Finance

How To Start A Savings And Loans Company

Published: January 16, 2024

Learn how to start your own finance company specializing in savings and loans. Discover the essential steps and strategies to ensure success in the competitive financial industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Concept of Savings and Loans Companies

- Conducting Market Research and Analysis

- Developing a Business Plan

- Legal and Regulatory Requirements

- Financing Options for Starting a Savings and Loans Company

- Setting Up Operational Infrastructure

- Hiring and Training Staff

- Marketing and Advertising Strategies

- Managing Risk and Compliance

- Providing Excellent Customer Service

- Monitoring and Evaluating Performance

- Conclusion

Introduction

Welcome to the exciting world of savings and loans companies! If you’re interested in starting your own financial institution and helping individuals and businesses build their financial future, then starting a savings and loans company might be the perfect venture for you.

A savings and loans company, also known as a thrift institution, is a type of financial institution that specializes in accepting savings deposits from customers and providing loans to individuals and businesses. These institutions play a crucial role in the financial sector by promoting savings, providing access to credit, and contributing to the overall economic growth.

Starting a savings and loans company requires careful planning, extensive knowledge of the finance industry, and a solid understanding of regulatory requirements. This article will guide you through the process of establishing your own savings and loans company, from conducting market research to providing excellent customer service.

It’s important to note that starting a savings and loans company can be a complex and highly regulated process. It requires a substantial investment of time, resources, and capital. However, with the right approach and diligent execution, it can also be a rewarding and profitable venture.

In the sections to follow, we will delve into the various aspects of starting a savings and loans company, including how to conduct market research, develop a comprehensive business plan, navigate legal and regulatory requirements, secure financing, set up operational infrastructure, hire and train staff, implement effective marketing strategies, manage risk and compliance, and provide excellent customer service.

By the end of this guide, you will have a solid foundation and actionable insights to embark on your journey of starting a successful savings and loans company. So, let’s get started!

Understanding the Concept of Savings and Loans Companies

Savings and loans companies, also known as thrift institutions or thrifts, are financial institutions that serve the dual purpose of accepting deposits from customers and providing loans to individuals and businesses. These institutions act as intermediaries between savers and borrowers, facilitating the flow of funds in the economy.

One of the primary functions of savings and loans companies is to encourage savings. They offer various types of deposit accounts, such as savings accounts, certificates of deposit (CDs), and money market accounts. These accounts allow individuals and businesses to deposit their surplus funds and earn interest on their savings over time.

Another crucial role of savings and loans companies is to provide loans to individuals and businesses who require financing. These loans can be used for various purposes, such as home mortgages, personal loans, business investments, or educational expenses. By providing access to credit, savings and loans companies support economic growth and development.

Savings and loans companies differ from other financial institutions, such as commercial banks, in their focus and business model. While commercial banks engage in a wide range of financial activities, including investment banking and wealth management, thrift institutions primarily focus on promoting savings and providing affordable loans.

Historically, savings and loans companies were heavily regulated and restricted to serving a specific geographic area or community. However, regulatory changes over the years have allowed these institutions to expand their operations and offer a broader range of financial products and services.

Today, savings and loans companies continue to play a vital role in the financial sector, particularly in supporting individuals and small businesses that may have limited access to banking services. These institutions operate on the principles of prudence, community-focused lending, and providing personalized customer service.

When starting a savings and loans company, it’s important to have a deep understanding of the financial industry, including the different types of loans, interest rates, risk management, and regulatory frameworks. This knowledge will help you effectively manage the operations of your savings and loans company and serve the needs of your customers.

In the next section, we will explore the critical steps involved in conducting market research and analysis to identify opportunities and potential challenges for your savings and loans company.

Conducting Market Research and Analysis

Market research and analysis are essential steps in starting a savings and loans company. It involves gathering information about the target market, understanding customer needs and preferences, identifying potential competitors, and evaluating market trends and opportunities. This research is crucial for developing a comprehensive business plan and making informed decisions about your company’s positioning and strategy.

The first step in market research is to define your target market. Determine the demographic characteristics of your ideal customers, such as age, income level, occupation, and location. Understand their financial needs, goals, and preferences. This will help you tailor your products and services to meet their specific requirements.

Next, gather information about the size and potential growth of the market. Analyze the local and national economic conditions, as well as any regulatory changes that may impact the industry. This analysis will help you assess the demand for your services and identify any potential barriers to entry.

Identify your competitors and analyze their strengths and weaknesses. Study their product offerings, interest rates, fees, and customer service. Identify any gaps in the market that you can capitalize on or areas where you can differentiate your savings and loans company to attract customers.

