Finance

How To Start A Real Estate Investment Company

Published: October 17, 2023

Learn how to start a real estate investment company and secure financing for your ventures with our comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Define Your Investment Strategy

- Step 2: Conduct Market Research

- Step 3: Create a Business Plan

- Step 4: Secure Financing

- Step 5: Establish Legal Structure

- Step 6: Obtain Licenses and Permits

- Step 7: Build a Network of Professionals

- Step 8: Find Investment Properties

- Step 9: Analyze Potential Deals

- Step 10: Purchase and Manage Properties

- Step 11: Expand Your Portfolio

- Step 12: Monitor and Adjust Your Strategy

- Conclusion

Introduction

Welcome to the world of real estate investing! If you’ve ever dreamed of starting your own real estate investment company, now is the perfect time to turn that dream into a reality. Real estate investing has proven to be a lucrative venture for many individuals, providing a path to financial freedom and long-term wealth accumulation.

Starting a real estate investment company can be both exciting and challenging. It requires careful planning, market research, and a solid understanding of the financial aspects involved. This guide will walk you through the essential steps to help you launch your own successful real estate investment company.

As with any business venture, the first step is to define your investment strategy. Are you interested in residential properties, commercial properties, or a combination of both? Will you focus on fix and flip projects, rental properties, or wholesaling? Defining your strategy will help you narrow down your target market and guide your decision-making process.

Step 1: Define Your Investment Strategy

Defining your investment strategy is the foundation of your real estate investment company. It involves determining the types of properties you will focus on, the level of risk you are comfortable with, and the desired return on investment (ROI).

One key consideration is whether you want to invest in residential properties, commercial properties, or a combination of both. Residential properties include single-family homes, duplexes, apartments, and condominiums, while commercial properties encompass office buildings, retail spaces, and industrial properties. Each type of property carries its own set of benefits and risks, so it’s essential to evaluate your goals and resources before making a decision.

Next, consider the specific investment strategies you will employ within the chosen property type. Some popular strategies include:

- Fix and Flip: This strategy involves purchasing distressed properties, renovating them, and selling them for a profit.

- Rental Properties: With this strategy, you aim to generate passive income by purchasing properties and renting them out to tenants.

- Wholesaling: Wholesaling involves finding deeply discounted properties and assigning the contract to another buyer for a fee.

- Development: Development involves acquiring land or properties with the goal of improving the value through construction or redevelopment.

Consider your skills, resources, and interests when selecting your investment strategy. It’s important to choose a strategy that aligns with your strengths and that you feel comfortable executing.

Additionally, determine your target market. Will you focus on a specific geographic location or neighborhood? Understanding the local market conditions and trends will help you identify opportunities and make informed investment decisions.

Once you have defined your investment strategy, write it down and refer back to it regularly. Your investment strategy will serve as a roadmap for your business and help you stay focused on your long-term goals.

Step 2: Conduct Market Research

Market research is a crucial step in starting a real estate investment company. It involves gathering and analyzing data to understand the current state of the real estate market and identify potential opportunities.

Begin by researching the local market where you plan to invest. Look for information on property prices, rental rates, vacancy rates, and market trends. Understanding the market dynamics will help you determine the demand and supply of properties, as well as the potential for rental income or appreciation.

Consider factors such as population growth, job market, and the overall economic condition of the area. Is the area experiencing steady population growth? Are there major employers in the region that attract people to the area? These factors can influence property values and demand for rentals.

It’s also crucial to research the competition. Identify other real estate investors or companies operating in your target market. Analyze their investment strategies, property portfolios, and pricing. Understanding your competition will help you differentiate yourself and identify gaps in the market that you can exploit.

In addition to local market research, it’s essential to stay informed about broader real estate trends and national economic indicators. This will give you a broader perspective and help you make more informed investment decisions.

Utilize online tools and platforms to access real estate data and market reports. Websites like Zillow, Redfin, and Realtor.com provide valuable insights into property values, sales trends, and rental rates.

Another effective way to conduct market research is to network with local real estate professionals. Attend networking events, join real estate investment associations, and connect with real estate agents, lenders, and property managers in your target market. These connections can provide you with insider knowledge, off-market deals, and potential partnerships.

