Home>Finance>What Are Short-Term Investments On Balance Sheet

Finance

What Are Short-Term Investments On Balance Sheet

Modified: February 6, 2024

Discover the importance of short-term investments on a balance sheet and how they contribute to financial planning in the field of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Short-term Investments

- Types of Short-term Investments

- Marketable Securities

- Treasury Bills

- Certificate of Deposits (CDs)

- Commercial Paper

- Money Market Funds

- Cash Equivalents

- Accounting for Short-term Investments on the Balance Sheet

- Presentation of Short-term Investments on the Balance Sheet

- Impact of Short-term Investments on Financial Statements

- Conclusion

Introduction

Short-term investments are a crucial component of a company’s balance sheet. They are financial assets that are expected to be converted into cash within a relatively short period, typically one year or less. These investments serve as a way for businesses to generate returns on excess cash that is not immediately needed for day-to-day operations. Additionally, short-term investments provide a level of liquidity and flexibility for companies, allowing them to seize opportunities or meet unexpected financial obligations.

In this article, we will delve into the definition of short-term investments, explore different types of short-term investments, discuss their accounting treatment on the balance sheet, and analyze the impact of these investments on a company’s financial statements. Understanding the nature and significance of short-term investments is essential for both investors seeking opportunities and companies striving to efficiently manage their financial resources.

Short-term investments play a vital role in optimizing a company’s overall investment strategy. By diversifying their portfolio, companies can reduce risk and potentially achieve higher returns. They also serve as a valuable tool for managing cash flow and maintaining financial stability. In essence, short-term investments are an integral part of a company’s financial planning, ensuring liquidity, and providing a buffer against market volatility.

Investors, on the other hand, can also benefit from short-term investments. These investments offer a higher degree of liquidity compared to long-term alternatives, enabling investors to swiftly deploy capital into profitable ventures or take advantage of market opportunities that can yield quick returns. Moreover, short-term investments are generally considered less risky and provide a sense of security as the investment horizon is relatively shorter.

However, it is important to note that while short-term investments have advantages, they also come with their own set of risks. The value of these investments can fluctuate due to market conditions, interest rate changes, or economic uncertainties. Investors and companies must carefully assess the risks associated with each type of short-term investment and consider their risk tolerance and investment objectives.

In the following sections, we will explore various types of short-term investments, discussing their characteristics, advantages, and considerations. Understanding these different options will equip individuals and businesses with the knowledge to make informed investment decisions and effectively manage their financial resources.

Definition of Short-term Investments

Short-term investments, also known as temporary investments or marketable securities, are financial assets that are easily convertible to cash and have a maturity period of one year or less. These investments are typically made by businesses and individuals to park excess funds and generate returns in a relatively short period of time.

Short-term investments can take various forms, including marketable securities, treasury bills, certificates of deposit, commercial paper, money market funds, and cash equivalents. These options offer varying degrees of liquidity, risk, and potential return. The choice of investment depends on the investor’s risk appetite, investment goals, and prevailing market conditions.

Marketable securities, such as stocks and bonds, are commonly held as short-term investments. They are easily tradable on recognized stock exchanges and offer the potential for capital appreciation or interest income. However, the value of marketable securities can be subject to market volatility, making them riskier than other short-term investments.

Treasury bills, or T-bills, are short-term debt instruments issued by governments to finance their short-term funding needs. T-bills are considered to be one of the safest short-term investments as they are backed by the full faith and credit of the issuing government. They are typically sold at a discount to their face value and redeemed at par upon maturity, providing investors with a predetermined return.

Certificates of deposit (CDs) are time deposits offered by banks and financial institutions. They have a fixed maturity period and typically offer a higher rate of interest than regular savings accounts. CDs are protected by deposit insurance, making them a relatively low-risk investment option. However, early withdrawal may result in penalties.

Commercial paper is a short-term debt instrument issued by corporations to meet their working capital needs. It is typically unsecured and has maturities ranging from a few days to several months. Commercial paper is commonly favored by institutional investors due to its relatively higher yields compared to other short-term investments. However, it carries a risk of default if the issuing company faces financial difficulties.

Money market funds are investment vehicles that invest in highly liquid and low-risk instruments, such as Treasury bills, commercial paper, and short-term bonds. These funds aim to maintain a stable net asset value (NAV) per share, making them suitable for investors seeking capital preservation and ready access to their funds.