Additionally, conduct surveys and interviews with potential customers to gather insights into their financial needs and preferences. Understand their perception of savings and loans companies and identify any pain points or areas for improvement. This information will help you refine your business model and develop targeted marketing strategies.

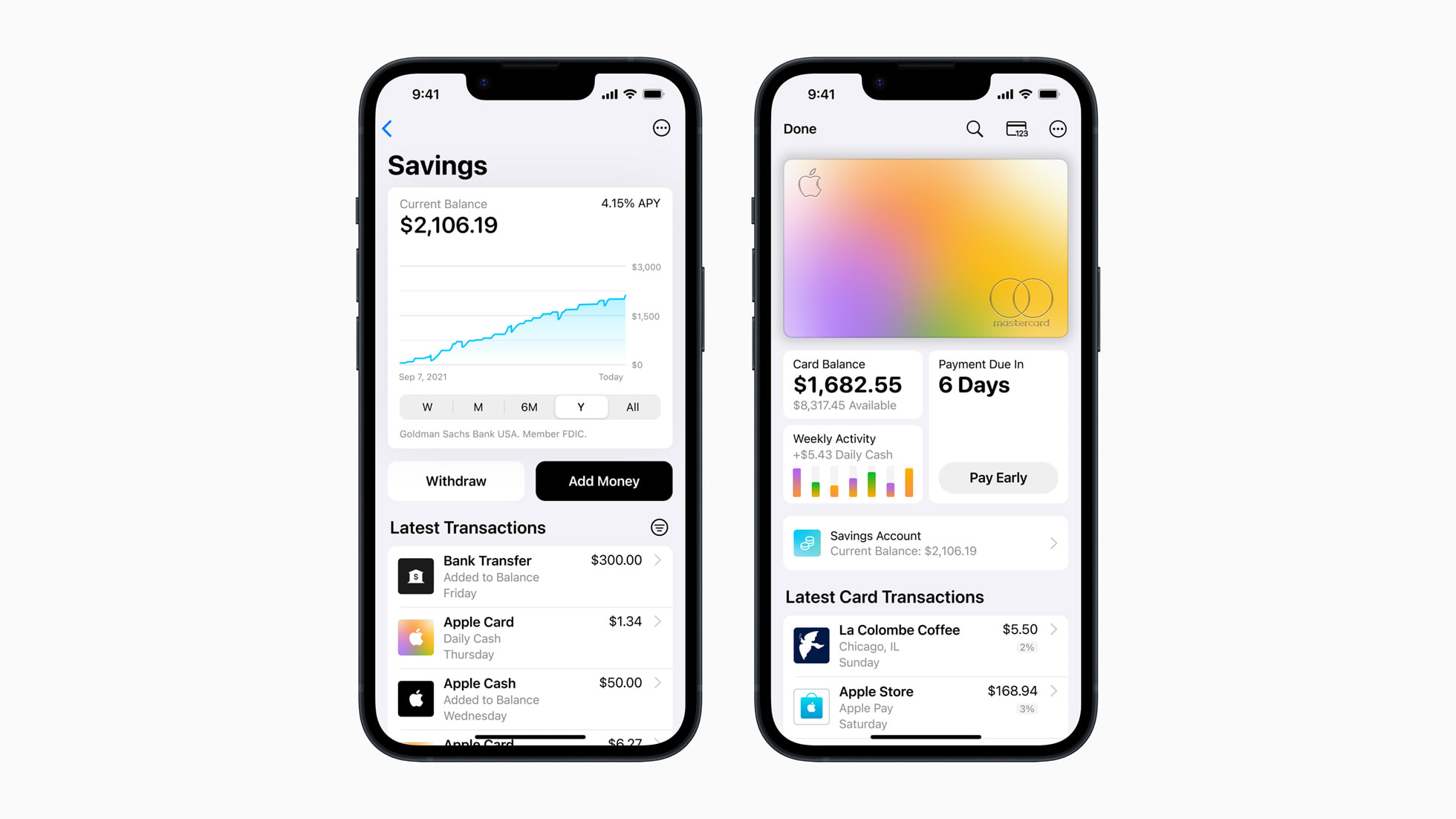

When conducting market research, also consider the technological landscape and digital trends. Assess the viability of online and mobile banking services, as well as the potential demand for digital payment solutions. This will help you stay ahead of the competition and meet the evolving needs of customers in the digital age.

Finally, analyze the financial viability of your savings and loans company. Estimate the potential revenue and expenses, taking into account factors such as interest income, loan defaults, operating costs, and regulatory compliance. This analysis will help you determine the appropriate pricing strategies and set realistic financial goals for your company.

