Finance

How To Set Up A Life Insurance Trust

Modified: December 29, 2023

Learn how to set up a life insurance trust for optimal financial planning and security. Safeguard your loved ones with a strategic financial solution.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is a Life Insurance Trust?

- Benefits of Setting Up a Life Insurance Trust

- Choosing the Right Trustee

- Determining the Type and Amount of Insurance Coverage

- Drafting the Trust Document

- Funding the Trust

- Administering the Trust

- Tax Implications of a Life Insurance Trust

- Considerations for Revocable and Irrevocable Trusts

- Conclusion

Introduction

When it comes to planning for the future, one area that is often overlooked is life insurance. While most people understand the importance of having a life insurance policy to provide financial security for their loved ones in the event of their passing, not many are aware of the benefits of setting up a life insurance trust. A life insurance trust is a legal arrangement that can help protect and manage the proceeds of a life insurance policy for the beneficiaries.

In this article, we will delve into the intricacies of setting up a life insurance trust and explore the various benefits it offers. We will also discuss the key considerations involved in choosing the right trustee, determining the type and amount of insurance coverage, drafting the trust document, funding the trust, and administering it. Lastly, we will touch upon the tax implications of a life insurance trust and highlight the differences between revocable and irrevocable trusts.

By the end of this article, you will have a comprehensive understanding of how to set up a life insurance trust and the advantages it can bring for both you and your beneficiaries.

What is a Life Insurance Trust?