Cash equivalents are highly liquid assets that are readily convertible to cash within a short period, typically three months or less. Examples of cash equivalents include money market funds, short-term government bonds, and highly liquid commercial paper. These investments provide a safe haven for excess cash while earning a modest return.

Overall, short-term investments serve as a means to generate returns on idle funds and enhance liquidity. They offer flexibility and a balance between risk and return. By carefully evaluating their investment options and understanding the characteristics of each type of short-term investment, individuals and businesses can make informed decisions to optimize their financial resources.

Types of Short-term Investments

Short-term investments encompass a range of options that offer varying levels of risk, return, and liquidity. Here are some common types of short-term investments:

1. Marketable Securities:

Marketable securities are financial instruments that are traded on recognized stock exchanges, such as stocks and bonds. They can be easily converted into cash and offer the potential for capital appreciation or dividend income. However, marketable securities are subject to market volatility and carry a certain level of risk. Investors should carefully assess their risk tolerance and investment objectives before investing in these securities.

2. Treasury Bills:

Treasury bills, also known as T-bills, are short-term debt instruments issued by governments to finance their short-term funding needs. They are considered one of the safest short-term investments as they are backed by the full faith and credit of the issuing government. T-bills are typically sold at a discount to their face value and redeemed at par upon maturity, providing investors with a predetermined return.

3. Certificate of Deposits (CDs):

Certificates of Deposit, or CDs, are time deposits offered by banks and financial institutions. They have fixed maturity periods and generally offer higher interest rates than regular savings accounts. CDs are considered relatively low-risk investments as they are protected by deposit insurance. However, early withdrawal may result in penalties.

4. Commercial Paper:

Commercial paper is a short-term debt instrument issued by corporations to meet their immediate funding needs. It is typically unsecured and has maturities ranging from a few days to several months. Commercial paper offers higher yields compared to other short-term investments, making it attractive to institutional investors. However, there is a risk of default if the issuing company faces financial difficulties.

5. Money Market Funds:

Money market funds are mutual funds that invest in highly liquid and low-risk instruments, such as Treasury bills, commercial paper, and short-term bonds. These funds aim to maintain a stable net asset value (NAV) per share, making them suitable for investors seeking capital preservation and ready access to their funds.

6. Cash Equivalents:

Cash equivalents are highly liquid assets that are readily convertible to cash within a short period, typically three months or less. Examples of cash equivalents include money market funds, short-term government bonds, and highly liquid commercial paper. These investments provide a safe haven for excess cash while earning a modest return.

It is important for investors and businesses to consider their risk tolerance, investment horizon, and liquidity needs when choosing among these short-term investment options. By diversifying their short-term investment portfolio and staying aware of market conditions, individuals and companies can effectively manage their financial resources and maximize returns while maintaining liquidity.

Marketable Securities

Marketable securities are financial instruments that are traded on recognized stock exchanges and can be easily converted into cash. Common examples of marketable securities include stocks and bonds, which are considered as short-term investments due to their relatively liquid nature.

Stocks: Stocks, also known as equities, represent ownership in a company. When investors purchase stocks, they become shareholders and have a stake in the company’s profits and assets. Stocks offer the potential for both capital appreciation and dividend income. However, their value can fluctuate based on market conditions and the performance of the issuing company. While stocks can be volatile in the short term, historically, they have delivered strong returns over the long term, making them an attractive option for investors with a higher risk tolerance.

Bonds: Bonds are debt instruments issued by governments, municipalities, and corporations to raise capital. When an investor buys a bond, they essentially lend money to the issuer in exchange for regular interest payments and the return of the principal amount upon maturity. Bonds are considered less risky than stocks as they provide fixed income and have a defined maturity date. However, bond prices can still fluctuate based on changes in interest rates and the creditworthiness of the issuer.

Investing in marketable securities requires careful consideration of an investor’s risk tolerance, investment goals, and knowledge of the financial markets. It is essential to conduct thorough research and analysis of individual companies or bonds before making investment decisions. Investors may also choose to invest in mutual funds or exchange-traded funds (ETFs) that hold a diversified portfolio of marketable securities, offering a level of diversification and professional management.

