Finance

How To Reinvest Dividends In Fidelity

Published: January 3, 2024

Learn how to reinvest dividends in Fidelity and maximize your returns with our expert financial advice and tips. Take control of your finances and grow your wealth today.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of dividend reinvestment with Fidelity! If you’re an investor looking to grow your wealth through dividend-paying stocks, Fidelity offers a convenient and hassle-free way to reinvest those dividends and potentially accelerate your investment returns. In this article, we’ll delve into the concept of dividend reinvestment, explore the benefits of using Fidelity for this purpose, and provide a step-by-step guide on how to set up dividend reinvestment with Fidelity.

Dividends are a share of a company’s profits that are distributed to its shareholders on a regular basis. Instead of simply pocketing these dividends, you have the option to reinvest them back into the company by buying additional shares. Dividend reinvestment allows you to harness the power of compounding, as your reinvested dividends can generate even more dividends in the future.

When it comes to dividend reinvestment, Fidelity has established itself as a reputable and trusted brokerage firm, offering a range of investment options and tools to help you make the most out of your reinvested dividends. With Fidelity, you can benefit from their robust platform, excellent customer service, and a wide selection of dividend-paying stocks to choose from.

Setting up dividend reinvestment with Fidelity is a straightforward process and can be done in just a few steps. Whether you’re a beginner investor or a seasoned pro, this article will guide you through the process and equip you with the knowledge and resources to make informed decisions.

So, if you’re ready to dive into the world of dividend reinvestment with Fidelity, let’s explore the benefits, learn how to set it up, and discover some tips and tools for maximizing your returns.

Understanding Dividend Reinvestment

Dividend reinvestment is a powerful strategy that allows investors to compound their returns over time. Instead of receiving dividend payments in cash, investors can choose to reinvest those dividends into additional shares of the underlying stock. This process is automated and can be facilitated by brokerage firms like Fidelity.

By reinvesting dividends, you are essentially buying more shares of the same stock or mutual fund, which increases your ownership stake in the company. Over time, this can lead to a significant accumulation of shares and the potential for greater capital appreciation.

Dividend reinvestment offers several advantages. Firstly, it helps to maximize the total return of your investments. Rather than allowing dividends to sit idle in a cash account earning minimal interest, reinvesting them provides the opportunity for exponential growth as the reinvested dividends generate their own dividends.

Secondly, dividend reinvestment can enhance the power of compounding. Compounding is the process of earning returns on both the original investment and the accumulated returns. By reinvesting dividends, you increase the number of shares you hold, and in turn, the potential for future dividend payments. This creates a compounding effect that can substantially increase your overall returns over time.

Additionally, dividend reinvestment can help to smooth out the volatility of the stock market. By reinvesting dividends, you continually invest in the market, regardless of whether prices are high or low. This dollar-cost averaging approach can help to reduce the impact of market fluctuations and potentially enhance your long-term gains.

It’s important to note that dividend reinvestment is not limited to individual stocks. Many mutual funds also offer dividend reinvestment programs, allowing investors to automatically reinvest dividends into additional fund shares. This is particularly advantageous for investors looking to diversify their holdings and access a broad range of securities within a single investment vehicle.

Overall, dividend reinvestment is a valuable strategy for long-term investors seeking to grow their wealth. By harnessing the power of compounding and taking advantage of Fidelity’s dividend reinvestment program, you can potentially accelerate your investment returns and achieve your financial goals more effectively.

Benefits of Reinvesting Dividends with Fidelity

Reinvesting dividends with Fidelity can bring numerous advantages to investors looking to grow their wealth. Fidelity, as a renowned brokerage firm, offers a range of benefits and features that make it an attractive choice for dividend reinvestment. Let’s explore some of the key benefits:

1. Compounding Returns:

By reinvesting dividends with Fidelity, you have the opportunity to harness the power of compounding. As your reinvested dividends are used to purchase additional shares, these new shares can generate their own dividends, further accelerating your overall returns over time.