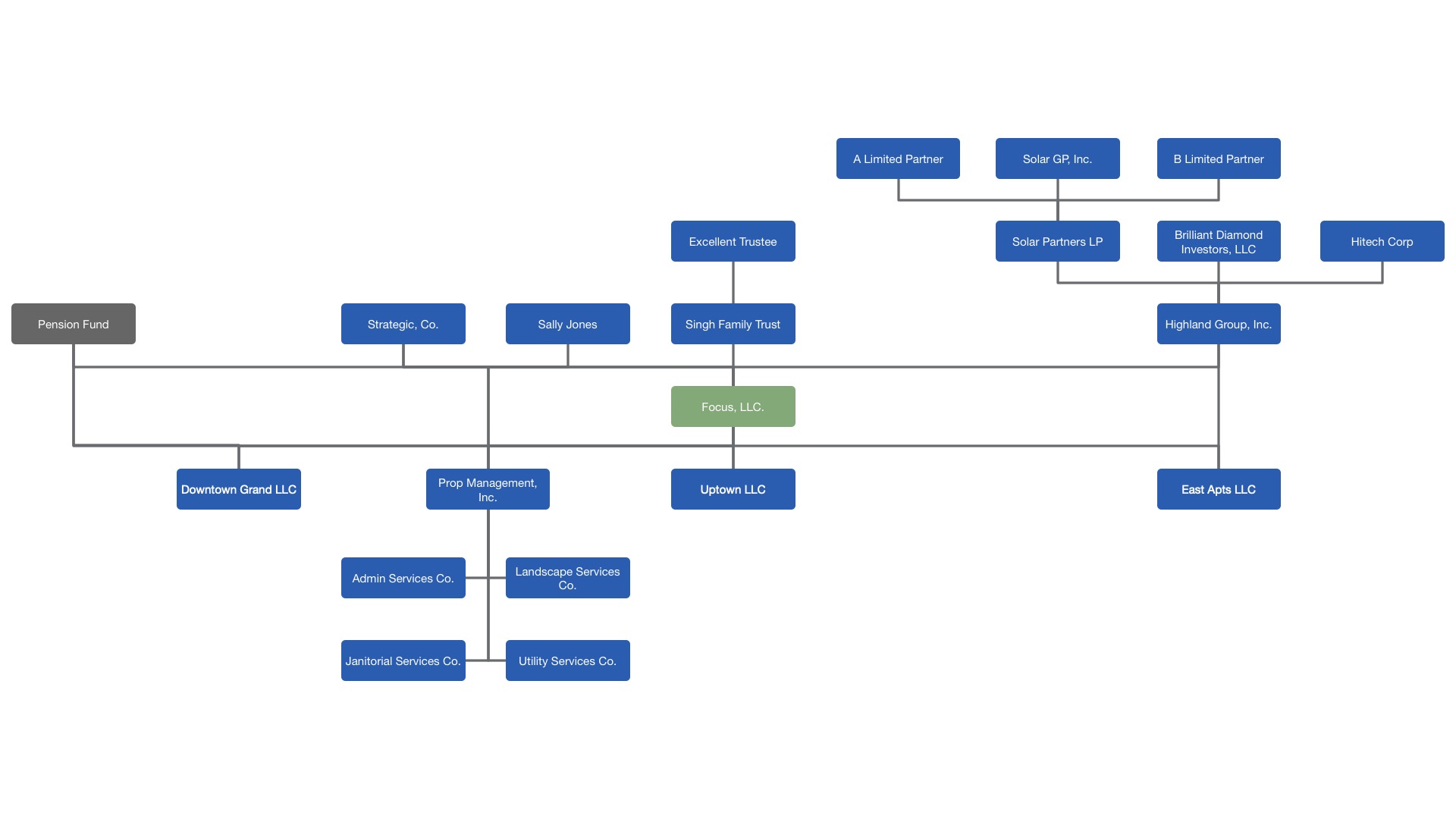

A life insurance trust, also known as an Irrevocable Life Insurance Trust (ILIT), is a legal arrangement that is specifically designed to hold and manage the proceeds of a life insurance policy. It allows the policyholder to ensure that the insurance proceeds are distributed according to their wishes, while also providing potential tax benefits.

When a life insurance policy is owned by an ILIT, the policy proceeds are paid directly into the trust upon the death of the insured individual. The trustee, who is designated by the policyholder, then manages and distributes the proceeds according to the terms of the trust document. This ensures that the funds are used for the intended purpose, such as providing financial support to the beneficiaries, paying off debts, or funding education expenses.

One of the main reasons for setting up a life insurance trust is to protect the policy proceeds from estate taxes. When an individual owns a life insurance policy, the death benefit is included as part of their estate for tax purposes. This means that if the total value of the estate exceeds the estate tax exemption threshold, the policy proceeds may be subject to hefty estate taxes. By utilizing a life insurance trust, the policy proceeds are effectively removed from the individual’s estate, reducing the potential tax liability.

Another important aspect of a life insurance trust is that it provides a level of control over the distribution of the funds. The trust document can specify when and how the funds should be distributed to the beneficiaries, ensuring that they are used responsibly and in accordance with the wishes of the policyholder. This level of control can be particularly beneficial in situations where the beneficiaries are minors, have special needs, or may not be financially responsible.

Overall, a life insurance trust offers a structured and controlled approach to managing the proceeds of a life insurance policy. It allows the policyholder to have peace of mind knowing that their loved ones will be taken care of in the event of their death, while also providing potential tax advantages. In the following sections, we will explore the benefits of setting up a life insurance trust in more detail.

Benefits of Setting Up a Life Insurance Trust

Setting up a life insurance trust offers several key advantages that can significantly impact your financial planning and the future well-being of your loved ones. Let’s explore some of the main benefits of establishing a life insurance trust:

- Estate Tax Planning: One of the primary benefits of a life insurance trust is the ability to minimize or eliminate estate taxes. The policy proceeds held within the trust are not considered part of your estate for tax purposes, reducing the taxable value of your estate and potentially saving your beneficiaries from paying hefty estate taxes.

- Control Over Distribution: By placing the life insurance policy proceeds in a trust, you can dictate how and when the funds are distributed to your beneficiaries. This level of control allows you to ensure that the funds are used responsibly and in line with your intentions. It can be particularly helpful if you have beneficiaries who are minors, have special needs, or may struggle with managing a large sum of money.

- Protection from Creditors: Assets held within a life insurance trust are typically protected from the claims of creditors. This means that if any of your beneficiaries have outstanding debts or face potential lawsuits, the funds in the trust can remain safeguarded and secure.

- Preserving Government Benefits: If you have beneficiaries who are receiving government benefits, such as Medicaid or Supplemental Security Income (SSI), a life insurance trust can help preserve their eligibility for these programs. By bypassing the direct receipt of the insurance proceeds, you can prevent the funds from being counted as income or assets, thereby preserving their access to important government support.

- Privacy and Confidentiality: A life insurance trust offers the benefit of privacy and confidentiality. Unlike a will, which becomes part of the public record upon your death, a trust allows you to maintain the privacy of your financial affairs and the details of your beneficiaries. This can be especially advantageous for individuals who value their privacy or have concerns about potential disputes or unwanted attention.

