Finance

How To Make A Verizon Insurance Claim

Published: November 23, 2023

Learn how to make a Verizon insurance claim and protect your finances. Get step-by-step guidance for easy filing and maximizing your coverage.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Reasons for Making a Verizon Insurance Claim

- Understanding Verizon Insurance Coverage

- Step-by-Step Guide to Making a Verizon Insurance Claim

- Required Documentation for a Verizon Insurance Claim

- Filing a Verizon Insurance Claim Online

- Filing a Verizon Insurance Claim via Phone

- Tracking Your Verizon Insurance Claim

- Common Mistakes to Avoid When Making a Verizon Insurance Claim

- Additional Tips for a Successful Verizon Insurance Claim

Introduction

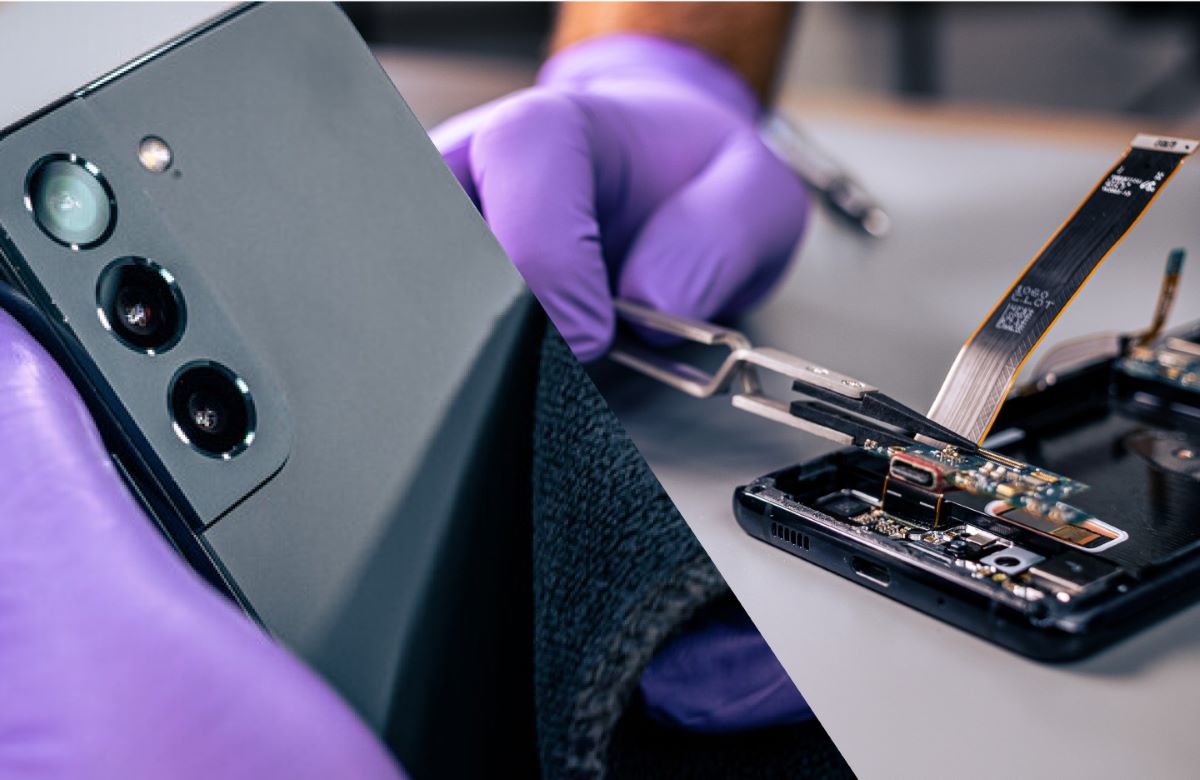

Insurance plays a crucial role in protecting our valuable possessions, and when it comes to insuring our smartphones and electronic devices, Verizon Insurance provides a reliable and convenient solution. Accidents happen, and if your phone gets damaged, lost, or stolen, making a Verizon Insurance claim can help you get a replacement device quickly and efficiently.

In this article, we will guide you through the process of making a Verizon Insurance claim, providing you with all the necessary information and step-by-step instructions. Whether you accidentally drop your phone, lose it during your daily commute, or experience a theft, having Verizon Insurance can provide peace of mind knowing that you have coverage.