When it comes to accounting for marketable securities, they are recorded at fair market value on the balance sheet. Any changes in the value of marketable securities are recognized in the income statement, which can have an impact on a company’s profitability. Furthermore, the classification of marketable securities as either current or non-current depends on the intent of the company and its ability to convert them into cash within the next year.

Overall, marketable securities provide investors with the opportunity to participate in the growth of businesses or earn income through debt instruments. However, it is crucial to carefully assess the risks and rewards associated with investing in marketable securities and to diversify one’s portfolio accordingly to mitigate risks and maximize returns.

Treasury Bills

Treasury bills, commonly referred to as T-bills, are short-term debt instruments issued by governments to finance their short-term funding needs. T-bills are considered to be one of the safest investments available as they are backed by the full faith and credit of the issuing government.

T-bills are issued with various maturities, typically ranging from a few days to one year. They are sold at a discount to their face value, which represents the interest earned by the investor upon maturity. For example, if an investor buys a $1,000 T-bill with a discount rate of 1%, they will pay $990 upfront and receive $1,000 when the bill matures.

Treasury bills are highly liquid as they are actively traded on the secondary market. Investors can buy T-bills directly from the government through auctions or through brokerage firms. They can also sell them before maturity, although the price may fluctuate based on prevailing interest rates and market conditions.

One of the advantages of investing in T-bills is their low risk. Since they are issued by the government, the likelihood of default is extremely low, making them a popular choice for risk-averse investors. Moreover, T-bills are considered to be risk-free from credit and interest rate risks. However, they still carry a small degree of inflation risk, as the return on T-bills may not keep pace with inflation over the short term.

Treasury bills offer several benefits to investors. They provide a relatively high level of liquidity, allowing investors to convert their investment into cash quickly if needed. T-bills are also used as a benchmark for determining short-term interest rates and serve as a foundation for many other financial products.

From an accounting standpoint, T-bills are recorded as short-term investments on a company’s balance sheet. They are classified as marketable securities and are reported at their amortized cost or fair market value. Any changes in the value of T-bills are recognized as unrealized gains or losses in the income statement, which can impact a company’s financial performance.

In summary, Treasury bills are a low-risk investment option for short-term investors. They offer stability and liquidity, making them suitable for individuals and institutions looking to preserve capital with minimal risk. However, investors should consider other factors, such as inflation and opportunity costs, when making investment decisions. T-bills provide a reliable source of income and serve as a cornerstone in the portfolio diversification strategy of many investors.

Certificate of Deposits (CDs)

Certificates of Deposit, commonly known as CDs, are time deposits offered by banks and financial institutions. They are considered as short-term investments because they have fixed maturity periods ranging from a few months to several years.

When investing in a CD, an individual deposits a fixed amount of money with the bank or financial institution for a specified period. In return, the investor receives interest payments at regular intervals, such as monthly, quarterly, or annually. At the end of the maturity period, the investor receives the original principal amount back, including the accumulated interest.

The interest rate on CDs is typically higher than that of regular savings accounts since the investor agrees to leave the money with the bank for a specific duration. The longer the maturity period of the CD, the higher the interest rate is likely to be. CDs are also considered to be lower-risk investments since they are insured by the Federal Deposit Insurance Corporation (FDIC) in the United States, up to the maximum coverage limit.

CDs offer several advantages to investors. First, they provide a stable and predictable return since the interest rate is fixed throughout the investment period. This makes CDs suitable for risk-averse investors looking for a guaranteed source of income. Second, CDs offer flexibility in choosing the duration of the investment, ranging from a few months to several years. This makes it possible for investors to align their investment strategy with their financial goals and anticipated cash flow needs.

It is important to note that withdrawing funds from a CD before its maturity date may result in penalties, such as a reduction in accrued interest or forfeiture of a portion of the principal amount. The penalty amount varies depending on the terms and conditions set by the bank or financial institution.

From an accounting perspective, CDs are typically classified as short-term investments on a company’s balance sheet. They are reported at their cost or amortized cost and any interest earned is recognized as interest income over the investment period. The maturity date of the CD determines whether it is categorized as a current asset or a non-current asset.

In summary, Certificate of Deposits (CDs) are a low-risk investment option for individuals and businesses seeking a stable and predictable return. They provide the flexibility to choose the investment duration and offer FDIC insurance protection. However, investors should be mindful of the penalties associated with early withdrawals and consider their liquidity needs before investing in CDs.