By conducting thorough market research and analysis, you will gain valuable insights into the industry and your target market. This will enable you to make informed decisions, develop a solid business plan, and position your savings and loans company for success in a competitive market.

In the next section, we will explore the crucial steps involved in developing a comprehensive business plan for your savings and loans company.

Developing a Business Plan

A well-developed business plan is a crucial tool for starting a savings and loans company. It serves as a roadmap for your venture, outlining your goals, strategies, and plans for success. A comprehensive business plan not only helps you attract investors and secure financing but also provides a solid foundation for managing and growing your company.

The first step in developing a business plan is to clearly define your company’s mission and vision. Identify the purpose of your savings and loans company, the values it stands for, and the unique value proposition you will offer to customers. This will guide all your future decisions and activities.

Next, conduct a thorough assessment of the market and competitive landscape, building upon the market research conducted earlier. Identify your target market, customer segments, and key competitors. Evaluate their strengths and weaknesses and identify opportunities and threats in the market. This analysis will enable you to create effective strategies for differentiation and customer acquisition.

Outline your product and service offerings, detailing the types of accounts you will offer (such as savings accounts, certificates of deposit, and money market accounts) and the loans you will provide (such as mortgage loans, personal loans, and business loans). Specify the features, benefits, and terms of each product or service to demonstrate their value to customers.

Develop a marketing and sales strategy to attract and retain customers. Identify your target audience and outline your branding, advertising, and promotional activities. Consider leveraging digital channels such as social media, online marketing, and search engine optimization to reach a broader audience and increase your visibility.

Outline your organizational structure and management team. Specify the roles and responsibilities of key personnel and highlight their relevant experience and qualifications. Investors and lenders will be interested in the expertise and capabilities of your team in managing a savings and loans company.

Financial projections are a critical component of a business plan. Create a detailed forecast of your revenue, expenses, and cash flow over the next three to five years. Include assumptions, such as interest rates, loan defaults, and market conditions, to support your projections. This will demonstrate the financial viability and potential profitability of your savings and loans company.

Finally, outline your risk management and compliance strategies. Identify potential risks, such as credit risk, interest rate risk, and regulatory compliance. Detail how you will mitigate these risks and ensure compliance with applicable laws and regulations. This will instill confidence in investors and lenders that you have considered and prepared for potential challenges.

A well-developed business plan provides a clear roadmap for starting and growing your savings and loans company. It demonstrates your understanding of the market, outlines your strategies for differentiation and success, and instills confidence in your potential investors and lenders.

In the next section, we will explore the legal and regulatory requirements involved in starting a savings and loans company.

Legal and Regulatory Requirements

Starting a savings and loans company involves complying with various legal and regulatory requirements to ensure the integrity, stability, and transparency of your operations. These requirements are designed to protect depositors, borrowers, and the overall financial system. It is crucial to understand and adhere to these regulations to establish a legally compliant savings and loans company.

The first step is to determine the legal structure of your savings and loans company. Options include sole proprietorship, partnership, corporation, or limited liability company (LLC). Each structure has its own legal implications, including liability, taxation, and governance. Consult with an attorney or business advisor to choose the most appropriate structure for your company.

Obtaining the necessary licenses and permits is a critical step in starting a savings and loans company. Requirements vary by jurisdiction, so research the specific licensing regulations in your location. Generally, you will need to apply for a banking license from the relevant regulatory authority, such as the Office of the Comptroller of the Currency (OCC) or the state banking department.

As part of the licensing process, you will be required to provide detailed information about your company, including its organizational structure, business plan, financial projections, capital requirements, and compliance policies and procedures. The regulatory authority will review your application and assess your suitability to operate a savings and loans company.

Compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations is essential to prevent money laundering, terrorist financing, and other illicit activities. Develop robust AML and KYC policies and procedures to screen customers, monitor transactions, and report suspicious activities to the appropriate authorities.

Your savings and loans company will also need to comply with consumer protection laws and regulations. These laws govern fair lending practices, truth in lending disclosures, and privacy protections for customer information. Implement policies and procedures to ensure compliance with these regulations and protect the rights and interests of your customers.

It’s important to note that regulatory requirements may also include maintaining a minimum capital level, conducting regular audits and examinations, filing financial reports, and providing adequate disclosures to customers. Stay updated on any changes in regulations and ensure ongoing compliance to avoid penalties and sanctions.

