Finance

How To Promote Life Insurance

Published: October 16, 2023

Learn effective strategies to promote life insurance and secure your financial future. Explore our comprehensive guide on promoting life insurance and make informed financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understand the Importance of Life Insurance

- Identify Your Target Audience

- Create a Strong Value Proposition

- Utilize Digital Marketing Techniques

- Develop Content Marketing Strategy

- Leverage Social Media Platforms

- Collaborate with Influencers and Partners

- Offer Referral Incentives

- Use Email Marketing Campaigns

- Build Trust and Credibility with Customer Testimonials

- Provide Exceptional Customer Service

- Measure and Track your Marketing Efforts

- Conclusion

Introduction

Welcome to the world of life insurance promotion! In this article, we will explore various strategies and techniques to help you effectively promote life insurance to your target audience. Life insurance is a crucial financial product that provides protection and peace of mind to individuals and their loved ones. However, promoting life insurance can be challenging due to its complex nature and the need to address the sensitive topic of mortality.

With the right approach, you can overcome these challenges and successfully connect with potential customers who are in need of life insurance coverage. The key is to understand the importance of life insurance, identify your target audience, and create a strong value proposition that resonates with their needs and desires. By utilizing digital marketing techniques, content marketing strategies, and social media platforms, you can effectively reach and engage your target market.

Furthermore, collaborating with influencers and partners, offering referral incentives, and utilizing email marketing campaigns can significantly boost your promotional efforts. Building trust and credibility with customer testimonials and providing exceptional customer service are also essential components of a successful life insurance promotion strategy.

Finally, it is crucial to measure and track your marketing efforts to understand what is working and what needs improvement. By analyzing data and making necessary adjustments, you can optimize your promotional campaigns and drive better results.

Now, let’s dive into the world of life insurance promotion and discover the strategies and techniques that will help you effectively promote life insurance and connect with your target audience.

Understand the Importance of Life Insurance

Before diving into the promotion of life insurance, it is essential to understand why life insurance is crucial for individuals and their families. Life insurance provides financial protection and peace of mind in the event of an individual’s death. It serves as a safety net, ensuring that loved ones are taken care of and their financial needs are met, even after the policyholder is no longer there to provide for them.

Life insurance can provide various benefits, such as:

- Income Replacement: In the unfortunate event of a policyholder’s death, life insurance can provide a lump sum payment to replace lost income. This ensures that the policyholder’s family can maintain their standard of living and cover essential expenses like mortgage payments, education costs, and daily living expenses.

- Debt Repayment: Life insurance can be used to pay off outstanding debts, such as mortgages, car loans, or credit card debt. This prevents the burden of debt from falling on the shoulders of grieving family members.

- Estate Planning: Life insurance can also be used as a tool for estate planning. It allows policyholders to leave a legacy for their loved ones, ensuring that their financial assets are distributed according to their wishes.

- Business Continuity: For business owners, life insurance can help ensure the continuity of their businesses by providing funds to cover expenses, pay off debts, or facilitate the transition of ownership.

Additionally, life insurance offers various types of coverage, such as term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years, while permanent life insurance offers lifetime coverage with an investment component.

Understanding the importance of life insurance allows you to effectively communicate its value to your target audience. By highlighting the financial security, peace of mind, and protection it provides, you can engage potential customers and help them realize the importance of obtaining life insurance coverage.

Now that we have explored the significance of life insurance, let’s move on to the next step: identifying your target audience.

Identify Your Target Audience

When promoting life insurance, it is crucial to identify and understand your target audience. Different demographics and segments have unique needs, aspirations, and financial goals that you should tailor your messaging and marketing efforts towards. By identifying your target audience, you can create highly targeted and personalized marketing campaigns that resonate with their specific needs and motivations.

Here are some key factors to consider when identifying your target audience:

- Demographics: This includes factors such as age, gender, marital status, occupation, income level, and geographical location. Understanding these demographics will help you tailor your messaging to appeal to specific groups of individuals who may be more inclined to purchase life insurance.

- Life Stage: Consider the life stage your target audience is in. Are they young professionals starting families? Empty nesters planning for retirement? By understanding the life stage of your target audience, you can emphasize the benefits of life insurance that align with their current needs and priorities.

- Financial Goals and Concerns: Identify the financial goals and concerns of your target audience. Are they focused on saving for retirement, planning for their children’s education, or worried about protecting their assets? Understanding these goals and concerns enables you to position life insurance as a solution that addresses their specific financial needs.

