Home>Finance>How Much Does QuickBooks Charge For Merchant Fees?

Finance

How Much Does QuickBooks Charge For Merchant Fees?

Published: February 24, 2024

Find out the latest QuickBooks merchant fees and charges to manage your finances effectively. Learn how much QuickBooks charges for merchant services.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of QuickBooks merchant fees! Whether you're a small business owner, a freelancer, or an entrepreneur, understanding the costs associated with processing payments through QuickBooks is crucial for managing your finances effectively. QuickBooks, a popular accounting software developed by Intuit, offers a seamless way to handle your business's financial transactions, including accepting payments from customers. However, it's essential to grasp the intricacies of QuickBooks merchant fees to make informed decisions and optimize your revenue streams.

Navigating the realm of merchant fees can seem daunting at first, but fear not! In this comprehensive guide, we'll delve into the details of QuickBooks merchant fees, unraveling the fee structure, exploring additional charges, comparing QuickBooks fees with other providers, and providing valuable tips for effectively managing these expenses. By the end of this journey, you'll emerge equipped with the knowledge and insights needed to make informed choices regarding QuickBooks merchant fees, empowering you to streamline your payment processing and maximize your business's financial efficiency.

Let's embark on this enlightening expedition into the realm of QuickBooks merchant fees, where we'll unravel the intricacies of pricing, fees, and charges, empowering you to navigate the financial landscape with confidence and clarity. Whether you're a seasoned business owner or just venturing into the entrepreneurial world, understanding QuickBooks merchant fees is a vital step towards financial success and stability. So, fasten your seatbelt and get ready to explore the world of QuickBooks merchant fees!