Commercial Paper

Commercial paper is a short-term debt instrument issued by corporations to meet their immediate funding needs. It serves as a way for companies to raise capital quickly and efficiently, typically for periods ranging from a few days to several months.

Commercial paper is typically issued at a discount to face value, with the difference between the discounted purchase price and the face value representing the interest earned by the investor. The interest rate on commercial paper is influenced by various factors, including market conditions, creditworthiness of the issuer, and the maturity period.

One of the primary advantages of investing in commercial paper is the potential for higher yields compared to other short-term investments. Due to the relatively higher risk associated with commercial paper, investors can expect to earn a higher return. However, it’s important to note that the increased yield also comes with a higher degree of risk, as the issuer may default on payment.

When considering an investment in commercial paper, investors should assess the creditworthiness of the issuing company. Ratings agencies such as Standard and Poor’s (S&P), Moody’s, and Fitch provide evaluations of the credit quality of commercial paper issuers, giving investors an indication of the level of risk associated with the investment.

Commercial paper offers benefits to both companies and investors. For companies, commercial paper provides a flexible and cost-effective method of raising short-term funds to finance day-to-day business operations, manage working capital, or fund specific projects. It allows companies to diversify their funding sources and reduce their reliance on bank loans or lines of credit.

For investors, commercial paper can provide an attractive investment option compared to other short-term instruments. It offers potentially higher yields than Treasury bills or money market funds, making it appealing to institutional investors seeking short-term income. However, it is important to carefully evaluate the creditworthiness of the issuer and assess the risks associated with each individual investment.

From an accounting standpoint, commercial paper is typically classified as a marketable security on a company’s balance sheet. If the maturity period is less than one year, it is reported as a current asset. The value of commercial paper is recorded at its amortized cost or fair value, with any changes in value recognized in the income statement.

In summary, commercial paper serves as a significant source of short-term funding for corporations while providing potentially higher yields for investors. However, investors should conduct proper due diligence and carefully assess the creditworthiness of the commercial paper issuer to determine the level of risk they are comfortable with.

Money Market Funds

Money market funds are investment vehicles that pool money from individuals and institutions to invest in highly liquid, low-risk, short-term instruments. They aim to maintain a stable net asset value (NAV) of $1 per share, making them an attractive option for investors seeking capital preservation and easy access to their funds.

Money market funds primarily invest in instruments such as Treasury bills, commercial paper, certificates of deposit, and short-term government bonds. These investments have short maturities and high credit quality, making them relatively safe and providing stable returns.

One of the key advantages of money market funds is the high degree of liquidity they offer. Investors can typically redeem their shares at any time, converting them into cash quickly. This makes money market funds an ideal choice for individuals and businesses needing immediate access to funds without sacrificing safety.

Money market funds play a vital role in cash management strategies for both individuals and corporations. They provide a reliable and convenient option for parking excess cash temporarily, ensuring that idle funds can still earn a modest return while remaining easily accessible.

Additionally, money market funds can serve as a viable alternative to traditional savings accounts or short-term deposits. They often offer higher yields compared to regular bank accounts while maintaining a similar level of safety due to their diversified portfolio of highly liquid and low-risk investments.

Investors should note that money market funds are not guaranteed or insured by the government, unlike bank savings accounts or certificates of deposit. While money market funds strive to maintain a stable NAV of $1 per share, there is still a slight possibility of experiencing a small decline or “breaking the buck” during periods of extreme market volatility or a significant credit event.

From an accounting perspective, money market funds are classified as an investment or a current asset on the balance sheet, depending on the anticipated holding period of the investment. They are recorded at amortized cost or fair value, with any unrealized gains or losses recognized in the income statement.

In summary, money market funds offer a balance between liquidity, safety, and returns. They provide a convenient and low-risk investment option for individuals and businesses with surplus cash, allowing them to earn a modest return while maintaining easy access to their funds. However, investors should carefully evaluate the specific money market fund, consider the associated risks, and ensure that the fund aligns with their investment objectives and risk tolerance.

Cash Equivalents

Cash equivalents are highly liquid assets that are easily convertible into cash within a short period, typically three months or less. These assets are considered as short-term investments due to their high degree of liquidity and low risk. Cash equivalents serve as a safe haven for excess cash while earning a modest return.