- Attitudes and Values: Consider the attitudes and values of your target audience. Are they risk-averse, seeking stability and security? Are they motivated by the desire to leave a legacy for future generations? By understanding their values, you can create messaging that resonates with their core beliefs.

Once you have identified your target audience, you can develop personalized marketing strategies that effectively reach and engage them. For example, if your target audience consists of young families, you can emphasize the importance of protecting their children’s financial future and highlight the affordability of term life insurance. On the other hand, if your target audience is retirees, you can focus on the benefits of permanent life insurance and estate planning.

Understanding your target audience is a critical step in creating a targeted and effective life insurance promotion strategy. By identifying their demographics, life stage, financial goals, concerns, and attitudes, you can tailor your messaging and marketing efforts to resonate with their unique needs and motivations.

Now that you have identified your target audience, let’s move on to the next step: creating a strong value proposition.

Create a Strong Value Proposition

When promoting life insurance, it is essential to communicate a strong value proposition that clearly articulates the benefits and value that your product offers to your target audience. A value proposition is a succinct statement that answers the fundamental question: “Why should someone choose your life insurance over competitors or choose to purchase life insurance at all?”

Here are some key elements to consider when creating a strong value proposition for your life insurance promotion:

- Financial Security: Highlight how your life insurance coverage provides financial security and peace of mind in the event of an untimely death. Emphasize the ability of your policies to replace lost income, pay off debts, cover daily expenses, and support loved ones during difficult times.

- Customized Solutions: Showcase how your life insurance plans can be tailored to meet the unique needs and goals of individuals and families. Whether it’s term life insurance for young professionals or permanent life insurance for estate planning, emphasize the flexibility and customization options available.

- Competitive Premiums: Highlight competitive pricing and affordable premiums to demonstrate the value and affordability of your life insurance coverage. Show how your rates compare favorably to competitors while still providing comprehensive coverage.

- Exceptional Customer Service: Emphasize the quality of customer service your company provides, such as responsive agents, easy claims process, and ongoing support. Highlight how your commitment to customer satisfaction sets you apart from competitors.

- Financial Education and Guidance: Position your company as a trusted advisor by offering educational resources and guidance on financial planning, investment options, and estate planning. Show how you go beyond just selling life insurance to providing valuable knowledge and expertise to your customers.

Remember to tailor your value proposition to your specific target audience. Address their unique needs, concerns, and aspirations to create a strong emotional connection and demonstrate the relevance of your life insurance coverage.

Once you have crafted a compelling value proposition, integrate it into your marketing materials, website, social media platforms, and advertising campaigns. Consistently reinforce the value that you bring to potential customers and illustrate why your life insurance coverage is the best choice for them.

Now that you have a strong value proposition, let’s explore how to utilize digital marketing techniques to effectively promote your life insurance products.

Utilize Digital Marketing Techniques

Digital marketing plays a crucial role in promoting life insurance to a wide audience. By leveraging digital platforms and techniques, you can reach a larger audience, increase brand visibility, and generate leads for your life insurance products. Here are some effective digital marketing techniques to consider:

- Search Engine Optimization (SEO): Optimize your website and content with relevant keywords, meta tags, and quality backlinks to improve your website’s visibility in search engine results. A high-ranking website will attract organic traffic and increase the chances of potential customers finding your life insurance offerings.

- Pay-Per-Click (PPC) Advertising: Use platforms like Google Ads or Bing Ads to display advertisements for relevant keywords and target specific demographics. This method allows you to reach potential customers actively searching for life insurance and pay only when someone clicks on your ad.

- Content Marketing: Create informative and valuable content such as blog posts, articles, and videos that educate your audience about the importance of life insurance and address their concerns and questions. Share this content through your website, social media channels, and email newsletters to attract and engage potential customers.

- Social Media Marketing: Utilize platforms like Facebook, Instagram, LinkedIn, and Twitter to connect with your target audience, share valuable content, and promote your life insurance products. Create engaging posts, run targeted ads, and encourage interaction to build brand awareness and capture leads.

- Email Marketing: Develop an email list of interested prospects and existing customers, and send regular newsletters or email campaigns that provide valuable information, promotions, and updates on your life insurance products. Personalize the content based on the recipient’s preferences and needs to increase engagement.