Understanding QuickBooks Merchant Fees

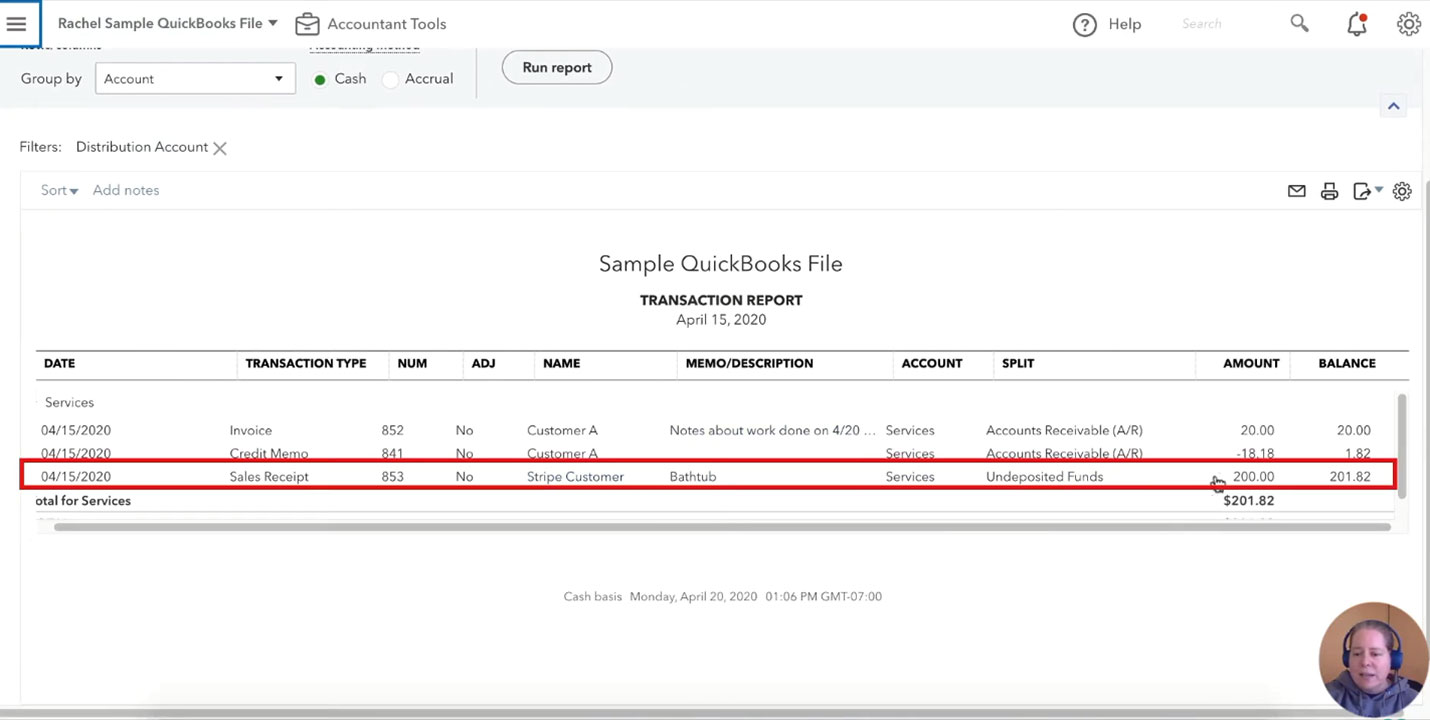

Before delving into the specifics of QuickBooks merchant fees, it’s essential to grasp the fundamental concept of these charges. When you utilize QuickBooks to process customer payments, whether through credit card transactions, bank transfers, or online invoices, QuickBooks incurs costs to facilitate these transactions. These costs are passed on to you in the form of merchant fees. Essentially, QuickBooks merchant fees are the expenses associated with processing payments and maintaining the infrastructure required for seamless and secure financial transactions.

QuickBooks offers a convenient and integrated platform for managing your business’s financial operations, including invoicing, bookkeeping, and payment processing. By understanding the intricacies of QuickBooks merchant fees, you gain insight into the expenses incurred when leveraging the platform’s payment processing capabilities. This understanding is pivotal for effectively managing your business’s financial resources and optimizing your revenue streams.

Moreover, comprehending QuickBooks merchant fees enables you to make informed decisions when choosing payment processing methods for your business. Whether you’re evaluating the cost-effectiveness of credit card transactions, assessing the impact of different payment channels on your bottom line, or comparing QuickBooks fees with those of other payment processors, a solid understanding of merchant fees empowers you to navigate the financial landscape with confidence and clarity.

As we journey deeper into the realm of QuickBooks merchant fees, we’ll unravel the intricacies of the fee structure, explore additional charges, and equip you with valuable insights for effectively managing these expenses. By gaining a comprehensive understanding of QuickBooks merchant fees, you’ll be well-equipped to make strategic financial decisions that align with your business objectives and contribute to long-term success.

QuickBooks Merchant Fee Structure

Now that we’ve established the importance of comprehending QuickBooks merchant fees, let’s delve into the specific structure of these fees. QuickBooks employs a transparent and straightforward fee structure, designed to provide clarity and predictability for businesses leveraging its payment processing services. The primary components of QuickBooks merchant fees typically include transaction fees, processing rates, and subscription costs, each playing a distinct role in shaping the overall expense of processing payments through the platform.

