Home>Finance>How To Write An Estimate For An Insurance Claim

Finance

How To Write An Estimate For An Insurance Claim

Published: November 19, 2023

Learn the essential steps to write an accurate and comprehensive estimate for an insurance claim in the finance industry. Master the art of estimating with our expert tips and techniques.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When disaster strikes, whether it’s a natural calamity or an unexpected accident, having the right insurance coverage can save you from financial ruin. However, filing an insurance claim can be a complex process, requiring meticulous documentation and a thorough understanding of the insurance policy. One vital aspect of this process is writing an estimate for the insurance claim.

An estimate is a detailed report that provides an assessment of the damage or loss incurred, along with the projected cost of repairs or replacement. It serves as a crucial document for insurance companies to determine the validity of the claim and the appropriate compensation amount to be awarded. Writing an accurate and comprehensive estimate is paramount to ensure a smooth claims process and expedite the restoration of your property and finances.

In this article, we will delve into the essential steps involved in creating a well-crafted estimate for an insurance claim. We’ll discuss the purpose of an estimate, the information you need to gather, and the key components that should be included in your estimate. By following these guidelines and carefully documenting the damage, you can increase your chances of a successful claim and a fair settlement.

Purpose of an Estimate for an Insurance Claim

The primary purpose of an estimate for an insurance claim is to provide a detailed and accurate assessment of the damage or loss suffered. Insurance companies rely on these estimates to evaluate the legitimacy of the claim and determine the appropriate amount of compensation to be awarded. A well-written estimate serves as a critical tool for both the policyholder and the insurer in resolving the claim efficiently.

Here are the key reasons why an estimate is crucial in the insurance claims process:

- Evaluating the Validity of the Claim: An estimate serves as evidence to support the claim made by the policyholder. It provides a detailed account of the damage, including its extent and the estimated cost of repairs or replacement. This helps the insurance company determine whether the damage falls within the coverage provided by the policy and verify the legitimacy of the claim.

- Determining the Compensation Amount: The estimate plays a vital role in calculating the compensation amount that the policyholder is entitled to receive. It provides a breakdown of the repair or replacement costs, including materials, labor, and any additional expenses. The insurance company uses this information to assess the financial impact of the loss and determine the appropriate settlement.

- Negotiating with the Insurance Company: A well-documented and comprehensive estimate can give the policyholder an advantage during the negotiation process. By providing a clear and detailed breakdown of the damages and associated costs, the policyholder can present a strong case for a higher settlement. The estimate serves as a negotiation tool to ensure fair compensation for the loss.

- Expediting the Claims Process: An accurate and detailed estimate helps streamline the claims process. By providing all the necessary information upfront, the policyholder can minimize delays and expedite the assessment and settlement of the claim. This allows for a faster restoration of the property and a quicker resolution of the financial burden.

Overall, an estimate for an insurance claim serves as a crucial document that provides a clear and detailed assessment of the damage and associated costs. It is an essential tool in establishing the validity of the claim, determining the appropriate compensation amount, and facilitating a smooth and efficient claims process. By preparing a well-crafted estimate, policyholders can effectively communicate their loss to the insurance company and increase their chances of a fair and timely settlement.

Gathering Essential Information

Before writing an estimate for an insurance claim, it is essential to gather all the necessary information. This information will help provide a clear and accurate assessment of the damage or loss and ensure that the estimate is comprehensive and detailed. Here are some key steps to follow when gathering essential information:

- Inspect the Damage: Conduct a thorough inspection of the property to assess the extent of the damage. Take note of all affected areas and document any visible signs of damage, such as broken windows, water leaks, or structural issues. It is important to be as detailed as possible in your observations.

- Photograph or Videotape the Damage: Visual documentation is crucial in supporting your claim. Take clear photographs or videos of the damage from multiple angles, capturing both wide shots and close-ups. This will provide visual evidence of the loss and help substantiate your estimate.