Remember, market research is an ongoing process. Keep track of market trends and adjust your investment strategy accordingly. Stay informed about any zoning changes, new development projects, or infrastructure improvements that may impact property values and rental demand.

By conducting thorough market research, you will gain valuable insights that will guide your investment decisions and increase your chances of success in the real estate market.

Step 3: Create a Business Plan

Creating a business plan is a crucial step in starting a real estate investment company. It serves as a roadmap for your business, outlining your goals, strategies, and financial projections.

Start by outlining the executive summary of your business plan, which provides an overview of your company and its objectives. It should include your mission statement, business structure, target market, and competitive advantage.

Next, detail your investment strategy, including the types of properties you will focus on, your chosen market, and the specific investment strategies you will employ.

Include a detailed analysis of your target market. This should include information about the local real estate market, population demographics, income levels, and rental demand. Understand the opportunities and challenges in your target market and explain how your business will capitalize on them.

Outline your marketing and sales strategies. How will you find and acquire investment properties? Will you rely on networking, direct mail, online advertising, or a combination of methods? Describe your approach to property management, tenant screening, and lease agreements.

Provide an overview of your team and their roles. If you plan to work with partners or hire employees, explain their qualifications and how they will contribute to the success of the business. Highlight any relevant experience or certifications that demonstrate your expertise in real estate investing.

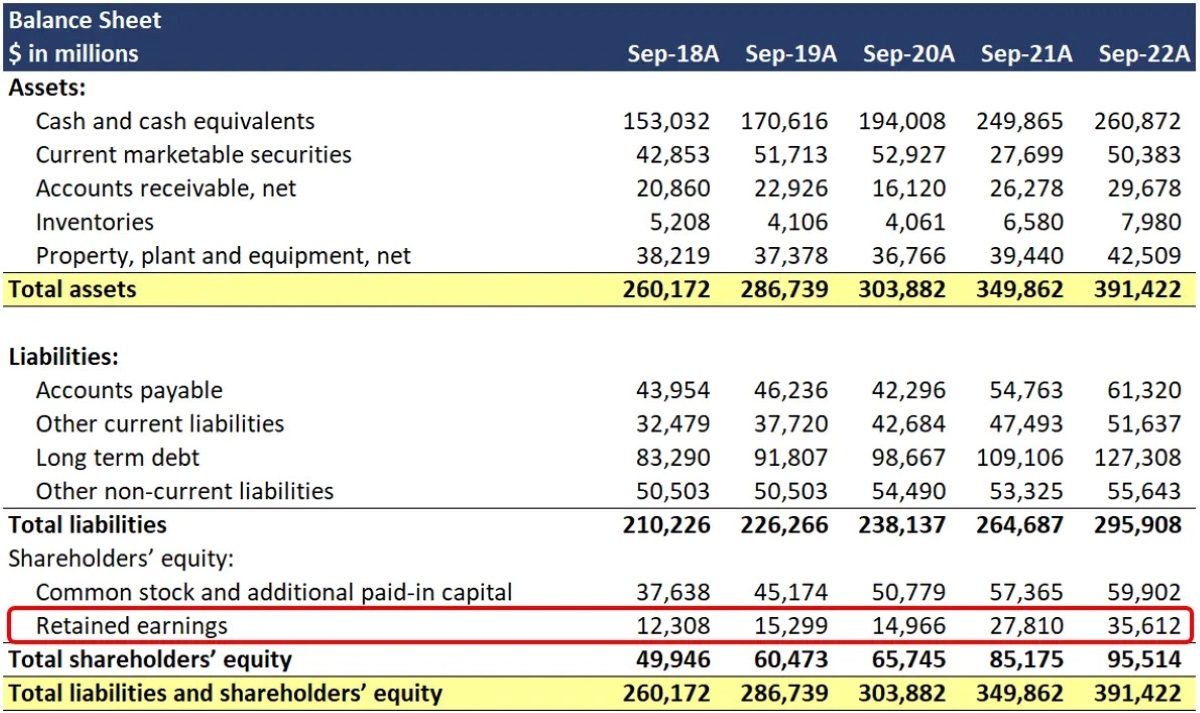

The financial section of your business plan is crucial. It should include a detailed analysis of your initial investment capital, projected revenue, and expenses. Include a cash flow forecast and an income statement that outlines your expected revenue and expenses over a specific period of time.

