Finance

How To Start An Investment LLC

Published: October 17, 2023

Learn how to start an investment LLC and take control of your finances with our comprehensive guide. Start building your wealth today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Choose a Name for Your Investment LLC

- Step 2: Conduct a Name Availability Search

- Step 3: Register Your Investment LLC

- Step 4: Draft an Operating Agreement

- Step 5: Obtain an EIN (Employer Identification Number)

- Step 6: Open a Business Bank Account

- Step 7: Obtain Necessary Permits and Licenses

- Step 8: Determine Your Investment Strategy

- Step 9: Start Building Your Investment Portfolio

- Step 10: Develop a Marketing Plan

- Step 11: Consider Hiring Professionals (Accountant, Attorney, etc.)

- Step 12: Set Up an Efficient Record-Keeping System

- Conclusion

Introduction

Welcome to the world of investment! Are you ready to take control of your financial future and start your very own Investment LLC? Setting up an investment LLC can be a rewarding and lucrative venture, allowing you to invest in various assets and generate passive income.

An Investment LLC, or Limited Liability Company, provides numerous advantages for investors. It offers liability protection, flexible management, and tax benefits. By establishing an LLC, you separate your personal assets from your investment activities, safeguarding your wealth and reducing your personal liability.

Starting an Investment LLC might seem like a daunting task, but worry not – we’ve got you covered. In this guide, we will walk you through the essential steps to help you kickstart your investment journey.

Before diving into the nitty-gritty details, it’s important to note that starting an investment LLC requires careful planning and decision-making. You’ll need to determine your investment strategy, choose a suitable name for your LLC, register your business, and more. Additionally, it is always recommended to consult with professionals such as accountants and attorneys to ensure compliance with local laws and regulations.

Now, let’s embark on this exciting adventure and learn how to start your very own investment LLC.

Step 1: Choose a Name for Your Investment LLC

The first step in starting your investment LLC is to choose a name for your company. This is an important decision, as it will be the brand that represents your business and creates a lasting impression on potential clients and investors.

When selecting a name, it’s important to consider a few key factors. First and foremost, you want your name to be memorable and reflective of your investment goals and values. It should convey professionalism and instill trust in your target audience.

Additionally, you’ll want to ensure that the name you choose is not already in use. Conduct a thorough search to avoid any potential legal issues down the line. Checking with the U.S. Patent and Trademark Office (USPTO) can help you determine if your chosen name is already trademarked.

Another consideration is to choose a name that is SEO-friendly. This means using keywords that are relevant to your investment niche. Being SEO-friendly can help improve your online visibility and attract potential clients who are searching for investment opportunities.

Remember, your name should also comply with the naming regulations of your state’s Secretary of State office. These regulations may include requirements such as adding “LLC” or “Limited Liability Company” to the end of your name.

Once you have a few name ideas in mind, do some research to see if the domain name is available for a website. Having a corresponding website will be crucial for your online presence and marketing efforts.

Overall, choosing a name for your investment LLC requires careful consideration. Take your time, brainstorm ideas, and make sure it aligns with your brand and investment goals. A strong and memorable name can set the foundation for a successful business.

Step 2: Conduct a Name Availability Search

After selecting a name for your investment LLC, it’s important to conduct a name availability search to ensure that the name is not already in use by another business entity. This step is crucial to avoid any potential legal conflicts and to ensure that your chosen name is unique.

To conduct a name availability search, you can begin by checking with the Secretary of State’s office in your state. Most Secretary of State websites have a business entity search feature where you can enter your desired LLC name and see if it is already registered. It’s important to note that the search process may vary slightly from state to state.

In addition to checking with the Secretary of State, you should also search the USPTO database to see if your chosen name is already trademarked. Registering a name that is already trademarked can lead to legal complications and potential infringement issues.

Performing a comprehensive search will help you determine if your chosen name is available for use. If your preferred name is already taken, you may need to come up with alternative options or modify your chosen name slightly to ensure uniqueness. It’s always a good idea to have a few backup names in case your first choice is not available.

Keep in mind that each state has its own specific rules and regulations regarding business names. Some states may require certain phrases or designators to be included in the name, such as “LLC” or “Limited Liability Company”. Make sure to familiarize yourself with the naming requirements in your state to avoid any potential issues during the registration process.