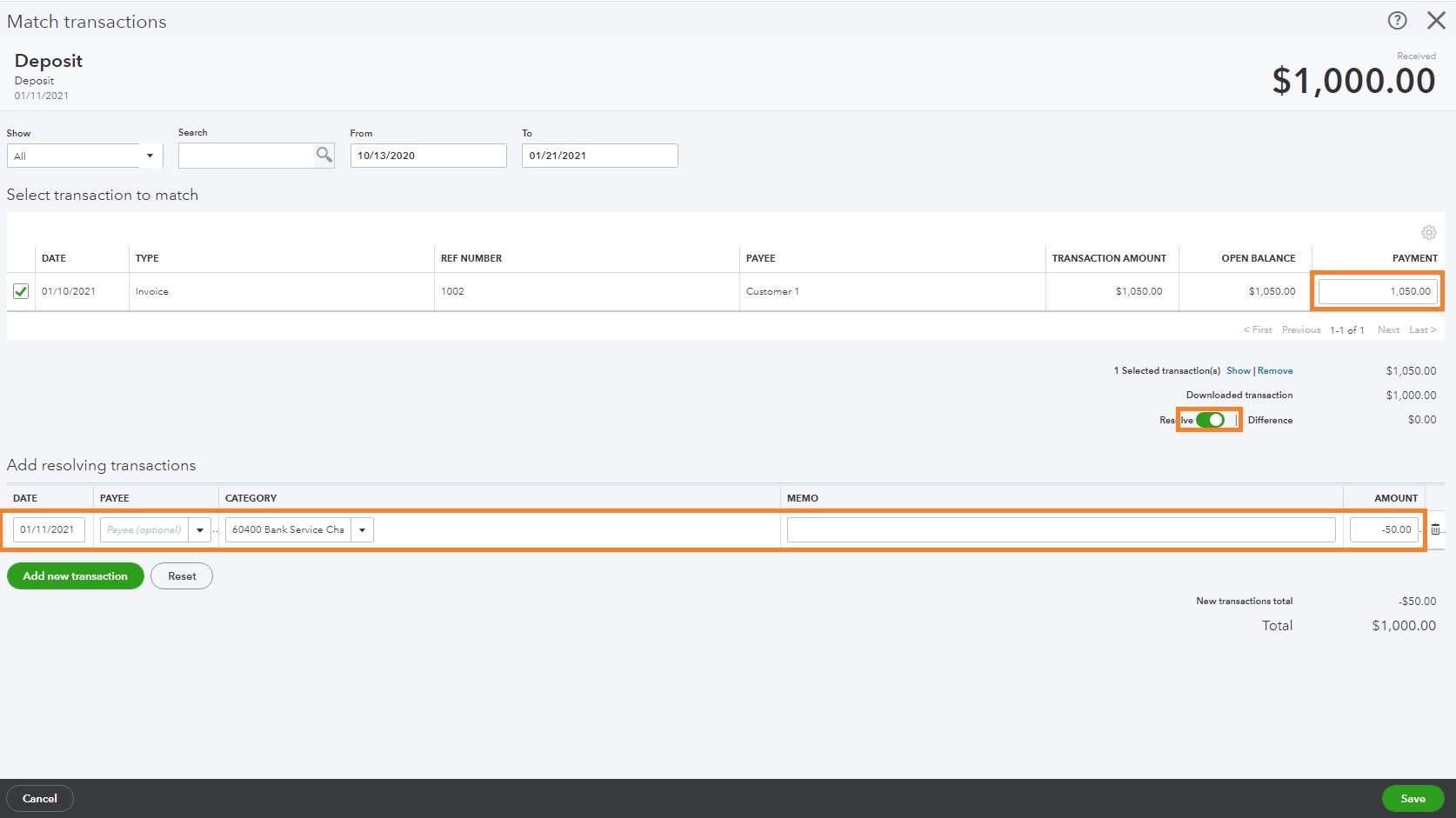

Transaction fees are a fundamental aspect of QuickBooks merchant fees, encompassing the charges incurred for each individual transaction processed through the platform. These fees are often calculated as a percentage of the transaction amount, accompanied by a flat fee for each transaction. Additionally, processing rates, which may vary based on the payment method used (e.g., credit card, bank transfer), contribute to the overall merchant fees. Understanding the nuances of transaction fees and processing rates is essential for accurately estimating the cost of accepting different forms of payment through QuickBooks.

Furthermore, QuickBooks subscription costs are an integral part of the fee structure, as they encompass the regular fees associated with accessing and utilizing the platform’s payment processing features. These subscription costs may vary based on the specific plan or package chosen, with each tier offering distinct features and pricing. By comprehending the interplay between transaction fees, processing rates, and subscription costs, businesses can gain clarity regarding the financial implications of integrating QuickBooks payment processing into their operations.

It’s important to note that while QuickBooks strives to maintain a transparent fee structure, businesses should carefully review and compare the details of different pricing plans to align the platform’s offerings with their unique operational needs and financial objectives. By gaining a comprehensive understanding of the fee structure, businesses can make informed decisions regarding payment processing methods, optimize their cost-effectiveness, and streamline their financial operations within the QuickBooks ecosystem.