Engaging the services of legal and compliance professionals is highly recommended to navigate the complex legal and regulatory landscape. They can provide expert guidance on fulfilling requirements, developing compliance frameworks, and staying current with regulatory changes.

By understanding and adhering to the legal and regulatory requirements, you can establish a trusted and compliant savings and loans company. This will assure customers, investors, and regulators of the integrity and stability of your operations, enhancing your reputation and long-term viability in the industry.

In the next section, we will explore financing options for starting a savings and loans company.

Financing Options for Starting a Savings and Loans Company

Starting a savings and loans company requires a significant investment of capital to meet regulatory requirements, establish operations, and ensure sufficient liquidity. There are various financing options available to entrepreneurs looking to fund their savings and loans company. Each option has its own advantages and considerations, so it’s important to carefully evaluate and choose the most appropriate financing solution.

The first source of financing to consider is personal savings or investments. Using your own funds or investments from friends and family can be a viable option to kickstart your savings and loans company. This can demonstrate your commitment and confidence in the venture, making it more attractive to potential lenders or investors.

Traditional bank loans are another common financing option. Approach banks and financial institutions that specialize in business loans and have experience in the banking industry. Prepare a comprehensive business plan, financial projections, and any required documentation to support your loan application. Make sure to shop around and compare offers to secure the most favorable terms and interest rates.

If obtaining a bank loan proves challenging due to strict lending criteria or lack of collateral, you may consider alternative financing options. Crowdfunding platforms, such as Kickstarter or GoFundMe, can be utilized to raise funds from a large pool of individuals who believe in your business idea. Peer-to-peer lending platforms connect borrowers directly with individual lenders, bypassing traditional banks.

Another financing option is to seek strategic partnerships or joint ventures with established financial institutions. This can provide not only the necessary capital but also expertise and credibility. Explore potential partnerships with banks, credit unions, or other non-banking financial institutions that align with your values and objectives.

For those looking to attract capital from multiple investors, seeking venture capital or angel investors may be a viable option. These investors are typically interested in high-growth business opportunities and can provide not only funding but also valuable industry connections and guidance. Prepare a compelling pitch deck and business plan to attract potential investors and demonstrate the potential of your savings and loans company.

Additionally, consider exploring government programs and grants available to support small business growth and entrepreneurship. Research funding options specific to financial institutions or consult with local government agencies or business development centers in your area for guidance and assistance.

Before pursuing any financing option, it is essential to carefully analyze the costs associated with the funding, such as interest rates, repayment terms, and potential dilution of ownership. Conduct a thorough financial analysis to ensure that your savings and loans company can generate sufficient revenue and cash flow to meet repayment obligations and grow sustainably.

Remember, securing financing for starting a savings and loans company may require a combination of different sources, and it is crucial to have a solid business plan and financial projections to instill confidence in potential investors or lenders.

In the next section, we will explore the steps involved in setting up the operational infrastructure for your savings and loans company.

Setting Up Operational Infrastructure

Setting up the operational infrastructure for your savings and loans company is a critical step in establishing a strong foundation for your business. This infrastructure includes the physical and technological resources, systems, and processes needed to effectively and efficiently operate your financial institution.

The first aspect to consider is the physical location of your savings and loans company. Choose a suitable location that is easily accessible for customers and meets regulatory requirements. Consider factors such as proximity to potential customers, visibility, parking facilities, and the availability of necessary amenities.

Next, invest in the necessary technology infrastructure to support your operations. Implement robust core banking software or financial management systems to manage customer accounts, transactions, and loans. This software should have features such as customer relationship management (CRM), online banking capabilities, and compliance tools to streamline operations and enhance customer service.

Establish effective data security measures to protect sensitive customer information and comply with regulatory requirements. Implement firewalls, encryption, and secure authentication systems to safeguard customer data from unauthorized access or malicious activities. Regularly update and monitor these systems to stay ahead of emerging threats.

Develop efficient operational processes and workflows to ensure smooth and timely execution of various banking activities. This includes account opening, loan processing, funds transfers, and customer service. Standardize procedures and implement checklists or automation tools to minimize errors and enhance productivity.

Invest in a reliable and responsive customer service infrastructure. This can include trained customer service representatives, dedicated phone lines or helplines, email support, and online chat features. Providing excellent customer service is crucial in building trust and loyalty with customers and differentiating your savings and loans company from competitors.

Implement strong risk management practices to mitigate potential risks and uncertainties. Develop risk assessment frameworks and procedures to evaluate creditworthiness, monitor loan portfolios, and identify any potential red flags. Regularly review and update risk management policies to adapt to changing market conditions and regulatory requirements.