By conducting a thorough name availability search, you can ensure that your chosen name is legally available for use, preventing any conflicts or confusion with existing businesses. Taking the time to do your due diligence at this stage will save you time, effort, and potential legal troubles in the future.

Step 3: Register Your Investment LLC

Once you have chosen a name for your investment LLC and confirmed its availability, the next step is to register your business with the appropriate government authorities. Registering your investment LLC is a crucial step in establishing your business as a legal entity and gaining the necessary permissions and protections.

The registration process may vary depending on the state where you plan to operate your investment LLC. Typically, you will need to file articles of organization or a certificate of formation with the Secretary of State’s office. These documents provide essential information about your business, including its name, address, purpose, and members or managers.

Before filing the necessary paperwork, it’s important to review the requirements and regulations of your state. Some states may have specific forms or additional documents that need to be submitted. Additionally, there may be filing fees associated with registering your LLC.

When preparing the articles of organization or certificate of formation, be sure to include accurate and complete information to avoid any delays or issues during the registration process. It’s important to provide a valid and up-to-date address where you can receive official correspondence from the state government and maintain good standing.

After submitting the required documents and paying the applicable fees, you will need to wait for the state to process your registration. The processing time can vary depending on the workload of the Secretary of State’s office. Once your LLC is officially registered, you will receive a certificate or acknowledgment from the state.

It’s worth mentioning that some states may require additional steps after the initial registration process, such as publishing a notice of your LLC formation in local newspapers. Make sure to familiarize yourself with any post-registration requirements in your state.

By registering your investment LLC, you are establishing your business as a separate legal entity, providing liability protection, and gaining access to various benefits and opportunities. It’s a crucial step in establishing your business and setting the foundation for success in the investment industry.

Step 4: Draft an Operating Agreement

Once your investment LLC is registered, it’s time to create an operating agreement. Although not all states legally require an operating agreement, it is highly recommended to have one in place. An operating agreement is a legal document that outlines the ownership and operating procedures of your LLC.

The operating agreement serves as a guide for how your investment LLC will be managed and operated. It establishes the roles and responsibilities of the members or managers, outlines decision-making processes, and addresses various important aspects of your business.

When drafting an operating agreement, there are several key components to consider:

- Ownership Structure: Clearly define the ownership interests and contributions of each member, including their percentage of ownership and voting rights.

- Management Structure: Specify whether the LLC will be member-managed or manager-managed. In a member-managed LLC, all members have a say in the management of the business. In a manager-managed LLC, one or more designated managers will handle day-to-day operations.

- Distribution of Profits and Losses: Outline how profits and losses will be allocated among members, as well as any specific distribution arrangements.

- Decision-Making Processes: Establish how major decisions will be made within the LLC, including voting rights, dispute resolutions, and the process for admitting new members.

- Roles and Responsibilities: Clearly define the roles, responsibilities, and authority of each member or manager within the LLC.

- Buy-Sell Agreement: Consider including provisions for the transfer or sale of membership interests, including restrictions, rights of first refusal, and buy-out options.

It is important to customize your operating agreement to suit the specific needs and goals of your investment LLC. Consulting with an attorney specializing in business law can be beneficial in ensuring that your operating agreement covers all essential aspects and complies with relevant state laws.

Remember that an operating agreement is a dynamic document and can be amended or updated as your business grows and evolves. Be sure to keep your operating agreement up to date to reflect any changes in ownership, management, or other important matters.

An operating agreement provides clarity, structure, and legal protection for your investment LLC. It helps establish a strong foundation for your business and fosters smooth operations and communication among members or managers.

Step 5: Obtain an EIN (Employer Identification Number)

Obtaining an Employer Identification Number (EIN) is an essential step in the process of starting your investment LLC. An EIN is a unique nine-digit number issued by the Internal Revenue Service (IRS) to identify your business for tax purposes.

The EIN serves as the LLC’s tax ID, similar to how a social security number identifies an individual. It is necessary for a variety of business-related tasks, including opening a bank account, filing tax returns, hiring employees, and conducting financial transactions.

