Finance

How To Invest In Life Insurance Like Banks

Modified: February 21, 2024

Discover how banks invest in life insurance and learn how you too can grow your finance portfolio with this comprehensive guide on investing in life insurance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Life insurance is a financial product that provides financial protection to individuals and their loved ones in the event of death or disability. While most people are familiar with the concept of purchasing life insurance coverage for themselves or their family members, it may come as a surprise that banks and financial institutions also invest in life insurance.

In this article, we will explore the reasons why banks invest in life insurance, the benefits of investing in this asset class, different types of life insurance investments, risks and considerations, as well as how individuals can invest in life insurance like banks.

Life insurance has long been seen as a core component of a well-rounded financial plan for individuals and families. However, banks have also recognized the value of life insurance as an investment that can provide attractive returns and act as a diversification tool within their overall investment portfolios.

By investing in life insurance, banks can leverage the steady and predictable cash flows generated by insurance premiums and policyholder contributions. This allows them to earn consistent returns and enhance their profitability.

Furthermore, life insurance investments offer banks a low correlation with other financial markets, such as stocks and bonds. This diversification benefit can help banks mitigate their overall portfolio risk and improve their resilience to market downturns.

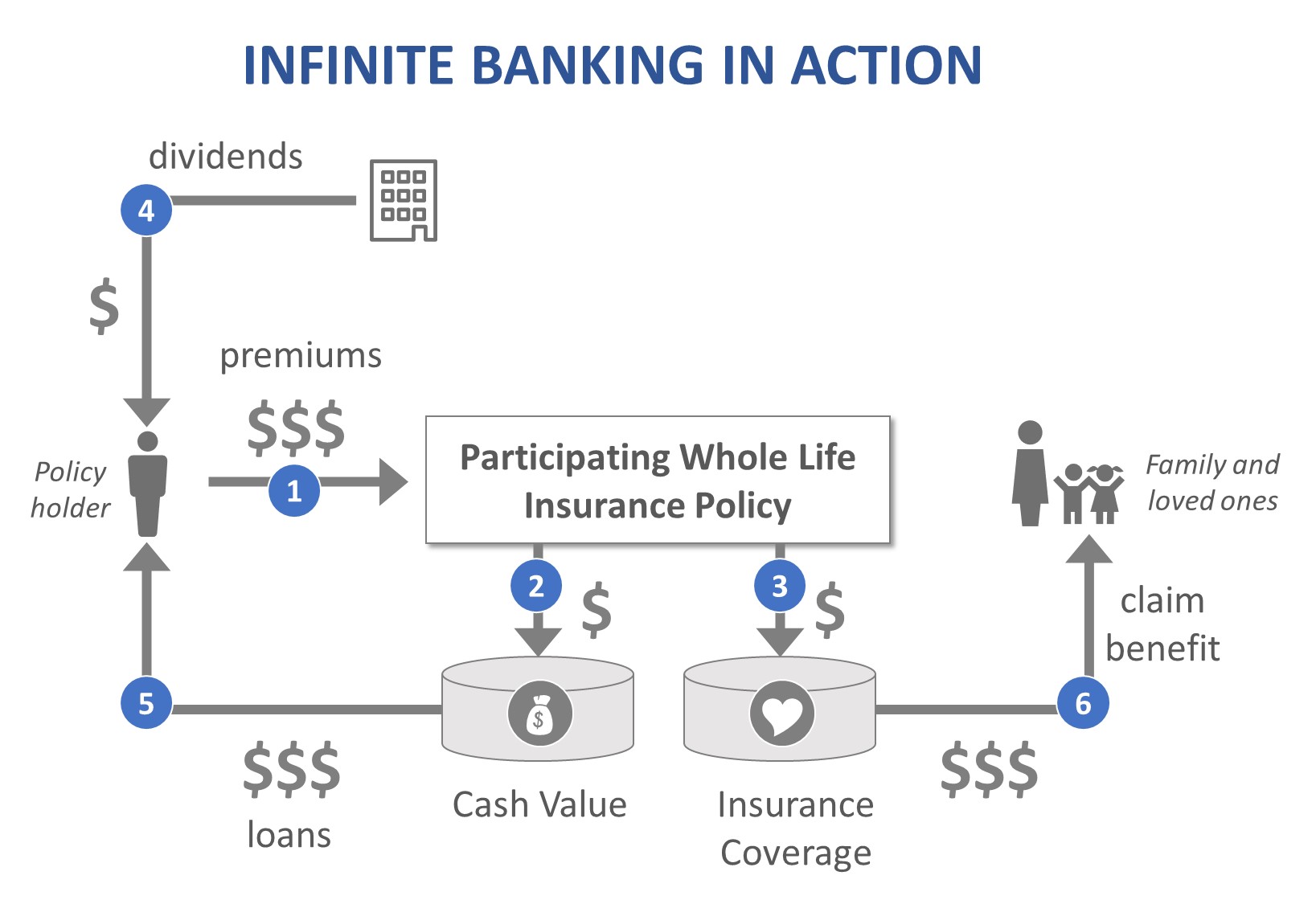

In addition to the financial benefits, investing in life insurance allows banks to fulfill their role as lenders and providers of financial services. By investing in life insurance policies, banks can essentially extend credit to policyholders by offering policy loans and utilizing the cash value of the policies as collateral.

With this understanding of why banks invest in life insurance, let’s explore the various benefits that individuals can also gain by investing in this asset class.

The Basics of Life Insurance

Before delving into the specifics of investing in life insurance, it’s important to have a solid understanding of the basics of this financial product.

