Finance

How To Make An Insurance Card

Published: November 26, 2023

Learn how to create and design your own personalized insurance card. Get expert tips and advice on finances to ensure maximum coverage and savings.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

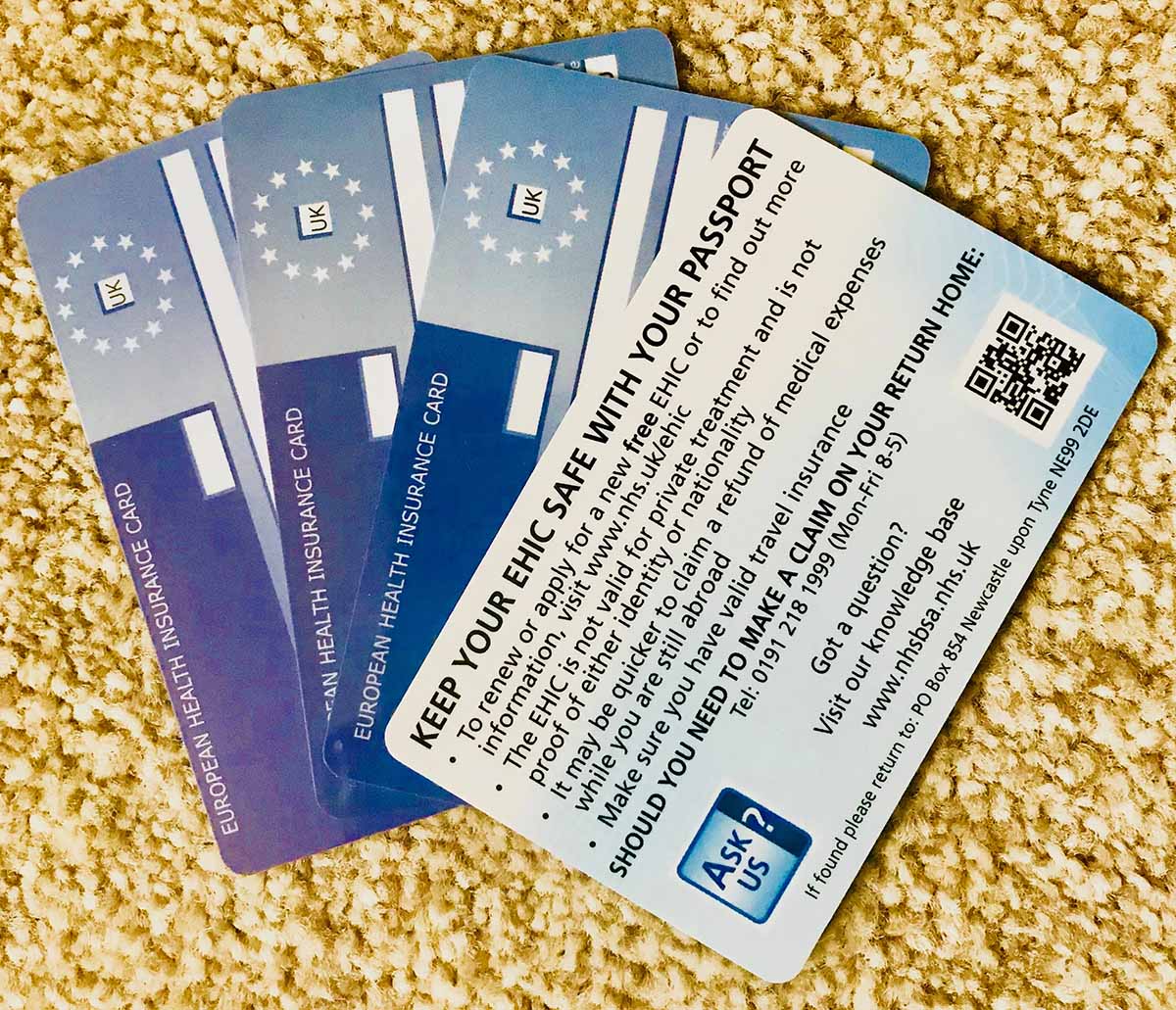

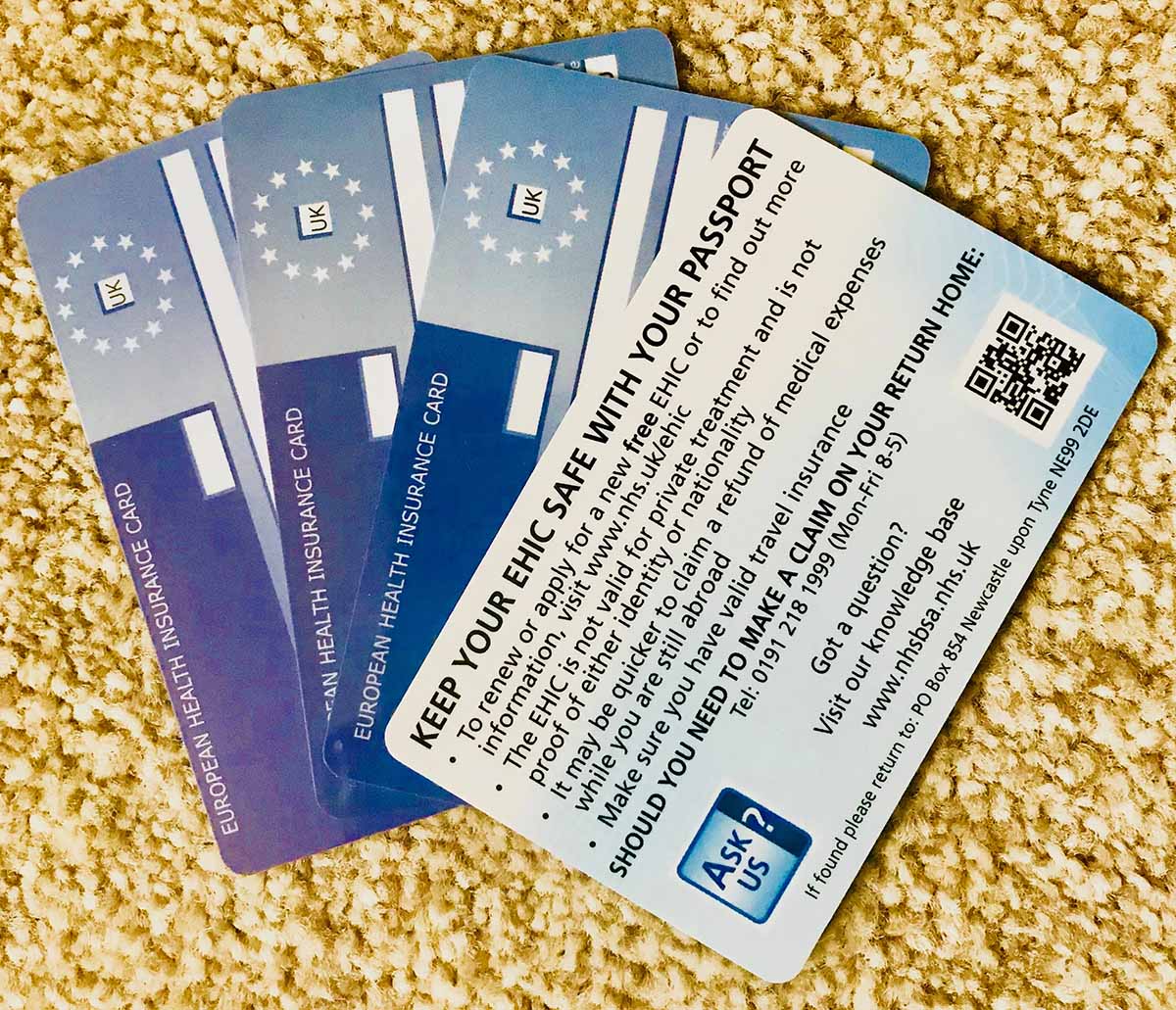

Welcome to our comprehensive guide on how to create an insurance card. In today’s digital age, having a physical insurance card may seem unnecessary, but it is still required in many situations. Whether you need it for a car insurance policy, health insurance, or any other type of coverage, having a tangible proof of insurance is essential.

An insurance card serves as proof of your coverage and helps in case of an emergency or if you need to file a claim. It contains vital information, such as your policy number, the name of the insurance company, and contact details, which can be invaluable when dealing with medical professionals, law enforcement, or a collision on the road.