Additional Fees and Charges

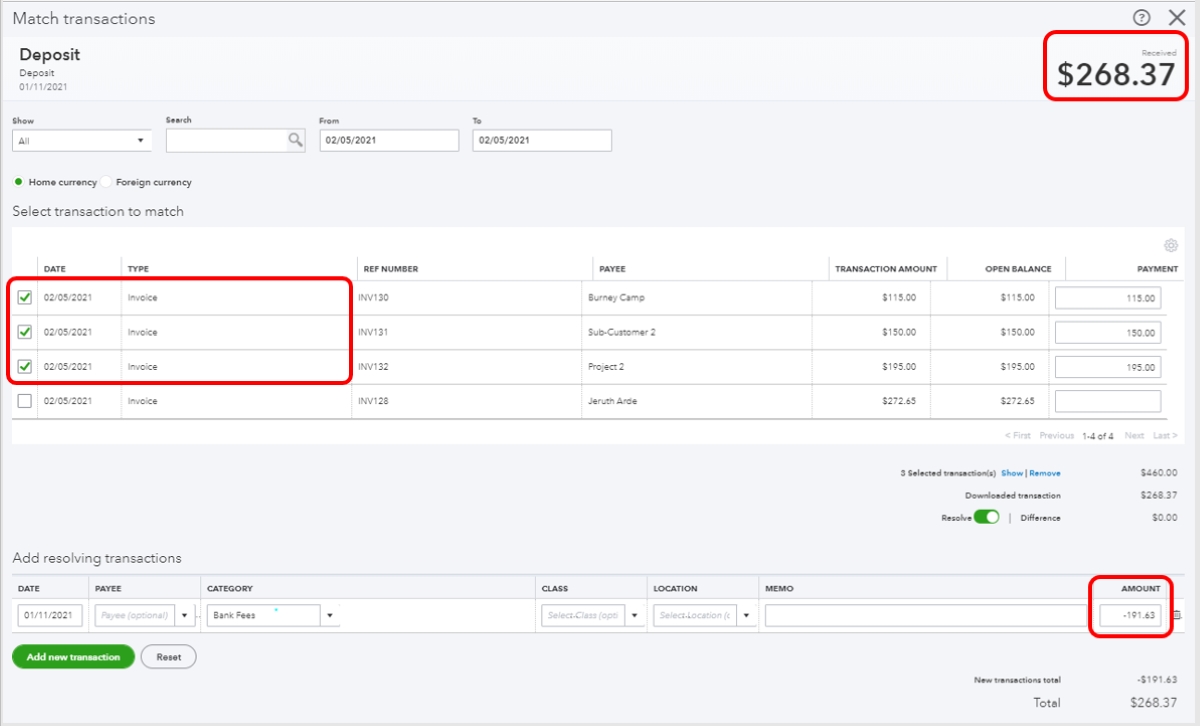

Beyond the core components of QuickBooks merchant fees, businesses should be mindful of additional fees and charges that may impact their overall expenses when utilizing the platform’s payment processing services. These supplementary costs, while not always immediately apparent, can significantly influence the total expenditure associated with processing payments through QuickBooks. By understanding and accounting for these additional fees, businesses can effectively manage their financial resources and optimize the cost-efficiency of leveraging QuickBooks for payment processing.

One notable additional charge is the chargeback fee, which may be incurred when a customer disputes a transaction and initiates a chargeback through their financial institution. QuickBooks may impose a fee for processing and managing chargebacks, reflecting the administrative and operational costs associated with resolving these disputes. It’s essential for businesses to comprehend the implications of chargeback fees and implement strategies to minimize the occurrence of chargebacks, thereby mitigating these additional expenses.

Moreover, businesses utilizing QuickBooks for online payments should be aware of potential fees related to ACH bank transfers, especially for expedited or same-day transfers. While standard bank transfers may incur minimal or no fees, expedited transfers often involve additional charges to expedite the processing and delivery of funds. Understanding the fee structure for ACH bank transfers enables businesses to make informed decisions regarding the timing and cost-effectiveness of utilizing this payment method through QuickBooks.

Furthermore, businesses operating in specific industries or processing high volumes of transactions should consider the potential impact of PCI compliance fees. Payment Card Industry Data Security Standard (PCI DSS) compliance is essential for safeguarding sensitive payment data and maintaining secure transaction processing. QuickBooks may impose PCI compliance fees to support the implementation and maintenance of robust security measures, ensuring the protection of both businesses and their customers. By accounting for PCI compliance fees, businesses can prioritize data security and regulatory adherence while managing their overall payment processing costs.

By comprehensively understanding and proactively managing these additional fees and charges, businesses can optimize the cost-effectiveness of leveraging QuickBooks for payment processing, aligning their financial strategies with long-term sustainability and growth objectives.

Comparing QuickBooks Merchant Fees with Other Providers

When evaluating the cost-effectiveness of payment processing solutions, comparing QuickBooks merchant fees with those of other providers is a strategic approach to optimizing financial efficiency. Different payment processors and merchant service providers offer varying fee structures, transaction rates, and subscription costs, making it essential for businesses to assess the competitive landscape and identify the most advantageous solution for their specific needs.