At its core, life insurance is a contract between an individual, known as the policyholder, and an insurance company. The policyholder pays regular premiums to the insurance company, and in return, the insurance company promises to pay a predetermined sum of money, known as the death benefit, to the designated beneficiaries upon the policyholder’s death.

Life insurance policies come in various forms, but the two main types are term life insurance and permanent life insurance.

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. If the policyholder passes away during the term, the insurance company pays the death benefit to the beneficiaries. Term life insurance is generally more affordable, making it a popular choice for individuals seeking temporary coverage to protect their loved ones.

Permanent life insurance, on the other hand, provides coverage for the policyholder’s entire lifetime. This type of insurance includes a cash value component that grows over time. Policyholders can often access the accumulated cash value through policy loans or withdrawals, providing a source of liquidity during their lifetime.

It’s important to note that life insurance is not just for financial protection in the event of death. Depending on the type of policy, it can also serve as an investment vehicle and provide additional benefits such as tax advantages and cash value accumulation.

When considering life insurance as an investment, individuals should carefully assess their financial goals, risk tolerance, and overall financial situation. Factors such as age, health, and family dynamics should also be taken into account to determine the appropriate type and amount of life insurance coverage.

Now that we have established the fundamentals of life insurance, let’s explore why banks choose to invest in this asset class and the benefits it offers.

Why Banks Invest in Life Insurance

Life insurance has become an attractive investment option for banks due to several key reasons:

1. Steady and Predictable Cash Flows: Life insurance policies generate regular premium payments from policyholders. These premium payments serve as a stable source of cash inflow for banks. Unlike other investments that may be subject to market fluctuations, the cash flows from life insurance policies are relatively consistent and secure.