Consider the financing options available to you. Will you use personal savings, secure a bank loan, or seek investors? Provide a plan for how you will fund your initial and ongoing operations.

Lastly, create a timeline for your business. Outline milestones and goals for the next few years, along with the actions you will take to achieve them. This will help you stay focused and measure your progress over time.

Your business plan should be well-organized, concise, and clearly communicate your vision for the real estate investment company. It will serve as a valuable tool when seeking financing, attracting partners, or presenting your business to potential investors or lenders.

Step 4: Secure Financing

Securing financing is a critical step in starting a real estate investment company as it provides the necessary capital to fund your property acquisitions and operations. There are several financing options available, and the right choice will depend on your financial situation and investment goals.

1. Self-Financing: If you have sufficient personal savings or access to funds, you may choose to self-finance your real estate investments. This means using your own money to purchase properties and cover the associated expenses. Self-financing gives you full control over your investments and eliminates the need to pay interest or meet lender requirements.

2. Traditional Bank Loans: Banks and other financial institutions offer various loan options for real estate investors. To qualify for a bank loan, you will need a good credit history, a solid business plan, and collateral to secure the loan. These loans typically require a down payment and regular monthly payments of principal and interest.

3. Hard Money Loans: Hard money loans are short-term, high-interest loans provided by private investors or companies. These loans are based on the value of the property rather than the borrower’s creditworthiness. Hard money loans are often used for fix and flip projects or when there is a need for quick financing.

4. Joint Ventures: Partnering with other investors or real estate professionals can be a way to secure financing. In a joint venture, each party contributes funds or resources to acquire and manage properties together. Joint ventures allow you to leverage the experience and capital of your partners while sharing the risks and rewards.

5. Private Money Lenders: Private money lenders are individuals or companies that provide loans to real estate investors. These lenders have less stringent requirements compared to traditional banks and can provide financing for various investment strategies. Private money lenders may charge higher interest rates, but they can be a valuable source of capital, especially for investors with unique or unconventional projects.

When seeking financing, it’s important to have a well-prepared business plan that outlines your investment strategy, financial projections, and potential returns. This will give lenders and investors confidence in your ability to succeed in the real estate market.

Consider consulting with a mortgage broker or financial advisor who specializes in real estate investing. They can help you explore different financing options and guide you in choosing the best funding source for your investment company.

Remember, securing financing is not only about obtaining the necessary funds but also about ensuring that the terms and conditions are favorable to your investment goals. Carefully evaluate the cost of financing, including interest rates, fees, and repayment terms, to ensure that it aligns with your investment strategy and projected returns.

Step 5: Establish Legal Structure

Establishing a legal structure for your real estate investment company is essential for protecting your assets, managing liability, and ensuring compliance with relevant laws and regulations. Choosing the right legal structure will depend on various factors, including your investment goals, the number of partners involved, and the level of control you desire.

Here are some common legal structures for real estate investment companies:

- Sole Proprietorship: This is the simplest form of business structure, where you operate as an individual without any separate legal entity. While it offers simplicity and minimal paperwork, it also exposes your personal assets to potential liabilities. Sole proprietorship is not an ideal choice for real estate investment companies due to the associated risks.

- Partnerships: A partnership involves two or more individuals or entities coming together to form a business. There are two main types of partnerships: general partnerships and limited partnerships. In a general partnership, all partners share equal control and liability. In a limited partnership, there are general partners who manage the business and limited partners who contribute capital but have limited liability.

- Limited Liability Company (LLC): An LLC offers liability protection for its members while providing flexibility in terms of management and taxation. It combines the benefits of a partnership and a corporation. As an LLC owner, your personal assets are generally protected from business liabilities, and the company’s profits and losses can pass through to your personal tax return.