- Record the Date and Time of the Incident: Note down the date and time when the damage occurred. This information is important for the insurance company to determine whether the claim falls within the policy’s coverage period.

- Document the Cause of the Damage: Identify the cause of the damage or loss and provide a detailed account of what happened. This could include a fire, flood, storm, accident, or vandalism. The insurance company will need this information to assess the claim and verify coverage.

- Collect Relevant Documents: Gather any supporting documents related to the damage or loss. This can include invoices, receipts, repair estimates, maintenance records, or previous insurance claim information. These documents will help provide additional evidence and validate your claim.

- Retrieve Insurance Policy Information: Review your insurance policy to understand the coverage and exclusions. Take note of your policy number, contact information for your insurance agent or company, and any specific requirements or procedures for filing a claim.

- Communicate with Witnesses: If there were any witnesses to the incident, collect their contact information. Their statements can provide additional support for your claim.

- Keep Detailed Records: Throughout the claims process, maintain a record of all communication with the insurance company. Note down the dates, times, and details of any phone conversations or emails exchanged. This will help track the progress of your claim and serve as documentation of your efforts.

By gathering all the necessary information, you can ensure that your estimate is accurate, comprehensive, and well-supported. This will not only increase the chances of a successful claim but also help expedite the claims process and facilitate a fair settlement.

Assessing the Damage

After gathering all the essential information, the next step in writing an estimate for an insurance claim is to assess the damage. This involves conducting a detailed evaluation of the affected property to determine the extent and severity of the loss. Here are some important considerations when assessing the damage:

- Physical Inspection: Carefully examine the damaged areas to identify any visible signs of destruction. Note the extent and location of the damage, including structural issues, broken items, or any other significant impacts. Take measurements if necessary to accurately document the size and scope of the damage.

- Hidden Damage: In addition to visible damage, it is crucial to consider any hidden damage that may not be immediately apparent. For example, water damage can lead to mold growth or structural weakening over time. Consult professional experts, such as contractors or restoration specialists, to assess the full extent of the damage and identify any underlying issues.

- Cost of Repairs or Replacement: Estimate the cost of repairs or replacement for each damaged item or area. This should include materials, labor, permits, and any additional expenses required to restore the property to its pre-loss condition. Obtain multiple quotes from reputable contractors to ensure accuracy in estimating costs.

- Depreciation: Take into account the age, condition, and remaining useful life of the damaged items. Insurance policies often consider depreciation, which is the reduction in value over time, when determining the compensation amount. Calculate the depreciation factor based on the policy terms to adjust the estimated cost accordingly.

- Temporary Repairs: If immediate repairs are necessary to prevent further damage, document the cost of these temporary measures. This includes expenses for emergency services, temporary shelter, or securing the property. Keep accurate records of all temporary repair costs for reimbursement purposes.

- Code Upgrades: Determine if any building codes or regulations have changed since the property was originally constructed. If repairs or replacement must comply with updated codes, include the associated costs in your estimate. This ensures that the property is restored to meet current safety and building standards.

During the assessment process, it is important to be thorough and meticulous. Take detailed notes, photographs, and videos to support your findings. Consult with professionals, if needed, to ensure an accurate evaluation of the damage and realistic estimation of repair or replacement costs. By conducting a comprehensive assessment, you will be well-equipped to provide a detailed and accurate estimate for your insurance claim.

Understanding Insurance Terminology

When writing an estimate for an insurance claim, it is essential to have a clear understanding of the terminology used in the insurance industry. Familiarizing yourself with these terms will enable you to communicate effectively with the insurance company and accurately document the details of the claim. Here are some key insurance terms to be aware of:

- Deductible: The deductible is the amount the policyholder is responsible for paying out of pocket before the insurance coverage kicks in. It is important to consider the deductible when estimating the total cost of the claim.

- Premium: The premium is the amount the policyholder pays to the insurance company in exchange for coverage. It is typically paid on a regular basis, such as monthly or annually.

