Finance

How To Pick Good Stocks For Short-Term

Published: January 17, 2024

Learn how to pick good stocks for short-term investments in finance. Maximize your returns with expert advice and strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Short-Term Stock Trading

- Factors to Consider when Picking Stocks for Short-Term Trading

- Technical Analysis Indicators for Short-Term Stock Selection

- Fundamental Analysis for Short-Term Stock Selection

- Common Mistakes to Avoid when Picking Stocks for Short-Term Trading

- Conclusion

Introduction

Welcome to the world of short-term stock trading, where smart investors can potentially make quick profits by capitalizing on market fluctuations. Short-term trading involves buying and selling stocks within a short time frame, typically a few days to a few weeks, in order to take advantage of short-term price movements.

While long-term investing focuses on the fundamentals and the long-term growth potential of a stock, short-term trading is more about timing and technical analysis. It requires a different set of skills and strategies to identify stocks with short-term profit potential.

If you’re interested in venturing into the exciting world of short-term stock trading, then it’s important to have a solid understanding of the factors to consider when picking stocks and the tools available to aid in your decision-making process. This article will guide you through the key considerations and provide insights into how to pick good stocks for short-term trading.

Before we dive into the specifics, it’s crucial to note that short-term trading carries a higher level of risk compared to long-term investing. The volatile nature of short-term stock prices can result in rapid gains or losses, depending on market conditions and individual stock performance. Therefore, it’s essential to approach short-term trading with a disciplined mindset, proper risk management, and a well-defined trading strategy.

Now, let’s explore the factors to consider when picking stocks for short-term trading and the analysis techniques that can help you make informed decisions.

Understanding Short-Term Stock Trading

Short-term stock trading, also known as active trading or day trading, is a strategy where investors aim to profit from short-term price fluctuations in the stock market. Unlike long-term investing, which focuses on the long-term growth potential of a stock, short-term trading involves taking advantage of short-term market movements to generate quick profits.

Unlike long-term investors, who may hold stocks for months or even years, short-term traders typically hold stocks for a few days to a few weeks. They rely on technical analysis, chart patterns, and indicators to make quick trading decisions based on short-term price movements.

Short-term stock trading requires a more hands-on approach compared to long-term investing. Traders closely monitor price changes, market trends, and news events that may impact the stock they are trading. They execute trades promptly, often leveraging margin accounts to increase their buying power and potential returns. However, this increased activity and leverage also come with higher risks.

Successful short-term traders have a deep understanding of market dynamics and the ability to interpret technical analysis indicators. They must stay updated on market news and events that can impact stock prices. It’s important to note that short-term trading may not be suitable for everyone, as it requires active monitoring, quick decision-making, and the ability to manage risk effectively.

Short-term trading can be exciting and potentially rewarding, but it is not without its challenges. Traders need to be disciplined and have a well-defined trading plan. Emotional control is crucial, as impulsive decisions based on fear or greed can lead to poor trading outcomes.

Lastly, it’s important to mention that short-term trading is subject to various rules and regulations. Depending on your jurisdiction and the platform you trade on, there may be restrictions on pattern day trading, minimum account balance requirements, and limitations on the number of trades you can execute in a day. Familiarize yourself with the rules and regulations applicable to your trading activities to ensure compliance.

Now that we have a basic understanding of short-term stock trading, let’s delve into the key factors to consider when picking stocks for short-term trading.

Factors to Consider when Picking Stocks for Short-Term Trading

When it comes to picking stocks for short-term trading, there are several factors to consider that can greatly influence your trading success. While there’s no foolproof formula for picking winning stocks, paying attention to these key factors can help you make more informed decisions:

- Market Trends: Monitoring the overall market trends is crucial for short-term traders. It’s important to align your trades with the market direction. Trading against the trend can increase the risk of losses.

- Liquidity: Choose stocks that are liquid and have high trading volumes. Stocks with low liquidity can be difficult to buy or sell quickly, leading to slippage and higher transaction costs.

- Volatility: Short-term traders thrive on volatility. Look for stocks with a history of price volatility as it presents opportunities for quick gains. Volatile stocks tend to have larger price swings, allowing traders to capitalize on short-term price movements.