Verizon Insurance offers comprehensive coverage for a wide range of situations, including accidental damage, loss, theft, and even device malfunction after the manufacturer’s warranty expires. With Verizon Insurance, you don’t have to worry about the high costs of repairing or replacing your device. However, it is important to understand your coverage and the necessary steps to follow when making a claim.

By familiarizing yourself with the Verizon Insurance claim process and ensuring you have the required documentation, you can expedite the claim and get your replacement device as soon as possible. In this article, we will walk you through the necessary steps for making a Verizon Insurance claim and provide tips to avoid common mistakes that may delay the process.

So let’s dive in and learn how to make a Verizon Insurance claim, ensuring you have the knowledge and confidence to handle any unfortunate incidents with your smartphone or electronic device.

Reasons for Making a Verizon Insurance Claim

There are several reasons why you might find yourself needing to make a Verizon Insurance claim. Accidents and mishaps can occur at any time, and having insurance coverage ensures that you are protected financially in these situations. Here are some common scenarios where making a Verizon Insurance claim becomes necessary:

- Accidental Damage: It’s all too easy to accidentally drop your phone or tablet, resulting in a cracked screen or internal damage. With Verizon Insurance, you can make a claim to have your device repaired or replaced, saving you from the high costs of repairs.

- Loss: Misplacing or losing your phone can be a frustrating experience. However, with Verizon Insurance, you can file a claim to receive a replacement device, minimizing the inconvenience and financial burden associated with replacing a lost phone.

- Theft: A stolen phone can lead to privacy concerns, as well as financial loss. Verizon Insurance covers theft, allowing you to file a claim and receive a replacement device promptly. It’s important to note that you must report the theft to the police and provide the necessary documentation when making a claim.

- Malfunction: Over time, electronic devices can experience hardware or software issues that are beyond your control. If your device malfunctions after the manufacturer’s warranty expires, Verizon Insurance can cover the repair or replacement, ensuring that you can continue using your device without major disruptions.

Regardless of the reason for your Verizon Insurance claim, having insurance coverage offers peace of mind and financial protection. It allows you to safeguard your investment and stay connected without the added burden of unexpected expenses.

Understanding Verizon Insurance Coverage

Before making a Verizon Insurance claim, it’s important to have a clear understanding of the coverage provided by your insurance policy. Verizon offers various insurance plans that cater to different needs and budgets. Here are the key aspects to consider when understanding Verizon Insurance coverage:

- Accidental Damage: Verizon Insurance covers accidental damage to your device, including cracked screens, water damage, and other unforeseen incidents that result in device malfunction or failure.

- Loss and Theft: If you lose your device or it gets stolen, Verizon Insurance can help you obtain a replacement device. It’s important to note that in the case of theft, you are required to report the incident to the police and provide the necessary documentation when filing a claim.

- Device Malfunction: In addition to accidental damage, Verizon Insurance covers device malfunctions that occur after the manufacturer’s warranty expires. This ensures that you are protected from unexpected hardware or software issues that may render your device unusable.

Verizon Insurance offers comprehensive coverage, but it’s important to note that certain situations may not be covered. For example, intentional damage or negligence resulting in device damage may not be eligible for a claim. It’s essential to review your insurance policy and familiarize yourself with the terms and conditions to have a clear understanding of what is covered and what is not.

It’s also worth noting that Verizon Insurance is different from the manufacturer’s warranty that comes with your device. While the manufacturer’s warranty covers defects in materials and workmanship, Verizon Insurance extends coverage to accidental damage, loss, and theft, providing additional protection for your device.

Understanding the coverage provided by Verizon Insurance is crucial to ensure that you know what situations are eligible for a claim. This knowledge will help you navigate the claim process more effectively and save time when filing a claim for your damaged, lost, or stolen device.

Step-by-Step Guide to Making a Verizon Insurance Claim

When you find yourself in a situation where you need to make a Verizon Insurance claim, following the correct process is essential to ensure a smooth and successful claim. Here is a step-by-step guide to help you navigate the process:

- Contact Verizon: As soon as you discover the damage, loss, or theft of your device, contact Verizon customer service. You can reach them by phone or visit a Verizon store to report the issue and initiate the claim process.

- Provide Information: The Verizon customer service representative will guide you through the necessary steps and gather information related to your claim. Be prepared to provide details about the incident, such as when and how the damage or loss occurred.

- Confirm Coverage: The representative will verify your insurance coverage and confirm that the incident falls within the eligible scenarios for a claim. They will also inform you about any deductibles or fees that may apply.