- Video Marketing: Create videos that explain the benefits of life insurance, share customer testimonials, and provide educational content. Publish these videos on platforms like YouTube, embed them on your website, and share them on social media to increase brand visibility and engagement.

Remember to track and analyze the performance of your digital marketing efforts. Measure the website traffic, conversions, click-through rates, and engagement metrics to identify what strategies are working best and optimize your campaigns accordingly.

By utilizing these digital marketing techniques, you can effectively reach your target audience, build brand awareness, and generate leads for your life insurance products. However, digital marketing is just one piece of the puzzle. In the next sections, we will explore additional strategies such as content marketing, social media platforms, and customer testimonials that will further enhance your life insurance promotion efforts.

Develop Content Marketing Strategy

A strong content marketing strategy is key to promoting life insurance effectively. By creating and sharing valuable, informative, and engaging content, you can establish yourself as a trusted authority in the industry and attract potential customers. Here are some essential steps to develop an effective content marketing strategy for your life insurance promotion:

- Define Your Objectives: Determine the goals you want to achieve through content marketing. Do you want to generate leads, increase brand awareness, educate your target audience, or all of the above? Clarifying your objectives will guide your content creation process.

- Identify Your Target Audience: Understand your target audience’s demographics, needs, and preferences. This knowledge will help you create content that resonates with and addresses their specific concerns and interests.

- Create Engaging Content: Produce high-quality, informative, and engaging content that educates, informs, and entertains your audience. This can include blog posts, e-books, infographics, videos, and podcasts. Focus on topics that are relevant to life insurance, such as explaining policy types, providing tips for selecting coverage, or discussing the importance of estate planning.

- Optimize for SEO: Incorporate relevant keywords, meta tags, and descriptions in your content to improve its visibility in search engine results. This will increase the chances of your content being discovered by potential customers actively searching for life insurance information.

- Promote Your Content: Share your content on your website, blog, and social media platforms to increase visibility and reach a wider audience. Encourage social sharing and engagement to amplify the reach of your content.

- Utilize Guest Posting: Seek opportunities to contribute guest posts on industry-relevant websites and publications. This allows you to showcase your expertise and reach a new audience who may be interested in life insurance.

- Measure and Analyze: Track the performance of your content using analytics tools. Measure metrics such as website traffic, engagement, and conversion rates to understand which types of content are resonating most with your audience. Use these insights to refine and improve your content strategy over time.

Consistency is key in content marketing. Regularly producing and sharing valuable content will establish your brand’s presence, build trust, and position you as a go-to resource for life insurance information. Remember to always align your content with your target audience’s needs and preferences, focusing on addressing their pain points and providing solutions.

Now that you have a solid content marketing strategy, let’s explore how to leverage social media platforms to enhance your life insurance promotion efforts.

Leverage Social Media Platforms

Social media platforms offer a powerful toolset for promoting life insurance. With billions of users worldwide, these platforms provide an opportunity to reach and engage with your target audience on a personal level. Here are some effective strategies to leverage social media platforms in your life insurance promotion:

- Select the Right Platforms: Identify the social media platforms that align with your target audience’s demographics and preferences. Facebook, Instagram, Twitter, and LinkedIn are popular choices for promoting life insurance, but make sure to focus on the platforms most relevant to your audience.

- Create Compelling Profiles: Optimize your social media profiles with relevant keywords, a clear and concise description of your life insurance offerings, and an appealing visual aesthetic. Your profiles should reflect your brand’s identity and attract potential customers.

- Engage with Your Audience: Be active on social media by responding to comments, messages, and inquiries. Engage with your audience through meaningful conversations, providing helpful information, and addressing their concerns. This builds trust and establishes you as a reliable source of information.

- Share Valuable Content: Create and share content that is relevant and valuable to your audience. This can include informative blog posts, educational videos, customer testimonials, and industry news. Focus on providing helpful insights and tips about life insurance to demonstrate your expertise and provide value to your followers.

- Utilize Visual Content: Visual content such as images, infographics, and videos tend to have higher engagement rates on social media. Use eye-catching visuals to convey your message, showcase your products, and capture the attention of your audience scrolling through their feeds.

- Run Targeted Advertising Campaigns: Take advantage of the targeting capabilities offered by social media platforms to run effective advertising campaigns. Set specific demographics, interests, and behaviors to reach your desired audience. This allows you to reach potential customers who fit your target audience criteria and increase the visibility of your life insurance promotions.