- News and Events: Stay informed about the latest news and events that can impact the stock market. Earnings reports, mergers and acquisitions, economic data, and geopolitical news can significantly influence stock prices. Reacting quickly to news can give you an edge in short-term trading.

- Technical Analysis: Utilize technical analysis tools and indicators to identify patterns and trends in stock prices. Chart patterns, moving averages, and oscillators can help you determine entry and exit points for your trades.

- Sector Performance: Analyze the performance of specific sectors or industries. Certain sectors may outperform or underperform the broader market. By focusing on sectors with positive momentum or strong fundamentals, you increase the probability of selecting winning stocks.

- Risk versus Reward: Assess the risk-reward profile of each trade. Set stop-loss orders to limit potential losses and determine your profit targets. It’s essential to maintain a favorable risk-reward ratio to protect your capital and maximize potential gains.

It’s important to note that these factors are not independent of each other. They often intertwine and influence one another. For example, news events can trigger market trends and increase stock volatility. By considering these factors collectively, you can make more well-rounded decisions when selecting stocks for short-term trading.

Now that we’ve explored the factors to consider, let’s turn our attention to the technical analysis indicators that can assist in short-term stock selection.

Technical Analysis Indicators for Short-Term Stock Selection

Technical analysis is a widely used approach in short-term trading that involves studying historical price data, patterns, and indicators to predict future stock price movements. By utilizing technical analysis indicators, traders can identify potential entry and exit points for their short-term trades. Here are some key technical analysis indicators used in short-term stock selection:

- Moving Averages (MA): Moving averages are commonly used to identify trends and determine support and resistance levels. Short-term traders often rely on shorter time-frame moving averages, such as the 50-day or 100-day moving average, to analyze short-term price movements.

- Relative Strength Index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements. Traders use the RSI to identify overbought or oversold conditions, which can indicate potential reversals in stock price.

- Bollinger Bands: Bollinger Bands consist of a moving average line and two standard deviation lines above and below it. These bands can help traders identify periods of high volatility and potential entry or exit points.

- Volume: Trading volume is an essential indicator for short-term traders. Higher volume often accompanies significant price movements, suggesting increased buying or selling pressure. Unusually high volume can indicate a potential trend reversal.

- MACD: The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that helps traders identify the strength and direction of a stock’s trend. The MACD uses two moving averages and a histogram to represent changes in momentum.

- Stochastic Oscillator: The Stochastic Oscillator is a momentum indicator that compares a stock’s closing price to its price range over a specific period. Traders use the Stochastic Oscillator to identify overbought or oversold conditions and potential trend reversals.

- Candlestick Patterns: Candlestick patterns provide visual representations of a stock’s price action. Patterns such as doji, hammer, and engulfing patterns can indicate potential reversals or continuation of a trend.

It’s important to note that technical analysis indicators should be used in conjunction with other tools and factors mentioned earlier. These indicators are not foolproof and can provide false signals. Therefore, it’s crucial to validate signals from technical indicators with other forms of analysis before making trading decisions.

Now that we’ve covered the technical analysis indicators, let’s move on to the role of fundamental analysis in short-term stock selection.

Fundamental Analysis for Short-Term Stock Selection

While technical analysis plays a significant role in short-term stock selection, fundamental analysis also has its place. Fundamental analysis involves evaluating a company’s financial health, industry position, and market outlook to determine the intrinsic value of its stock. Here are some key aspects of fundamental analysis to consider when selecting stocks for short-term trading:

- Earnings Reports: Pay close attention to a company’s quarterly and annual earnings reports. Positive earnings surprises or strong growth in revenue and profits can lead to short-term price increases.

- Industry Analysis: Analyze the industry or sector in which the stock operates. Look for favorable industry trends, market demand, and competitive advantages that can drive short-term stock price movements.

- Company News and Events: Keep track of company news, such as product launches, partnerships, or regulatory approvals. Positive news can boost investor sentiment and lead to short-term price appreciation.