- Submit Documentation: Depending on the nature of your claim, you will be required to provide supporting documentation. This may include proof of purchase, police reports (in the case of theft), or photographs of the damage.

- Pay Deductible (if applicable): If your claim is approved and there is a deductible associated with your insurance plan, you will be required to pay the deductible amount before receiving your replacement device.

- Receive Replacement Device: Once your claim is processed and approved, Verizon will provide you with a replacement device. This may be a refurbished device or a similar model, depending on availability.

It’s important to follow each step carefully and provide accurate information and documentation to expedite the claim process. Failure to do so may result in delays or complications with your claim. Remember to keep records of all communication and documentation exchanged during the claim process for future reference.

By following these step-by-step instructions, you can navigate the Verizon Insurance claim process with confidence and ensure a seamless experience in getting your replacement device.

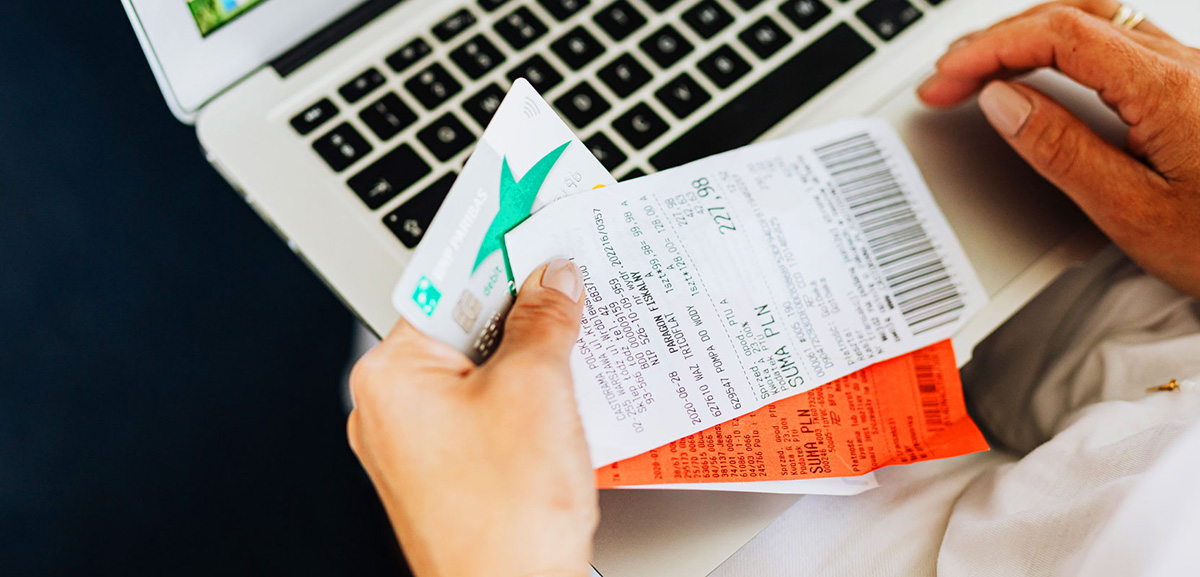

Required Documentation for a Verizon Insurance Claim

When filing a Verizon Insurance claim, it is essential to gather and provide the necessary documentation to support your claim and ensure a smooth and efficient process. The specific documentation required may vary depending on the nature of your claim, but here are some common documents you may need to submit:

- Proof of Purchase: You will typically be asked to provide proof of purchase, such as a receipt or invoice, to verify the ownership and value of the device you are claiming for. This document should clearly show the details of the purchase, including the device model, serial number, and purchase date.

- Police Report: In case of theft, you will need to file a police report and provide a copy of it as part of your claim documentation. The police report helps validate the incident and provides additional evidence to support your claim.

- Damage Documentation: If your device has been physically damaged, including cracked screen or water damage, it is essential to document the extent of the damage. Take clear photographs of the damaged device from various angles and include close-up shots to clearly showcase the damage.

- Device Information: Be prepared to provide accurate information about your device, including the make, model, and serial number. This information helps validate the device and ensures that the replacement device you receive is compatible and suitable for your needs.

- Insurance Policy Information: Keep a copy of your Verizon Insurance policy information handy, including the policy number and coverage details. This will facilitate the claim process and ensure that the correct coverage is applied to your claim.