- Collaborate with Influencers: Partner with influencers in the finance and insurance industry who have a significant following and influence. They can help promote your life insurance offerings to their audience and lend credibility to your brand. Host live Q&A sessions, interviews, or guest posts with influencers to engage with their audience and tap into their trusted networks.

- Encourage User-Generated Content (UGC): Encourage your audience to share their experiences with your life insurance coverage through user-generated content. This can include testimonials, success stories, or personal anecdotes. By showcasing real-life examples, you build trust and inspire others to consider your life insurance products.

Consistency is key in social media marketing. Regularly post content, engage with your audience, and monitor the performance of your campaigns to fine-tune your strategies. Learn from the insights gained and adapt to the preferences and behaviors of your target audience.

Now that you have learned how to leverage social media platforms, let’s explore the benefits of collaborating with influencers and partners to enhance your life insurance promotion efforts.

Collaborate with Influencers and Partners

Collaborating with influencers and partners is a powerful strategy to enhance your life insurance promotion efforts. Influencers have established credibility and a significant following in niche markets, making them influential voices that can help raise awareness about your life insurance offerings. Partnerships with complementary businesses can also provide mutual benefits by expanding your reach and tapping into new customer bases. Here are some key benefits and strategies for collaborating with influencers and partners:

- Increased Reach and Visibility: Influencers have built a loyal and engaged audience that trusts their recommendations. By partnering with influencers relevant to the finance or insurance industry, you can tap into their followers and gain visibility among your target audience.

- Trust and Credibility: Influencers have already established trust and credibility with their audience. When they endorse your life insurance products or share their experiences, it can greatly influence their followers’ purchasing decisions.

- Social Media Campaigns: Collaborate with influencers to create social media campaigns that promote your life insurance offerings. This can include sponsored posts, reviews, giveaways, or live Q&A sessions. Leverage their creativity and unique style to provide authentic and engaging content that resonates with their audience.

- Guest Blogging: Partner with influencers or industry experts to contribute guest blog posts on reputable insurance or finance websites. This allows you to showcase your expertise, reach a new audience, and gain backlinks to your own website, which can improve your search engine rankings.

- Webinars and Events: Collaborate with influencers or partners to host webinars or participate in industry events. This provides an opportunity to connect with a larger audience, share valuable insights, and position your brand as an authority in the life insurance space.

- Affiliate Programs: Establish affiliate programs with influencers or partners where they earn a commission for each customer they refer to your life insurance products. This incentivizes them to advocate for your offerings and can significantly expand your customer base.

- Co-Branded Content: Create co-branded content with influencers or partners to leverage their expertise and audience. This can include e-books, videos, or podcasts that provide valuable information about life insurance and showcase both parties as trusted sources.

- Track and Measure Performance: Set clear goals and metrics to track the performance of your collaborations. Monitor website traffic, social media engagement, leads, and conversions to assess the effectiveness of your influencer and partner campaigns. Adjust your strategies as needed to optimize results.

Remember to choose influencers and partners that align with your brand values and target audience. Seek partnerships that provide a mutually beneficial arrangement where both parties can leverage each other’s reach and audience to maximize promotional efforts.

Collaborating with influencers and partners can extend your brand’s reach, enhance credibility, and foster trust among your target audience. By forming strategic partnerships, you can amplify your life insurance promotion efforts and connect with new customers.

Now, let’s explore another effective strategy: offering referral incentives to boost your life insurance promotion.

Offer Referral Incentives

One effective strategy to boost your life insurance promotion is to offer referral incentives. Referrals are a powerful tool in acquiring new customers as they come from trusted sources – friends, family, or colleagues – who can vouch for the value and quality of your life insurance products. By incentivizing your existing customers to refer others to your offerings, you can tap into their networks and generate qualified leads. Here are some key benefits and strategies for offering referral incentives:

- Organic Growth: Referral incentives can stimulate organic growth as satisfied customers become brand advocates and actively promote your life insurance products to their networks. Word-of-mouth is a powerful marketing tool that can significantly expand your customer base.

- Enhanced Trust and Credibility: People trust recommendations from their friends and family. When a customer refers someone to your life insurance offerings, it carries a level of trust and credibility that can greatly influence the prospect’s decision to explore your products.

- Incentivize Advocacy: Offer incentives to customers who refer others to your life insurance products. This can take the form of cash rewards, discounts on premiums, gift cards, or even exclusive perks. Make the rewards attractive and valuable enough to motivate your customers to actively advocate for your offerings.