Examples of cash equivalents include money market funds, short-term government bonds, and highly liquid commercial paper. These investments are characterized by their stability, high credit quality, and short maturities.

One of the key advantages of cash equivalents is their high level of liquidity. They can be readily converted into cash without experiencing significant price fluctuations or loss of value. This allows individuals and companies to access funds quickly in case of unexpected expenses or investment opportunities.

Cash equivalents also provide a safe and relatively low-risk investment option. They are typically issued by governments, financial institutions, or highly reputable corporations with strong credit ratings. As a result, they offer a higher level of security compared to longer-term investments or riskier asset classes, such as stocks or corporate bonds.

Investors often turn to cash equivalents to preserve capital and maintain stability in their portfolios. They offer a means to park excess cash temporarily while providing a conservative return. Cash equivalents are particularly suitable for risk-averse investors who prioritize capital preservation over higher potential returns.

From an accounting standpoint, cash equivalents are reported as current assets on the balance sheet. They are typically recorded at their cost or amortized cost, representing the amount initially invested. Any interest earned from cash equivalents is recognized as interest income in the income statement.

It is important to note that although cash equivalents are relatively safe investments, they may not offer the potential for significant capital appreciation or high yields. They are best suited for individuals and businesses seeking stability and liquidity rather than aggressive short-term gains.

In summary, cash equivalents are highly liquid assets that serve as a safe and low-risk investment option. They provide stability, easy access to funds, and a conservative return. Cash equivalents play a crucial role in managing excess cash and ensuring financial resilience, especially for individuals and businesses with a priority for liquidity and capital preservation.