2. Convenience and Automation:

Fidelity’s dividend reinvestment program offers convenience and automation, eliminating the need for manual reinvestment. Once you set up the program, Fidelity takes care of reinvesting your dividends automatically, saving you time and effort. This seamless process allows you to focus on your investing strategy and long-term goals.

3. Cost-Efficient:

Dividend reinvestment with Fidelity is cost-efficient. Rather than incurring additional fees for each reinvestment transaction, Fidelity often allows for commission-free reinvestment of dividends, helping you maximize the value of your returns. This can be particularly beneficial for investors who regularly receive dividends from multiple holdings.

4. Diversification:

Fidelity offers a wide selection of dividend-paying stocks and mutual funds to choose from, allowing you to diversify your portfolio easily. The ability to reinvest dividends across different companies and sectors helps to mitigate risk and enhance the potential for consistent returns.

5. Access to Research and Tools:

Fidelity provides investors with access to a range of research tools, market insights, and educational resources. This wealth of information can assist you in making informed decisions about which dividend-paying securities to reinvest in. Fidelity’s platform also offers comprehensive portfolio analysis and tracking tools to help you monitor the progress of your dividend reinvestment strategy.

6. Flexibility:

With Fidelity’s dividend reinvestment program, you have the flexibility to choose which holdings to reinvest dividends into. You can allocate your reinvested dividends to specific stocks or funds based on your investment goals and risk tolerance. This level of control allows you to customize your portfolio and adapt to changing market conditions.

In summary, reinvesting dividends with Fidelity offers compelling benefits for investors. From the power of compounding returns to the convenience and cost-efficiency of automated reinvestment, Fidelity’s dividend reinvestment program provides a robust and user-friendly platform to help you grow your wealth over the long term.

Setting Up Dividend Reinvestment with Fidelity

Setting up dividend reinvestment with Fidelity is a straightforward process that can be done in a few simple steps. Here’s a step-by-step guide to help you get started:

Step 1: Open an Account:

If you don’t already have an account with Fidelity, you’ll need to open one first. Fidelity offers various account types, such as individual brokerage accounts, IRAs, and 401(k) plans. Choose the account type that best aligns with your investment goals and preferences.

Step 2: Choose Dividend-Paying Investments:

Once your account is set up, you’ll need to choose dividend-paying investments that you want to reinvest. Fidelity provides a wide range of stocks and mutual funds that offer dividends. Conduct thorough research and select investments that align with your investment strategy and risk tolerance.

Step 3: Verify Dividend Reinvestment Eligibility:

Before proceeding with dividend reinvestment, confirm that the stocks or funds you’ve chosen are eligible for reinvestment. While most dividend-paying securities are eligible, some may have specific criteria or restrictions. Double-check the eligibility requirements to ensure a seamless reinvestment process.

Step 4: Set Up Dividend Reinvestment:

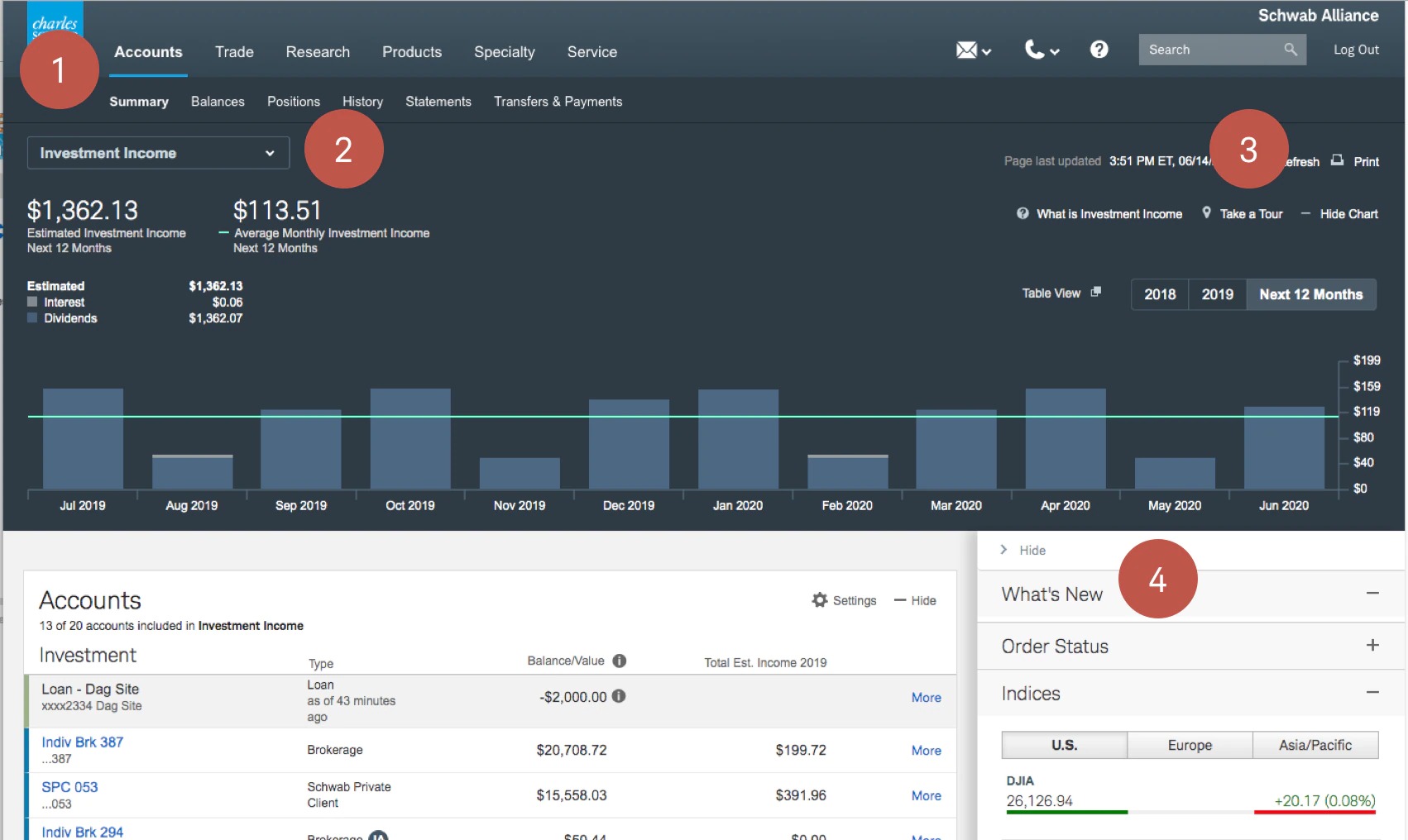

To set up dividend reinvestment, log in to your Fidelity account and navigate to the “Account Features” or “Dividends and Distributions” section. Look for the option to enroll in a dividend reinvestment program. Follow the prompts and provide the necessary information, including the investments you want to reinvest dividends into.

Step 5: Review and Confirm:

After entering your reinvestment preferences, carefully review the details before confirming your enrollment. Ensure that all information is accurate, including the investments chosen for reinvestment and the reinvestment ratio. Pay attention to any fees or charges associated with the program to make an informed decision.

Step 6: Monitor and Manage:

Once you have set up dividend reinvestment with Fidelity, you can monitor your progress through your account dashboard. Fidelity provides tools and resources to track your dividend income, reinvestment transactions, and overall portfolio performance. Regularly review your reinvestment strategy and make adjustments as needed based on your financial goals and market conditions.

It’s important to note that dividend reinvestment is not a one-time setup process – it is an ongoing strategy. As you continue to invest and receive dividends, Fidelity will automatically reinvest them according to your preferences, helping you compound your returns and grow your wealth over time.

By following these simple steps, you can conveniently set up dividend reinvestment with Fidelity and take advantage of the benefits it offers.