- Corporation: A corporation is a separate legal entity, distinct from its owners. It provides the highest level of liability protection, but it also involves more extensive legal requirements and formalities. Corporations have the ability to issue shares and attract investors, making it a suitable structure for larger real estate investment companies.

Before deciding on a legal structure, consult with an attorney or a business advisor who specializes in real estate to understand the legal and tax implications of each structure. They can help you choose the option that aligns best with your goals and provides the necessary legal protection.

Once you have selected a legal structure, you will need to register your company with the appropriate government authorities. This typically includes obtaining an Employer Identification Number (EIN) from the Internal Revenue Service (IRS) and registering your business with the state or local government.

Complying with local laws and regulations is crucial to ensure that your real estate investment company operates legally. This includes understanding zoning laws, landlord-tenant regulations, property management requirements, and any licensing or permitting obligations.

Keep in mind that establishing a legal structure is not a one-time task. It’s important to maintain proper documentation, adhere to reporting requirements, and seek legal advice when necessary to stay compliant with changing regulations and protect the interests of your real estate investment company.

Step 6: Obtain Licenses and Permits

Obtaining the necessary licenses and permits is a vital step in starting a real estate investment company. It ensures that your business operates legally and ethically while maintaining compliance with local, state, and federal regulations.

The specific licenses and permits required will depend on various factors, including the location of your business and the types of real estate activities you engage in. Here are some common licenses and permits to consider:

- Real Estate Broker’s License: If your business involves acting as a broker, facilitating real estate transactions for others, you may need to obtain a real estate broker’s license. The requirements for obtaining this license vary by state, but typically involve completing pre-licensing education, passing an exam, and meeting experience or education requirements.

- Real Estate Salesperson License: If you have agents or employees who will be involved in real estate sales or leasing, they may need to obtain a real estate salesperson license. Similar to a broker’s license, this license requires completing education and passing an exam.

- Business License: Most cities or municipalities require businesses to obtain a general business license. This license permits you to conduct business within the jurisdiction and ensures that you meet local regulations and zoning requirements.

- Property Management License: If your real estate investment company offers property management services, you may need a separate license specific to property management. This ensures that you meet the requirements for handling tenant deposits, maintaining records, and handling rental property inspections.

- Specialized Licenses or Permits: Depending on your specific real estate activities, you may require additional licenses or permits. For example, if you plan to engage in real estate development, you may need permits for construction or renovations. If you plan to operate in a specialized field, such as affordable housing or historic properties, there may be additional requirements to consider.

Research the licensing requirements in your jurisdiction and consult with a local attorney or real estate professional to ensure that you have a clear understanding of the licenses and permits needed for your specific business activities.

Keep in mind that maintaining these licenses and permits typically requires ongoing compliance with continuing education, renewal periods, and timely fee payments. Regularly review and update your licenses to ensure that you remain in good standing with the relevant authorities.

Operating without the necessary licenses and permits can result in legal repercussions, fines, or even the suspension of your business activities. It’s crucial to prioritize obtaining and maintaining the appropriate licenses and permits to demonstrate professionalism, build trust with clients, and protect the reputation of your real estate investment company.

Step 7: Build a Network of Professionals

Building a robust network of professionals is essential for the success of your real estate investment company. Surrounding yourself with a team of experts will provide valuable guidance, support, and access to resources that can help you achieve your investment goals.

Here are some key professionals to consider adding to your network:

- Real Estate Agents: Partnering with experienced real estate agents who specialize in the local market can provide you with access to off-market deals, market insights, and negotiation expertise. They can help you find potential investment properties that align with your investment strategy and assist with the buying or selling process.

- Property Managers: If you plan to own and manage rental properties, having a reliable property management team is crucial. A property manager can handle tenant screening, rent collection, maintenance, and other day-to-day responsibilities, allowing you to focus on growing your portfolio.

- Contractors and Handymen: Maintaining properties and conducting renovations or repairs is an integral part of real estate investing. Establish relationships with reputable contractors and handymen who can handle various maintenance and improvement tasks efficiently and at a reasonable cost.