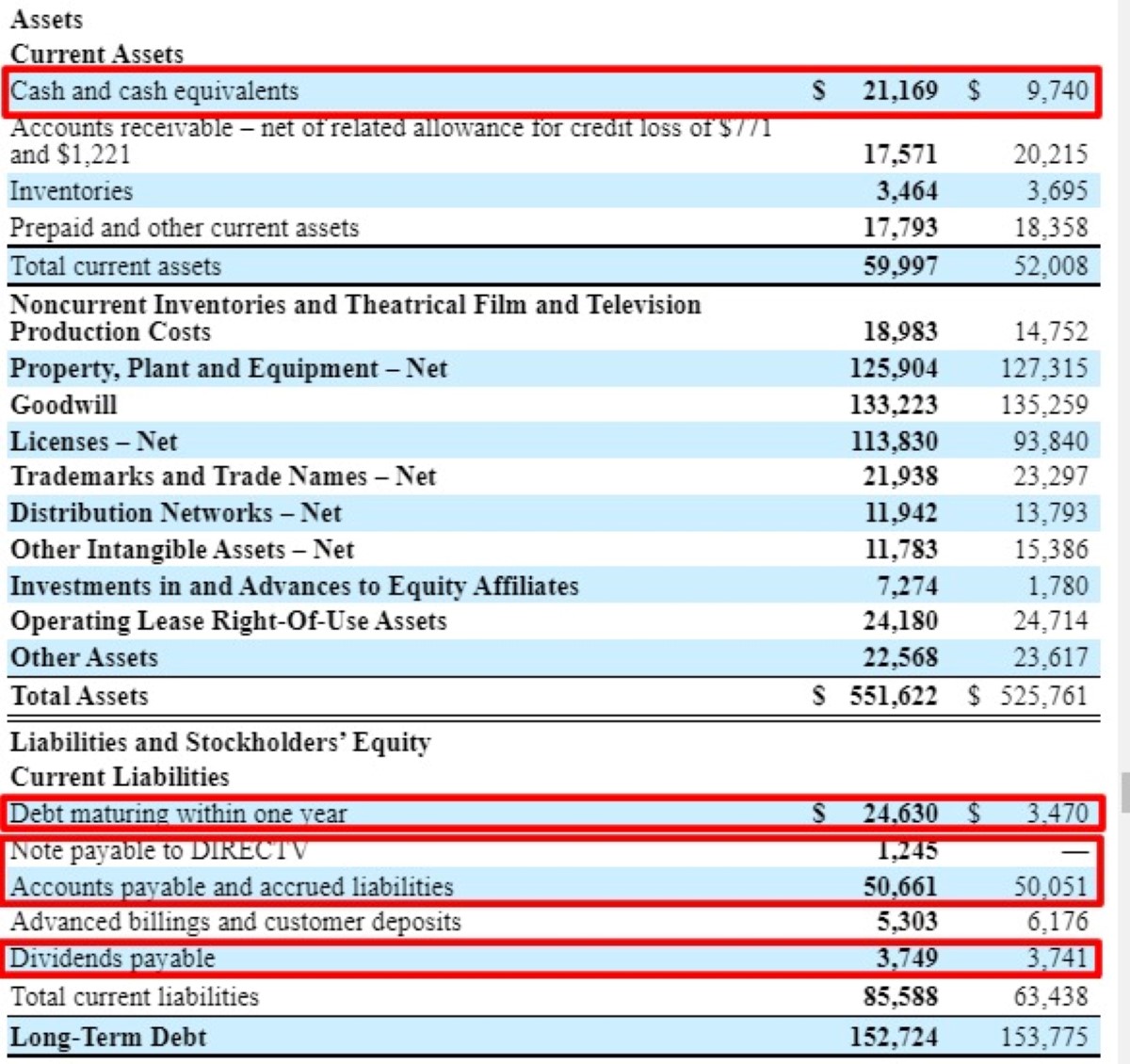

- Balance Sheet and Financial Ratios: Evaluate a company’s financial statements, including its balance sheet, income statement, and cash flow statement. Look for strong financial metrics, such as low debt levels, high liquidity, and attractive valuations.

- Management Analysis: Assess the competency and track record of a company’s management team. Strong leadership and strategic decisions can positively impact a stock’s short-term performance.

- Market Outlook: Consider broader market trends and economic conditions that can influence the stock’s short-term prospects. Factors such as interest rates, inflation, and geopolitical events can impact market sentiment and stock prices.

