Finance

How To Rapid Rescore Credit

Published: January 5, 2024

Improve your credit score quickly with our step-by-step guide on how to rapid rescore your credit. Get expert tips and advice on finance today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

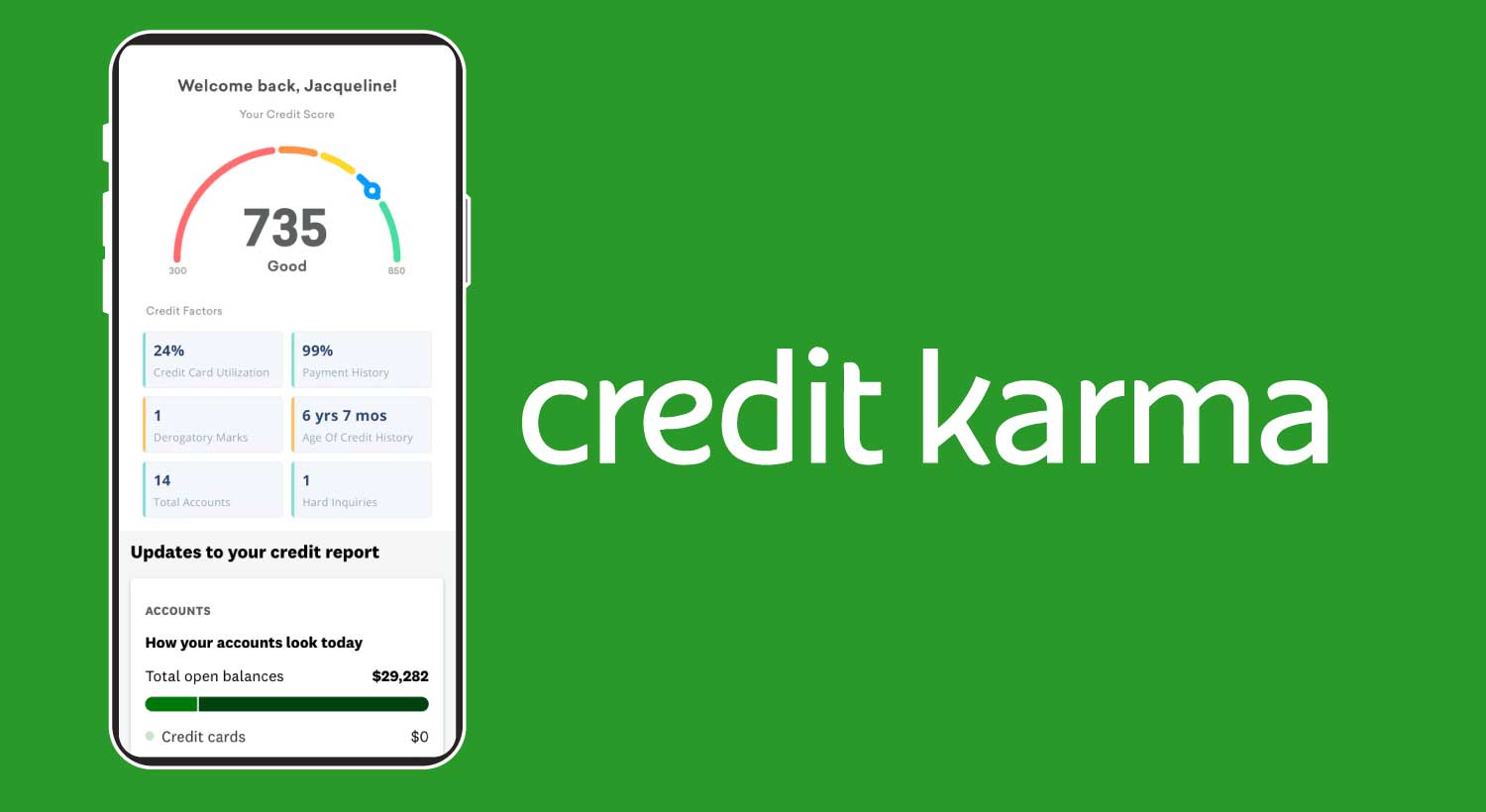

Welcome to the world of rapid rescoring, a powerful tool that can help you improve your credit score in a short period of time. Whether you’re looking to secure a mortgage, obtain a loan, or get better interest rates on credit cards, having a good credit score is crucial in today’s financial landscape. However, building and maintaining a strong credit score can take time, and sometimes you need a quick solution.