Applying for an EIN is a relatively straightforward process, and there are a few methods to choose from:

- Online Application: The fastest and easiest way to obtain an EIN is through the IRS’s online application system. You can complete the application form on the IRS website and receive your EIN immediately upon successful submission.

- Mail or Fax: If you prefer not to apply online, you can complete Form SS-4, Application for Employer Identification Number, and mail or fax it to the appropriate IRS office. It may take several weeks to receive your EIN using this method.

- Phone Application: In limited circumstances, you may apply for an EIN over the phone by contacting the IRS Business and Specialty Tax Line. This option is available only during specific hours and for certain types of entities.

When applying for an EIN, you will need to provide information about your investment LLC, such as its name, address, and ownership structure. It’s important to have this information ready before you begin the application process.

Once you have obtained an EIN, make sure to keep it safe and easily accessible for future reference. You will need to use your EIN for various tax and business-related activities, so it’s crucial to remember and protect this important identification number.

By obtaining an EIN, you ensure that your investment LLC is properly identified for tax purposes and can engage in a range of business activities. It is a crucial step in establishing your business’s legal and financial foundation.

Step 6: Open a Business Bank Account

Opening a business bank account for your investment LLC is a critical step in managing your finances and separating your personal and business transactions. A dedicated business bank account not only helps you maintain accurate financial records but also adds a layer of professionalism to your business.

When selecting a bank for your business account, consider a few key factors:

- Research Banks: Research different banks and compare their offerings, fees, and services. Look for banks that specialize in business accounts or offer features specifically tailored to meet the needs of small businesses or LLCs.

- Visit Local Branches: Visit the local branches of the banks you are considering. Ask about their account options, requirements, and any fees associated with maintaining the account.

- Account Features: Consider the features and benefits that are important to your investment LLC, such as online banking, mobile banking, ATM access, merchant services, and the ability to easily track and manage your finances.

- Fees and Minimum Balance: Review the fees associated with the business account, including monthly maintenance fees, transaction fees, and minimum balance requirements. Choose a bank that offers transparent and reasonable fees for your business needs.

- Documentation Required: Gather the necessary documents required by the bank to open a business account. This typically includes your LLC’s articles of organization, EIN, and identification documents for the authorized signers on the account.

Once you have selected the bank and gathered the required documentation, visit the bank in person or follow their online application process to open the account. During the account setup, ensure that you clearly indicate that it is a business account for your investment LLC.

After the account is opened, it’s important to keep personal and business finances separate. Only use the business bank account for LLC-related transactions and expenses. This separation will make record-keeping and tax filing easier and will also help protect your personal assets in case of any legal issues.

Regularly review your business bank statements, track your income and expenses, and reconcile the account to maintain accurate financial records. A well-managed business bank account will not only facilitate smooth financial operations but will also provide a clear picture of your investment LLC’s financial health.

By opening a dedicated business bank account, you establish a clear distinction between personal and business finances, streamline financial management, and ensure the proper handling of your investment LLC’s funds.

Step 7: Obtain Necessary Permits and Licenses

Before you can fully operate your investment LLC, it’s crucial to obtain any necessary permits and licenses required by your local, state, or federal authorities. Compliance with these regulatory requirements ensures that your business operates legally and meets industry-specific rules and standards.

The permits and licenses needed for your investment LLC may vary depending on factors such as your business location, nature of investment activities, and the types of assets you plan to invest in. Here are a few common permits and licenses you may need to consider:

- Business License: Most jurisdictions require a general business license that permits you to operate your business within their jurisdiction. Contact your local city or county government office to inquire about the specific requirements and application process for obtaining a business license.

- Professional Licenses: Depending on the nature of your investment activities, you may need to obtain professional licenses. For example, if you plan to offer financial advisory services, you may need to obtain licenses such as the Series 7 or Series 65 license from the Financial Industry Regulatory Authority (FINRA).

- Securities Licenses: If your investment LLC deals with securities, such as stocks, bonds, or other investment instruments, you may need to obtain licenses from the appropriate regulatory authorities, such as the Securities and Exchange Commission (SEC) or state securities regulators.

- Real Estate Licenses: If your investment LLC involves real estate investments or property management, you may need real estate licenses, such as a real estate broker or salesperson license, depending on your state’s requirements.