Step-by-Step Guide to Reinvesting Dividends with Fidelity

Reinvesting dividends with Fidelity is a straightforward process that can be completed using their user-friendly online platform. Here’s a step-by-step guide to help you navigate the process:

Step 1: Log in to your Fidelity Account:

Ensure you have your Fidelity account login credentials ready. Visit the Fidelity website and sign in to your account using your username and password.

Step 2: Navigate to the Account Overview:

Once logged in, navigate to the account overview page. You can usually find this page by clicking on the “Accounts” or “Portfolio” tab in the top menu.

Step 3: Select the Investment Account:

If you have multiple investment accounts with Fidelity, select the specific account where you want to reinvest dividends. It could be an individual brokerage account, IRA, or any other eligible account.

Step 4: Find the Dividend Reinvestment Section:

Look for the section related to dividend reinvestment in your investment account overview. This section is typically labeled as “Dividends” or “Dividends and Distributions.”

Step 5: Enroll in Dividend Reinvestment:

Once you’ve found the dividend reinvestment section, you should see an option to enroll in the program. Click on the appropriate button or link to initiate the enrollment process.

Step 6: Select the Investments to Reinvest:

After enrolling in the dividend reinvestment program, you will be prompted to choose the specific investments you want to reinvest dividends into. Fidelity provides a list of eligible securities, including stocks and mutual funds, from which you can make your selections.

Step 7: Set the Reinvestment Parameters:

Specify the reinvestment parameters based on your preferences. You may have options like percentage or full dividend reinvestment. Choose the desired reinvestment ratio or select the option to reinvest the full dividend amount.

Step 8: Review and Confirm:

Once you have made your selections, carefully review the details of your dividend reinvestment enrollment. Check that the investments and reinvestment parameters are accurately set. Take note of any fees or charges associated with the program.

Step 9: Submit the Enrollment:

Once you are satisfied with the details, submit the enrollment request. Fidelity may require you to confirm the enrollment through an additional verification step, such as using a security code.

Step 10: Monitor and Manage your Dividend Reinvestment:

After enrolling in the dividend reinvestment program, you can monitor and manage your reinvested dividends through your Fidelity account. Keep an eye on your dividend income, reinvestment transactions, and overall portfolio performance. Make adjustments to your reinvestment strategy as needed.

By following this step-by-step guide, you can easily reinvest your dividends with Fidelity and take advantage of the compounding power of reinvested dividends to grow your investment portfolio.

Tools and Resources for Dividend Reinvestment

When it comes to reinvesting dividends with Fidelity, you have access to a range of tools and resources to assist you in making informed decisions and maximizing your investment returns. Here are some valuable resources provided by Fidelity:

1. Dividend Reinvestment Calculator:

Fidelity offers a dividend reinvestment calculator that allows you to estimate the potential growth of your dividend reinvestments over time. This tool takes into account factors such as dividend yield, reinvestment frequency, and compounding to provide you with insights into the future value of your reinvested dividends.

2. Research and Insights:

Fidelity provides extensive research and market insights to help you make informed investment decisions. Their platform offers access to market research reports, analyst recommendations, and industry insights. Utilize this information to identify dividend-paying stocks and funds that align with your investment goals and risk tolerance.

3. Education Center:

Fidelity’s Education Center is a valuable resource for dividend investors. It offers a wide range of educational materials, including articles, tutorials, webinars, and videos, to help you deepen your understanding of dividend investing and dividend reinvestment strategies. Whether you’re a beginner or an experienced investor, the Education Center can provide you with valuable insights and guidance.

4. Portfolio Analysis Tools:

Fidelity’s portfolio analysis tools enable you to track and evaluate the performance of your dividend reinvestments. These tools provide a comprehensive overview of your portfolio, including dividend income, total returns, and asset allocation. Use these tools to monitor the progress of your reinvestment strategy and make informed decisions to optimize your portfolio’s performance.