Rapid rescoring offers just that – a way to expedite the credit score improvement process. This process can be especially beneficial if you have recently made significant changes to your credit history that have not yet been reflected in your credit score. A rapid rescore can ensure that these changes are promptly updated and considered by lenders, allowing you to enjoy the benefits of an improved credit score sooner rather than later.

In this article, we will explore the concept of rapid rescoring, how it works, and when it can be the right solution for you. We will also discuss the step-by-step process of utilizing rapid rescoring and the benefits and considerations associated with it. Additionally, we will touch on alternative methods that can help you enhance your credit score.

Now, let’s dive in and discover the power of rapid rescoring, and how it can provide you with the financial flexibility and opportunities you deserve.

Understanding Rapid Rescore

Rapid rescoring is a service offered by some credit bureaus and mortgage lenders that allows you to update and improve your credit score in a short amount of time. It is different from regular credit score updates because it focuses on specific items or changes in your credit history, rather than waiting for the usual monthly update cycle.

Typically, when you make changes to your credit history, be it paying off debts, reducing credit card balances, or resolving any errors, it can take up to 30 days (or even longer) for these changes to be reflected in your credit score. This delay can hinder your ability to secure loans, mortgages, or credit cards at favorable interest rates.

Rapid rescoring works by allowing you to provide evidence or documentation of the recent changes to your credit history. A credit specialist then reviews the information and communicates with the credit bureaus to expedite the update process. This can result in a more accurate and improved credit score within a few days, potentially opening up new financial opportunities for you.

It’s important to note that rapid rescoring is not a DIY approach to improving your credit score. It is a service that is typically offered through mortgage lenders or other financial institutions and requires their involvement. Additionally, not all credit bureaus or lenders offer rapid rescoring services, so it’s crucial to check with your lender or credit bureau to determine if this option is available.

Rapid rescoring is especially useful when you have a time-sensitive financial goal, such as obtaining a mortgage with a better interest rate or securing a loan for a major purchase. By quickly updating and improving your credit score, you can potentially save thousands of dollars in interest payments over the life of the loan.

Now that we have a basic understanding of rapid rescoring, let’s explore when it can be useful in your financial journey.

When is Rapid Rescore Useful?

Rapid rescoring can be a valuable tool in various financial situations where having an improved credit score is crucial. Here are a few scenarios where rapid rescoring can be particularly advantageous:

- You’re in the process of applying for a mortgage: When applying for a mortgage, lenders carefully assess your creditworthiness to determine the interest rate and terms they can offer you. A higher credit score can result in a lower interest rate, potentially saving you thousands of dollars over the life of your mortgage. Rapid rescoring can update your credit score quickly, allowing you to secure better loan terms.

- You want to qualify for a lower interest rate on a loan: Whether it’s an auto loan, personal loan, or credit card, having a higher credit score translates to better interest rates and borrowing options. If you’re planning to make a big purchase or consolidate your debts, rapid rescoring can help you qualify for a lower interest rate, saving you money in the long run.

- You’re planning a major financial decision: If you have a significant financial decision on the horizon, such as starting a business, purchasing an investment property, or securing financing for a large project, a higher credit score can greatly improve your chances of success. Rapid rescoring can ensure that your credit score accurately reflects any recent positive changes, giving you a competitive advantage.