- Claim: A claim is a request made by the policyholder to the insurance company for compensation or coverage for a loss or damage covered by the policy.

- Policyholder: The policyholder is the person or entity who holds the insurance policy and is entitled to the benefits and coverage provided by the policy.

- Coverage: Coverage refers to the protections and benefits provided by the insurance policy. It specifies what is covered, up to what limits, and under what circumstances.

- Limit: The limit is the maximum amount of coverage provided by the insurance policy. It can apply to different components of the policy, such as property damage, liability, or medical expenses.

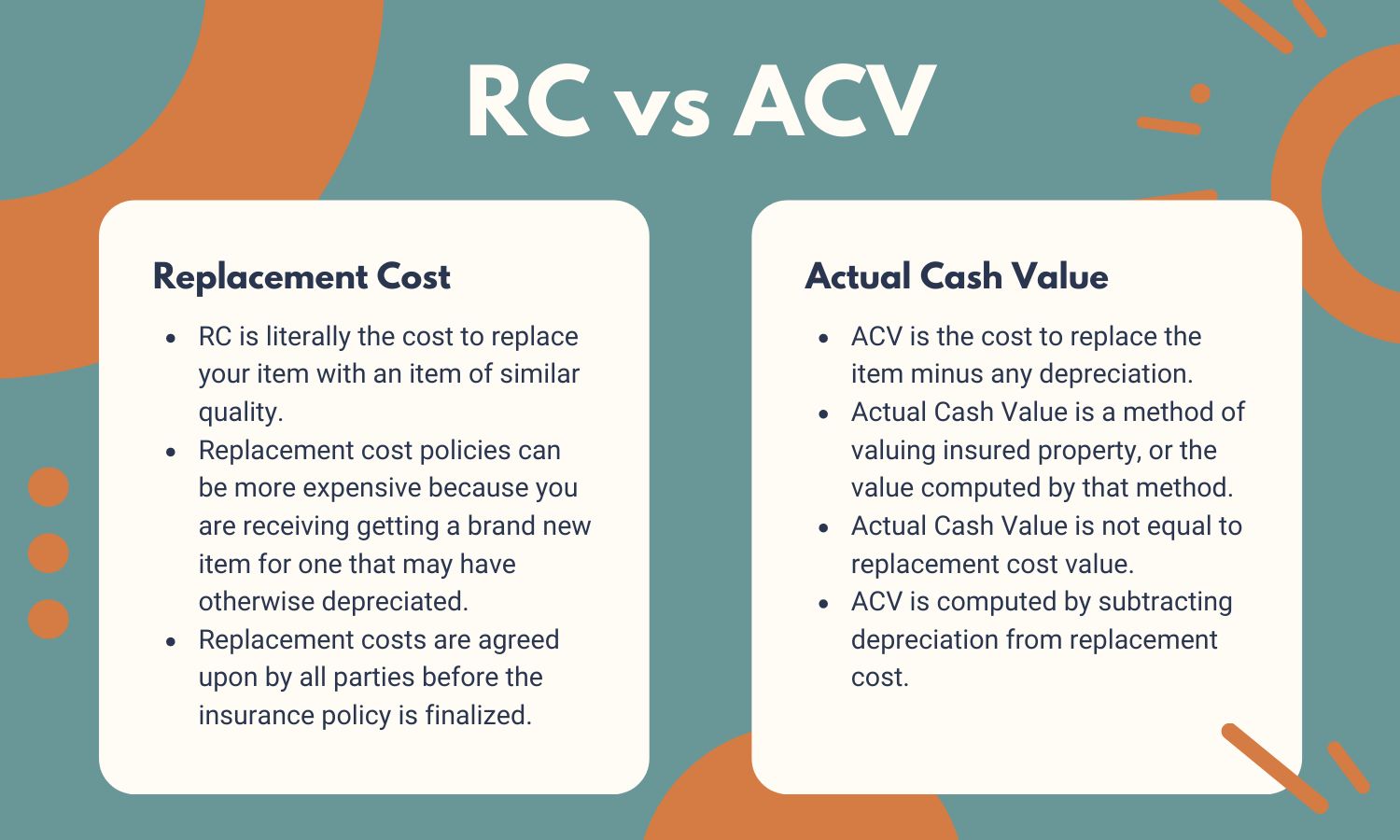

- Actual Cash Value (ACV): ACV is the value of an item or property at the time of the loss, taking into consideration its age, condition, and depreciation. It is used to calculate the compensation amount for items that have lost value over time.

- Replacement Cost Value (RCV): RCV is the cost to replace an item or property with a comparable one at current market prices. It is not adjusted for depreciation and is used to calculate the compensation amount for items that need to be completely replaced.

- Subrogation: Subrogation is the process by which an insurance company recovers the amount it paid out on a claim from another party who is responsible for the loss or damage. This allows the insurance company to avoid bearing the full financial burden.

- Proof of Loss: Proof of loss is a formal document that provides a detailed account of the damages or losses incurred. It is typically required by the insurance company as part of the claims process and serves as evidence of the claim.

Understanding these insurance terms will help you navigate the claims process with confidence and better communicate with the insurance adjuster. It will also aid in accurately documenting the details of the claim, ensuring that your estimate aligns with the policy provisions and requirements. By speaking the language of insurance, you can effectively advocate for your rights and maximize your chances of a fair and timely settlement.

Writing the Estimate

Now that you have assessed the damage and understand the insurance terminology, it’s time to write the estimate for your insurance claim. The estimate is a detailed report that outlines the extent of the damage, the necessary repairs or replacements, and the associated costs. Here are the key steps to follow when writing the estimate:

- Begin with a Header: Start the estimate with a clear and concise header that includes your name, contact information, policy number, and claim number. This header ensures that the estimate is properly identified and associated with your claim.

- Provide a Description of the Damage: Begin the body of the estimate by providing a comprehensive description of the damage. Be specific and detailed, highlighting all affected areas and items. Include information such as the cause of the damage, the date of the incident, and any relevant circumstances.

- Itemize the Repair or Replacement Costs: Breakdown the cost of repairs or replacements for each damaged item or area. Create a clear list, including materials, labor, and any additional expenses. Use accurate and up-to-date pricing information to ensure the estimate is realistic.

- Include Quantity and Measurements: Where applicable, include the quantity and measurements of materials needed for the repairs or replacements. This helps the insurance company understand the scope of the work and the required quantities of materials.

- Calculate the Total Cost and Subtotal: Sum up the individual costs to calculate the total cost of the repairs or replacements. Provide a clear subtotal that shows the breakdown of the costs by category, such as labor, materials, and additional expenses.

- Consider Contingency Costs: It’s important to include contingency costs in your estimate. Contingency costs account for unexpected factors that may arise during the repair or replacement process, such as hidden damage or unforeseen issues. Including a contingency percentage, usually between 10% and 20% of the total cost, provides a buffer for these unforeseen circumstances.

- Provide Additional Notes and Explanations: Use the estimate as an opportunity to provide any additional notes or explanations. This can include any special instructions, alternative options for repairs or replacements, or any other relevant information that helps clarify the estimate.

- Attach Supporting Documentation: Include any supporting documentation that validates the costs and estimates provided. This can include quotes from contractors, invoices for materials, or any other relevant documents that support the validity of the estimate.

- Review and Proofread: Before finalizing the estimate, review it thoroughly for accuracy and completeness. Check for any errors or omissions, and ensure that the estimate is well-organized and easy to understand. Proofread the estimate for any typos or grammatical errors.