- Real Estate Attorneys: Working with a real estate attorney is essential for navigating legal complexities, reviewing contracts, and ensuring compliance with local laws. They can provide guidance on legal documents, assist with negotiations, and help protect your interests in real estate transactions.

- Lenders and Mortgage Brokers: Developing relationships with lenders and mortgage brokers is crucial when securing financing for your investments. They can help you navigate loan options, provide information about interest rates and terms, and assist you in obtaining the best financing solutions for your needs.

- Accountants and Tax Advisors: Having a trusted accountant or tax advisor is crucial for managing your finances, maximizing tax benefits, and ensuring compliance with tax regulations. They can help you optimize your real estate investments, provide advice on tax planning, and assist with recordkeeping and financial reporting.

- Real Estate Investment Associations: Joining real estate investment associations and attending networking events allows you to connect with fellow investors, share knowledge, and learn from experienced professionals. These associations often provide educational resources, mentorship opportunities, and access to industry experts.

Remember, building a network is not only about receiving assistance but also about providing value to others. Foster mutually beneficial relationships by offering your expertise, sharing resources, and referring professionals to members of your network when appropriate.

Networking can also extend beyond professionals directly involved in real estate. Consider connecting with individuals in related fields such as insurance agents, appraisers, title agents, and architects. Their expertise can come in handy throughout your real estate investment journey.

Attend industry conferences, seminars, and local meetups to expand your network further. Engage in online forums, social media groups, and platforms dedicated to real estate investing to connect with like-minded individuals and gain insights from their experiences.

Building and nurturing a strong network of professionals will enhance your knowledge, open doors to opportunities, and increase your chances of success in the competitive real estate market.

Step 8: Find Investment Properties

Finding investment properties is a crucial step in growing your real estate investment company. To build a profitable portfolio, you need to identify properties that align with your investment strategy and offer the potential for attractive returns. Here are some effective strategies to help you find investment properties:

- Multiple Listing Service (MLS): The MLS is a database of properties listed for sale by real estate agents. Collaborating with a real estate agent who has access to the MLS can provide you with a wide range of properties to consider. You can set up search criteria based on your investment goals, such as location, property type, price range, and specific features.

- Networking and Word-of-Mouth: Tap into your network of real estate professionals, colleagues, and friends to let them know that you are actively seeking investment properties. Networking can often unearth off-market deals or pocket listings, which are properties not publicly advertised for sale. Attend local real estate events, join investment groups, and participate in online forums to expand your reach and connect with potential property sources.

- Direct Marketing: Implement direct marketing strategies to reach property owners directly. This can include sending targeted mailers, postcards, or personalized letters to property owners in your desired market. Be sure to highlight the benefits of working with a real estate investor, such as a quick and hassle-free sale. Additionally, utilize online platforms and social media to promote your interest in purchasing properties.

- Foreclosures and Auctions: Bank-owned properties and properties going through foreclosure or auction can offer great investment opportunities. Monitor foreclosure listings, attend foreclosure auctions, or work with foreclosure specialists who can guide you through the process. It’s crucial to conduct thorough due diligence and understand the risks associated with these types of properties.

- Real Estate Wholesalers: Real estate wholesalers specialize in finding deeply discounted properties and connecting them with investors. They often have a network of motivated sellers and can provide you with pre-screened deals. Collaborating with wholesalers can save you time and effort in sourcing potential investment properties.

- Online Real Estate Marketplaces: Utilize online platforms dedicated to real estate investing, such as LoopNet, Auction.com, or BiggerPockets. These platforms offer a wide range of investment properties, including residential, commercial, and multi-family properties. You can filter your search based on location, price range, property type, and other criteria.

When evaluating investment properties, consider factors such as location, potential rental income, renovation or repair costs, property appreciation potential, and market conditions. Conduct thorough due diligence, including property inspections, market analysis, and financial projections, to ensure that the property aligns with your investment goals and offers a favorable return on investment.

Stay patient and persistent in your search for investment properties. The real estate market can be competitive, and it may take time to find the right opportunities. Remember to align your property acquisitions with your overall investment strategy and focus on building a diversified and profitable portfolio over time.