- You want to maximize your credit card rewards: Many credit card issuers offer rewards programs based on your creditworthiness. By improving your credit score, you can potentially qualify for credit cards with better rewards programs, allowing you to earn cashback, airline miles, or other perks for your everyday spending.

It’s important to note that not all financial situations require rapid rescoring. If you don’t have an urgent need for a higher credit score or are not currently in the process of applying for loans or mortgages, it may be more cost-effective to focus on long-term credit-building strategies instead.

Now that we understand when rapid rescoring can be useful, let’s delve into how it works.

How Does Rapid Rescore Work?

Rapid rescoring is a process that involves working closely with your lender and credit bureaus to update and improve your credit score quickly. Here is an overview of how rapid rescoring works:

- Identify the need for rapid rescoring: The first step is to determine if rapid rescoring is the right solution for your specific situation. Consult with your lender or a credit specialist to evaluate if there are recent changes in your credit history that need to be quickly reflected in your credit score.

- Gather evidence and documentation: Once it has been confirmed that rapid rescoring is necessary, you will need to gather the supporting evidence and documentation for the changes you want to be considered. This may include proof of paying off debts, resolving errors, or any other significant credit-related activity.

- Provide the documentation to your lender: Send the collected documentation to your lender, who will act as the intermediary between you and the credit bureaus. They will review the information and determine if it meets the criteria for rapid rescoring.

- Lender submits the request to the credit bureaus: If the documentation is deemed suitable for rapid rescoring, your lender will submit the request to the credit bureaus on your behalf. They will provide the necessary evidence and explain the changes that need to be reflected in your credit score.

- Credit bureaus update your credit report: The credit bureaus will review the request and documentation provided by your lender. If everything is in order, they will update your credit report accordingly, taking into account the recent changes in your credit history. This could include updating balances, removing negative information, or adding positive information, depending on the nature of the updates.

- Receive the updated credit score: Once the credit bureaus have made the necessary updates to your credit report, your lender will receive the new credit score. They will then inform you of the updated score and provide you with any additional information or guidance.

- Enjoy the benefits of an improved credit score: With a higher credit score, you can now take advantage of better financing options, lower interest rates, and improved financial opportunities. Whether it’s securing a mortgage, obtaining a loan, or qualifying for a premium credit card, an improved credit score can open doors to financial success.

It’s important to note that rapid rescoring is a service provided by credit bureaus and certain lenders. The process may vary slightly depending on the specific institution you are working with. Therefore, it’s essential to communicate closely with your lender to understand their specific requirements and guidelines for rapid rescoring.

Now that we have explored how rapid rescoring works, let’s dive into a step-by-step guide to implementing rapid rescoring for your credit.

Step-by-Step Guide to Rapid Rescore Credit

If you’ve determined that rapid rescoring is the right option for you, here is a step-by-step guide to help you navigate the process:

- Consult with your lender: Start by discussing your desire for rapid rescoring with your lender. They will guide you through the process and provide you with the necessary information and requirements.

- Identify the changes to be addressed: Work with your lender to identify the specific changes in your credit history that need to be addressed. This could include paying off debts, resolving errors, or any other actions that can positively impact your credit score.

- Gather supporting documentation: Collect all the relevant documentation to support the changes you want to be considered. This may include bank statements, proof of payment, letters of resolution, or any other supporting evidence.

- Submit the documentation to your lender: Provide the gathered documentation to your lender as per their instructions. They will review and verify the information to ensure its suitability for rapid rescoring.

- Lender submits the request to the credit bureaus: Once your lender determines that the documentation meets the requirements, they will submit the rapid rescoring request to the credit bureaus on your behalf. They will provide the necessary evidence and explanations for the changes.

- Credit bureaus update your credit report: The credit bureaus will review the request and documentation provided by your lender. If everything is in order, they will update your credit report to accurately reflect the recent changes in your credit history.