Remember to maintain professionalism in the language and formatting of the estimate. Use clear and concise language, avoid jargon, and use a consistent and professional tone throughout the document. By following these steps, you can create a well-written estimate that accurately represents the damage and the associated costs, increasing the likelihood of a successful claim.

Key Components of an Estimate

When writing an estimate for an insurance claim, it’s important to include key components that provide a comprehensive and detailed overview of the damage and the associated costs. These components help the insurance company understand the extent of the loss and evaluate the validity of the claim. Here are the key components to include in your estimate:

- Description of the Damage: Begin the estimate with a clear and detailed description of the damage. This should include the affected areas, items, and any other relevant details that help paint a clear picture of the loss.

- Itemized List of Repairs or Replacements: Create an itemized list that outlines the specific repairs or replacements needed. Include each item or area separately, along with a detailed description of the work required.

- Cost Breakdown: Break down the costs associated with each repair or replacement item. Specify the cost of materials, labor, and any additional expenses involved in the restoration process. Be as detailed and accurate as possible to ensure an accurate representation of the costs.

- Quantity and Measurements: Where applicable, include the quantity and measurements of materials needed for the repairs or replacements. This provides a clear understanding of the scope of work and ensures accurate cost estimation.

- Total Cost and Subtotal: Calculate the total cost by summing up the individual costs. Provide a clear subtotal that breaks down the costs by category, such as labor, materials, and any additional expenses.

- Contingency Costs: Include contingency costs in your estimate. These costs account for any unforeseen circumstances that may arise during the repair or replacement process. Adding a contingency percentage, typically between 10% and 20% of the total cost, helps provide a cushion for unexpected expenses.

- Supporting Documentation: Attach any supporting documentation that validates the costs and estimates provided. This can include quotes from contractors, invoices for materials, or any other relevant documents that support the accuracy of the estimate.

- Additional Explanations: Include any additional explanations or notes that may help clarify the estimate. This can include alternative repair or replacement options, special instructions, or any other relevant information that may assist in the evaluation of the claim.

By including these key components in your estimate, you provide a comprehensive and detailed overview of the damage and associated costs. This ensures that the insurance company has all the necessary information to evaluate the claim accurately and make an informed decision regarding the compensation value.

Documenting the Claim

When filing an insurance claim, proper documentation is crucial to support your case and ensure a smooth claims process. Thoroughly documenting the claim helps provide evidence of the damage or loss and substantiates the validity of your claim. Here are important steps to consider when documenting your insurance claim:

- Record Detailed Information: Take the time to document detailed information about the incident. Include the date, time, and location of the event, as well as any relevant circumstances that led to the damage or loss.

- Photograph or Videotape the Damage: Visual evidence is highly effective in supporting your claim. Take clear and detailed photographs or videos of the damaged areas and items from multiple angles. Capture any visible signs of damage and make sure the images are well-lit and in focus.

- Collect Witness Statements: If there were any witnesses to the incident, gather their contact information and request written statements describing what they witnessed. These witness statements can be valuable in corroborating your claim.

- Keep a Written Journal: Maintain a written journal of all relevant events and conversations related to the claim. Include dates, times, and details of any communication with the insurance company, contractors, or other parties involved in the claims process.

- Retain Copies of Documentation: Make copies of all documents related to the claim, including estimates, invoices, receipts, and any correspondence with the insurance company. This ensures that you have a complete record of all the paperwork pertaining to your claim.

- Document Communication with the Insurance Company: Keep track of all communication with the insurance company. Record the date, time, and details of any phone conversations or emails exchanged. This helps ensure accurate record-keeping and allows you to monitor the progress of your claim.

- Maintain a Claim File: Create a dedicated file or folder to organize all the paperwork and documentation related to your claim. This will help you stay organized and easily access the necessary information when needed.

- Follow-Up in Writing: Whenever you have phone conversations or discussions with the insurance company, follow up with a written summary of the conversation. This serves as a record of your understanding and can help avoid any misunderstandings or disputes later on.