- Track and Reward Referrals: Implement a tracking system to accurately record and reward referrals. Use unique referral codes or links that customers can share with their contacts. This allows you to measure and attribute referrals accurately, making it easy to identify and reward customers for successful referrals.

- Create a Win-Win Incentive Structure: Design a referral program that benefits both the referrer and the person they refer. Offer incentives to both parties, such as a discount on premiums for the referrer and a bonus or discount for the new customer. This creates an attractive proposition for your existing customers and encourages them to actively participate in the referral program.

- Promote the Referral Program: Actively promote your referral program through various channels, such as your website, social media platforms, email newsletters, and customer communication. Highlight the benefits of participating in the program and provide clear instructions on how customers can refer others.

- Thank and Acknowledge Referrers: Show appreciation and recognition to customers who refer others to your life insurance offerings. Send personalized thank-you notes, rewards, or exclusive offers to acknowledge their efforts. This creates a positive experience for referrers and encourages them to continue referring others in the future.

- Monitor and Analyze Results: Continuously monitor and analyze the performance of your referral program. Track the number of successful referrals, conversion rates, revenue generated, and the overall impact on your customer acquisition efforts. Use this data to optimize your program and make adjustments to maximize its effectiveness.

By offering referral incentives, you can turn your satisfied customers into advocates who actively promote your life insurance offerings. This can result in a steady stream of qualified leads and organic growth for your business.

Now that you understand the power of referral incentives, let’s explore how to utilize email marketing campaigns to promote your life insurance products.

Use Email Marketing Campaigns

Email marketing is a highly effective tactic for promoting your life insurance products. It allows you to directly engage with your audience, build relationships, and nurture leads. By utilizing email campaigns, you can deliver targeted and personalized messages to your subscribers, keeping them informed about your offerings and driving conversions. Here are some key strategies for using email marketing campaigns in your life insurance promotion:

- Build an Email List: Start by building an email list of interested prospects and existing customers. Offer valuable resources, such as e-books or guides related to life insurance, in exchange for their email addresses. This helps grow your subscriber base and ensures that you have a receptive audience for your email campaigns.

- Segment Your Subscribers: Divide your email list into segments based on demographics, buying behavior, or specific interests. This allows you to create targeted campaigns that are tailored to the needs and preferences of each segment. For example, you can send different messages to a segment of young families versus retirees.

- Create Compelling Content: Develop engaging and informative content that provides value to your subscribers. This can include educational articles, tips for financial planning, success stories, or updates about your life insurance products. Use a mix of text, visuals, and links to keep the content interesting and encourage click-throughs.

- Personalize Your Emails: Personalization is key to effective email marketing. Address your subscribers by their names, tailor your content to their specific interests, and ensure that your emails are relevant to their stage of life and insurance needs. This personalized approach increases engagement and builds a stronger connection with your audience.

- Engage with Automated Workflows: Utilize automated email workflows to nurture leads and guide them through the customer journey. Set up a series of emails that are triggered by specific actions or milestones, such as a welcome series for new subscribers or a follow-up series to educate prospects about your life insurance products.