QuickBooks distinguishes itself by offering transparent and predictable merchant fees, enabling businesses to accurately estimate their payment processing expenses. However, comparing QuickBooks merchant fees with those of alternative providers allows businesses to gain a comprehensive understanding of the competitive pricing landscape and make informed decisions regarding their payment processing strategies.

One key aspect of comparing merchant fees involves assessing the transaction rates and processing fees offered by different providers. While QuickBooks may feature competitive transaction fees for credit card payments and bank transfers, businesses can leverage comparative analysis to identify providers offering lower rates or more favorable fee structures, potentially reducing their overall payment processing costs.

Additionally, businesses should consider the subscription costs and additional fees associated with alternative payment processors. By evaluating the comprehensive expense profiles of different providers, businesses can identify the most cost-effective solution that aligns with their operational requirements and financial objectives. Factors such as chargeback fees, ACH transfer charges, and PCI compliance fees should be carefully compared across different providers to ensure a holistic assessment of payment processing expenses.

Furthermore, businesses should assess the value-added features and capabilities offered by various payment processors in relation to their fee structures. While competitive merchant fees are important, the overall value derived from a payment processing solution, including integration capabilities, reporting tools, and customer support, should be factored into the comparative analysis. By evaluating the combination of fees and features, businesses can identify the optimal payment processing provider that delivers both cost-effectiveness and operational benefits.

Ultimately, comparing QuickBooks merchant fees with those of other providers empowers businesses to make informed decisions that optimize their payment processing costs while aligning with their broader financial and operational objectives.

