Finance

What Age Can You Start Building Credit

Published: January 11, 2024

Learn when you can start building credit and how it can benefit your finances. Find out the ideal age to begin establishing a strong credit history.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Building credit is an essential part of achieving financial stability and independence. It allows individuals to establish a positive credit history and gain access to loans, credit cards, and other financial opportunities. However, many people are unsure about when they can start building credit and what age is the right time to begin this important journey.

In this comprehensive guide, we will explore the factors that affect credit building, the legal age requirements to start building credit, and the strategies individuals can employ to establish and maintain a solid credit foundation at different stages of life.

Understanding the nuances of credit building is crucial to make informed financial decisions and secure a strong financial future. Whether you are a teenager looking to get a head start or a young adult preparing to enter the adult world, this article will provide invaluable insights on when and how to begin building credit.

So, let’s dive in and uncover the mysteries of credit building at different stages of life. Whether you’re just starting your financial journey or reevaluating your credit strategy, this guide will equip you with the knowledge you need to navigate the world of credit with confidence.

Understanding Credit

Before delving into the age at which you can start building credit, it’s essential to understand what credit means and how it works. In simple terms, credit refers to the ability to borrow money or access goods and services with the understanding that you will repay the lender or creditor at a later date.

When you apply for credit, such as a loan or credit card, the lender assesses your creditworthiness to determine if you are a responsible borrower. They evaluate factors like your credit history, income, employment stability, and debt-to-income ratio to gauge your ability to repay debts on time.

Your credit history is a record of your financial behavior and includes information such as your payment history, outstanding debts, length of credit history, and types of credit used. This information is compiled by credit reporting agencies and summarized in your credit report.

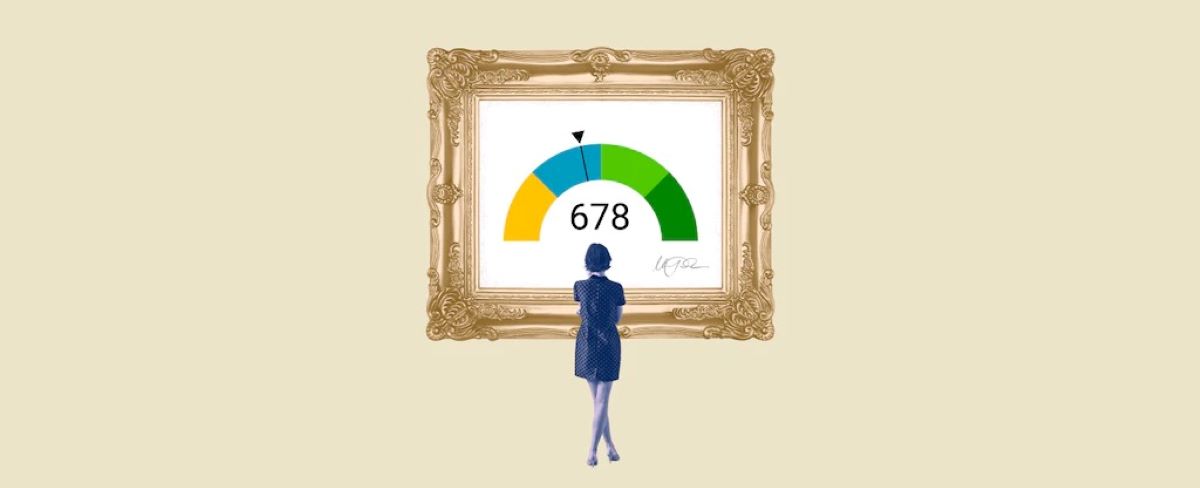

Your credit score, on the other hand, is a numerical value that represents your creditworthiness based on the information in your credit report. Credit scores typically range from 300 to 850, with a higher score indicating better creditworthiness.

Having a good credit score is crucial as it can impact various aspects of your financial life. It affects your ability to qualify for loans, the interest rates you’ll receive, and even your ability to rent an apartment or get a job in some cases.