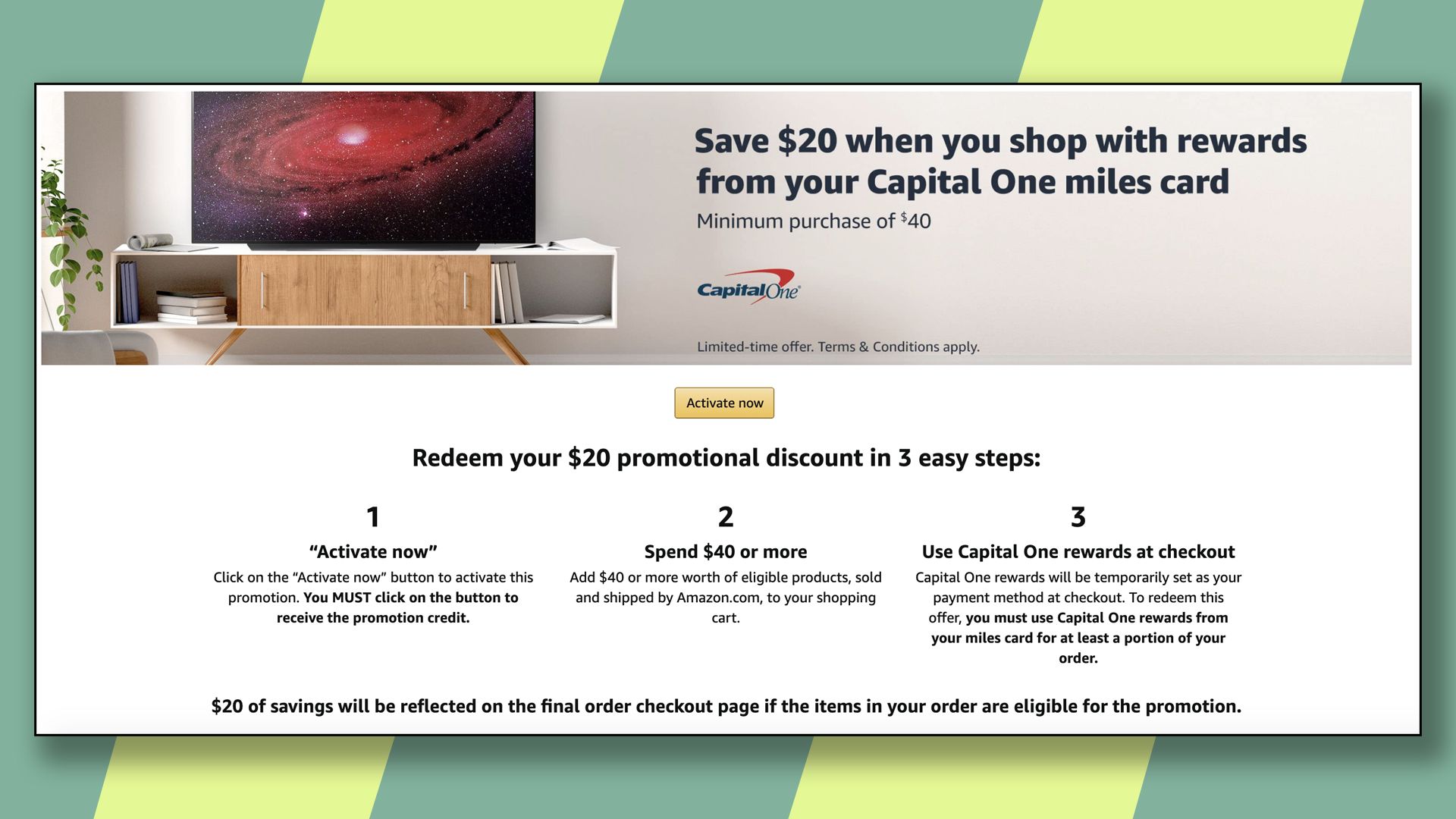

- Promote Exclusive Offers and Discounts: Provide exclusive offers, discounts, or promotions to your email subscribers. This incentivizes them to take action and increases the chances of converting them into customers. Make sure to highlight the value and urgency of the offer to create a sense of excitement and encourage prompt action.

- Optimize for Mobile: Ensure that your email campaigns are optimized for mobile devices. A significant portion of email opens occur on smartphones, so it is essential to design your emails to be mobile-friendly. Use responsive templates, clear and concise formatting, and large, clickable buttons to enhance the user experience on mobile devices.

- Analyze and Iterate: Regularly analyze the performance of your email campaigns. Monitor open rates, click-through rates, conversion rates, and unsubscribe rates to gauge the effectiveness of your campaigns. Use this data to make informed decisions, refine your email marketing strategy, and drive better results over time.

Email marketing allows you to stay top of mind with your audience, nurture leads, and drive conversions for your life insurance products. By delivering valuable content and personalized messages, you can build trust and establish yourself as a reliable source of insurance information and solutions.

Now that you have a grasp of email marketing, let’s explore how to build trust and credibility with customer testimonials.

Build Trust and Credibility with Customer Testimonials

Customer testimonials are a powerful tool for building trust and credibility in your life insurance promotion. Potential customers often rely on the experiences and opinions of others to inform their buying decisions. By showcasing positive testimonials from satisfied customers, you can instill confidence in your life insurance products and services. Here are some strategies for incorporating customer testimonials into your promotion:

- Collect and Gather Testimonials: Reach out to your existing customers and request their feedback and testimonials. Ask them to share their positive experiences with your life insurance products, the ease of the application process, and the support they received. Make it easy for customers to provide testimonials by offering various channels like email, online forms, or social media.