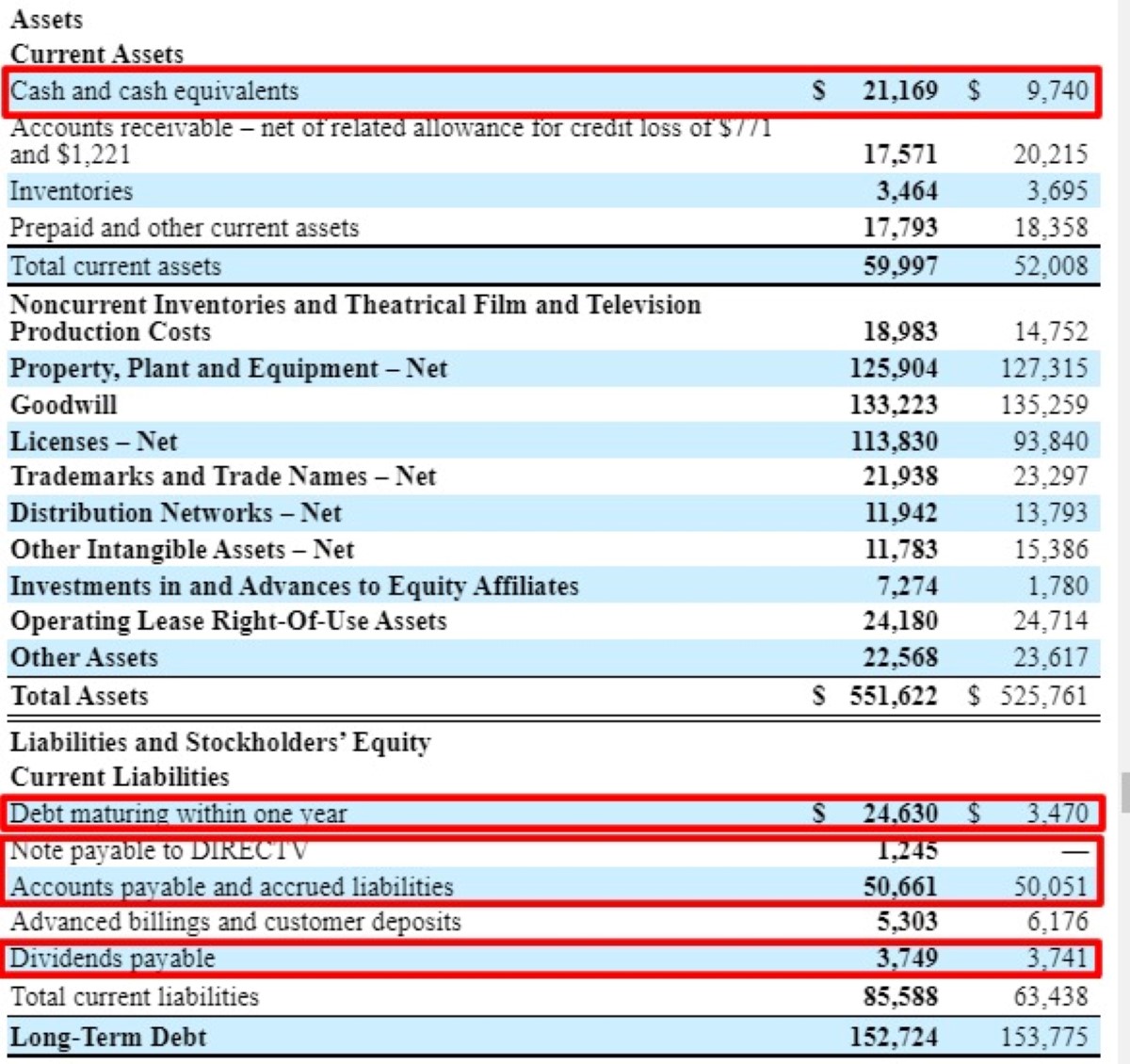

Accounting for Short-term Investments on the Balance Sheet

Accounting for short-term investments on the balance sheet involves recording and valuing these investments to reflect their current market value and classify them appropriately. Proper accounting ensures accurate financial reporting and provides transparency to stakeholders regarding a company’s investment activities.

Short-term investments are classified as either marketable securities or non-marketable securities. Marketable securities are those that can be easily bought and sold in active markets, such as stocks and bonds. Non-marketable securities refer to investments that cannot be readily sold or traded, such as loans or advances given to other entities.

Marketable securities are typically recorded at fair value on the balance sheet, which is the current market price. Any changes in the fair value are recognized in the income statement as unrealized gains or losses. Non-marketable securities, on the other hand, are usually recorded at cost or amortized cost, representing the amount initially invested.

In order to determine the fair value of marketable securities, companies may rely on quoted market prices from recognized stock exchanges or use pricing models based on observable market data. In cases where active market prices are not available, companies may use estimation techniques, such as valuation models or pricing inputs from similar securities.

It is important for companies to regularly evaluate the value of their short-term investments and adjust their balance sheet accordingly. This ensures that the financial statements accurately reflect the current market conditions and the performance of the investments.

Another aspect of accounting for short-term investments is the classification as either current or non-current assets. Current assets are those that are expected to be converted into cash within one year or the operating cycle of the company, whichever is longer. If the short-term investment is expected to be converted into cash within the next year, it is classified as a current asset. Otherwise, it is considered a non-current asset.

Proper accounting for short-term investments enables investors, creditors, and other stakeholders to assess the liquidity, risk, and value of a company’s investment portfolio. It allows for better decision-making and provides insights into the financial health and performance of the company.

In summary, accounting for short-term investments on the balance sheet involves recording and valuing these investments at fair value for marketable securities and cost or amortized cost for non-marketable securities. This ensures accurate financial reporting and transparency regarding a company’s investment activities, allowing stakeholders to evaluate its investment portfolio effectively.

Presentation of Short-term Investments on the Balance Sheet

The presentation of short-term investments on the balance sheet involves categorizing and disclosing these investments in a clear and organized manner to provide transparency to stakeholders about a company’s investment activities and their impact on its financial position.

Short-term investments are typically presented as a separate line item on the balance sheet, distinct from other current assets. This allows for better visibility and analysis of the company’s investment portfolio. The presentation may vary depending on the nature and classification of the investments, such as marketable securities or non-marketable securities.

For marketable securities, such as stocks or bonds, companies commonly disclose the breakdown of different types of investments within the line item of short-term investments. This provides additional insight into the composition and diversification of the investment portfolio. The fair value of marketable securities is typically reported based on available market prices or valuation techniques as discussed in the previous section on accounting for short-term investments.

Non-marketable securities, such as loans or advances given to other entities, may be separately disclosed within the short-term investments line item or presented as a separate line item altogether. These investments are typically reported at cost or amortized cost to reflect the amount initially invested. Any adjustments, such as impairment losses, are recognized separately.

Companies also provide additional disclosures in the footnotes to the financial statements regarding their short-term investments. These disclosures include information about the maturity dates, interest rates, credit ratings, and changes in fair value or cost of the investments. Such disclosures enhance transparency and provide meaningful information to stakeholders regarding the risks and uncertainties associated with the investments.