Tips for Managing QuickBooks Merchant Fees

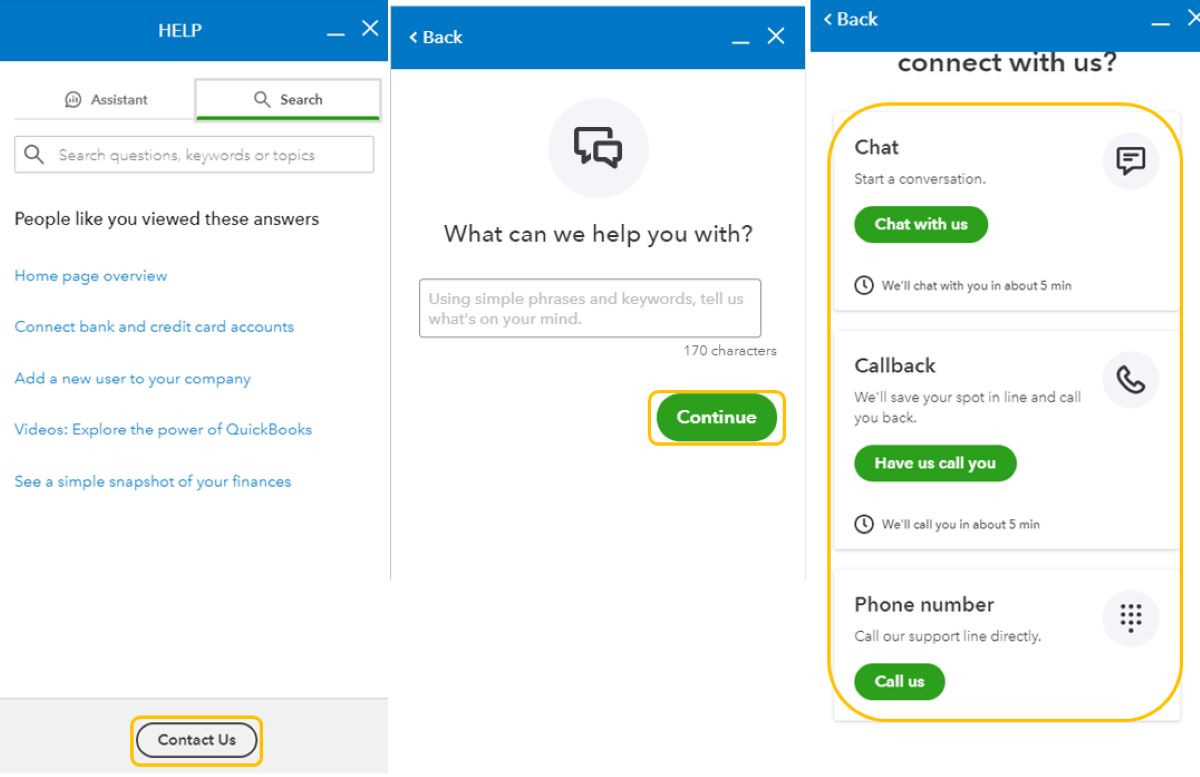

Effectively managing QuickBooks merchant fees is essential for optimizing your business’s financial efficiency and maximizing the value derived from the platform’s payment processing services. By implementing strategic practices and leveraging the available tools and resources, businesses can proactively control and minimize their merchant fees while streamlining their payment processing operations. Here are valuable tips for managing QuickBooks merchant fees:

- Regularly Review Fee Structures: Stay informed about the latest updates to QuickBooks merchant fees and subscription costs. Periodically reviewing the fee structure enables you to assess the financial impact of payment processing and identify opportunities to optimize your cost-effectiveness.

- Optimize Payment Methods: Evaluate the transaction fees and processing rates associated with different payment methods, such as credit card transactions and bank transfers. By strategically promoting cost-effective payment methods, you can minimize the impact of transaction fees on your overall expenses.

- Implement Fraud Prevention Measures: Mitigate the risk of chargebacks and associated fees by implementing robust fraud prevention measures. Utilize security features and verification protocols to safeguard transactions, reducing the occurrence of disputed charges and chargeback fees.

- Utilize Reporting and Analytics: Leverage QuickBooks reporting and analytics tools to gain insights into your payment processing activities. By analyzing transaction data and identifying trends, you can make informed decisions to optimize your payment processing strategies and minimize unnecessary fees.

- Stay PCI Compliant: Adhere to Payment Card Industry Data Security Standard (PCI DSS) requirements to maintain a secure payment environment. By prioritizing PCI compliance, you can minimize the risk of security breaches and associated compliance fees, contributing to long-term cost savings.

- Explore Discount Opportunities: Investigate potential discounts or promotional offers provided by QuickBooks or payment processors for specific transaction volumes or payment methods. Capitalize on available discounts to reduce your overall merchant fees without compromising the quality of service.

- Opt for Integrated Solutions: Integrate your payment processing activities with other QuickBooks features, such as invoicing and accounting, to streamline operations and minimize administrative costs. Integrated solutions can enhance efficiency while optimizing the value derived from your payment processing investment.

By implementing these proactive strategies and leveraging the capabilities of QuickBooks, businesses can effectively manage their merchant fees, optimize their payment processing costs, and strategically allocate financial resources to drive sustainable growth and success.

Conclusion

As we conclude our exploration of QuickBooks merchant fees, it’s evident that understanding and managing these expenses is integral to the financial well-being of businesses leveraging the platform for payment processing. QuickBooks offers a transparent fee structure, encompassing transaction fees, processing rates, and subscription costs, providing businesses with clarity and predictability regarding their payment processing expenses. By comprehensively understanding the fee structure and accounting for additional charges such as chargeback fees, ACH transfer costs, and PCI compliance fees, businesses can proactively manage their merchant fees and optimize their cost-effectiveness.

Comparing QuickBooks merchant fees with those of other providers enables businesses to make informed decisions regarding their payment processing strategies, identifying the most advantageous solution that aligns with their operational requirements and financial objectives. By evaluating transaction rates, subscription costs, and value-added features across different providers, businesses can optimize their payment processing costs while maximizing the overall value derived from their chosen solution.

Moreover, implementing strategic practices for managing QuickBooks merchant fees, such as optimizing payment methods, implementing fraud prevention measures, and leveraging reporting and analytics, empowers businesses to proactively control and minimize their payment processing expenses. By staying informed about fee structures, exploring discount opportunities, and opting for integrated solutions, businesses can streamline their operations and allocate financial resources strategically, contributing to sustainable growth and success.

Ultimately, navigating the realm of QuickBooks merchant fees requires a proactive and informed approach, leveraging the available tools, resources, and insights to optimize financial efficiency and maximize the value derived from payment processing. By embracing transparency, strategic management, and a commitment to cost-effectiveness, businesses can harness the full potential of QuickBooks as a seamless and reliable platform for managing their payment processing needs, driving financial stability and growth in the dynamic business landscape.