Understanding the fundamentals of credit is vital to make informed financial decisions and cultivate a positive credit history. As we explore the age at which you can start building credit, keep in mind the importance of responsible credit management and the long-term impact it can have on your financial well-being.

Factors Affecting Credit Building

Building credit is not solely dependent on age. Various factors come into play when it comes to establishing and building a solid credit history. Understanding these factors will help individuals make informed decisions and take proactive steps to improve their creditworthiness. Here are some of the key factors that can affect credit building:

- Payment History: Your payment history is one of the most critical factors in credit building. Making timely and consistent payments on your credit accounts, such as loans or credit cards, demonstrates responsible financial behavior and contributes to a positive credit history.

- Credit Utilization: Credit utilization refers to the amount of available credit you are currently using. Keeping your credit utilization ratio low, ideally below 30%, shows lenders that you are not heavily reliant on credit and can manage your debts responsibly.

- Credit Mix: Having a diverse mix of credit accounts, such as credit cards, loans, and mortgages, can positively impact your credit score. It demonstrates your ability to handle different types of credit responsibly.

- Length of Credit History: The length of your credit history plays a significant role in credit building. A longer credit history demonstrates your experience in managing credit over time and provides more data for lenders to assess your creditworthiness.

- New Credit Applications: Frequent applications for new credit can negatively impact your credit score. Each application results in a hard inquiry, which remains on your credit report for two years and can slightly reduce your credit score.

- Public Records and Negative Information: Public records, such as bankruptcies, tax liens, and collections, can significantly impact your credit score and make it difficult to build credit. It’s crucial to avoid these situations and address any negative information promptly.

These factors collectively contribute to your overall creditworthiness. It’s important to be mindful of these factors and adopt responsible financial habits to establish and maintain a positive credit history. As we explore the legal age to start building credit, keep in mind that working towards these factors will improve your chances of building a strong credit profile.

Legal Age to Start Building Credit

When it comes to the legal age to start building credit, it may vary depending on the country and jurisdiction. In the United States, for example, the legal age to enter into a contract, including obtaining a credit card or loan, is typically 18 years old. This age is considered adulthood, and individuals are generally responsible for their financial decisions and obligations.

However, it’s important to note that while 18 may be the legal age to start building credit independently, there are options available for minors to begin their credit journey with parental or guardian involvement. Some financial institutions offer secured credit cards or joint accounts where a responsible adult co-signs and acts as a guarantor for the minor.

By opening a secured credit card, for instance, the minor can start establishing a positive credit history. A secured credit card requires a cash collateral deposit, which becomes the credit limit. It serves as a responsible way to introduce young individuals to credit-building, with the added benefit of parental oversight and guidance.

It’s essential for parents or guardians to educate minors about responsible credit usage, making payments on time, and maintaining a low credit utilization ratio. This guidance will help them build good financial habits from an early age and set a solid foundation for future credit building.

In summary, although 18 is generally the legal age to start building credit independently, there are avenues for minors to begin their credit journey with the assistance of a responsible adult. Starting early can give young individuals a head start in establishing a positive credit history and learning crucial financial skills.

Building Credit as a Minor

Building credit as a minor can be a valuable opportunity to establish a positive credit history early on. While there are limitations and restrictions in place, there are still ways for minors to begin their credit journey and lay the foundation for a strong financial future. Here are some strategies for building credit as a minor:

- Authorized User: One option is to become an authorized user on a parent or guardian’s credit card. As an authorized user, the minor gains access to the credit card account and the account’s payment history is reported on their credit report. It’s important for the primary account holder to make regular on-time payments to benefit the minor’s credit profile.

- Secured Credit Card: Another avenue for minors to start building credit is through secured credit cards. A secured credit card requires a cash deposit as collateral, which becomes the credit limit. By using the secured card responsibly and making timely payments, minors can establish their credit history.

- Joint Account: With a parent or guardian’s involvement, minors can open a joint account. This allows them to share ownership and responsibility for the account. It’s important to note that both parties are equally liable for any debts or obligations associated with the joint account.