5. Mobile Apps:

Fidelity’s mobile apps allow you to manage your dividend reinvestment on the go. With features such as dividend alerts, account monitoring, and trade execution, you can stay connected to your investments and make timely decisions. The mobile apps offer a convenient and efficient way to reinvest dividends and stay informed about your portfolio performance.

6. Customer Support:

Fidelity provides excellent customer support to assist you with any questions or concerns related to dividend reinvestment. Their team of professionals is available via phone, email, or online chat to provide guidance and address any issues you may encounter during the dividend reinvestment process.

By utilizing these tools and resources provided by Fidelity, you can enhance your dividend reinvestment strategy and make well-informed decisions to optimize your investment returns.

Tips for Maximizing Dividend Reinvestment

Maximizing your dividend reinvestment strategy with Fidelity requires careful planning and informed decision-making. Here are some valuable tips to help you make the most out of your dividend reinvestment:

1. Reinvest in Dividend Aristocrats:

Dividend Aristocrats are companies that have consistently increased their dividends for at least 25 consecutive years. These companies have a strong track record of generating stable and growing dividends. Consider allocating a portion of your dividend reinvestment to Dividend Aristocrat stocks to benefit from their long-term dividend growth potential.

2. Diversify Your Holdings:

Ensure that your dividend reinvestment portfolio is well-diversified across different sectors and industries. Diversification helps to spread risk and can potentially improve your overall returns. Consider investing in a mix of dividend-paying stocks and mutual funds across various sectors to mitigate concentration risk.

3. Pay Attention to Dividend Yield:

Dividend yield is a crucial factor to consider when selecting investments for dividend reinvestment. Focus on stocks or funds with a reasonable dividend yield, balancing high yield with sustainability and growth potential. Be cautious of excessively high yields, as they may indicate underlying issues with the company’s financials.

4. Regularly Review and Adjust Your Portfolio:

Regularly review your dividend reinvestment portfolio to ensure it aligns with your investment goals and risk tolerance. Monitor the performance of your holdings, keeping an eye on any changes in dividend policies or financial outlooks. Make adjustments as needed to optimize your portfolio and seize opportunities.

5. Consider Dividend Reinvestment in Tax-Advantaged Accounts:

Investing in tax-advantaged accounts, such as IRAs or 401(k) plans, can enhance the benefits of dividend reinvestment. Dividends reinvested within these accounts can grow tax-free or tax-deferred, allowing for potentially higher overall returns. Evaluate the tax advantages of different account types and consider allocating dividend reinvestment to tax-advantaged accounts whenever possible.

6. Reinvest in Undervalued Stocks:

Look for opportunities to reinvest dividends into stocks that may be undervalued in the market. Undervalued stocks have the potential for capital appreciation, which can amplify the overall returns generated by dividend reinvestment. Conduct thorough research and analysis to identify potential undervalued opportunities.

7. Take Advantage of Dividend Reinvestment Plans:

In addition to Fidelity’s dividend reinvestment program, many companies offer their own dividend reinvestment plans (DRIPs). These plans allow you to directly reinvest dividends back into the issuing company’s stock, often at discounted prices. Explore the possibility of participating in these DRIPs to benefit from cost-effective reinvestment options.

By implementing these tips, you can optimize your dividend reinvestment strategy with Fidelity and potentially maximize your investment returns over the long term.

Conclusion

Reinvesting dividends with Fidelity can be a powerful strategy for investors looking to grow their wealth. By harnessing the power of compounding and taking advantage of Fidelity’s robust platform and resources, you can potentially accelerate your investment returns and achieve your financial goals.

In conclusion, dividend reinvestment with Fidelity offers a convenient and cost-effective way to potentially accelerate your investment returns. By reinvesting dividends and utilizing the tools and resources provided, you can take control of your financial future and work towards achieving your long-term goals. Start harnessing the power of dividend reinvestment with Fidelity and unlock the potential for compounding your wealth over time.