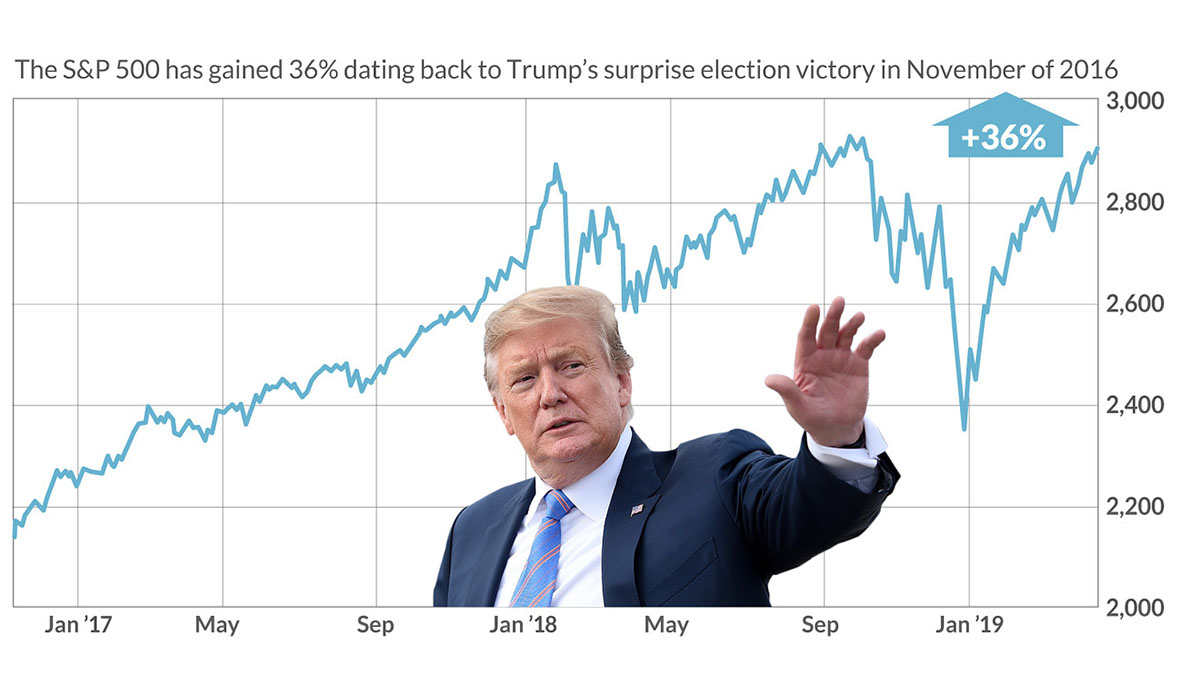

2. Diversification Benefits: Investing in life insurance allows banks to diversify their investment portfolios. Life insurance policies have a low correlation with traditional investment assets such as stocks and bonds. This means that the performance of life insurance investments is often not directly influenced by the ups and downs of the financial markets. This diversification helps banks reduce their exposure to overall market volatility and potentially enhance their risk-adjusted returns.

3. Long-Term Stability: Life insurance is a long-term investment as policyholders typically maintain their policies for extended periods. This long-term stability aligns with the typical investment strategy of banks, which often seek assets that offer consistent returns over an extended period. By investing in life insurance, banks can create a predictable income stream and enhance the stability of their investment portfolios.

4. Collateralization and Policy Loans: Banks can utilize the cash value of life insurance policies as collateral for loans. This allows them to lend money to policyholders at competitive interest rates, leveraging the policy’s cash value as security. The collateralization option provides banks with additional opportunities to generate income and expand their lending activities.

5. Regulation and Capital Requirements: Insurance investments are often subject to specific regulations and capital requirements that differ from those imposed on other types of investments. Banks, being financial institutions with expertise in regulatory compliance and risk management, are equipped to navigate these requirements effectively. By investing in life insurance, banks can optimize their balance sheets while adhering to regulatory standards.

6. Client Relationships and Cross-Selling Opportunities: Investing in life insurance allows banks to deepen their relationships with customers. By offering life insurance products, banks can cater to the financial needs of their clients and position themselves as comprehensive financial service providers. This can lead to additional cross-selling opportunities for other banking products and services, enhancing customer loyalty and retention.

Given these reasons, it is clear why banks view life insurance as an attractive investment option. In the next section, we will explore the benefits that individuals can also enjoy by investing in life insurance.