Combining fundamental analysis with technical analysis can provide a more comprehensive understanding of a stock’s potential short-term performance. Fundamental analysis helps identify stocks with strong underlying fundamentals, while technical analysis helps pinpoint favorable entry and exit points for short-term trades.

It’s important to note that fundamental analysis may not have an immediate impact on short-term stock prices. However, over time, as market participants digest the fundamental data, it can influence market sentiment and drive price movements.

Now that we’ve explored the role of fundamental analysis, let’s highlight some common mistakes to avoid when picking stocks for short-term trading.

Common Mistakes to Avoid when Picking Stocks for Short-Term Trading

Short-term trading can be both exciting and potentially profitable, but it also comes with its fair share of risks. To increase your success rate and avoid unnecessary losses, it’s important to be aware of common mistakes that traders often make when picking stocks for short-term trading. Here are some key pitfalls to avoid:

- Overtrading: One of the biggest mistakes is overtrading, which refers to excessive buying and selling of stocks. Overtrading can lead to increased transaction costs, unnecessary taxes, and emotional exhaustion. Stick to your trading plan and avoid impulsively entering and exiting trades.

- Ignoring Risk Management: Failing to implement proper risk management strategies is a recipe for disaster. Set stop-loss orders to limit potential losses and determine your risk tolerance before entering each trade. Avoid risking too much of your capital on a single trade.

- Chasing Hot Tips: Falling for hot stock tips or rumors can be tempting, but it’s a risky strategy. Relying on unsubstantiated information can lead to poor trading decisions and losses. Always do your own research and due diligence before making any trade.

- Ignoring Diversification: Putting all your eggs in one basket is a common mistake. Diversification helps spread risk and protect your portfolio. Avoid concentrating too much of your capital in a single stock or sector.

- Trading Based on Emotions: Emotional decision-making can be detrimental to your trading results. Fear, greed, and FOMO (fear of missing out) can cloud your judgment and lead to impulsive trading decisions. Stick to your trading plan and take emotions out of the equation.

- Not Staying Updated: Ignoring market news and events can leave you unaware of crucial information that may impact your trades. Stay informed about earnings reports, economic indicators, and other factors that can affect stock prices.

- Disregarding Exit Strategies: Having a plan for exiting a trade is just as important as entering one. Determine your profit targets and exit points before entering a trade. Avoid holding onto losing positions for too long, hoping for a turnaround.

Avoiding these common mistakes requires discipline, patience, and a well-defined trading strategy. By being aware of these pitfalls and actively working to avoid them, you increase your chances of making successful short-term trades.

Now that we’ve covered the mistakes to avoid, let’s conclude our discussion on picking stocks for short-term trading.

Conclusion

Picking good stocks for short-term trading requires a thoughtful and disciplined approach. By considering key factors such as market trends, liquidity, volatility, news events, and technical analysis indicators, you can enhance your chances of making profitable trades.

Technical analysis plays a crucial role in short-term stock selection, providing valuable insights into price patterns, trends, and momentum. Combining technical analysis with fundamental analysis gives you a more comprehensive understanding of a stock’s potential short-term performance.

However, it’s important to avoid common mistakes that can undermine your trading success. Overtrading, ignoring risk management, chasing hot tips, and making emotional trading decisions can lead to poor performance. It’s vital to stick to your trading plan, implement proper risk management strategies, and base decisions on sound analysis and research.

Remember, short-term trading carries inherent risks, and it’s not suitable for everyone. It requires active monitoring, quick decision-making, and the ability to manage emotions effectively. It’s crucial to continually educate yourself, stay updated on market news, and adapt your trading strategies as needed.

While short-term trading can offer the potential for quick profits, it’s essential to approach it with a realistic mindset. Not every trade will be a winner, and losses are a part of the game. By staying disciplined, managing risk, and learning from your experiences, you can increase your chances of long-term success in short-term trading.

Now, armed with the knowledge and insights gained from this article, you’re ready to embark on your journey to pick good stocks for short-term trading. Remember, practice, patience, and continuous learning will further sharpen your skills and improve your trading results. Good luck!