Finance

What Is Short-Term Debt On The Balance Sheet?

Modified: February 21, 2024

Learn about short-term debt on the balance sheet and its significance in finance. Gain insights into how it impacts a company's financial health and cash flow.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to analyzing a company’s financial health, one crucial aspect that investors and creditors pay close attention to is its balance sheet. The balance sheet provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. One key component of the liabilities side of the balance sheet is short-term debt.

Short-term debt is a type of borrowing that is expected to be repaid within one year or less. It usually includes obligations such as loans, lines of credit, and commercial paper that are due within a relatively short period of time.

In this article, we will explore the definition of short-term debt on the balance sheet, its various types, and its significance in assessing a company’s financial position. We will also delve into an example of short-term debt on the balance sheet and its impact on financial ratios. Lastly, we will discuss strategies for effectively managing short-term debt.

Understanding short-term debt is vital for investors, creditors, and even managers as it provides insights into a company’s liquidity, solvency, and ability to meet its short-term obligations. So, let’s dive in and explore the ins and outs of short-term debt on the balance sheet.

Definition of Short-Term Debt

Short-term debt, also known as current liabilities or current debt, is a category of debt that includes any obligations that a company is required to repay within a period of one year or less. It represents the portion of a company’s total debt that must be settled in the short term, typically with the use of current assets or from the proceeds of ongoing operations.

This type of debt is distinct from long-term debt, which has a maturity period exceeding one year. While long-term debt may consist of loans, bonds, or other financial instruments, short-term debt typically includes loans, lines of credit, and other forms of borrowing that have a shorter repayment timeline.

Short-term debt often serves as a temporary source of funding for a company’s short-term operational needs, such as financing payroll, inventory purchases, and working capital requirements. It allows companies to bridge any gap between cash inflows and outflows, ensuring smooth day-to-day operations.

It is important to note that short-term debt should not be confused with trade payables, which are the amounts owed to suppliers for purchases made on credit. Trade payables are typically classified as accounts payable, a separate category on the balance sheet.

The inclusion of short-term debt on the balance sheet provides important information about a company’s liquidity and its ability to meet its short-term financial obligations. Investors and creditors closely monitor this metric to assess a company’s short-term financial health and its ability to manage its cash flow effectively.

Now that we have a clear understanding of what short-term debt entails, let’s explore the different types of short-term debt that can appear on a company’s balance sheet.

Types of Short-Term Debt

Short-term debt can take various forms and arise from different sources. Here are some common types of short-term debt that you may find on a company’s balance sheet:

- Bank Loans: Companies often secure short-term financing through bank loans, which may include term loans or revolving lines of credit. Term loans provide a lump sum of funds repaid over a fixed period, while revolving lines of credit allow companies to borrow up to a specific credit limit and repay as funds are needed.

- Trade Credit: Trade credit refers to the credit extended to a company by its suppliers. This short-term debt allows the company to purchase goods and services on credit terms, typically with specified payment terms.

- Commercial Paper: Commercial paper is a short-term promissory note issued by corporations to raise short-term funds. It is typically unsecured and has a maturity of 270 days or less. Commercial paper is commonly used by large, creditworthy companies as a cost-effective means of obtaining short-term financing.

- Accounts Payable: While not a form of borrowing, accounts payable represents the amounts owed to suppliers or vendors for goods or services purchased on credit. These payables are typically due within a short period, making them a form of short-term debt for the company.

- Accrued Expenses: Accrued expenses are expenses incurred but not yet paid. These can include items such as salaries, utilities, rent, and taxes. While not a traditional form of borrowing, they represent short-term obligations that need to be settled in the near future.

- Notes Payable: Companies may issue short-term promissory notes or IOUs to borrow funds for a specific period. These notes payable have a fixed maturity date and typically accrue interest over the borrowing period.

These are just a few examples of the types of short-term debt that a company may have on its balance sheet. The specific composition of short-term debt will depend on the nature of the company’s operations, its financing activities, and its industry.

Now that we have explored the different types of short-term debt, let’s understand why it is important to consider short-term debt when analyzing a company’s financial position.