Benefits of Investing in Life Insurance

Investing in life insurance offers several benefits for individuals looking to grow their wealth and protect their financial future. Here are some key advantages:

1. Protection and Financial Security: The primary benefit of life insurance is providing financial protection to your loved ones in the event of your death. Life insurance policies offer a death benefit, which can help cover funeral expenses, pay off outstanding debts, replace lost income, and ensure your family’s financial security. This protection provides peace of mind knowing that your loved ones will be taken care of financially.

2. Tax Advantages: Life insurance investments can offer tax advantages that other investment vehicles may not provide. The growth of the cash value within a life insurance policy is generally tax-deferred, meaning you don’t have to pay taxes on the investment gains until you withdraw the funds. This tax-deferred growth can potentially allow your investment to compound at a faster rate compared to taxable investment accounts.

3. Cash Value Accumulation: Permanent life insurance policies have a cash value component that accumulates over time. As you pay premiums, a portion of the payment goes towards building the cash value. This cash value can be accessed through policy loans or withdrawals during your lifetime, providing a source of liquidity for emergencies, education expenses, or supplementing retirement income.

4. Estate Planning: Life insurance can play a significant role in estate planning. The death benefit from a life insurance policy can be used to pay estate taxes, ensuring that your assets can be passed on to your heirs without them having to sell off assets to cover the tax liability. By strategically incorporating life insurance into your estate plan, you can maximize the value of your estate and minimize the burden on your beneficiaries.

5. Growth Potential: Investing in certain types of life insurance policies, such as variable life insurance, provides the opportunity for investment growth. Variable life insurance policies allow policyholders to allocate their cash value among different investment options, such as stocks, bonds, or mutual funds. This allocation flexibility can potentially lead to higher investment returns over the long term, although it’s important to carefully monitor and manage your investments to mitigate market risks.

6. Protecting Insurability: Another advantage of investing in life insurance at a younger age is ensuring your insurability. Life insurance premiums are generally based on factors such as age, health, and lifestyle. By investing in life insurance early, you lock in lower premiums while you are young and healthy. This can be particularly beneficial if you have dependents or anticipate a need for life insurance coverage in the future.

Investing in life insurance provides individuals with a combination of financial protection, tax advantages, and potential growth. It’s important to assess your financial goals, risk tolerance, and overall financial situation to determine the most suitable type and amount of life insurance coverage.

In the following sections, we will explore the different types of life insurance investments, potential risks to consider, and how individuals can invest in life insurance similar to banks.

Types of Life Insurance Investments

Investing in life insurance offers individuals a range of options to suit their financial goals and risk tolerance. Here are some common types of life insurance investments:

1. Whole Life Insurance: Whole life insurance is a form of permanent life insurance that provides coverage for the policyholder’s entire lifetime. One of the key features of whole life insurance is the accumulation of cash value over time. The cash value grows at a guaranteed rate determined by the insurance company, and policyholders can access the cash value through policy loans or withdrawals. Whole life insurance offers stability, guarantees, and lifelong coverage, making it a popular choice for those seeking long-term insurance protection along with an investment component.

2. Universal Life Insurance: Universal life insurance is another type of permanent life insurance that offers greater flexibility compared to whole life insurance. With universal life insurance, policyholders have the ability to adjust the death benefit and premium payments to suit their changing needs and financial circumstances. Universal life insurance policies often have a cash value component that earns interest based on market conditions. This investment feature allows policyholders to potentially accumulate more wealth over time.

3. Variable Life Insurance: Variable life insurance is a type of permanent life insurance that provides investment options within the policy. Policyholders have the ability to allocate a portion of their premium payments into investment accounts, such as stocks, bonds, or mutual funds. The investment performance of these accounts determines the overall cash value growth. Variable life insurance offers the potential for higher investment returns but also carries higher risks compared to other types of life insurance. It is important to carefully monitor and manage the investments within variable life insurance policies.

4. Term Life Insurance with Return of Premium (ROP): Term life insurance with ROP is a hybrid policy that combines the temporary coverage of term life insurance with a return of premium feature. With this type of policy, if the policyholder outlives the term, the insurance company refunds all the premiums paid over the term. Term life insurance with ROP provides the benefit of no lost premiums if the policyholder doesn’t pass away during the coverage period. Although the return of premium feature does not offer investment growth, it can still be an appealing option for individuals who want affordable life insurance coverage and the possibility of a future premium refund.