- Piggybacking: Piggybacking is a strategy where a minor becomes an authorized user on a trusted adult’s credit card account. The minor benefits from the cardholder’s positive credit history, even though they may not have any direct access to the account.

While these options provide opportunities for minors to start building credit, it’s crucial to emphasize responsible credit practices. Minors should understand the importance of making payments on time, keeping credit utilization low, and maintaining a positive credit history.

It’s also a good idea for parents or guardians to actively monitor the minor’s credit activity and provide guidance on financial responsibility. By instilling good credit habits early on, minors can develop a solid understanding of credit and set themselves up for future success in managing their financial well-being.

Building Credit in Your Late Teens

Your late teens are a crucial time to start building credit as you transition into adulthood. Establishing a solid credit foundation during this period can set you up for financial success in the years to come. Here are some strategies for building credit in your late teens:

- Open a Student Credit Card: Many financial institutions offer credit cards specifically designed for students. These cards often have lower credit limits and tailored benefits for young individuals. Use the card responsibly, making small purchases and paying the balance in full each month to build a positive credit history.

- Apply for a Secured Credit Card: If you are unable to qualify for a traditional credit card, consider applying for a secured credit card. With a secured card, you provide a refundable security deposit as collateral, and this deposit becomes your credit limit. Making timely payments on the card will help you establish a positive credit history.

- Become an Authorized User: If you have a trusted family member or guardian with good credit, ask them to add you as an authorized user on one of their credit cards. Their positive credit history can be reported on your credit report and help boost your credit score.

- Monitor Your Credit: It’s crucial to keep an eye on your credit report and credit score. You can obtain a free credit report once a year from the major credit reporting agencies. Regularly reviewing your report allows you to identify any mistakes or discrepancies and address them promptly.

- Build Good Financial Habits: Building credit goes hand in hand with developing good financial habits. Make it a priority to pay your bills on time, keep your credit utilization low, and avoid taking on excessive debt. Consistency and responsibility are key to building a strong credit history.

Remember, building credit takes time, and it’s essential to be patient. By starting early and practicing responsible credit management, you can establish a positive credit history that will benefit you in the future when applying for loans, renting an apartment, or even applying for a job.

Utilizing these strategies in your late teens can give you a head start in building a solid credit foundation and setting yourself up for financial success as you continue your journey into adulthood.

Building Credit in Your Early 20s

Your early 20s is a critical time for building credit and establishing a strong financial foundation. As you transition into adulthood and navigate new financial responsibilities, it’s important to take proactive steps to build and maintain a healthy credit profile. Here are some strategies for building credit in your early 20s:

- Continue to Use Credit Responsibly: If you already have a credit card or loan, continue to use it responsibly. Make all payments on time and keep your credit utilization ratio low. Consistent, responsible credit usage is key to maintaining a positive credit history.

- Consider Opening New Credit Accounts: As you gain more financial independence and stability, you may want to consider opening additional credit accounts. This can include a mix of credit cards and different types of loans, such as a car loan or a small personal loan.

- Monitor Your Credit Score: Regularly check your credit score to keep track of your progress and identify areas for improvement. Many free online resources allow you to monitor your credit score and receive notifications of any changes or updates to your credit report.

- Diversify Your Credit Mix: Lenders look favorably upon individuals with a diverse credit mix, meaning a variety of credit types. Consider adding a different type of credit to your portfolio, such as a car loan or a store credit card, to demonstrate your ability to manage different forms of credit.

- Build a Relationship with a Financial Institution: Establishing a relationship with a reputable financial institution can be beneficial in the long run. Consider opening a checking or savings account and utilizing the institution’s credit-building services and resources.

- Manage Student Loans Responsibly: If you have student loans, make sure to manage them responsibly. Make payments on time and explore repayment options that fit your financial situation. The responsible handling of your student loans can positively impact your credit history.