Ensure that you have sufficient physical and human resources to support the operational needs of your savings and loans company. This includes hiring and training competent staff who have knowledge of banking processes, compliance requirements, and customer service skills. Consider outsourcing certain functions, such as IT support or auditing, if it makes financial and operational sense.

Procure the necessary equipment and furniture to support day-to-day operations, such as computers, printers, security cameras, vaults, and office furniture. Adhere to security standards and implement appropriate measures to safeguard physical assets.

Finally, establish strong internal controls and governance mechanisms to ensure operational efficiency, compliance with regulations, and accountability. Implement regular audits, internal control reviews, and reporting mechanisms to assess the effectiveness of your operational infrastructure and identify areas for improvement.

By setting up a robust operational infrastructure, you can create a solid foundation for your savings and loans company. This will help streamline operations, ensure regulatory compliance, provide excellent customer service, and position your institution for long-term success in the financial industry.

In the next section, we will explore the crucial steps involved in hiring and training staff for your savings and loans company.

Hiring and Training Staff

The success of a savings and loans company greatly depends on having a competent and dedicated team. Hiring and training staff is a crucial step in building a capable workforce that will drive your company’s growth and provide excellent service to customers.

Start by defining the roles and responsibilities required for your savings and loans company. Determine the key positions such as loan officers, tellers, customer service representatives, compliance officers, and administrative staff. Identify the skills, qualifications, and experience necessary for each role.

Advertise job openings through various channels, such as online job boards, professional networks, and local recruitment agencies. Screen resumes and conduct interviews to assess candidates’ qualifications, experience, and cultural fit within your organization. Consider conducting both technical and behavioral interviews to evaluate their competency and compatibility.

During the recruitment process, prioritize candidates with a background in finance or banking. Look for employees who possess strong analytical skills, attention to detail, and the ability to handle financial transactions accurately. In addition, seek candidates with excellent communication and customer service skills, as they will be the face of your company.

As you build your team, focus on creating a diverse and inclusive workforce. Embrace diversity in terms of education, experience, age, and background. A diverse team can bring a wide range of perspectives and contribute to innovative solutions, fostering a positive and inclusive work environment.

Once you have hired the right individuals, invest in their training and development. Develop a comprehensive training program that covers the necessary skills and knowledge required for their roles. Provide training on banking regulations, customer service protocols, loan processing, risk management, and compliance procedures.

Consider partnering with professional training organizations or consulting firms specializing in the financial industry to design and deliver customized training programs. This can ensure that your staff receives up-to-date and industry-relevant training that aligns with best practices and regulatory requirements.

In addition to formal training, encourage ongoing professional development. Provide opportunities for staff to attend industry conferences, seminars, and workshops that enhance their knowledge and skills. Support employees in obtaining relevant certifications, such as Certified Banker (CB) or Certified Fraud Examiner (CFE), to further their professional growth and demonstrate their expertise.

Continuous training and performance appraisal are essential for maintaining a high standard of service and adherence to regulations. Conduct regular performance evaluations to assess employees’ performance, identify areas for improvement, and provide constructive feedback. Offer opportunities for career advancement and acknowledge exceptional performance through rewards and recognition programs.

Building a strong and motivated team requires effective leadership. As the leader of your savings and loans company, foster a positive work culture that emphasizes teamwork, integrity, and a commitment to excellence. Lead by example and create an environment where employees feel valued, empowered, and motivated to contribute to the success of the company.

By hiring the right individuals, providing comprehensive training, and fostering a positive work environment, you can build a skilled and dedicated team that will drive the growth and success of your savings and loans company.

In the next section, we will explore effective marketing and advertising strategies to promote your savings and loans company.

Marketing and Advertising Strategies

Implementing effective marketing and advertising strategies is essential for promoting your savings and loans company and attracting customers. These strategies will help raise awareness about your brand, differentiate your services, and drive customer acquisition. Here are some key strategies to consider:

Define Your Target Audience: Clearly identify your target market and tailor your marketing efforts to their specific needs and preferences. Understand their financial goals, demographics, and preferred communication channels. This will enable you to create targeted marketing messages that resonate with your audience.

Build a Strong Brand: Develop a compelling brand identity that reflects the values and unique selling proposition of your savings and loans company. Create a distinctive logo, design consistent visuals, and craft a compelling brand message. Consistently portray your brand across all marketing channels to build trust and recognition.

Utilize Digital Marketing: Leverage digital channels to reach and engage with your target audience. Set up a professional website that provides information about your services, features customer testimonials, and highlights your competitive advantages. Implement Search Engine Optimization (SEO) techniques to improve your website’s visibility in search engine results.