- Compliance with Regulatory Bodies: Depending on your business’s focus, you may also need to comply with specific industry regulations and standards. For example, if you plan to invest in environmentally sensitive projects, you may need to obtain permits from environmental protection agencies.

It’s essential to conduct thorough research and consult with professionals, such as attorneys or industry-specific consultants, to determine the specific permits and licenses you need for your investment LLC. Failure to obtain these required permits and licenses can result in legal issues, penalties, or the inability to conduct certain investment activities.

Keep in mind that the requirements for permits and licenses can change over time, so it’s important to regularly review and renew them as necessary to stay in compliance with applicable laws and regulations. Additionally, consider consulting with professionals who specialize in your specific industry to ensure ongoing compliance with any evolving regulatory requirements.

Obtaining the necessary permits and licenses for your investment LLC demonstrates your commitment to operating your business legally and ethically. It ensures that you comply with all applicable laws and regulations and builds trust with clients, investors, and regulatory authorities.

Step 8: Determine Your Investment Strategy

Before you start investing with your LLC, it’s important to determine your investment strategy. Your investment strategy lays the foundation for your investment decisions and helps guide your overall approach towards building a successful investment portfolio.

When determining your investment strategy, consider the following factors:

- Investment Goals: Define your investment goals, whether it’s capital appreciation, generating passive income, long-term growth, or a combination of these objectives. Clarifying your goals will help shape your investment approach.

- Risk Appetite: Assess your risk tolerance and determine how comfortable you are with potential fluctuations and volatility in the investment market. Understanding your risk appetite will help you determine the types of assets and investment vehicles that align with your comfort level.

- Asset Allocation: Decide how you will allocate your investment capital across different asset classes, such as stocks, bonds, real estate, commodities, or alternative investments. Consider diversification to mitigate risk and maximize potential returns.

- Time Horizon: Determine your investment time horizon, whether it’s short-term, medium-term, or long-term. This will influence the types of investment strategies and assets you choose, as well as your approach to risk management and liquidity.

- Research and Due Diligence: Conduct thorough research and due diligence on potential investment opportunities. Analyze market trends, study financial statements, and assess the risks and potential returns of different investments.

- Monitoring and Adjustments: Regularly monitor and evaluate your investment performance. Be prepared to make adjustments to your investment strategy as market conditions and your goals evolve.

Remember, each investment strategy is unique to the investor and their specific goals and circumstances. There is no one-size-fits-all approach, and what works for one person may not work for another. Take the time to assess your personal financial situation, consult with professionals if needed, and stay informed about market trends and economic factors that may impact your investment decisions.

Having a well-defined investment strategy helps you make informed decisions and approach your investment activities with a clear focus. It provides a framework for evaluating opportunities and managing risks, enhancing your chances of building a successful investment portfolio with your investment LLC.

Step 9: Start Building Your Investment Portfolio

With your investment strategy in place, it’s time to start building your investment portfolio with your investment LLC. A well-structured and diversified portfolio can help you achieve your investment goals and generate consistent returns over time.

When building your investment portfolio, consider the following:

- Diversification: Diversify your portfolio by investing in a variety of asset classes, sectors, and regions. This helps spread risk and potentially improve returns as different investments may perform differently under various market conditions.

- Asset Allocation: Allocate your investment capital across different asset classes based on your investment strategy and risk appetite. For example, you may allocate a portion to stocks, bonds, real estate, or alternative investments, depending on your goals and risk tolerance.

- Research and Due Diligence: Conduct thorough research on potential investment opportunities before making decisions. Analyze financial statements, consider market trends, and seek professional advice if needed to make informed investment choices.

- Regular Monitoring and Rebalancing: Regularly monitor your portfolio’s performance and make adjustments as necessary. Rebalance your portfolio periodically to maintain your desired asset allocation and align with changes in market conditions or your investment goals.

- Risk Management: Implement risk management strategies to protect your portfolio. This may include setting stop-loss orders, diversifying within asset classes, and considering hedging or insurance options to mitigate potential risks.

- Consider Long-Term Perspective: Keep a long-term perspective when building your portfolio. While short-term market fluctuations may occur, focusing on long-term investment goals can help you ride out volatility and capture potential growth opportunities.