5. Indexed Universal Life Insurance: Indexed universal life insurance is a form of permanent life insurance that offers a cash value component tied to the performance of an underlying index, such as the S&P 500. The cash value has the potential to grow based on the positive movement of the index, while still providing downside protection. Indexed universal life insurance offers policyholders the opportunity to participate in market gains, making it an attractive option for those seeking potential investment growth while maintaining a level of protection.

These are just a few examples of the types of life insurance investments available in the market. Each type has its own unique features, benefits, and considerations. It’s important to carefully evaluate your financial objectives, risk tolerance, and time horizon before selecting the most suitable life insurance investment for your needs.

Next, we will discuss the risks and considerations associated with investing in life insurance.

Risks and Considerations

While investing in life insurance can offer numerous benefits, it’s crucial to be aware of the potential risks and considerations associated with these investments. Here are some important factors to keep in mind:

1. Investment Risk: Certain types of life insurance, such as variable life insurance and indexed universal life insurance, are linked to investment accounts that carry market risk. The performance of these investment accounts can fluctuate based on market conditions, potentially affecting the cash value growth of the policy. It’s essential to understand the level of investment risk and be prepared for potential losses when investing in life insurance with an investment component.

2. Policy Expenses: Life insurance policies often come with various fees and expenses, which can impact the overall returns of the investment. These expenses may include administrative fees, mortality charges, and investment management fees. It’s important to thoroughly review and understand the policy documents to assess the impact of these costs on the potential returns of the investment.

3. Policyholder Obligations: Life insurance policies require regular premium payments to keep the coverage in force. If a policyholder fails to pay the premiums as required, the policy may lapse, resulting in a loss of coverage and potential forfeiture of any accumulated cash value. It’s crucial to assess your ability to meet the premium payment obligations before committing to a life insurance investment.

4. Policy Flexibility: Some types of life insurance policies offer flexibility in adjusting premium payments, death benefits, and investment allocations. However, modifying these features may have certain limitations and consequences. Before making any changes to your policy, it’s important to consult with the insurance company and understand the potential impact on the investment and coverage.

5. Insurance Company Strength: When investing in life insurance, it’s crucial to consider the financial strength and reputation of the insurance company. A financially stable insurer is more likely to honor its obligations and provide a reliable return on your investment. Research the insurance company’s credit ratings and reviews to ensure its credibility and stability.

6. Changing Financial Needs: Your financial circumstances, goals, and needs may evolve over time. It’s important to regularly evaluate your life insurance investment in light of any changes to ensure it aligns with your current financial objectives. This may involve adjusting premium payments, death benefit amounts, or even considering other investment options if necessary.

Investing in life insurance requires careful consideration of these risks and considerations. It’s advisable to seek the guidance of a financial advisor or insurance professional who can assess your individual circumstances and provide recommendations tailored to your specific needs.

In the next section, we will discuss how individuals can invest in life insurance similar to banks and maximize the benefits associated with these investments.

How to Invest in Life Insurance

Investing in life insurance requires thoughtful planning and consideration. Here are the key steps to help individuals invest in life insurance effectively:

1. Assess Your Financial Goals: Begin by evaluating your financial goals and objectives. Determine the purpose of your life insurance investment, whether it’s to provide financial protection for your loved ones, accumulate cash value for future needs, or both. Understanding your goals will guide you in selecting the most suitable type and amount of life insurance coverage.

2. Determine Your Risk Tolerance: Consider your risk tolerance when choosing a life insurance investment. If you are comfortable with market fluctuations and seek potential higher returns, you may opt for a policy with an investment component like variable life insurance or indexed universal life insurance. If you prefer stability and guarantees, whole life insurance or universal life insurance with a fixed interest rate may be more suitable.