In this step-by-step guide, we will walk you through the process of creating an insurance card from scratch. From gathering the necessary information to designing and printing the card, we will cover all the essential aspects to ensure you have a valid and reliable proof of insurance.

Keep in mind that creating an insurance card does not mean forging or falsifying information. It is crucial to provide accurate and up-to-date details on the card, as any misrepresentation can lead to serious legal consequences. This guide aims to help you create a legitimate and compliant insurance card that meets the legal requirements of your jurisdiction.

Now, let’s dive into the step-by-step process of creating an insurance card that will provide you with peace of mind and serve as a reliable proof of your insurance coverage when you need it the most.

Step 1: Gathering Required Information

The first step in creating an insurance card is to gather all the necessary information. This includes both personal details and policy-specific information. Here’s a checklist of the information you will need:

- Your full name: Provide your legal name as it appears on your insurance policy.

- Contact information: Include your current address, phone number, and email address.

- Policy number: This is a unique identifier associated with your insurance policy. It can usually be found on your policy documents or insurance correspondence.

- Insurance company name: Include the name of your insurance company or provider.

- Effective date: The effective date of your policy indicates when your coverage begins.

- Expiration date: The expiration date represents the last day your policy will be valid.

- Insurance agent contact: If you have an insurance agent, provide their contact information. This includes their name, phone number, and email address.

It is important to ensure that all the information you gather is accurate and up-to-date. This will help avoid any discrepancies or issues when presenting your insurance card to a third party. Reach out to your insurance provider or refer to your policy documents if you are unsure about any of the details.

Once you have gathered all the necessary information, you are ready to move on to the next step in the process: designing the insurance card.

Step 2: Designing the Insurance Card

Now that you have collected all the required information, it’s time to design your insurance card. The design should be clear, professional, and easy to read. Here are a few tips to help you create an effective design:

- Choose a layout: Decide on a layout that suits your preferences and the amount of information you need to include. You can opt for a traditional card design with the insurance company logo at the top and the details below, or you can explore different layouts that best represent your personal style.

- Select a font: Use a legible font that is easy to read. Avoid overly decorative fonts that may make the information on the card difficult to understand. Stick to standard fonts like Arial, Helvetica, or Times New Roman.

- Color scheme: Choose a color scheme that aligns with your insurance company or personal branding. Use colors that are visually appealing but do not overpower the text. It is recommended to use contrasting colors for better readability.

- Incorporate a logo: Include your insurance company logo on the card. If you do not have a company logo, you can consider using a relevant symbol or icon that represents the type of insurance you have.

If you are confident in your design skills, you can use design software like Adobe Photoshop or Illustrator to create a digital version of your insurance card. However, if graphic design is not your forte, there are plenty of free online tools and templates available that can help you create a professional-looking card with ease.

Remember, the goal of the design is to present the necessary information clearly and professionally. Avoid cluttering the card with unnecessary graphics or excessive details that may distract from the important information it is intended to convey.

Once you have finalized the design, you are ready to move on to the next step: adding relevant details to your insurance card.

Step 3: Adding Relevant Details

Now that you have designed the layout of your insurance card, it’s time to add the relevant details that will make it a valid proof of insurance. Here’s what you need to include:

- Your full legal name: Make sure to input your complete and accurate legal name as it appears on your insurance policy. This helps ensure that the card is legally valid.

- Policy number: Include your policy number on the card. This is a unique identifier specific to your insurance policy and helps insurance providers identify your coverage.

- Insurance company details: Add the name of your insurance company or provider, along with their contact information such as phone number and website. This allows others to easily verify the authenticity of your insurance.

- Effective and expiration dates: Clearly state the date when your insurance policy goes into effect and when it expires. This provides a clear timeframe during which your coverage is valid.

In addition to these essential details, you may also want to include additional information that can be helpful in case of an emergency or when filing a claim:

- Emergency contact numbers: Include emergency contact numbers, such as the insurance company’s 24-hour hotline or customer service line. This ensures that you have the necessary information readily available in case of an emergency.

- Insurance agent contact details: If applicable, note down the contact details of your insurance agent. This allows others to reach out to your agent directly for any inquiries or assistance.

Remember to keep the information legible. Use a font size that is easily readable and allocate sufficient space for each detail. If needed, you can also consider using headings or bold text to make certain information stand out.

Once you have added all the relevant details to your insurance card, it’s time to move on to the next step: printing the card.