It’s crucial to double-check the specific documentation requirements for your claim by contacting Verizon customer service or reviewing the claim instructions provided by Verizon. Providing accurate and complete documentation will help expedite your claim and increase the chances of a successful outcome.

Remember to make copies of all the documents you submit for your claim and keep them in a safe place for future reference. Having organized documentation will make it easier to track the progress of your claim and address any potential inquiries or issues that may arise.

Filing a Verizon Insurance Claim Online

Filing a Verizon Insurance claim online is a convenient and straightforward process. It allows you to initiate your claim from the comfort of your own home or anywhere with internet access. Here are the steps to file a Verizon Insurance claim online:

- Visit the Verizon Insurance Claim Center: Start by accessing the Verizon Insurance Claim Center on the Verizon Wireless website. Look for the “File a Claim” or “Insurance Claims” section on the website to access the claim portal.

- Log in to Your Verizon Account: If you have an existing Verizon account, log in using your username and password. If you don’t have an account, you will need to create one to proceed with filing the claim.

- Select the Device and Claim Type: Once logged in, you will be prompted to select the device for which you are filing the claim and the type of claim you need to make (e.g., accidental damage, loss, or theft).

- Provide Claim Details: Fill out the required information for your claim, including the details of the incident and any supporting documentation as requested. Make sure to provide accurate and complete information to avoid any delays in processing your claim.

- Review and Submit: Take a moment to review all the information you provided to ensure its accuracy. Once you are satisfied, submit your claim through the online portal.

- Confirmation and Tracking: After submitting your claim, you will receive a confirmation email or reference number. This will serve as proof that your claim has been successfully submitted. You can also use this reference number to track the progress of your claim.

Filing a Verizon Insurance claim online offers the convenience of completing the process at your own pace and from anywhere with internet access. It allows you to provide all the necessary information and documentation digitally, reducing the need for physical paperwork.

If you encounter any difficulties or have questions during the online filing process, you can contact Verizon customer service for assistance. They will be able to guide you through the steps or provide any additional information you may need to complete your claim successfully.

Filing a Verizon Insurance Claim via Phone

If you prefer to file a Verizon Insurance claim via phone, you can do so by contacting Verizon customer service directly. Their representatives are available to assist you and guide you through the claim process. Here’s how you can file a Verizon Insurance claim via phone:

- Call Verizon Customer Service: Dial the Verizon customer service hotline or the designated number for insurance claims. This information can typically be found on the Verizon website or by searching online for the appropriate contact number.

- Provide Account Verification: When you connect with a customer service representative, be prepared to verify your account information. This may involve providing your Verizon account number, phone number, or other identifying details to confirm your eligibility for a claim.

- Explain the Situation: Clearly explain the nature of your claim, whether it is accidental damage, loss, or theft. Provide detailed information about when and how the incident occurred, including any relevant supporting details.

- Provide Documentation as Requested: The customer service representative may ask you to submit supporting documents to process your claim. This could include proof of purchase, police reports (in the case of theft), or photos of the damage. Follow their instructions and provide the requested documentation promptly.

- Review and Confirm: Ensure that the representative has accurately recorded all the details of your claim. Review the information provided by the representative for accuracy and make any necessary corrections or additions.

- Receive Claim Confirmation: Once you have provided all the necessary information, the representative will confirm that your claim has been successfully filed and provide you with a claim reference number or confirmation details. This reference number will be important for tracking the progress of your claim.

By filing a Verizon Insurance claim via phone, you can have a direct conversation with a customer service representative who can guide you through the process and address any questions or concerns you may have. They will be able to provide immediate assistance and ensure that your claim is submitted correctly.

Remember to keep a record of the claim reference number and any other relevant information provided during your phone call. This will help you track the progress of your claim and refer back to it if needed in the future.

Tracking Your Verizon Insurance Claim

Once you have filed a Verizon Insurance claim, it’s natural to want to track its progress and stay updated on the status of your claim. Verizon provides options to easily track your insurance claim, allowing you to stay informed throughout the process. Here’s how you can track your Verizon Insurance claim:

Online Tracking:

Verizon offers an online tracking portal where you can monitor the progress of your claim. To access it, visit the Verizon Wireless website and navigate to the “Insurance Claims” or “Track Your Claim” section. You will typically be prompted to enter your claim reference number, phone number, or other identifying details to access the tracking information. The online tracking portal will provide you with real-time updates on the status of your claim, including whether it is being processed, approved, or if any additional information is required.