- Showcase Diverse Testimonials: Highlight testimonials from a diverse range of customers. This can include individuals of different age groups, backgrounds, professions, and life stages. By showcasing a variety of testimonials, potential customers can relate to different perspectives and see the relevance of your life insurance products to their own situations.

- Include Specific Details: When displaying customer testimonials, ensure that they include specific details and examples of how your life insurance products have made a difference in their lives. This helps potential customers envision the benefits and outcomes they can expect from choosing your offerings.

- Use Multimedia Formats: Incorporate multimedia formats to add credibility and authenticity to customer testimonials. This can include videos, audio clips, or images of customers sharing their experiences. Visual elements provide a more compelling and engaging way to showcase testimonials.

- Share Testimonials Across Channels: Display customer testimonials prominently on your website, landing pages, social media profiles, and email campaigns. Use quotes or snippets in your marketing materials to catch the attention of potential customers. When prospects see positive feedback from satisfied customers consistently, it builds trust and increases their confidence in your life insurance products.

- Request permission and Verify Authenticity: Always obtain permission from customers before publishing their testimonials. Ensure that the testimonials are genuine and authentic by including the customer’s name, photo, and any relevant credentials. This creates transparency and credibility.

- Create Case Studies: Transform satisfied customer testimonials into detailed case studies that showcase how your life insurance products have helped customers overcome specific challenges or achieve their financial goals. Case studies provide in-depth insights into the value of your offerings and present real-life examples that potential customers can relate to.

- Encourage Reviews on Online Platforms: Encourage your customers to leave reviews and ratings on online platforms such as Google, Yelp, or industry-specific review sites. Positive reviews not only add to your credibility but also improve your online reputation and make it easier for potential customers to find positive feedback about your life insurance products.

Customer testimonials are a powerful social proof that can sway potential customers to choose your life insurance offerings. By incorporating authentic and diverse testimonials into your promotion, you can build trust, credibility, and confidence in the minds of your target audience.

Now that you understand the importance of customer testimonials, let’s explore the significance of providing exceptional customer service in your life insurance promotion efforts.

Provide Exceptional Customer Service

Exceptional customer service is a crucial aspect of your life insurance promotion efforts. It not only ensures customer satisfaction but also helps build long-term relationships, loyalty, and positive word-of-mouth recommendations. By going above and beyond to provide a stellar customer experience, you can differentiate your brand from competitors and attract new customers. Here are some strategies for providing exceptional customer service:

- Responsive Communication: Be prompt and responsive in your communication with customers. Whether it is through phone, email, or social media, aim to provide quick and helpful responses to their queries or concerns. Swift and effective communication shows customers that you value their time and are committed to addressing their needs.

- Empathy and Understanding: Show empathy and understanding towards your customers’ unique circumstances. Life insurance can be a sensitive and emotional topic, so it’s important to approach each interaction with compassion. Listen actively, be supportive, and demonstrate that you genuinely care about their well-being and financial security.

- Clear and Transparent Information: Provide clear and transparent information about your life insurance products, coverage options, terms, and conditions. Use simple and plain language to explain complex concepts and ensure that customers fully understand what they are getting. Avoid jargon or industry-specific terms that might confuse or overwhelm them.

- Efficient Application Process: Streamline your application and underwriting process to make it as smooth and efficient as possible. Simplify paperwork, minimize steps, and offer digital options to reduce any potential hassle for customers. Clear communication and assistance throughout the application process can significantly enhance the customer experience.

- Proactive Communication: Keep customers informed about important updates, policy changes, or relevant news related to their life insurance coverage. Proactively reaching out to them with helpful information shows that you are actively monitoring and managing their policies, fostering trust and confidence in your services.

- Professional and Knowledgeable Staff: Ensure that your customer service team is highly trained, knowledgeable, and professional. They should have a deep understanding of your life insurance products and be able to provide accurate information and guidance to customers. Invest in ongoing training and development to maintain a high standard of service.

- Handle Claims Promptly: Process claims efficiently and with empathy. Maintain a straightforward claims process and keep customers informed about the progress of their claims. A quick and hassle-free claims experience demonstrates your commitment to supporting customers during difficult times.

- Solicit Feedback and Act on It: Regularly seek feedback from your customers through surveys, reviews, or direct communication. Actively listen to their suggestions and concerns, and use the feedback as an opportunity for improvement. Address any issues promptly and take proactive steps to enhance the customer experience based on their feedback.