- Receive the updated credit score: After the credit bureaus have updated your credit report, your lender will receive the new credit score. They will then inform you of the updated score and provide any additional guidance or information.

- Utilize your improved credit score: With an improved credit score in hand, take advantage of the new opportunities available to you. Whether it’s securing a loan, obtaining a mortgage, or applying for premium credit cards, your improved credit score can open doors to financial success.

Keep in mind that the duration of the rapid rescoring process may vary depending on the complexity of your situation and the responsiveness of the credit bureaus. Be sure to maintain regular communication with your lender throughout the process to stay updated.

Now that you have a step-by-step guide to rapid rescoring, let’s explore the benefits associated with this credit-improvement approach.

Benefits of Rapid Rescore

Rapid rescoring offers several benefits that can have a significant impact on your financial journey. Let’s take a closer look at some of the key advantages of utilizing rapid rescoring:

- Quick credit score improvement: One of the most obvious benefits of rapid rescoring is the ability to improve your credit score quickly. Instead of waiting for the regular monthly update cycle, rapid rescoring allows changes in your credit history to be reflected promptly, potentially saving you weeks or even months of waiting.

- Increased chances of loan approval: By improving your credit score through rapid rescoring, you enhance your chances of loan approval. Lenders often prioritize applicants with higher credit scores as they are considered less risky borrowers. This can give you a competitive edge in obtaining loans, mortgages, and other forms of credit.

- Better loan terms and interest rates: A higher credit score achieved through rapid rescoring can lead to better loan terms and lower interest rates. This translates into significant savings over the life of your loan, helping you reduce the overall cost of borrowing.

- Access to premium credit cards and rewards programs: With an improved credit score, you may qualify for premium credit cards that offer enhanced rewards and perks. These benefits can include cashback offers, airline miles, hotel discounts, or other exclusive rewards programs.

- Faster achievement of financial goals: Rapid rescoring allows you to quickly enhance your creditworthiness, helping you achieve your financial goals faster. Whether it’s buying a home, starting a business, or funding a major purchase, an improved credit score enables you to move forward with your plans more efficiently.

- Expedited credit rehabilitation after negative events: If you’ve experienced a negative credit event, such as a missed payment or bankruptcy, rapid rescoring can help expedite the recovery process. By promptly updating your credit score with positive changes, you can mitigate the impact of these events and rebuild your credit more swiftly.

It’s important to weigh the benefits against the potential costs associated with rapid rescoring. Some lenders may charge fees for providing this service, so make sure to carefully consider the financial implications before proceeding.

Now that we understand the benefits of rapid rescoring, let’s discuss some important considerations to keep in mind before utilizing this credit-improvement strategy.

Considerations Before Using Rapid Rescore

While rapid rescoring can be a valuable tool for improving your credit score, it’s essential to weigh the considerations involved before proceeding. Here are some key factors to consider before utilizing rapid rescoring:

- Eligibility and availability: Rapid rescoring is typically offered through mortgage lenders or other financial institutions and may not be available for all types of credit situations. It’s important to check with your lender or credit bureau to determine if you are eligible for rapid rescoring and if they offer this service.

- Cost: Some lenders may charge a fee for providing the rapid rescoring service. Before deciding to proceed, it’s important to understand the cost involved and evaluate if the potential benefits outweigh the expenses.

- Impact on credit score: While rapid rescoring can potentially improve your credit score, it’s important to note that it does not guarantee a specific outcome. The credit bureaus have sole discretion in updating your score based on the provided information. Ensure that the changes you’re seeking to implement are accurate and supported by documentation.

- Temporary score fluctuations: Rapid rescoring can cause temporary fluctuations in your credit score. This is because the credit bureaus may update different credit factors at different times. It’s important to be prepared for these temporary fluctuations and understand that your score may not stabilize immediately.