These are just a few of the key benefits that come with setting up a life insurance trust. It is important to note that the advantages may vary depending on your individual circumstances and the specific details of your estate plan. Consulting with a qualified estate planning attorney or financial advisor is vital to ensure that a life insurance trust aligns with your goals and objectives.

In the next sections, we will dive into the considerations for selecting the right trustee and determining the type and amount of insurance coverage for your life insurance trust.

Choosing the Right Trustee

One of the most critical decisions you’ll need to make when setting up a life insurance trust is choosing the right trustee. The trustee is responsible for managing the trust and ensuring that the trust’s provisions are followed. Selecting the right trustee is essential to the success and proper administration of the trust. Here are some important factors to consider when choosing a trustee:

- Reliability and Integrity: The trustee should be someone you trust implicitly to handle your financial affairs and carry out the responsibilities of the trust. Look for individuals who demonstrate reliability, honesty, and a strong ethical compass.

- Financial Knowledge and Experience: The trustee should have a good understanding of financial matters and be experienced in managing assets. This knowledge and expertise will help them make informed decisions about investment strategies and ensure that the trust’s assets are prudently managed.

- Availability and Longevity: Consider the trustee’s availability and willingness to serve in this role for an extended period. Ideally, the trustee should be in good health and have the ability to fulfill their fiduciary duties for the duration of the trust’s existence.

- Impartiality: The trustee should be able to act impartially and treat all beneficiaries fairly. They should be able to set aside personal biases or conflicts of interest and make decisions in the best interest of the trust and its beneficiaries.

- Communication Skills: Effective communication is essential for the trustee to keep beneficiaries informed about the trust’s status, provide regular reports, and address any questions or concerns that may arise.

- Professional Trustee Option: In some cases, it may be appropriate to consider a professional trustee such as a trust company or a financial institution. Professional trustees have the necessary expertise, experience, and resources to effectively manage the trust, ensuring compliance with legal requirements and providing consistent administration.

It’s important to note that while family members or close friends may seem like an obvious choice as a trustee, it is crucial to assess their suitability objectively. Consider whether they possess the necessary qualifications and skills to fulfill their duties. Additionally, involving multiple trustees or appointing a professional trustee alongside a family member can help provide a balance of expertise and personal connection.

Once you have identified potential trustees, it is advisable to have open and honest discussions with them about their willingness to take on the role. Understanding their commitments, expectations, and any potential conflicts of interest can help you make an informed decision when selecting the trustee for your life insurance trust.

Next, we will delve into the considerations for determining the type and amount of insurance coverage for your life insurance trust.

Determining the Type and Amount of Insurance Coverage

When setting up a life insurance trust, one crucial step is determining the type and amount of insurance coverage that will adequately meet the needs of the trust and its beneficiaries. Here are some key considerations to keep in mind:

- Type of Insurance Policy: There are different types of life insurance policies available, including term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, while permanent life insurance covers you for your entire life and includes an investment component. Consider the specific needs of your trust and the financial goals you want to achieve when deciding which type of policy is most suitable.

- Policy Face Amount: The face amount, or death benefit, is the amount of money that will be paid out upon the death of the insured individual. It is important to assess the financial needs of your beneficiaries and any potential expenses that the trust will need to cover, such as paying off debts, funding education, or providing ongoing financial support. Properly evaluating these needs will help determine the appropriate face amount for the policy.

- Policy Ownership: In order to ensure that the policy proceeds are held within the life insurance trust, it is crucial to designate the trust as the owner of the policy. This ensures that the proceeds are distributed according to the terms of the trust and helps achieve the desired estate planning objectives.

- Insurability: Before finalizing the type and amount of insurance coverage, consider your insurability. Factors such as age, health conditions, and lifestyle choices can impact your ability to secure affordable coverage. It’s important to evaluate your insurability and work with an insurance agent or broker to find the policy that best fits your needs and budget.

- Premium Payments: Premiums are the regular payments made to maintain the life insurance policy. Consider the affordability of the premiums and ensure that the trust has sufficient funds to cover them. If necessary, you may need to explore different premium payment options or adjust the policy face amount to fit within your budget.