Step 9: Analyze Potential Deals

Analyzing potential deals is a critical step in the real estate investment process. It involves evaluating the financial viability and potential return on investment of a property before making a purchase. Proper analysis helps you make informed decisions, minimize risks, and maximize your chances of success. Here are key factors to consider when analyzing potential deals:

- Market Analysis: Evaluate the local market conditions, including supply and demand, rental rates, property values, and economic indicators. Understand the neighborhood dynamics, such as proximity to schools, transportation, amenities, and future development plans. A thorough market analysis helps determine the potential for rental income, property appreciation, and demand for the property.

- Financial Analysis: Assess the financial aspects of the deal, including the purchase price, financing options, closing costs, and estimated monthly expenses (such as property taxes, insurance, utilities, and maintenance costs). Calculate the net operating income (NOI) by subtracting expenses from gross rental income. Analyze the cash flow to ensure the property generates positive cash flow after accounting for all expenses.

- Return on Investment (ROI): Calculate the potential return on investment to determine if the deal aligns with your investment goals. Evaluate metrics such as cash-on-cash return, cap rate, and internal rate of return (IRR). Compare the projected ROI to industry benchmarks and assess if the investment opportunity meets your expectations.

- Risk Assessment: Identify and assess potential risks associated with the property. Consider factors such as vacancy rates, potential repairs or renovations needed, neighborhood stability, and potential changes in market conditions. Assessing risks helps formulate contingency plans and determine if the potential rewards outweigh the risks involved.

- Exit Strategy: Plan your exit strategy before finalizing a deal. Consider your investment horizon and options for selling or refinancing the property in the future. A well-defined exit strategy ensures that you have an exit plan in place to achieve your investment objectives and adapt to market changes.

- Due Diligence: Engage in thorough due diligence to evaluate the property’s condition, legal status, and any potential liabilities. Conduct property inspections, review title documents, contracts, and lease agreements. Consult with professionals, such as attorneys and inspectors, to ensure that you have a comprehensive understanding of the property before making a purchase decision.

Use financial analysis tools, real estate investment software, or spreadsheets to assist with calculations and projections. It’s important to be conservative in your assumptions and factor in contingencies for unexpected expenses or fluctuations in the market.

Remember that no deal is perfect, and not every opportunity will meet all your criteria. Continuously refine your analysis process and learn from each potential deal, whether you move forward with it or not.

Ultimately, analyzing potential deals requires a balance of quantitative analysis and informed decision-making based on market knowledge and experience. This step is crucial in mitigating risks and ensuring that the properties you choose align with your investment goals and strategies.

Step 10: Purchase and Manage Properties

Once you have analyzed and identified a promising investment property, it’s time to move forward with the purchase and subsequent management of the property. This step requires careful execution and ongoing attention to ensure a profitable and smoothly operating real estate investment. Here’s what you need to consider:

Purchasing the Property:

- Negotiation: Negotiate the purchase price and terms with the seller or their representative. Conduct thorough due diligence to uncover any potential issues or concerns that could impact the property’s value or your investment.

- Financing: Finalize your financing arrangements, whether it’s through a bank loan, private lender, or other funding source. Ensure that you satisfy all lender requirements and complete the necessary paperwork.

- Inspections and Appraisals: Schedule property inspections to assess the condition of the property, identify any necessary repairs or maintenance, and ensure compliance with local building codes. Additionally, an appraisal may be required to determine the property’s value and support your financing.

- Closing: Work with a real estate attorney or closing agent to complete the legal process of transferring ownership of the property. Review all documents thoroughly, sign the necessary paperwork, and make the required payments.

Managing the Property:

- Property Maintenance: Regularly maintain the property by addressing repairs, conducting routine inspections, and ensuring the property remains in good condition. This includes managing tenant requests or employing a property management team to handle day-to-day operations.

- Tenant Management: If you have rental properties, effectively manage your tenants. This involves finding and screening qualified tenants, preparing lease agreements, collecting rent, addressing tenant concerns, and conducting periodic inspections.

- Financial Management: Maintain accurate financial records for each property, including rent collections, expenses, and tax-related documents. Consider implementing software or utilizing accounting services to ensure accurate and streamlined financial management.