It’s important to note that building an investment portfolio is an ongoing process. As your investment knowledge and market conditions evolve, you may need to make adjustments and fine-tune your portfolio. Stay informed about economic trends, market news, and changes in regulations that may impact your investments.

Consider seeking guidance from financial advisors or investment professionals who can provide tailored advice based on your specific goals and risk tolerance. Their expertise can help you make informed investment decisions and navigate the complexities of the investment landscape.

Building a well-constructed investment portfolio takes time, patience, and discipline. By following your investment strategy, conducting thorough research, and staying vigilant in monitoring and adjusting your portfolio, you can increase your chances of achieving your investment goals and maximizing returns with your investment LLC.

Step 10: Develop a Marketing Plan

As you continue to grow your investment LLC, it’s crucial to develop a comprehensive marketing plan to promote your services, attract potential investors, and build a strong brand presence in the market. A well-defined marketing plan will help you effectively reach your target audience and differentiate your investment offerings from competitors.

When developing your marketing plan, consider the following key elements:

- Identify Your Target Market: Understand your ideal clients and investors. Consider their demographics, investment preferences, financial goals, and risk tolerance. This will help you tailor your marketing messages and strategies to resonate with your target audience.

- Position Your Brand: Clarify and articulate your unique value proposition. Clearly define what sets your investment LLC apart from others in the market. This will help you position your brand and communicate your competitive advantage to potential investors.

- Create a Strong Online Presence: Build a professional website that showcases your investment services, team expertise, and performance track record. Use search engine optimization techniques to increase your online visibility and attract organic traffic. Leverage social media platforms, content marketing, and email campaigns to engage with your audience and share valuable insights.

- Networking and Relationship Building: Attend industry events, join investment clubs, and actively participate in relevant professional associations. Networking can help you establish valuable connections, build relationships, and gain referrals from industry peers and leaders.

- Investor Education and Thought Leadership: Position yourself and your investment LLC as experts in the field. Share educational content through blog posts, articles, webinars, or podcasts. Offering valuable insights and demonstrating your knowledge can establish credibility and attract potential investors.

- Referral Program: Develop a referral program to incentivize existing clients, partners, and contacts to refer potential investors to your investment LLC. Offer rewards or benefits for successful referrals, as this can be an effective way to expand your client base.

- Analyze and Measure Results: Regularly review and analyze the effectiveness of your marketing efforts. Track key metrics such as website traffic, lead generation, conversion rates, and client acquisition. Use this data to refine your strategies and make informed marketing decisions.

Remember that marketing is an ongoing process that requires continuous effort and adaptation. Stay up-to-date with market trends, new marketing technologies, and changes in investor behavior. Regularly review your marketing plan and make necessary adjustments to stay aligned with your business goals.

Consider allocating a budget for marketing activities to ensure that you have the resources needed to implement your strategies effectively. Investing in marketing can yield long-term benefits by attracting more potential investors and enhancing your brand’s reputation in the investment industry.

By developing a robust marketing plan, you can effectively promote your investment LLC, engage with your target audience, and attract potential investors who align with your investment offerings and philosophy.

Step 11: Consider Hiring Professionals (Accountant, Attorney, etc.)

As your investment LLC grows and becomes more complex, it is important to consider hiring professionals such as accountants, attorneys, and other specialists who can provide valuable expertise and guidance. These professionals can help you navigate the complexities of financial regulations, legal requirements, tax compliance, and overall business management.

Here are some key professionals to consider hiring:

- Accountant: An accountant can assist you with bookkeeping, financial statements, tax planning, and compliance. They can help ensure that your investment LLC’s financial records are accurate, and your tax obligations are met.

- Attorney: An attorney specializing in business law can help review and draft contracts, operating agreements, and other legal documents. They can also provide guidance on legal compliance, intellectual property, and potential legal risks associated with your investment activities.

- Financial Advisor: A financial advisor can provide investment advice and guidance tailored to your investment goals. They can help you fine-tune your investment strategy, identify new investment opportunities, and navigate market fluctuations.

- Compliance Specialist: If your investment LLC is subject to specific regulatory requirements, such as securities laws or environmental regulations, you may consider hiring a compliance specialist to ensure your investment activities remain in compliance with relevant laws and regulations.