3. Research Insurance Companies: Research reputable insurance companies that offer the type of life insurance investment you are interested in. Look for insurers with a strong financial standing, good track record, and positive customer reviews. Choosing a reliable and reputable insurance company is crucial to ensure the safety and performance of your investment.

4. Determine Premium Payments: Consider your budget and financial capability in determining the premium payments for your life insurance policy. Ensure that the premium amount is affordable and sustainable over the long term to maintain the coverage and investment growth. Consult with an insurance professional to find a balance between your financial capacity and the coverage you need.

5. Customize Your Life Insurance Policy: Work closely with an insurance professional to customize your life insurance policy to meet your specific needs. Determine the appropriate death benefit amount, policy term (for term life insurance), and desired level of coverage. If opting for a policy with an investment component, consider your risk tolerance and investment preferences to choose the right investment options within the policy.

6. Regularly Review and Evaluate: Life insurance is a long-term investment, but it’s essential to review and evaluate your policy periodically. Assess the performance of the investment component, review the coverage amount in light of any changes in your financial situation or life circumstances, and ensure that the policy remains aligned with your goals and needs.

7. Seek Professional Advice: Consider consulting with a financial advisor or insurance professional who can provide guidance tailored to your specific financial situation and goals. They can help you navigate the complexities of life insurance investments, evaluate different policy options, and assist in selecting the most suitable solution for your needs.

By following these steps and seeking expert advice, individuals can invest in life insurance effectively and maximize the benefits of these investments for their financial well-being and the security of their loved ones.

In the following sections, we will explore how to compare policies and providers, as well as how to monitor and manage your life insurance investments.

Comparing Policies and Providers

When investing in life insurance, it’s important to compare policies and providers to ensure you make an informed decision. Here are the key factors to consider:

1. Types of Policies: Begin by understanding the different types of life insurance policies available, such as term life insurance, whole life insurance, universal life insurance, or variable life insurance. Evaluate the features, benefits, and limitations of each type to determine which aligns best with your financial goals and risk tolerance.

2. Coverage Amount: Assess your financial needs and obligations to determine the appropriate coverage amount. Consider factors such as outstanding debts, mortgage, income replacement needs, education expenses, and any other financial responsibilities you want the life insurance policy to address. Ensure the coverage amount is sufficient to meet your objectives.

3. Premium Costs: Compare the premium costs of different policies from various providers. Request quotes and analyze the premium amounts for the coverage and features you require. Remember to consider your budget and assess whether you can comfortably afford the premiums over the policy’s duration.

4. Financial Strength and Reputation: Research the financial strength and reputation of insurance providers before committing to a policy. Check their ratings from credit rating agencies and read customer reviews to gauge their reliability and ability to fulfill their financial obligations.

5. Policy Features and Riders: Evaluate the additional features and riders offered by insurance providers. These may include options for accelerated death benefits, disability income riders, or long-term care riders. Assess these features and determine if they align with your specific needs, providing added value to your life insurance policy.

6. Cash Value Accumulation: If you are interested in policies with a cash value component, compare the growth potential and taxation policies of different providers. Evaluate the interest rates offered on the cash value component and understand how it accumulates over time.

7. Policy Terms and Renewal: Review the terms and conditions of the policy, including the length of the coverage term, renewal options, and any potential premium increases. Consider whether the policy provides the flexibility you require, especially if your financial circumstances may change in the future.

8. Customer Service: Consider the quality of customer service provided by the insurance company. Assess their responsiveness, accessibility, and willingness to address your inquiries and concerns promptly. Good customer service is essential for a smooth and hassle-free experience with your life insurance policy.

Comparing policies and providers allows you to make an informed decision, selecting a life insurance policy that suits your specific needs, preferences, and financial goals. It’s advisable to seek guidance from a trusted insurance professional who can help navigate the complexities and provide personalized recommendations based on your circumstances.

Next, we will discuss how to monitor and manage your life insurance investments effectively.