- Risk Management: Protect your investment by obtaining appropriate insurance coverage, such as property insurance and liability insurance. Regularly assess potential risks, implement necessary safety measures, and stay up-to-date with legal and regulatory requirements.

- Continuous Market Analysis: Stay informed about market trends, rental rates, and changes in the local real estate market. Continuously evaluate your rental rates and adjust them according to market conditions to maximize income and stay competitive.

Consider utilizing property management software to streamline operations, track income and expenses, and communicate with tenants efficiently. Additionally, effective communication, responsiveness, and professionalism with tenants can help maintain positive relationships and foster tenant satisfaction.

Regularly assess your investment portfolio and individual property performance to ensure they align with your investment goals. Make adjustments as needed, such as reevaluating rental rates, implementing renovations or improvements, or refinancing the property to optimize cash flow and returns.

Remember, successful property management requires dedication, attention to detail, and a commitment to providing quality housing or services to tenants. By diligently managing your properties, you can maximize returns, mitigate risks, and build a reputation as a reliable real estate investor.

Step 11: Expand Your Portfolio

Once you have gained experience and established a solid foundation with your initial investments, it’s time to consider expanding your real estate investment portfolio. Expanding your portfolio allows you to diversify your holdings, increase your potential returns, and achieve long-term financial growth. Here are key steps to consider when expanding your portfolio:

- Review and Refine Your Investment Strategy: Before expanding, revisit and refine your investment strategy. Assess what has worked well and identify any areas for improvement. Consider factors such as the types of properties, locations, investment goals, and risk tolerance. Refining your strategy will provide clarity and guide your future investment decisions.

- Set Clear Goals: Establish clear goals for portfolio expansion, such as the number of properties you want to add, the target locations, and the desired return on investment. Having specific goals will help you stay focused and measure your progress.

- Build Your Network: Continue networking and expanding your professional relationships. Strengthen relationships with real estate agents, investors, lenders, and other industry professionals who can alert you to potential investment opportunities. Attend real estate conferences, seminars, and networking events to connect with like-minded individuals and stay updated on the latest market trends.

- Stay Informed about the Market: Conduct regular market research to identify emerging trends, changing demographics, and potential investment hotspots. Understand the dynamics of different markets and evaluate opportunities in areas with strong economic growth and potential for property appreciation.

- Secure Financing: Revisit your financing options and ensure you have adequate funding in place to support your portfolio expansion. Evaluate your cash reserves, consider refinancing existing properties, or explore partnership opportunities to access additional capital.

- Perform Rigorous Due Diligence: Thoroughly research and analyze potential investment properties. Conduct proper due diligence, including property inspections, financial analysis, market analysis, and assessment of potential risks. Pay close attention to rental demand, potential cash flow, and appreciation potential to choose properties that align with your investment goals.

- Consider Different Property Types: Explore different property types to diversify your portfolio. This could include residential properties, commercial properties, multi-family properties, or even alternative real estate investments such as vacation rentals or storage facilities.

- Implement Effective Property Management Practices: Strengthen your property management practices to handle the increased workload. Ensure you have systems in place to efficiently manage a larger portfolio, including tenant screening, property maintenance, rent collection, and financial management.

- Evaluate Risk and Return: Continuously assess the risk and return of each potential investment. Consider factors such as market stability, vacancy rates, potential cash flow, and appreciation potential. Strive for a balanced portfolio that minimizes risk while providing attractive returns.

- Monitor and Adjust Performance: Regularly monitor the performance of your expanded portfolio. Evaluate each property’s income, expenses, and returns. Make adjustments as needed, such as optimizing rental rates, implementing property improvements, or strategically divesting underperforming assets.

Expanding your real estate investment portfolio requires careful planning, diligent research, and a commitment to ongoing management. It’s important to remain disciplined, focused, and adaptable as you navigate the challenges and seize new opportunities. With the right strategy and execution, portfolio expansion can lead to increased wealth, financial security, and the achievement of your long-term investment objectives.