It is important to regularly review and reassess your life insurance policy and the trust’s needs over time. Changes in personal circumstances, such as the birth of children, marriage, divorce, or changes in financial goals, may require adjustments to the policy coverage. Stay proactive in evaluating your insurance needs and consult with your insurance advisor or financial planner to ensure that the policy remains aligned with your objectives.

Once you have determined the type and amount of insurance coverage, you can proceed to draft the trust document, which we will explore in the next section.

Drafting the Trust Document

Once you have made decisions regarding the type and amount of insurance coverage for your life insurance trust, the next crucial step is to draft the trust document. The trust document outlines the specific provisions and instructions for the trust’s administration and distribution of the life insurance proceeds. Here are some important considerations when drafting the trust document:

- Consult an Attorney: It is highly recommended to work with an experienced estate planning attorney who specializes in trusts to ensure that your trust document is legally sound and aligns with your intentions. They can help navigate the complexities of trust law, provide guidance on important decisions, and assist in properly drafting the document.

- Clearly Define Trust Terms: The trust document should clearly define the terms and conditions of the trust, including who the beneficiaries are, how and when the trust assets will be distributed, and any specific instructions or restrictions. Be thorough and precise in describing the intentions and desires you have for the trust.

- Appointment of Trustee: The trust document should clearly identify the trustee or trustees who will be responsible for administering the trust. It should outline their powers and duties, including the authority to manage the trust assets and make distributions to the beneficiaries.

- Successor Trustees: It is important to designate one or more successor trustees in case the initial trustee is unable or unwilling to fulfill their duties. This ensures a smooth transition of trust administration and eliminates the need for court intervention.

- Special Circumstances: If you have beneficiaries with special needs, minors, or complex family dynamics, it is important to address these situations within the trust document. Consider incorporating provisions that cater to specific circumstances, such as creating a special needs trust or setting forth guidelines for managing assets on behalf of minor beneficiaries.

- Include Spendthrift Provisions: To protect the trust assets from being accessed by creditors or being subject to claims, consider incorporating spendthrift provisions within the trust document. These provisions restrict the beneficiaries’ ability to transfer or sell their interest in the trust and provide an added layer of asset protection.

When drafting the trust document, make sure to review it thoroughly and seek legal advice to ensure it accurately reflects your intentions. Keep in mind that the trust document is a legally binding document and any ambiguity or oversight could lead to unintended consequences in the future.

Once the trust document is finalized, the next step is funding the trust, which we will explore in the following section.

Funding the Trust

Funding the life insurance trust is a crucial step in finalizing its establishment. It involves transferring ownership of the life insurance policy from the insured individual to the trust itself. By funding the trust, you ensure that the policy proceeds will be distributed and managed according to the provisions outlined in the trust document. Here are some key considerations when funding the trust:

- Changing Policy Ownership: To fund the trust, you will need to change the ownership of the life insurance policy from your name to the name of the trust. This typically involves completing the necessary paperwork provided by the insurance company and effectively transferring the ownership rights to the trustee of the trust.

- Notify the Insurance Company: It is important to inform the insurance company about the change in ownership and provide them with the necessary documentation to ensure the policy is properly registered in the name of the trust. This step helps avoid any potential complications when the time comes for the distribution of the policy proceeds.

- Premium Payments: After the trust is funded, it is crucial to ensure that the premiums for the life insurance policy are paid in a timely manner. This responsibility typically falls on the trustee, who will utilize trust funds or other available resources to cover the premium payments. Regularly reviewing the trust’s financial status and making provisions for the ongoing premium payments is essential to maintain the policy’s validity.

- Consider Insurability: When funding the trust, it is important to consider the insurability of the insured individual. If you anticipate any changes in health or other factors that may affect insurability, it may be wise to secure the life insurance policy before making the transfer to the trust. This helps ensure that the policy proceeds are protected and that the trust is adequately funded for the future.

- Evaluate Additional Assets: While the life insurance policy will likely be the main asset of the trust, it is important to assess whether additional assets should be transferred into the trust to further provide for the beneficiaries. This may include other financial accounts, real estate, or valuable personal property. Consulting with an attorney or financial advisor can help determine the most appropriate assets to fund the trust.

It is crucial to keep accurate records of the funding process, including documentation of the change in policy ownership and any additional assets transferred to the trust. These records will help ensure the proper administration of the trust and assist in the future distribution of the trust assets to the beneficiaries.