Providing exceptional customer service is an ongoing commitment that requires dedication and a customer-centric approach throughout your organization. By delivering exceptional service, you can create loyal customers who become advocates for your brand and help drive your life insurance promotion through positive word-of-mouth referrals.

Now that we have explored the importance of customer service, let’s move on to the next section: measuring and tracking your marketing efforts.

Measure and Track your Marketing Efforts

Measuring and tracking your marketing efforts is essential to understand the effectiveness of your life insurance promotion strategies and make data-driven decisions. By analyzing key metrics and tracking performance, you can identify what is working well and what areas need improvement. Here are some important steps to measure and track your marketing efforts:

- Define Key Performance Indicators (KPIs): Determine the specific KPIs that align with your marketing goals. These can include metrics such as website traffic, conversion rates, click-through rates, lead generation, customer acquisition cost, or social media engagement. Clearly define what success looks like for each KPI.

- Set Up Analytics Tools: Implement analytics tools such as Google Analytics or marketing automation platforms to track and measure the performance of your website, email campaigns, and social media efforts. Configure these tools to capture data on relevant metrics and create customized reports.

- Analyze Website Traffic: Monitor your website traffic by examining the number of visitors, referral sources, time spent on site, and page views. Analyze user behavior, such as the most visited pages, bounce rates, and conversion funnels to identify areas for improvement and optimize the user experience.

- Track Conversion Rates: Measure the conversion rates at different stages of your marketing funnel, such as lead generation forms, quote requests, or policy sales. Assess the effectiveness of your landing pages, call-to-action buttons, and lead nurturing efforts to optimize conversions and improve the ROI of your promotion.

- Monitor Social Media Engagement: Track the engagement metrics on your social media platforms, including likes, shares, comments, and click-through rates. Identify which types of content resonate most with your audience and adjust your social media strategy accordingly.

- Analyze Email Campaign Performance: Evaluate the performance of your email marketing campaigns by reviewing open rates, click-through rates, and conversion rates. Assess which subject lines, content, or call-to-action buttons generate the most engagement, and optimize your email campaigns based on these insights.

- Review Return on Investment (ROI): Calculate the ROI of your marketing efforts by comparing the costs incurred with the revenue generated. This helps you understand the profitability of your promotional activities and make informed decisions about resource allocation.

- A/B Testing: Conduct A/B testing on your marketing campaigns by comparing different variations of your content, landing pages, or advertisements. Test elements such as headlines, images, colors, or call-to-action buttons to determine which variations drive better results and optimize your campaigns accordingly.

- Regularly Evaluate and Refine: Continuously review and analyze your marketing data to identify trends, patterns, and areas for improvement. Use the insights gained from your tracking efforts to refine your strategies, implement new tactics, and iterate on your promotional activities.

Remember that tracking and measuring your marketing efforts is an ongoing process. Regularly monitor the performance of your campaigns, make data-driven decisions, and adapt your strategies based on the results to optimize your life insurance promotion and drive better outcomes.

Now that you understand the importance of measuring and tracking your marketing efforts, let’s move to the concluding section.

Conclusion

Promoting life insurance successfully requires a comprehensive and strategic approach that incorporates various techniques and channels. By understanding the importance of life insurance, identifying your target audience, and creating a strong value proposition, you can effectively connect with potential customers who are in need of life insurance coverage.

Utilizing digital marketing techniques, such as search engine optimization (SEO), pay-per-click (PPC) advertising, content marketing, social media marketing, email marketing, and collaborating with influencers and partners, enables you to reach and engage your target audience on a wider scale.

Offering referral incentives and leveraging customer testimonials help build trust, enhance credibility, and generate word-of-mouth recommendations. Providing exceptional customer service ensures customer satisfaction and fosters long-term relationships.

Measuring and tracking your marketing efforts through various analytics tools allows you to analyze data, identify what is working well, and make data-driven decisions to optimize your promotional campaigns for greater success.

In conclusion, promoting life insurance requires a combination of effective strategies, thorough understanding of the target audience, and consistent effort to provide exceptional customer experiences. By implementing the techniques outlined in this article, you can effectively promote life insurance, connect with your target audience, and drive success in your marketing endeavors.

Remember, the world of life insurance promotion is dynamic, so stay updated with industry trends, continuously adapt your strategies, and always aim for excellence in delivering your message to potential customers.