repair a vehicle, or deal with any unexpected expense, having the ability to obtain cash quickly can provide peace of mind.

2. Wide Acceptance: Capital One credit cards are widely accepted globally, providing you with the convenience of accessing cash advances at ATMs and financial institutions worldwide. This means you can rely on your Capital One credit card for cash advances no matter where you are located.

3. Rewards and Benefits: Some Capital One credit cards offer rewards programs that allow you to earn cash back, airline miles, or other rewards on your spending. By using your credit card for cash advances, you may also earn rewards on these transactions, helping you maximize the benefits and value of your credit card.

4. Credit Limit Utilization: Utilizing a cash advance can be an effective way to use your available credit limit when you need it. If you have a low balance on your credit card but need immediate funds, a cash advance can help you access available credit without relying on external sources.

While using a Capital One credit card for cash advances can be beneficial, it’s important to consider the following factors as well:

1. Higher Fees and Interest Rates: Cash advances typically have higher fees and interest rates compared to regular credit card purchases. You need to be mindful of the associated costs and ensure that you can comfortably repay the cash advance in a timely manner to avoid excessive interest charges.

2. Impact on Credit Utilization: Taking a cash advance will increase your credit card balance, potentially affecting your overall credit utilization ratio. Higher credit utilization can have a negative impact on your credit score. It’s crucial to consider the impact on your credit and only use cash advances when necessary.

3. Repayment Responsibility: Repayment is essential, and you should have a clear plan to pay off the cash advance as quickly as possible. Defaulting or making late payments can result in additional fees and negative consequences for your credit score.

4. Other Alternatives: Before opting for a cash advance, explore alternative options to meet your financial needs. Consider utilizing savings, seeking assistance from friends or family, or exploring lower-cost borrowing options like personal loans or lines of credit.

By weighing the benefits and considerations, you can make an informed decision about using your Capital One credit card for cash advances. It’s crucial to utilize this service responsibly and have a repayment plan in place to mitigate any potential financial drawbacks.

Alternatives to Cash Advances on Capital One Credit Cards

While cash advances can provide quick access to funds, they come with higher fees and interest rates compared to regular credit card transactions. If you find yourself in need of money but want to avoid the costs associated with cash advances on your Capital One credit card, here are some alternative options to consider:

1. Emergency Savings: If possible, tap into your emergency savings account. Having a dedicated fund for unexpected expenses can help you avoid high-interest cash advances and provide peace of mind in times of financial need.

2. Personal Loans: Consider applying for a personal loan through a financial institution or online lender. Personal loans often have lower interest rates compared to cash advances and allow you to borrow a lump sum amount with a fixed repayment schedule.

3. Balance Transfer: If you have other credit cards with available credit, consider transferring the balance from your Capital One credit card to a card with a lower interest rate or promotional balance transfer offer. This can help reduce your interest charges and provide more affordable repayment options.

4. Peer-to-Peer Lending: Explore peer-to-peer lending platforms that connect borrowers directly with individual lenders. This alternative lending option may offer more favorable interest rates and borrowing terms compared to cash advances.

5. Negotiate Payment Plans: If you’re facing a financial emergency, reach out to the service providers or creditors involved to negotiate a payment plan. Many companies are willing to work with customers to establish manageable installment payments or deferments.

6. Borrow from Friends or Family: Consider borrowing from trusted friends or family members who may be willing to lend you money. Ensure that you have a clear repayment plan in place and that both parties are comfortable with the arrangement.

7. Side Gig or Freelancing: Explore opportunities to generate extra income by taking on a side gig or freelancing. This additional income can help cover unexpected expenses without needing to rely on credit or cash advances.

8. Credit Counseling or Financial Assistance: If you’re facing financial difficulties, seek guidance from a reputable credit counseling agency or financial assistance program. These organizations can provide advice and explore options to help you manage your finances effectively.

Remember, it’s important to carefully consider your financial situation and weigh the pros and cons of each alternative. Explore the terms and conditions, compare interest rates and fees, and determine which option best aligns with your needs and ability to repay the borrowed funds.

By exploring these alternatives, you can potentially avoid the higher costs associated with cash advances on your Capital One credit card and find a more affordable solution to your financial needs.

Conclusion

Using a cash advance on your Capital One credit card can provide convenient access to immediate funds when needed. However, it’s important to carefully consider the associated fees, interest rates, and repayment responsibilities before opting for this option. Cash advances typically come with higher costs compared to regular credit card transactions, so it’s crucial to use them sparingly and responsibly.

Before deciding to take a cash advance, explore alternative options such as utilizing emergency savings, personal loans, or balance transfers. These alternatives can potentially offer lower interest rates and more flexible repayment terms, helping you avoid excessive debt and interest charges.

When using a cash advance, be diligent about repayment. Make timely payments, and whenever possible, pay more than the minimum amount due. This will help you reduce your balance and limit the amount of interest that accrues over time.

Remember that cash advances should be considered as a last resort and only used in emergencies. It’s important to have a clear plan for repayment and explore other financial resources before resorting to a cash advance on your Capital One credit card.

By understanding the fees, interest rates, and considerations involved, you can make informed decisions about using a cash advance on your Capital One credit card when necessary. Prioritize responsible borrowing and financial management to ensure that your credit card remains a valuable tool that supports your financial goals and needs.