Importance of Short-Term Debt on the Balance Sheet

Short-term debt plays a crucial role in assessing a company’s financial position and overall stability. Here are several reasons why short-term debt on the balance sheet is important:

- Liquidity Assessment: Short-term debt provides insights into a company’s liquidity, which refers to its ability to meet its short-term financial obligations. By analyzing the amount and composition of short-term debt, investors and creditors can evaluate the company’s ability to generate sufficient cash flow to cover its near-term liabilities.

- Working Capital Management: Short-term debt often helps finance a company’s working capital needs, which includes maintaining sufficient cash, inventory, and accounts receivable to support daily operations. By monitoring the short-term debt levels, investors and creditors can assess how effectively the company manages its working capital requirements.

- Financial Stability: High levels of short-term debt relative to a company’s current assets can indicate financial instability. It suggests a higher risk of default or an inability to meet short-term obligations when the debts come due. Investors and creditors look for a healthy balance between short-term debt and current assets to ensure a company’s financial stability.

- Debt Servicing Capacity: Short-term debt requires regular interest payments and repayment of principal within a relatively short period. By analyzing the company’s financial ratios, such as the interest coverage ratio and the current ratio, investors and creditors can assess the company’s ability to service its short-term debt obligations using its available cash flow and current assets.

- Investor Confidence: Short-term debt levels can influence investor confidence in a company. High levels of short-term debt may be perceived as a sign of financial stress or poor management. On the other hand, a prudent and well-managed level of short-term debt can instill investor confidence and demonstrate that the company has a strong financial position.

Overall, the inclusion of short-term debt on the balance sheet is critical for evaluating a company’s short-term financial health, its capacity to manage its obligations, and its overall financial stability. It provides valuable insights to investors, creditors, and other stakeholders in making informed decisions about the company’s prospects and risk profile.

Now, let’s move on to an example that illustrates how short-term debt appears on the balance sheet.