- Insurance Advisor: An insurance advisor can help assess your insurance needs and recommend appropriate coverage for your investment LLC. They can assist with risk management strategies, such as liability insurance, property insurance, and professional liability coverage.

These professionals have the knowledge and expertise to provide valuable advice, ensure regulatory compliance, and help mitigate potential risks. While hiring professionals involves additional costs, their guidance can save you time, money, and potential legal complications in the long run.

When hiring professionals, take the time to research and choose individuals or firms with expertise in your specific industry. Seek recommendations from trusted sources and conduct interviews to ensure you find the right fit for your investment LLC’s needs.

Remember that hiring professionals is not a one-time task. Regularly revisit your needs and reassess whether your current team of professionals meets your evolving requirements. As your investment LLC expands or faces new challenges, you may need to bring on additional professionals or adjust the scope of services provided by existing professionals.

By having a team of professionals supporting your investment LLC, you can ensure sound financial management, legal compliance, and strategic decision-making, allowing you to focus on your investment activities and overall business growth.

Step 12: Set Up an Efficient Record-Keeping System

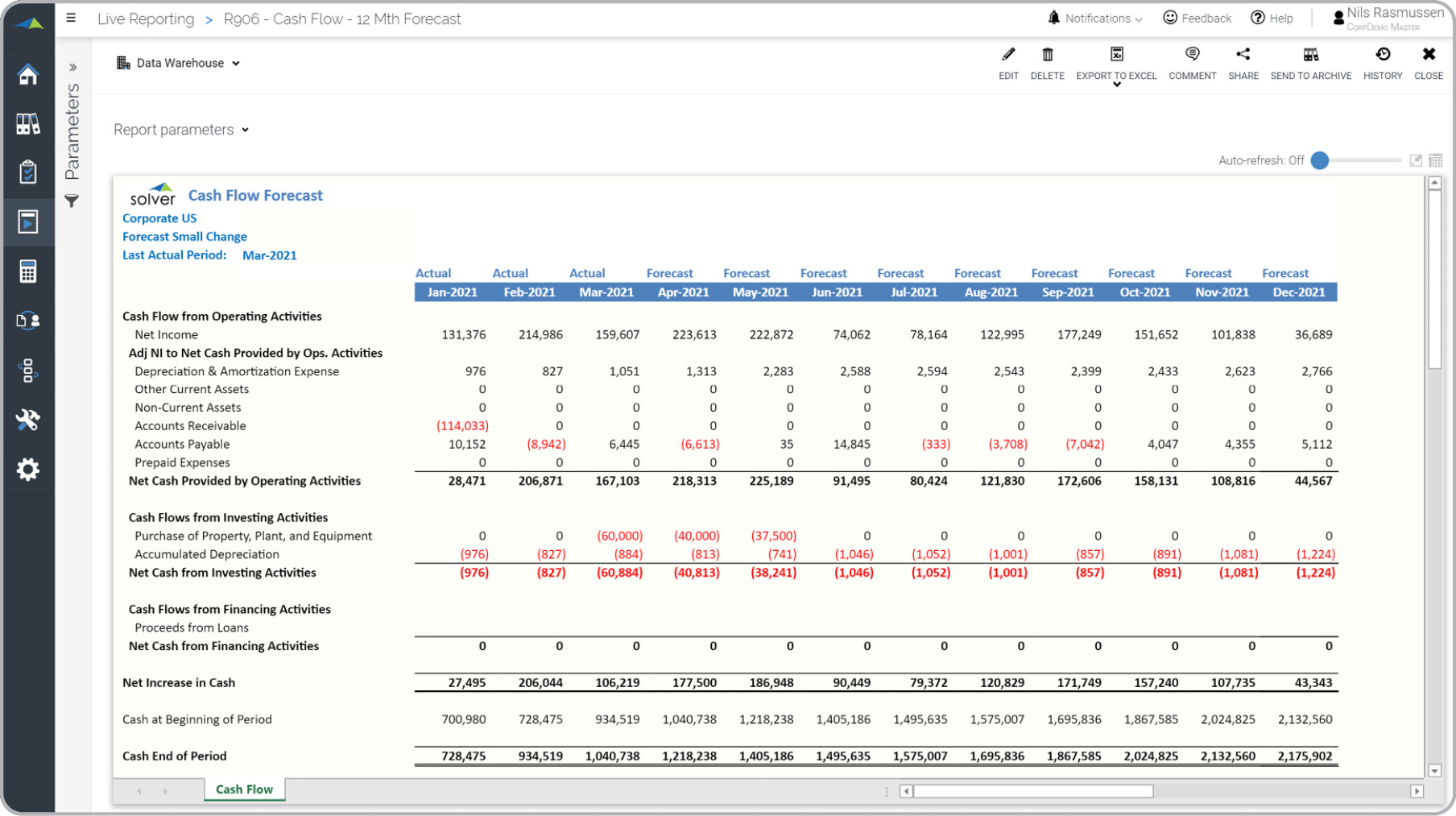

Setting up an efficient record-keeping system is crucial for the success and smooth operation of your investment LLC. A well-organized and accurate record-keeping system allows you to keep track of financial transactions, maintain compliance with regulatory requirements, and make informed business decisions.

Here are some essential steps to set up an efficient record-keeping system:

- Choose Accounting Software: Consider using accounting software specifically designed for small businesses or investment firms. This software can streamline your financial record-keeping, automate routine tasks, and generate accurate reports.

- Categorize and Organize Documents: Develop a system for categorizing and organizing financial documents, such as bank statements, receipts, invoices, and tax records. Use folders, digital storage, or cloud-based systems to keep these documents easily accessible and well-organized.

- Maintain Regular Bookkeeping: Regularly update your accounting records with accurate and detailed information about income, expenses, investments, and any other financial transactions. This will provide you with a clear overview of your financial position and facilitate tax reporting.

- Separate Personal and Business Finances: Ensure that personal and business finances are kept separate. Maintain separate bank accounts and credit cards for personal and business use. This separation will help you accurately track business-related transactions and simplify tax reporting.