Engage in Content Marketing: Create valuable and informative content that educates and engages your target audience. Develop blog posts, articles, and videos that provide insights into personal finance, tips for saving, and other relevant topics. Share this content through your website, social media platforms, and email newsletters to position your company as an industry authority.

Utilize Social Media: Establish a strong presence on social media platforms such as Facebook, Twitter, Linkedin, and Instagram. Engage with your audience by sharing helpful financial tips, news, and updates about your company. Respond promptly to customer inquiries and comments to build trust and foster positive relationships.

Implement Referral Programs: Encourage your existing customers to refer their friends, family, and colleagues to your savings and loans company. Offer incentives such as referral bonuses or discounted rates for successful referrals. Word-of-mouth recommendations can be a powerful and cost-effective way to attract new customers.

Participate in Community Events: Get involved in local community events and sponsor relevant initiatives. This helps to establish your company as an active participant in community development and builds trust among potential customers. Support financial literacy programs or host educational seminars to demonstrate your commitment to customer empowerment.

Monitor and Analyze Results: Regularly monitor the performance of your marketing and advertising strategies. Use analytics tools to track website traffic, social media engagement, and conversions. Evaluate which strategies are generating the best results and adjust your marketing efforts accordingly. Continuously refine your marketing approach to optimize your return on investment.

Comply with Advertising Laws and Regulations: Ensure that your marketing and advertising efforts comply with relevant laws and regulations. Stay up-to-date with advertising standards, consumer protection laws, and financial industry regulations. Avoid making false or misleading claims and focus on providing transparent and accurate information to your customers.

By implementing these marketing and advertising strategies, you can effectively promote your savings and loans company, attract new customers, and build a strong and loyal customer base. Keep in mind that consistency, creativity, and ongoing evaluation are key to achieving long-term marketing success.

In the next section, we will explore the importance of managing risk and compliance in your savings and loans company.

Managing Risk and Compliance

Managing risk and compliance is of utmost importance in the operations of a savings and loans company. By effectively managing risk and complying with regulatory requirements, you can ensure the stability and integrity of your financial institution. Here are key considerations for managing risk and compliance:

Identify and Assess Risks: Conduct a comprehensive risk assessment to identify potential risks that could impact your savings and loans company. This includes credit risk, interest rate risk, liquidity risk, operational risk, and compliance risk. Evaluate the likelihood and potential impact of each risk and develop strategies to mitigate and manage them effectively.

Develop Risk Management Policies and Procedures: Establish robust risk management policies and procedures to guide your operations. Clearly define risk appetite and establish risk limits for various aspects of your business activities. Implement controls, monitoring systems, and reporting mechanisms to ensure risks are properly identified, assessed, and managed.

Comply with Regulatory Requirements: Stay updated on relevant laws and regulations governing the financial sector. Ensure that your savings and loans company adheres to these requirements in terms of lending practices, customer privacy, interest rate disclosures, fair lending, and other applicable regulations. Regularly review and update compliance policies and procedures to meet evolving regulatory standards.

Implement Effective Internal Controls: Establish a strong system of internal controls to safeguard your company’s assets, prevent fraud or unauthorized activities, and ensure accurate financial reporting. Segregate duties, conduct regular internal audits, and implement checks and balances to maintain the integrity of your operations.

Monitor and Manage Non-Performing Loans: Develop strategies to effectively manage non-performing loans and mitigate potential losses. Implement loan monitoring systems to identify early signs of delinquency, establish recovery procedures, and work closely with borrowers to minimize defaults. Regularly review and update your loan portfolio to assess credit quality and take necessary actions when risks arise.

Establish an Effective Anti-Money Laundering (AML) Program: Implement robust AML procedures to prevent money laundering, terrorist financing, and other illicit activities. Conduct customer due diligence, implement transaction monitoring systems, and report suspicious activities to the appropriate authorities as required by law. Provide regular training to employees to ensure they understand their responsibilities in detecting and preventing financial crimes.

Maintain Adequate Capital and Liquidity: Ensure your savings and loans company maintains sufficient capital and liquidity to meet regulatory requirements and manage unexpected events. Regularly assess your capital adequacy ratios and liquidity positions to ensure your company remains financially stable and able to handle potential risks.

Provide Ongoing Training and Education: Develop a strong culture of risk management and compliance by providing regular training and education to your employees. Ensure they understand their roles and responsibilities in managing risks and complying with regulations. Stay updated on industry best practices and incorporate them into your training programs.