Example of Short-Term Debt on the Balance Sheet

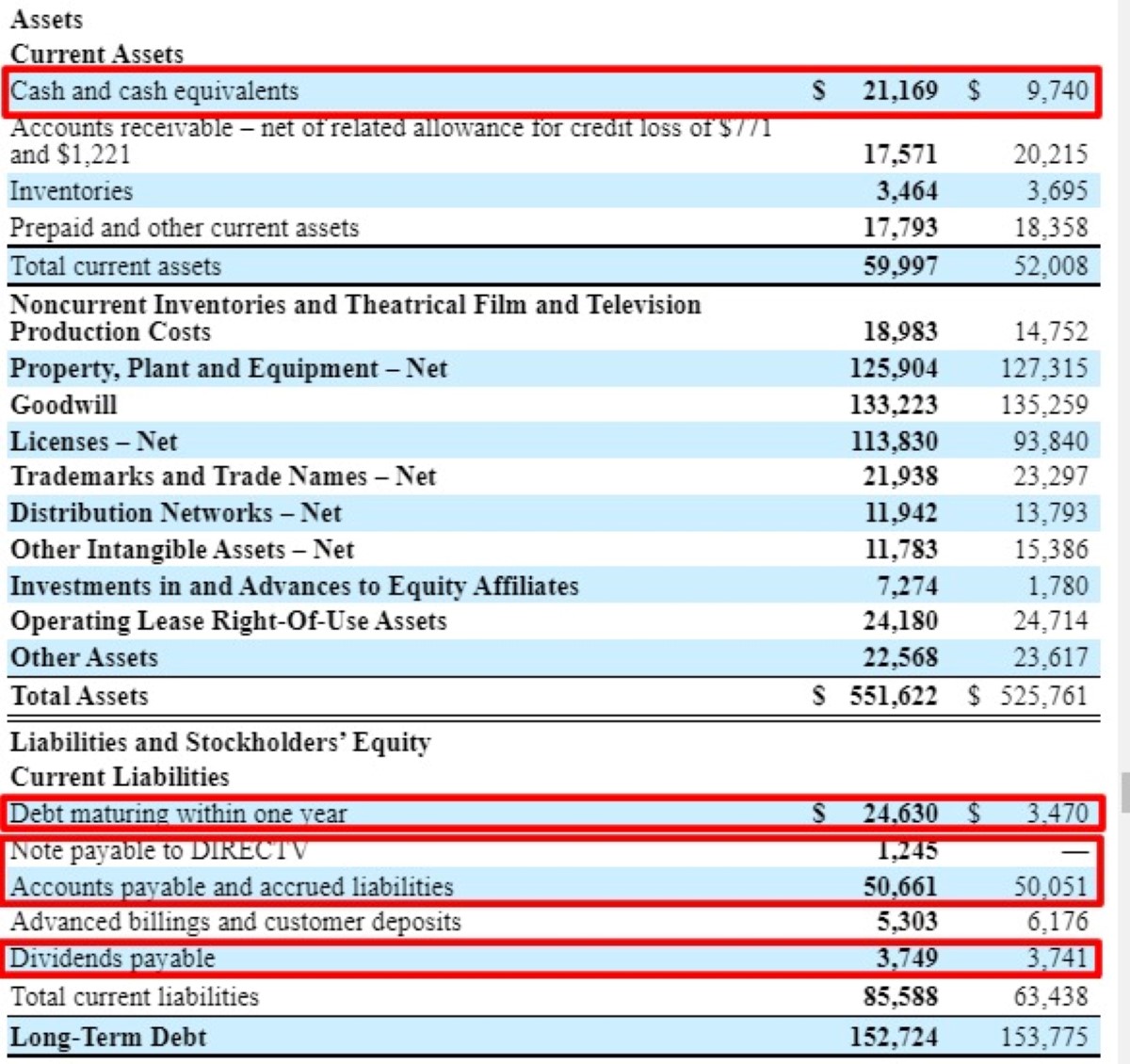

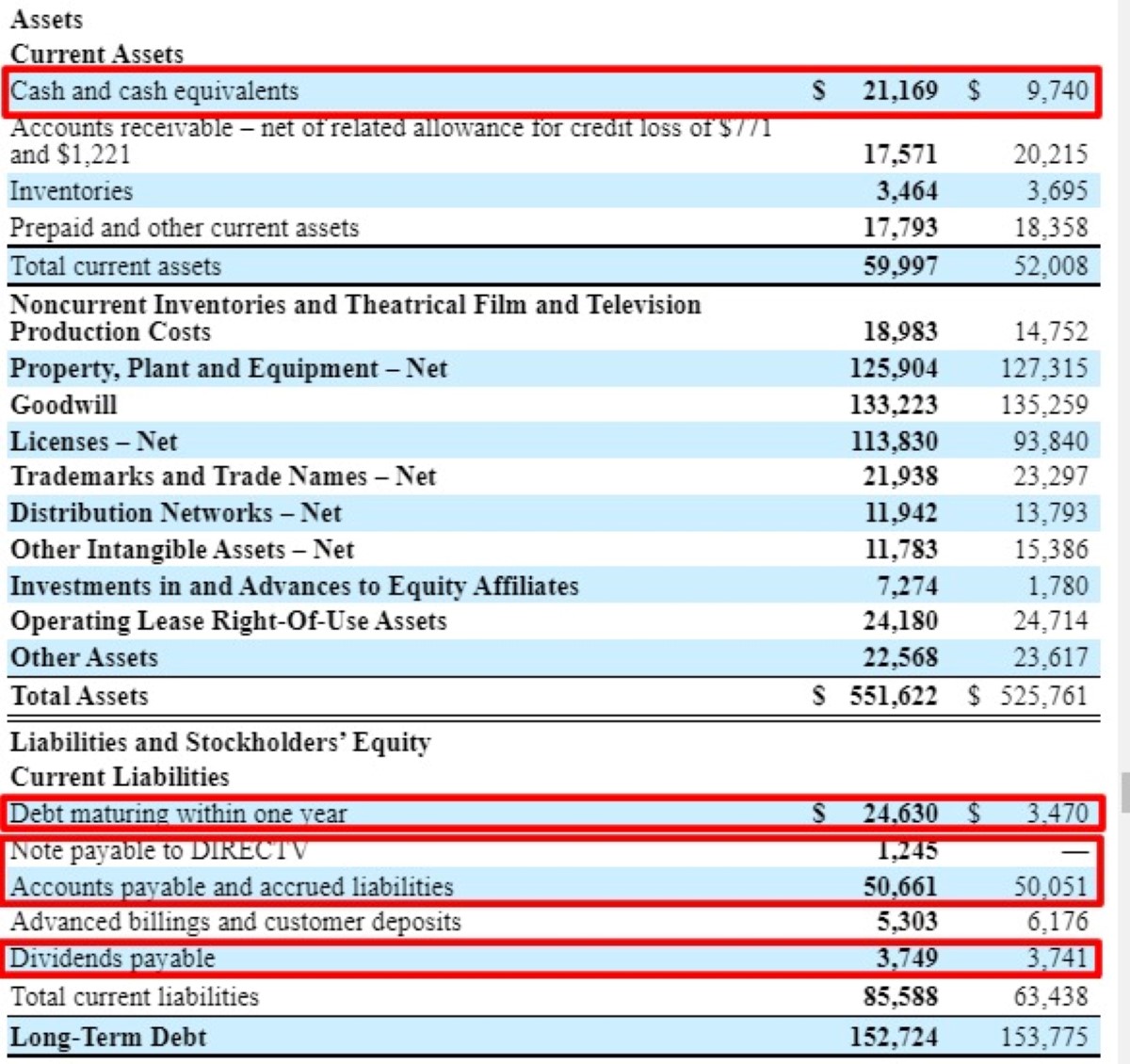

Let’s consider an example of a hypothetical company, XYZ Corporation, and examine how short-term debt appears on its balance sheet. The balance sheet of XYZ Corporation as of December 31, 2021, is as follows:

| Assets | Liabilities | Equity | ||

|---|---|---|---|---|

| Cash | $100,000 | Accounts Payable | $50,000 | Share Capital |

| Accounts Receivable | $75,000 | Short-Term Debt | $150,000 | Retained Earnings |

| Inventory | $120,000 | Other Current Liabilities | $25,000 | |

| Fixed Assets | $500,000 |

In the example above, we can see that XYZ Corporation has a short-term debt of $150,000, which is categorized under the liabilities section of the balance sheet. This debt is due within one year or less.

This short-term debt could consist of a combination of bank loans, lines of credit, or any other form of borrowing that XYZ Corporation has taken on to meet its short-term financial obligations. It represents the amount of money that the company owes and must repay within the next 12 months.

By analyzing this information, investors, creditors, and other stakeholders can assess the company’s liquidity, its ability to meet its short-term obligations, and its financial stability. They can also compare the short-term debt level with the company’s current assets to evaluate its debt-to-asset ratio, a measure of financial leverage and risk.

It’s important to note that this is just a simplified example for illustrative purposes. In reality, a company’s balance sheet may include more detailed information about its short-term debt, such as the interest rates, maturity dates, and specific terms of the loans or credit facilities.

Now that we have explored an example of short-term debt on the balance sheet, let’s move on to understanding the impact of short-term debt on various financial ratios.

Impact of Short-Term Debt on Financial Ratios

Short-term debt has a significant impact on various financial ratios that are used to assess a company’s financial performance, liquidity, and solvency. Here are some key financial ratios that are influenced by the level of short-term debt:

- Current Ratio: The current ratio is calculated by dividing a company’s current assets by its current liabilities. Current assets include cash, accounts receivable, and inventory, while current liabilities encompass short-term debt, accounts payable, and other current obligations. A higher current ratio indicates better short-term liquidity, as it demonstrates that a company has sufficient current assets to cover its short-term liabilities.

- Quick Ratio: The quick ratio, also known as the acid-test ratio, is a more stringent measure of a company’s short-term liquidity. It excludes inventory from current assets, as inventory may take time to convert into cash. Instead, the quick ratio focuses on highly liquid assets such as cash and accounts receivable. By excluding inventory, the quick ratio provides a more conservative assessment of a company’s ability to meet short-term obligations.

- Debt-to-Equity Ratio: The debt-to-equity ratio is calculated by dividing a company’s total debt, including short-term debt and long-term debt, by its total equity. This ratio measures the proportion of a company’s financing that is contributed by debt holders versus equity shareholders. A higher debt-to-equity ratio indicates a higher level of leverage and financial risk, as it signifies a greater reliance on debt financing.

- Interest Coverage Ratio: The interest coverage ratio assesses a company’s ability to meet its interest expense obligations. It is calculated by dividing a company’s earnings before interest and taxes (EBIT) by its interest expenses. A higher interest coverage ratio indicates that the company has sufficient earnings to cover its interest payments on its short-term debt and other borrowings.

- Operating Cash Flow Ratio: The operating cash flow ratio compares a company’s operating cash flow to its short-term debt obligations. It measures the company’s ability to generate sufficient cash flow from its core operations to repay its short-term debt. A higher operating cash flow ratio indicates better cash generation and a stronger ability to meet short-term debt obligations.