Step 12: Monitor and Adjust Your Strategy

The final step in successfully managing your real estate investment company is to continuously monitor and adjust your strategy as needed. The real estate market is ever-changing, and adapting to new trends, economic conditions, and investment opportunities is crucial for long-term success. Here’s what you need to consider when monitoring and adjusting your strategy:

- Regular Portfolio Review: Conduct periodic reviews of your investment portfolio to evaluate the performance of each property. Assess the financials, including cash flow, occupancy rates, and return on investment. Identify any properties that may need improvements or repositioning and make necessary adjustments.

- Market Research and Analysis: Stay informed about market trends, economic indicators, and local market conditions. Regularly analyze market data to understand shifts in rental rates, property values, and demand. Adjust your investment strategy to align with changing market dynamics and identify new opportunities.

- Monitor Cash Flow: Keep a close eye on the cash flow of each property, ensuring income exceeds expenses. Regularly review rental rates, expenses, and property management costs to identify areas where adjustments can be made to optimize cash flow. Plan for potential contingencies and maintain adequate reserves for unexpected expenses or vacancies.

- Refine Financing Strategies: Continually evaluate your financing options to ensure you have the most favorable terms and rates. Monitor interest rates and explore opportunities for refinancing or restructuring existing financing to improve cash flow or capital utilization. Evaluate new funding sources or partnerships that can provide additional capital for future investments.

- Stay Educated: Real estate is a dynamic industry, and staying educated about changes in laws, regulations, and best practices is crucial. Attend continuing education courses, participate in webinars, read industry publications, and join real estate investment associations to stay abreast of the latest trends and developments.

- Engage with Industry Professionals: Maintain strong relationships with various professionals such as real estate agents, attorneys, accountants, and property managers. Regularly consult with them to gain insights, seek advice, and tap into their expertise. These professionals can provide valuable guidance and help identify ways to optimize your investment strategy.

- Adapt to Technology: Embrace technology tools and platforms that can streamline your operations, improve efficiency, and enhance communication with tenants, contractors, and other stakeholders. Utilize property management software, accounting software, and automated systems to simplify day-to-day tasks and improve overall operational effectiveness.

- Assess Risk-Return Tradeoffs: Continuously evaluate the risk and return profile of your investments. As market conditions evolve, reassess risks associated with each property and make adjustments as necessary. Be willing to allocate resources differently to balance risk while maximizing returns.

- Seek Professional Advice: Consider working with a financial advisor or real estate consultant who can provide objective insights and guidance. They can help assess your investment strategy, provide market analysis, and offer recommendations based on their expertise and understanding of your financial goals.

Remember, monitoring and adjusting your strategy is an ongoing process. Stay proactive, adaptable, and open-minded in order to respond effectively to changing market conditions and seize new opportunities for growth. By staying vigilant and continuously refining your approach, you can position yourself for long-term success in the dynamic world of real estate investing.

Conclusion

Congratulations on reaching the end of this comprehensive guide on how to start a real estate investment company. By following the twelve steps outlined, you are well-equipped to embark on your journey into the exciting world of real estate investing.

Starting a real estate investment company requires careful planning, market research, and a solid understanding of the financial aspects involved. By defining your investment strategy, conducting thorough market research, creating a business plan, securing financing, establishing a legal structure, obtaining licenses and permits, building a network of professionals, finding investment properties, analyzing potential deals, purchasing and managing properties, expanding your portfolio, and continuously monitoring and adjusting your strategy, you can navigate the challenges and maximize your chances of success.

Remember, real estate investing is a dynamic industry. The market will fluctuate, trends will change, and new opportunities will arise. It’s crucial to stay informed, continuously educate yourself, and adapt your strategy as needed. Surround yourself with a team of trusted professionals, stay connected with industry experts, and leverage technology to streamline your operations.

As you embark on your real estate investment journey, always keep your long-term financial goals in mind. Invest with patience, diligence, and a focus on building a sustainable and profitable portfolio. Be willing to learn from both successes and challenges along the way.

Starting a real estate investment company is an exciting and rewarding venture. With the right strategies, knowledge, and perseverance, you have the potential to create financial freedom, generate passive income, and build long-term wealth. Best of luck on your real estate investing journey!