- Consult with Professionals: Consider consulting with professionals such as contractors, appraisers, or public adjusters who can provide expert advice and guidance throughout the claims process. Their expertise can be invaluable in accurately documenting the damage and ensuring a fair settlement.

Remember, thorough documentation is key to a successful insurance claim. By following these steps and maintaining organized and detailed records, you strengthen your case and increase your chances of a favorable outcome. Always consult your insurance policy and follow the specific guidelines and documentation requirements set forth by your insurance provider.

Reviewing and Finalizing the Estimate

After preparing the estimate for your insurance claim, it is crucial to review and finalize it before submitting it to the insurance company. Taking the time to carefully review the estimate ensures its accuracy and increases the likelihood of a smooth claims process. Here are important steps to follow when reviewing and finalizing your estimate:

- Verify Accuracy and Completeness: Review the estimate to ensure that all the information provided is accurate and complete. Check for any errors, omissions, or inconsistencies in the description of the damage, itemized costs, and overall calculations.

- Check for Required Attachments: Confirm that all necessary supporting documentation, such as photographs, invoices, quotes, or other relevant documents, are properly attached to the estimate. These attachments provide evidence and substantiate the validity of your claim.

- Consider Policy Coverage and Limits: Ensure that the estimate aligns with the coverage and limits specified in your insurance policy. Review the policy terms to verify that the repairs or replacements are eligible under the policy, and that the estimated costs fall within the coverage limits.

- Evaluate Accuracy of Cost Estimates: Double-check the accuracy of the cost estimates for repairs or replacements. Verify that the costs are reasonable, based on market rates, and reflect the scope of work required to restore the damaged property.

- Review Contingency Costs: Assess the contingency costs included in the estimate. Confirm that the percentage allocated for contingencies is appropriate and provides a sufficient buffer for any unforeseen expenses that may arise during the repair or replacement process.

- Proofread for Clarity and Grammar: Thoroughly proofread the estimate for clarity, grammar, and spelling. A well-written and error-free estimate enhances your professionalism and ensures that the information is communicated clearly to the insurance company.

- Ensure Proper Formatting: Pay attention to the formatting and presentation of the estimate. Use clear headings, sections, and bullet points to make the estimate easy to read and navigate. Proper formatting enhances the professionalism of the document.

- Consult with Professionals: If needed, seek advice from professionals such as contractors or public adjusters to review and validate the estimate. Their expertise can provide valuable insights and ensure the estimate is accurate and comprehensive.

- Keep a Copy for Your Records: Make a copy of the finalized estimate for your own records. This ensures that you have a copy of the estimate submitted to the insurance company for future reference or if any discrepancies arise during the claims process.

By following these steps, you can review, refine, and finalize your estimate with confidence. A well-reviewed and accurately prepared estimate increases the likelihood of a seamless claims process and a fair settlement with the insurance company.

Conclusion

Writing an estimate for an insurance claim is a critical step in the claims process. A well-crafted estimate serves as a detailed and accurate report that outlines the damage or loss, the necessary repairs or replacements, and the associated costs. Through thorough documentation and comprehensive information, the estimate provides the insurance company with the necessary evidence to assess the validity of the claim and determine a fair compensation amount.

Throughout the process, it is essential to gather all the essential information, assess the damage accurately, understand insurance terminology, and write a detailed estimate. By following these steps, you can navigate the claims process more effectively and increase the chances of a successful outcome.

Remember, clear and concise communication, attention to detail, and proper documentation are key to writing an effective estimate. By providing accurate information, supporting documentation, and adhering to the guidelines set forth by your insurance policy, you can advocate for your rights and ensure a fair and timely settlement for your insurance claim.

In conclusion, writing an estimate for an insurance claim requires a combination of knowledge, organization, and attention to detail. By following the steps outlined in this article, you can enhance your ability to present a strong case to the insurance company and increase the likelihood of a successful resolution and recovery from your loss.