- Focus on long-term credit-building strategies: Rapid rescoring is a short-term solution for credit score improvement. It’s crucial to also focus on long-term credit-building strategies, such as making timely payments, keeping credit card balances low, and correcting errors on your credit report. These strategies will help maintain a healthy credit score even after the rapid rescoring process is complete.

- Impact on future credit applications: While rapid rescoring can increase your chances of credit approval, keep in mind that lenders review various factors when considering your application. Your credit score is just one component of the overall assessment. Other factors, such as income, employment history, and debt-to-income ratio, also play a significant role in the decision-making process.

Before opting for rapid rescoring, carefully evaluate your financial situation, goals, and the potential impact of an improved credit score. Consider whether the cost, time, and effort involved align with your needs and objectives.

Now, let’s explore some alternative methods that can help improve your credit score without relying solely on rapid rescoring.

Alternatives to Rapid Rescore

While rapid rescoring can be an effective tool for quickly improving your credit score, there are alternative methods you can consider. These methods focus on long-term credit-building strategies that can help you maintain a healthy credit profile. Here are a few alternatives to rapid rescoring:

- Regular credit monitoring and disputing errors: Regularly monitoring your credit report allows you to catch any errors or inaccuracies that could be negatively impacting your credit score. Disputing these errors with the credit bureaus can lead to a correction and a subsequent increase in your credit score.

- Payment history improvement: Your payment history has a significant impact on your credit score. Making payments on time and in full is crucial for maintaining a positive credit profile. By consistently making timely payments, you can gradually improve your creditworthiness over time.

- Credit utilization management: The amount of credit you are using compared to your total available credit, known as credit utilization, is a crucial factor in calculating your credit score. Keeping your credit card balances low and using credit responsibly can enhance your credit utilization ratio, resulting in a higher credit score.

- Lengthening credit history: The length of your credit history is another important factor in determining your creditworthiness. Building a long and positive credit history by maintaining accounts in good standing can help improve your credit score over time.

- Adding positive credit references: If you have limited credit history or want to establish new positive credit references, consider adding authorized user accounts or obtaining a secured credit card. These actions can help build a positive credit history and improve your creditworthiness in the eyes of lenders.

- Seeking professional credit counseling: If you’re struggling with significant debt or need personalized guidance on improving your credit score, seeking assistance from a reputable credit counseling agency can be beneficial. They can provide expert advice, develop a customized plan, and negotiate with creditors to help you regain control of your financial situation.

It’s important to note that improving your credit score is a gradual process that requires patience and consistency. While rapid rescoring can provide a quick boost, focusing on these long-term credit-building strategies can lead to sustainable improvements in your credit profile.

Now that we’ve explored alternatives to rapid rescoring, let’s conclude our discussion.

Conclusion

Rapid rescoring can be a valuable tool for quickly improving your credit score in specific situations. It provides a way to expedite the credit score update process, allowing you to enjoy the benefits of an improved credit score in a shorter timeframe. Whether you’re applying for a mortgage, seeking better loan terms and interest rates, or aiming to maximize credit card rewards, rapid rescoring can potentially open doors to financial opportunities.

However, before deciding to utilize rapid rescoring, it’s important to consider the eligibility criteria, associated costs, and potential impact on your credit score. Evaluating these factors will help you determine if it’s the right solution for your specific needs and goals.

Furthermore, it’s essential to remember that rapid rescoring is not a standalone solution for long-term credit health. Building and maintaining a healthy credit profile requires consistent effort, such as monitoring and disputing errors, improving payment history, managing credit utilization, lengthening credit history, and adding positive credit references.

Ultimately, the decision to use rapid rescoring or alternative credit-building methods depends on your individual circumstances and financial goals. It may be beneficial to consult with a financial advisor or credit specialist who can provide tailored guidance based on your specific situation.

By understanding the concept of rapid rescoring, considering its benefits and limitations, and exploring alternative strategies, you can make informed decisions to improve and maintain a healthy credit profile. Remember that building good credit is a journey that takes time, discipline, and a strategic approach.