Engage External Auditors and Consultants: Engage external auditors and consultants to conduct periodic audits, assess your risk management framework, and ensure compliance with regulatory requirements. They can provide independent assessment, identify potential weaknesses, and suggest improvements to your risk management and compliance practices.

By actively managing risks and complying with regulations, you can protect the interests of your stakeholders, maintain the trust of your customers, and ensure the long-term success of your savings and loans company.

In the next section, we will explore the crucial aspect of providing excellent customer service to build lasting relationships.

Providing Excellent Customer Service

Providing excellent customer service is essential for the success and growth of your savings and loans company. Exceptional customer service not only enhances customer satisfaction but also builds loyalty, attracts new customers, and enhances your company’s reputation. Here are key strategies to provide excellent customer service:

Understand Customer Needs: Take the time to understand the specific needs and goals of your customers. Listen actively and ask probing questions to gather information about their financial objectives, concerns, and preferences. Use this knowledge to tailor your services and offer personalized solutions.

Offer Clear Communication: Ensure that your communication with customers is clear, transparent, and easily understandable. Explain complex financial concepts in a simplified manner, provide accurate and timely information, and guide customers through the loan application or account opening process step-by-step. Avoid using jargon or technical terms that may confuse or intimidate customers.

Deliver Prompt Service: Respond to customer inquiries and requests promptly. Aim to provide quick turnaround times for loan approvals or account opening processes. Establish service level agreements and communicate realistic timelines to manage customer expectations. Keep customers informed about the progress of their requests to avoid unnecessary frustration or anxiety.

Maintain a Friendly and Professional Attitude: Develop a positive and welcoming atmosphere in all customer interactions. Respect and empathize with your customers’ concerns and make them feel valued. Train your staff to have a friendly and professional attitude, ensuring that they are courteous, patient, and attentive to customer needs. Encourage staff to go the extra mile to exceed customer expectations.

Provide Financial Guidance: Offer personalized financial guidance and advice to help customers make informed financial decisions. Educate them about various saving and investment options, explain loan terms and conditions, and outline the potential benefits and risks associated with different financial products. Empower your customers to make sound financial choices aligned with their goals.

Solve Problems with Empathy: Address customer complaints or issues promptly and with empathy. Train your staff to handle difficult situations effectively and professionally. Actively listen to customer concerns, apologize for any inconvenience caused, and work towards finding a satisfactory resolution. Turn negative experiences into positive ones to build trust and loyalty.

Offer Multiple Communication Channels: Provide various channels for customers to reach out to your savings and loans company. Offer options such as phone, email, social media, and online chat. Monitor these channels regularly and respond promptly to customer inquiries or feedback. Apply a consistent and personalized approach across all communication channels.

Seek Customer Feedback: Regularly seek customer feedback to understand their perception of your services and identify areas for improvement. Conduct customer surveys, engage in social listening, and encourage reviews or testimonials. Use this feedback to refine your processes, address any pain points, and enhance the overall customer experience.

Continuous Staff Training: Invest in ongoing training and development programs for your staff to enhance their customer service skills and knowledge of financial products. Regularly update them on industry trends, regulatory changes, and best practices in customer service. Emphasize the importance of a customer-centric approach and empower your staff to make decisions that prioritize customer satisfaction.

Appreciate and Reward Loyalty: Show appreciation for your customers’ loyalty by offering incentives, rewards, or special offers. Create loyalty programs that provide exclusive benefits and perks to customers who have been with your savings and loans company for a certain period or meet specific criteria. Recognize and reward customers for referring new clients to your company.

By prioritizing excellent customer service, you can build lasting relationships, gain customer trust, and differentiate your savings and loans company from competitors. Happy and satisfied customers become advocates for your brand, helping you attract new customers and achieve long-term success.

In the next section, we will explore the importance of monitoring and evaluating the performance of your savings and loans company.

Monitoring and Evaluating Performance

Monitoring and evaluating the performance of your savings and loans company is crucial for ensuring its success and identifying areas for improvement. By regularly assessing key performance indicators and metrics, you can make informed decisions, optimize operations, and drive growth. Here are key considerations for monitoring and evaluating performance:

Establish Key Performance Indicators (KPIs): Define and track KPIs that align with your business goals and objectives. These can include metrics such as loan portfolio quality, customer satisfaction ratings, loan processing time, profitability ratios, and customer acquisition rates. Choose KPIs that provide meaningful insights into the various aspects of your business performance.