Phone Inquiry:

If you prefer to inquire about the status of your claim over the phone, you can contact Verizon customer service and provide them with your claim reference number. The representative should be able to provide you with the latest information on the progress of your claim and address any questions or concerns you may have.

Email Communication:

Verizon may also send email updates regarding the status of your claim. Make sure to check your inbox and spam folder regularly for any updates from Verizon regarding your claim progress. These emails may contain important information or requests for additional documentation, so it’s vital to review them promptly and respond accordingly.

By utilizing these tracking options, you can keep tabs on the progress of your Verizon Insurance claim and stay informed about any developments. If you have any concerns or questions during the tracking process, don’t hesitate to reach out to Verizon customer service for assistance. They will be able to provide you with the most up-to-date information and address any inquiries you may have about your claim.

Common Mistakes to Avoid When Making a Verizon Insurance Claim

When making a Verizon Insurance claim, it’s essential to avoid common mistakes that can potentially delay or complicate the claim process. By being aware of these mistakes and taking preventive measures, you can ensure a smoother and more successful claim experience. Here are some common mistakes to avoid:

- Delaying the Claim: It’s important to initiate your claim as soon as possible after the incident occurs. Waiting too long to file a claim may result in complications or even the denial of your claim, as it may be seen as a breach of your insurance policy requirements.

- Providing Inaccurate or Incomplete Information: When filing your claim, ensure that you provide accurate and complete information about the incident. Providing incorrect or incomplete details may result in delays or the rejection of your claim.

- Failing to Document the Damage: If your device has been physically damaged, it is essential to take clear photographs that document the extent of the damage. Failing to do so may weaken your claim and make it more difficult to prove the need for repair or replacement.

- Not Keeping Copies of Documentation: It’s crucial to keep copies of all documentation related to your claim, including receipts, police reports, or any communication with Verizon. Having organized records will help you track the progress of your claim and address any discrepancies or inquiries that may arise.

- Not Reporting Theft to the Police: In the case of a stolen device, it’s important to report the incident to the police and obtain a copy of the police report. Failure to do so may result in the denial of your claim, as it is usually a requirement for theft-related claims.

- Not Following Up on the Claim: Once you have filed your claim, it’s essential to track its progress and follow up with Verizon if needed. Regularly check the status of your claim online or through customer service to ensure that it is being processed in a timely manner.

Avoiding these common mistakes can help streamline the Verizon Insurance claim process and increase the likelihood of a successful outcome. By being proactive, accurate, and meticulous throughout the process, you can expedite your claim and get the resolution you need for your damaged, lost, or stolen device.

Additional Tips for a Successful Verizon Insurance Claim

When making a Verizon Insurance claim, following a few additional tips can increase your chances of a successful and smooth claims process. Here are some valuable tips to keep in mind:

- Know Your Coverage: Familiarize yourself with the details of your Verizon Insurance coverage, including what is included and any deductibles or limits that apply. Understanding your coverage will help you navigate the claim process more effectively.

- Keep Your Proof of Purchase: Keep a copy of your device’s proof of purchase, such as a receipt or invoice. This documentation will help validate your ownership of the device and support your claim.

- Document Your Device: Before any incidents occur, take thorough photos or videos of your device from multiple angles. This serves as evidence of its condition prior to any damage or loss, which can be helpful for a successful claim.

- Be Prompt and Proactive: Report the incident and file your claim as soon as possible. Delaying the claim may lead to complications or even the denial of your claim.

- Provide Accurate Information: Double-check all the information you provide in your claim, ensuring it is accurate and complete. Mistakes or inaccuracies can delay the process or lead to the denial of your claim.

- Follow Instructions Clearly: Pay close attention to the instructions provided by Verizon, whether it’s regarding required documentation, the claim process, or any requests for additional information. Follow the instructions carefully to ensure a smooth and efficient claim experience.

- Keep Communication Records: Keep a record of all communication related to your claim, including names, dates, and details of conversations. This will be useful for future reference or if any issues or disputes arise during the claim process.

- Stay Engaged and Follow Up: Stay engaged in the claim process by regularly checking the status of your claim through the online tracking portal or contacting Verizon customer service for updates. Follow up if there are delays or if you have any concerns or questions about your claim.

By following these additional tips, you can enhance your chances of a successful Verizon Insurance claim. Being proactive, organized, and diligent in providing accurate information and documentation will help expedite your claim and ensure a smooth resolution to your device damage, loss, or theft.