These financial ratios, among others, provide valuable insights into a company’s liquidity, solvency, and financial health. By considering the impact of short-term debt on these ratios, investors and creditors can gain a deeper understanding of a company’s ability to manage its short-term financial obligations and make informed decisions about its risk and potential return.

It’s important to note that the interpretation of these ratios may vary across industries and company contexts. Comparisons should be made within industries or against historical performance to derive meaningful insights.

Now that we understand the impact of short-term debt on financial ratios, let’s explore strategies for effectively managing short-term debt.

Managing Short-Term Debt

Effective management of short-term debt is crucial for maintaining financial stability and ensuring smooth operations. Here are some strategies that companies can employ to manage their short-term debt:

- Optimize Working Capital: Companies can focus on optimizing their working capital by efficiently managing cash flow, inventory, and accounts receivable. This involves implementing effective cash management practices, such as timely collections from customers, negotiating favorable payment terms with suppliers, and maintaining an optimal level of inventory to avoid overstocking or shortages.

- Utilize Cash Flow Forecasting: Cash flow forecasting helps companies project their future cash inflows and outflows. By having a clear understanding of their cash position, companies can plan for their short-term debt obligations more effectively. They can anticipate potential cash shortfalls and take proactive measures to secure additional funding or manage their cash flows more prudently.

- Renegotiate Terms with Creditors: Companies experiencing financial difficulties may consider renegotiating the terms of their short-term debt with their creditors. This could involve extending repayment periods, reducing interest rates, or seeking temporary relief through debt restructuring agreements. Open communication and transparency with creditors can help create mutually beneficial solutions and alleviate financial burdens.

- Seek Alternative Financing Options: Companies can explore alternative sources of financing to meet short-term funding needs. This may include utilizing trade credit, factoring accounts receivable, or securing short-term loans from non-traditional lenders. Diversifying financing sources can provide additional flexibility and mitigate reliance on a single financing avenue.

- Monitor and Control Expenses: Controlling expenses is important for maintaining a healthy cash flow cycle and minimizing the need for excessive short-term borrowing. Companies should regularly review their expenditure patterns, identify areas of unnecessary spending, and implement cost-saving measures wherever possible. This includes monitoring discretionary expenditures, negotiating better pricing with suppliers, and optimizing operational efficiency.

- Maintain Adequate Reserves: Building reserves or contingency funds can act as a cushion during times of financial strain. By setting aside funds specifically for short-term debt repayment or unforeseen expenses, companies can reduce reliance on external financing sources and ease their financial burden in times of economic uncertainty or unexpected events.

By implementing these strategies, companies can effectively manage their short-term debt and improve their financial stability. It is important for companies to regularly review and adjust their debt management strategies, considering changes in market conditions, cash flow projections, and overall business objectives.

Now that we have explored strategies for managing short-term debt, let’s conclude our article.

Conclusion

Short-term debt is a critical component of a company’s balance sheet, representing the portion of debt that is due within one year or less. It plays a key role in assessing a company’s liquidity, financial stability, and ability to meet short-term obligations. Understanding and effectively managing short-term debt is essential for investors, creditors, and managers in evaluating a company’s financial health.

In this article, we explored the definition of short-term debt and its various types, such as bank loans, trade credit, commercial paper, accounts payable, accrued expenses, and notes payable. We highlighted the importance of short-term debt on the balance sheet, including its impact on financial ratios like the current ratio, debt-to-equity ratio, interest coverage ratio, and operating cash flow ratio.

We also provided an example of how short-term debt appears on a balance sheet and discussed strategies for managing short-term debt effectively. These strategies include optimizing working capital, utilizing cash flow forecasting, renegotiating terms with creditors, seeking alternative financing options, monitoring and controlling expenses, and maintaining adequate reserves.

By implementing these strategies, companies can enhance their financial stability, mitigate risk, and improve their overall performance. It is crucial to regularly review the company’s short-term debt position, adapt strategies as necessary, and communicate openly with stakeholders to ensure sound financial management.

In conclusion, short-term debt on the balance sheet is an important indicator of a company’s financial health and management capabilities. By carefully managing short-term debt obligations, companies can maintain liquidity, optimize their capital structure, and navigate the dynamic financial landscape successfully.