The presentation of short-term investments on the balance sheet is crucial for investors, creditors, and other stakeholders to assess the liquidity, risk, and value of a company’s investment portfolio. It allows them to understand the composition of the portfolio, the level of diversification, and the potential impact on the financial position and performance of the company.

It is important to note that presentation and disclosure requirements may vary across accounting frameworks or standards. Companies are required to follow the relevant accounting standards and regulatory requirements applicable in their jurisdiction.

In summary, the presentation of short-term investments on the balance sheet involves categorizing and disclosing these investments in a clear and organized manner. This includes separate line items for marketable and non-marketable securities, additional disclosures in the footnotes, and reporting the fair value or cost of the investments. This presentation enhances transparency and allows stakeholders to assess the investment portfolio’s impact on a company’s financial position.

Impact of Short-term Investments on Financial Statements

Short-term investments have a significant impact on a company’s financial statements, affecting various key components and providing insights into the company’s liquidity, profitability, and overall financial performance.

Balance Sheet:

On the balance sheet, short-term investments are reported as assets. They are typically classified as either marketable securities or non-marketable securities, depending on their convertibility, liquidity, and intended holding period. Marketable securities are reported at fair value, while non-marketable securities are reported at cost or amortized cost. The value of short-term investments contributes to the overall asset base of the company, providing an indication of its investment activities and potential sources of future cash inflows.

Income Statement:

The income statement reflects the impact of short-term investments on a company’s profitability. For marketable securities, any changes in fair value are recognized as unrealized gains or losses in the income statement. These unrealized gains or losses are not realized until the securities are sold. The income statement may also include any interest income or dividend income earned from marketable securities. Non-marketable securities, on the other hand, generally do not impact the income statement until their value is impaired or when they are disposed of.

Cash Flow Statement:

The cash flow statement highlights the effect of short-term investments on a company’s cash flow. When short-term investments are bought or sold, the cash flows related to these transactions are reported in the operating, investing, or financing activities section, depending on the nature of the investment. Cash inflows occur when short-term investments are sold or mature, while cash outflows occur when new investments are purchased. The cash flow statement provides insight into the company’s ability to generate and manage cash flows from its investment activities.

Disclosures:

Companies also provide relevant disclosures in the footnotes to the financial statements regarding their short-term investments. These disclosures may include information about the nature of the investments, the maturity dates, interest rates, credit ratings, fair value hierarchy, and any restrictions on their sale or disposal. These disclosures enhance transparency and provide stakeholders with additional insights into the risks, uncertainties, and potential impacts on the financial statements associated with the short-term investments.

Overall, short-term investments have a significant impact on a company’s financial statements, providing valuable information about its investment activities, liquidity, profitability, and cash flow generation. Stakeholders rely on these financial statements to assess a company’s financial health, investment strategy, and risk management practices.

Conclusion

Short-term investments play a crucial role in the financial planning and management of both individuals and businesses. By efficiently allocating excess funds, short-term investments provide opportunities for generating returns, maintaining liquidity, and managing financial stability.

We have explored various types of short-term investments, including marketable securities, treasury bills, certificates of deposits, commercial paper, money market funds, and cash equivalents. Each type offers different levels of risk, return, and liquidity, allowing investors to tailor their investment strategy to their unique goals and risk tolerance.

Accounting for short-term investments involves accurately recording and valuing these investments on the balance sheet. Marketable securities are typically reported at fair value, while non-marketable securities are recorded at cost or amortized cost. Proper presentation and disclosure of short-term investments on the balance sheet provide transparency for stakeholders to assess a company’s investment activities and financial position.

Short-term investments have a significant impact on a company’s financial statements. They contribute to the asset base on the balance sheet, affect the profitability and income statement through changes in fair value or interest income, and impact the cash flow statement by generating cash inflows or outflows. The financial statements and related disclosures provide valuable information for investors, creditors, and other stakeholders to evaluate a company’s financial health and performance.

In conclusion, short-term investments serve as a vital component of financial planning and risk management. By carefully considering the different types of investments, understanding their characteristics, and evaluating their impact on financial statements, individuals and businesses can make informed decisions to optimize their financial resources and achieve their short-term investment goals.