- Track Investment Performance: Develop a system to track and monitor the performance of your investments. Regularly review investment statements, update valuation figures, and keep detailed records of investment activities, such as buy/sell transactions, dividends, and interest earned.

- Establish Document Retention Policies: Determine how long you need to keep various types of records, taking into account legal and regulatory requirements. Develop document retention policies to ensure you retain documents for the required duration and securely dispose of them when no longer needed.

- Back Up Your Data: Regularly back up your financial data to protect against data loss. Use cloud-based storage or external hard drives to create secure backups of your accounting records and other important documents.

Remember to consult with professionals, such as accountants or business advisors, to ensure your record-keeping system meets legal and regulatory requirements specific to your investment LLC.

An efficient record-keeping system not only helps you maintain accurate financial records but also provides valuable data and insights for analyzing your investment performance, making informed decisions, and demonstrating transparency to potential investors and regulatory authorities.

Commit to consistently maintaining and updating your record-keeping system, as it is a critical component of your investment business’s success and long-term growth.

Conclusion

Starting an investment LLC is an exciting and potentially lucrative endeavor that allows you to take control of your financial future. By following the 12 steps outlined in this guide, you can establish a solid foundation for your investment business and navigate the complexities of the finance industry.

From choosing a name and registering your LLC to developing a marketing plan and setting up an efficient record-keeping system, each step is essential to ensure compliance, professionalism, and long-term success. Additionally, considering the hiring of professionals and determining your investment strategy will help you make informed decisions and navigate the ever-changing investment landscape.

Remember that building an investment LLC is a journey that requires dedication, continuous learning, and adaptability. Stay informed about industry trends, financial regulations, and market conditions to make informed investment decisions.

It’s also crucial to seek advice and guidance from professionals, such as accountants, attorneys, and financial advisors, who can provide expertise and support throughout your investment journey.

By following the steps outlined in this guide and staying committed to your investment goals, you can establish a successful investment LLC that offers valuable opportunities for both you and your investors. Take the time to plan, execute your strategies diligently, and always prioritize the best interests of your clients and your business.

With careful planning, proactive decision-making, and a commitment to excellence, your investment LLC has the potential to thrive and build a reputation as a trusted and successful player in the finance industry.