Next, we will explore the administration of the life insurance trust and the responsibilities of the trustee.

Administering the Trust

Administering a life insurance trust is a crucial responsibility that falls on the designated trustee. The trustee plays a vital role in managing the trust’s activities, ensuring its compliance with the terms outlined in the trust document, and safeguarding the best interests of the trust beneficiaries. Here are key aspects to consider when administering the trust:

- Communication with Beneficiaries: Keeping open lines of communication with the trust beneficiaries is essential. The trustee should regularly provide updates on the trust’s performance, facilitate any necessary distributions, and address any concerns or inquiries the beneficiaries may have. Clear and transparent communication helps establish trust and ensures that the beneficiaries understand the trust’s purpose and its administration.

- Record-keeping and Accounting: The trustee is responsible for maintaining accurate records of all transactions, investments, and distributions made by the trust. Detailed accounting is crucial to demonstrate transparency, showcase the trust’s financial health, and fulfill any reporting obligations outlined in the trust document or required by applicable laws.

- Investment Management: Depending on the terms of the trust document, the trustee may be responsible for investing the trust assets. Prudent investment management is crucial to preserve and potentially grow the trust’s funds. The trustee should act in accordance with their fiduciary duty and ensure that investments are made in a manner consistent with the trust’s objectives and with the goal of maximizing returns while managing risk.

- Meeting Legal and Tax Obligations: The trustee must ensure that the trust complies with all legal and tax requirements. This includes filing any necessary tax returns for the trust and distributing tax information to the beneficiaries. Consulting with a tax professional is advisable to navigate the complex tax regulations and ensure accurate reporting.

- Distributions to Beneficiaries: The trustee is responsible for making distributions to the trust beneficiaries as outlined in the trust document. This involves assessing the needs of the beneficiaries, determining the appropriate timing and amount of distributions, and ensuring compliance with any specific instructions or restrictions outlined in the trust.

- Regular Trust Review: It is important for the trustee to periodically review the trust’s provisions, investments, and overall performance. Regular evaluation helps ensure that the trust continues to align with the intentions of the grantor and that any necessary adjustments or revisions are made in a timely manner.

Administering a life insurance trust requires careful attention to detail, financial expertise, and adherence to legal and ethical standards. If the trustee feels overwhelmed or lacks the necessary knowledge, they should consider seeking professional guidance from an estate planning attorney, financial advisor, or trust company to ensure proper administration of the trust.

In the next section, we will explore the tax implications of a life insurance trust.

Tax Implications of a Life Insurance Trust

Understanding the tax implications of a life insurance trust is essential to ensure proper compliance and to maximize the benefits of the trust. While this section provides a general overview, it is important to consult with a tax professional to fully understand the specific tax laws and regulations that apply to your situation. Here are some key tax considerations for a life insurance trust:

- Income Tax: Life insurance proceeds paid to a life insurance trust are typically not subject to income tax. However, if the proceeds are retained within the trust and generate income, that income may be subject to income tax. The trust itself is considered a separate taxable entity and must file its own tax returns.

- Estate Tax: By placing the life insurance policy within a trust, the policy proceeds are generally excluded from the insured individual’s estate for estate tax purposes. This can help reduce the potential estate tax liability. However, it is important to consider any applicable estate tax exemptions and thresholds to ensure proper planning.

- Gift Tax: Funding a life insurance trust may trigger potential gift tax implications. If the value of the policy or the premium payments exceeds the annual gift tax exclusion, it may be necessary to file a gift tax return. However, the lifetime gift tax exemption can be used to offset any potential gift tax liability.

- Generation-Skipping Transfer (GST) Tax: If the life insurance trust includes beneficiaries who are more than one generation younger than the grantor, there may be potential GST tax implications. The GST tax is a separate tax that applies to certain transfers that “skip” a generation. Understanding and planning for GST tax obligations is important to ensure proper tax compliance.

- State and Local Taxes: In addition to federal tax considerations, it is crucial to consider the state and local tax laws that apply to the life insurance trust. Tax laws can vary significantly from state to state, so consulting with a tax professional knowledgeable in state tax matters is advisable.

- Charitable Contributions: If the life insurance trust includes provisions for charitable contributions, there may be potential tax benefits associated with those contributions. Consult with a tax advisor to understand the specific tax advantages of charitable giving within the context of the trust.