Step 4: Printing the Insurance Card

After you have designed and added all the necessary details to your insurance card, it’s time to print it out. Here are a few key considerations to keep in mind during the printing process:

- Quality paper: Choose a high-quality and durable paper for printing your insurance card. Opt for cardstock or a thick paper that will withstand everyday handling and won’t easily tear or get damaged.

- Printer settings: Adjust your printer settings to ensure optimal printing. Select the highest print quality available to ensure that the text, logos, and other details on the card are sharp and clear. If possible, use a color printer to accurately reproduce any colored elements in the design.

- Alignment: Ensure that the design and text are properly aligned on the card. Test print a sample copy on regular paper first to check for any alignment issues. Make adjustments as needed before printing on the final cardstock.

- Quantity: Determine the number of copies you need to print. It’s a good idea to have a few extra copies to keep at hand in case of loss or damage to the original card.

Once you have verified the alignment and printer settings, print the insurance card on the chosen paper. Allow the ink to dry completely before handling the printed cards to prevent smudging or smearing of the text and graphics.

Remember to keep the printed cards in a safe and easily accessible place. Consider keeping a copy in your wallet, glove compartment, or any other convenient location where it can be easily retrieved when needed.

Now that your insurance card is printed, it is time for the final step: ensuring legal compliance.

Step 5: Ensuring Legal Compliance

Creating an insurance card involves more than just designing and printing a piece of paper. It is crucial to ensure that your card meets all the legal requirements set by your jurisdiction. Here are some important points to consider for legal compliance:

- Accurate information: Double-check that all the information on your insurance card is accurate, including your name, policy number, and the name of the insurance company. Any inaccuracies could potentially invalidate your card.

- Valid coverage: Make sure that your insurance policy is active and up to date. If your policy has expired or been canceled, your card will no longer be valid.

- State or local requirements: Research and understand the specific requirements of your state or local jurisdiction when it comes to insurance cards. Some states may have specific formats, information, or design elements that must be included on the card.

- Insurance company approval: Verify whether your insurance provider requires any additional steps or approvals for creating an insurance card. Some companies may have specific guidelines or templates that need to be followed.

- Legible and clear: Ensure that all the text and information on the card are legible and clear. This includes using an appropriate font size and ensuring that there is enough contrast between the text and the background color.

- Backup documentation: It’s always a good idea to keep a copy of your insurance policy and other related documentation as a backup to support the validity of your insurance coverage.

By ensuring legal compliance, you can have peace of mind knowing that you have a valid and reliable insurance card that meets all the necessary requirements. Remember to periodically review and update your insurance card, especially when there are changes to your policy or personal information.

Having a physical insurance card that is legally compliant provides you with a tangible proof of insurance that can be easily presented when needed. Keep your insurance card along with your other important documents and be prepared to present it to relevant parties, such as law enforcement or healthcare providers, if required.

Congratulations! You have successfully completed all the steps to create an insurance card that is not only visually appealing but also meets legal requirements. Now you can confidently carry your insurance card with you, knowing that you have the necessary proof of coverage when it matters most.

Conclusion

Congratulations on successfully creating your own insurance card! By following the step-by-step process outlined in this guide, you have learned how to gather the necessary information, design the card, add relevant details, print it out, and ensure legal compliance. Now, you have a tangible proof of insurance that can be presented whenever required.

Remember, having a physical insurance card is important as it serves as proof of your coverage and can be invaluable in various situations. Whether you need it for a car insurance policy, health insurance, or any other type of coverage, having a valid and legally compliant insurance card can save you time, hassle, and potential legal consequences.

Make sure to keep your insurance card in a safe and easily accessible place, such as your wallet or glove compartment, so you can access it quickly when needed. Regularly review and update your card to ensure that the information remains accurate and up to date.

We hope that this comprehensive guide has been helpful in guiding you through the process of creating an insurance card. By following the steps and ensuring legal compliance, you can carry your insurance card with confidence, knowing that you have a reliable proof of insurance at your fingertips.

Always remember to renew your insurance policy on time to ensure uninterrupted coverage. Additionally, familiarize yourself with the specific requirements and regulations of your state or local jurisdiction regarding insurance cards to stay fully compliant.

Thank you for choosing our guide, and we wish you a safe and protected journey with your insurance coverage!