- Seek Financial Education and Guidance: Take advantage of resources and educational opportunities available to you. Attend workshops, read books, or seek advice from financial professionals to deepen your understanding of credit and finance.

By following these strategies, you can continue to build a solid credit history in your early 20s. This will not only help you gain access to better financial opportunities in the future but also set a strong foundation for a lifetime of responsible credit management.

Remember, building credit is a long-term process, and it’s essential to be patient and persistent. With responsible credit usage and strategic financial habits, you can shape a positive credit profile that will serve you well throughout your adult life.

Building Credit in Your 30s and Beyond

Building and maintaining good credit is important at any age, including your 30s and beyond. By this stage, you may have already established some credit history, but there are still steps you can take to continue building credit and ensure your financial stability. Here are some strategies for building credit in your 30s and beyond:

- Manage Debt Responsibly: If you have existing debts, such as a mortgage, car loan, or student loans, continue to make timely payments and manage your debt responsibly. This demonstrates your ability to handle high-value credit and can have a positive impact on your credit score.

- Keep Credit Accounts Open: It may be tempting to close old credit accounts you no longer use, but keeping them open can be beneficial for your credit score. The length of your credit history is a factor in credit scoring models, so maintaining older accounts shows a longer track record of responsible credit usage.

- Consider Credit Limit Increases: If you have a good payment history and low credit utilization, you can request a credit limit increase on your existing credit cards. A higher credit limit can improve your credit utilization ratio and potentially boost your credit score.

- Continued Responsible Credit Usage: Be mindful of your credit utilization and payment history. Avoid maxing out your credit cards and make all payments on time. Consistent, responsible credit usage demonstrates financial discipline and can positively impact your creditworthiness.

- Monitor Your Credit Regularly: Regularly check your credit reports from the major credit reporting agencies to ensure they are accurate and free of errors. Monitoring your credit helps you stay on top of any changes and gives you an opportunity to address issues promptly.

- Consider a Variety of Credit Types: As you navigate different financial milestones and goals, consider diversifying your credit mix. This may include taking out different types of loans, such as a home equity line of credit or a personal loan. A diverse credit portfolio shows lenders your ability to handle various forms of credit responsibly.

- Automate Payments: Set up automatic bill payments to ensure you never miss a payment due date. Timely payments are crucial for maintaining a positive payment history and strong credit scores.

Building credit in your 30s and beyond requires a continued focus on responsible credit management. By following these strategies, you can maintain and strengthen your creditworthiness, enabling you to access better financial opportunities and secure your long-term financial well-being.

Remember, building credit is a lifelong process, and it’s important to monitor and manage it throughout your adult life. By staying proactive and making wise financial choices, you can build a solid credit history that supports your financial goals and ambitions.

Conclusion

Building credit is a crucial aspect of financial management and establishing a strong financial foundation. While the legal age to start building credit independently may vary, there are strategies available for individuals of all ages to begin their credit journey.

Starting early and practicing responsible credit habits can give young individuals a head start in building a positive credit history. Whether as a minor or in your late teens, options like authorized user status, secured credit cards, and parental involvement can pave the way for future credit success.

As you enter your early 20s and beyond, it’s important to continue building credit through responsible credit usage, regular monitoring of your credit profile, and diversifying your credit mix. Managing debt, maintaining a low credit utilization ratio, and making timely payments are key components in maintaining a positive credit history.

Remember, building credit is a marathon, not a sprint. It requires patience, consistency, and responsible financial behavior. By establishing good credit habits at a young age and maintaining them throughout your adult life, you can secure access to better financial opportunities, such as obtaining favorable loan terms, renting an apartment, or even pursuing your entrepreneurial dreams.

Take the time to educate yourself about credit and financial management, utilize resources and tools available to you, and seek guidance when needed. Your credit journey is unique, and by understanding the factors that affect credit and implementing the strategies discussed in this article, you can navigate the world of credit with confidence and achieve long-term financial success.

Remember, building and maintaining good credit is within your reach, regardless of your age. Start today and reap the rewards of a strong credit history for a lifetime.