Monitoring and Managing Your Investments

Once you have invested in a life insurance policy, it’s important to monitor and manage your investment to ensure it continues to align with your financial goals. Here are some key considerations for effectively monitoring and managing your life insurance investments:

1. Regular Policy Reviews: Schedule periodic reviews of your life insurance policy to assess its performance and relevance. Review the policy’s cash value growth, death benefit coverage, and any investment options within the policy. Evaluate whether the policy is still meeting your financial objectives and make any necessary adjustments.

2. Stay Informed: Stay updated on any changes in the insurance industry and the financial markets that may impact your life insurance investment. Monitor economic trends, interest rates, and market conditions that could affect the investment component of your policy. Knowledge of the broader financial landscape will help you make informed decisions regarding your life insurance investment.

3. Monitor Premium Payments: Ensure you stay on top of premium payments to maintain the coverage and investment growth of your life insurance policy. Set up reminders or automated payments to avoid any lapses in coverage. Regularly assess your financial situation to ensure you can continue to afford the premium payments over the life of the policy.

4. Adjusting Investment Options: If your life insurance policy offers investment options, regularly review and consider adjusting your investment allocations based on your risk tolerance and market conditions. Consult with a financial advisor or insurance professional to ensure you are making informed investment decisions that align with your financial goals.

5. Reevaluate Coverage Needs: Life circumstances change over time, so it’s important to reassess your coverage needs periodically. Factors such as marriage, birth of children, changes in income, or retirement may require adjustments to the death benefit or the type of coverage you have. Regularly evaluate whether your life insurance policy adequately protects your loved ones and adjust as needed.

6. Tax Planning: Understand the tax implications of your life insurance investment. While life insurance policies may offer tax advantages, it’s important to be aware of any tax obligations that may arise from policy loans, withdrawals, or surrendering the policy. Consult with a tax advisor to optimize your tax position and ensure compliance with applicable tax laws.

7. Seek Professional Guidance: Life insurance investments can be complex, and seeking guidance from a financial advisor or insurance professional can be invaluable. They can help you navigate the intricacies of your policy, offer expertise on investment options, provide advice on policy reviews and adjustments, and ensure your life insurance investment remains in line with your financial goals.

By actively monitoring and managing your life insurance investments, you can make informed decisions, maximize the benefits of your policy, and effectively protect your financial future.

Next, we will conclude our discussion on investing in life insurance.

Conclusion

Investing in life insurance can provide individuals with a powerful tool for financial protection, growth, and wealth accumulation. By understanding the basics of life insurance, why banks invest in it, and the benefits it offers, individuals can make informed decisions to secure their financial future.

Life insurance offers the key advantage of providing financial security for loved ones in the event of death. Additionally, it can offer tax advantages, cash value accumulation, estate planning benefits, and potential investment growth. The various types of life insurance policies, including whole life insurance, term life insurance, universal life insurance, variable life insurance, and indexed universal life insurance, provide flexibility to meet different needs and risk tolerances.

When investing in life insurance, careful consideration of risks and considerations is essential. Understanding investment risks, policy expenses, policyholder obligations, and the financial strength of insurance providers ensures informed decision-making. Regularly reviewing and managing life insurance policies, monitoring premium payments, adjusting investment options, and reevaluating coverage needs are equally important to stay on track with financial goals.

Choosing the right life insurance policy and provider demands comparisons and thorough research. Examining policy features, coverage amounts, premium costs, financial strength, and customer service can help individuals make well-informed choices.

Monitoring and managing life insurance investments require regular policy reviews, staying informed about market conditions, ensuring timely premium payments, adjusting investment options, reevaluating coverage needs, and seeking professional guidance when necessary.

By following these guidelines, individuals can invest in life insurance like banks, benefiting from financial protection, potential investment growth, and the ability to secure their financial future.

It is recommended to consult with a financial advisor or insurance professional who can provide personalized advice tailored to specific circumstances. With careful planning and proactive management, life insurance investments can play a crucial role in achieving long-term financial security and peace of mind.