Maintain Accurate Financial Records: Keep thorough and up-to-date financial records to assess the financial health of your savings and loans company. Regularly review balance sheets, income statements, and cash flow statements to track revenue, expenses, and liquidity. Identify any areas of concern, such as increasing loan delinquencies or declining profitability, and take appropriate actions to address them.

Track Customer Satisfaction: Measure customer satisfaction through surveys, feedback forms, or online reviews. Monitor satisfaction levels, identify any recurring issues or customer concerns, and make improvements based on feedback. A high level of customer satisfaction leads to increased loyalty, referrals, and long-term success.

Perform Financial Analysis: Conduct financial analysis to assess the effectiveness of your lending practices and overall financial performance. Analyze metrics such as interest margin, loan loss provisions, return on assets, and liquidity ratios. Compare your performance against industry benchmarks and identify areas for improvement or efficiency gains.

Analyze Loan Portfolio Quality: Regularly assess the quality and risk profile of your loan portfolio. Evaluate metrics such as non-performing loan ratios, loan diversification, and loan loss reserves. Identify any potential credit risks and take proactive measures to address them. Performing stress tests on the loan portfolio can help assess its resilience against adverse economic conditions.

Implement Operational Monitoring: Monitor operational efficiency and effectiveness by measuring metrics such as loan processing time, loan application conversion rates, and employee productivity. Identify bottlenecks or areas of inefficiency and optimize processes to streamline operations. Implement technology solutions or automation where possible to improve efficiency and reduce human error.

Review Regulatory Compliance: Regularly review your savings and loans company’s compliance with regulatory requirements. Assess whether you are adhering to applicable laws, regulations, and reporting obligations. Ensure that compliance policies and procedures are up to date and communicate any changes in regulations to your staff. Mitigate regulatory and legal risks by conducting regular internal audits and assessments.

Embrace Continuous Improvement: Foster a culture of continuous improvement within your savings and loans company. Encourage feedback and ideas from employees at all levels. Implement suggestions for improvements, whether they relate to operations, customer service, or internal processes. Regularly review and update your business plan to align with changing market conditions and opportunities.

Seek External Expertise: Engage external consultants or industry experts to conduct independent assessments of your performance. They can provide insights, benchmark your performance against industry standards, and identify areas for improvement. Their objective perspective can bring new ideas and recommendations to help optimize your savings and loans company’s operations.

Develop Performance Dashboards: Create performance dashboards or reports that consolidate key performance metrics in one place. Regularly review these dashboards to track progress, identify trends, and make data-driven decisions. Share these insights with your team and use them to communicate the overall performance of your savings and loans company to key stakeholders.

By continually monitoring and evaluating performance, you can drive improvements, identify areas for growth, and ensure the long-term success of your savings and loans company. Regular performance assessments help you make informed decisions, optimize operations, and remain competitive in the dynamic financial services industry.

In the next section, we will conclude our comprehensive guide to starting and operating a savings and loans company.

Conclusion

Starting and operating a savings and loans company is an exciting and challenging endeavor that requires careful planning, regulatory compliance, and a customer-centric approach. Throughout this comprehensive guide, we have explored the key steps involved in starting your own financial institution.

We began by understanding the concept of savings and loans companies, their role in the financial sector, and their focus on promoting savings and providing loans. We then delved into the importance of conducting thorough market research and analysis to identify target markets, competitors, and opportunities.

Developing a solid business plan was emphasized as a crucial step, outlining your company’s mission, market strategies, financial projections, and risk management approaches. We discussed the legal and regulatory requirements that need to be met to establish a compliant savings and loans company.

Financing options were explored, including personal funds, bank loans, crowdfunding, and venture capital, as well as the significance of setting up a robust operational infrastructure and hiring and training a skilled team. Effective marketing and advertising strategies were highlighted to promote your savings and loans company, attract customers, and build a strong brand presence.

Managing risk and compliance is crucial and involves identifying and assessing risks, implementing risk management policies, and complying with regulatory requirements such as anti-money laundering and consumer protection laws.

Providing exceptional customer service was emphasized as a key differentiator, involving clear communication, prompt service, financial guidance, problem-solving with empathy, and appreciating customer loyalty. Monitoring and evaluating performance through key performance indicators and financial analysis helps optimize operations, mitigate risks, and drive growth.

By following these steps and incorporating the insights provided throughout this guide, you can lay a solid foundation for your savings and loans company and work towards long-term viability and success in the financial industry.

Remember, the journey of starting and running a savings and loans company is an ongoing process that requires adaptability, continuous learning, and dedication to meeting the evolving needs of customers and the regulatory landscape. Stay informed, aspire for excellence, and provide exceptional financial services to help individuals and businesses secure their financial future.