Proper tax planning and compliance are crucial when establishing and administering a life insurance trust. Working with an experienced tax professional or attorney who specializes in estate planning can help ensure that the trust is structured in a tax-efficient manner and that all necessary tax obligations are fulfilled.

Next, we will explore the considerations for revocable and irrevocable trusts when setting up a life insurance trust.

Considerations for Revocable and Irrevocable Trusts

When setting up a life insurance trust, one important decision to make is whether to establish a revocable or irrevocable trust. Both types of trusts offer distinct advantages and considerations. Understanding the characteristics of each will help guide your decision-making process. Here are some key considerations for revocable and irrevocable trusts:

Revocable Trust:

A revocable trust, also known as a living trust, allows the grantor to retain control over the trust assets during their lifetime. Here are some important considerations:

- Flexibility and Control: With a revocable trust, the grantor can modify, amend, or revoke the trust at any time. This provides flexibility to make changes to the trust’s provisions if circumstances or preferences change.

- Probate Avoidance: One of the notable benefits of a revocable trust is the ability to bypass probate. Since the trust assets are in the grantor’s control, they do not become subject to probate proceedings upon the grantor’s death. This can help streamline the transfer of assets to the beneficiaries and maintain privacy.

- Inclusion in the Estate: While a revocable trust offers probate avoidance benefits, it does not provide estate tax savings. The assets held in a revocable trust are still considered part of the grantor’s estate for tax purposes and may be subject to estate taxes if the estate exceeds the exemption thresholds.

Irrevocable Trust:

An irrevocable trust, as the name suggests, cannot be modified or revoked once it is established. This type of trust offers certain benefits and considerations:

- Asset Protection: Assets transferred to an irrevocable trust are typically shielded from creditors and potential legal claims. By permanently relinquishing control over the trust assets, the grantor gains an extra layer of asset protection and safeguards the assets for the beneficiaries.

- Estate Tax Planning: Irrevocable trusts can offer valuable estate tax planning opportunities. Since the assets are no longer considered part of the grantor’s estate, they are not subject to estate taxes upon the grantor’s death, provided the transfer occurred more than three years prior to the grantor’s passing. This can result in significant tax savings for the beneficiaries.

- Limited Control: As the grantor, once you transfer assets to an irrevocable trust, you relinquish control over those assets. This means that you are unable to make changes to the trust or retrieve the assets without the consent of the trustee and beneficiaries.

Choosing between a revocable and irrevocable trust depends on your specific goals, circumstances, and priorities. It is advisable to consult with an experienced estate planning attorney or financial advisor who can guide you in making an informed decision based on your unique situation.

Finally, let’s conclude this article by summarizing the main points discussed and emphasizing the importance of seeking professional advice when setting up a life insurance trust.

Conclusion

Setting up a life insurance trust is a valuable way to ensure the financial security and well-being of your loved ones while maximizing tax benefits and control over the distribution of your life insurance policy proceeds. Throughout this article, we have explored the key aspects of setting up a life insurance trust, including understanding what a life insurance trust is, the benefits it offers, selecting the right trustee, determining the type and amount of insurance coverage, drafting the trust document, funding the trust, administering the trust, and considering the tax implications and the choice between revocable and irrevocable trusts.

By establishing a life insurance trust, you can protect the policy proceeds from estate taxes, maintain control over the distribution of the funds, and provide for special circumstances such as minor beneficiaries or those with special needs. Additionally, the privacy and asset protection benefits of a life insurance trust further enhance your estate planning strategy and provide peace of mind.

However, it is crucial to emphasize that the information provided here serves as a general guide and is not exhaustive or tailored to your specific situation. Every individual’s financial circumstances and goals are unique, and it is essential to consult with an experienced estate planning attorney or financial advisor who can provide personalized advice and guidance to ensure that your life insurance trust is structured and administered correctly.

Remember to regularly review and update your life insurance trust as your circumstances change, and to work with professionals who can help you navigate the legal and tax complexities. By doing so, you can ensure that your life insurance policy proceeds are managed efficiently and provide the financial security and support you desire for your beneficiaries.

Ultimately, setting up a life insurance trust is a proactive step towards securing the financial future of your loved ones and ensuring your wishes are carried out. Take the time to carefully consider your options and seek professional assistance to create a well-structured and effective life insurance trust.