Finance

How To Update My Business Address With The IRS

Published: October 31, 2023

Learn how to update your business address with the IRS and stay compliant. Get expert tips and guidance for managing your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Updating your business address with the Internal Revenue Service (IRS) is crucial to ensure smooth communication and compliance with tax obligations. Whether you have moved to a new location or need to make changes to your existing business address, it’s essential to keep the IRS informed of the updated information. Failing to update your address can lead to missed correspondence, penalties, and potential legal issues.

Thankfully, the IRS provides a user-friendly online system that allows you to easily update your business address. In this article, we’ll guide you through the step-by-step process of updating your business address with the IRS. By following these instructions, you can ensure that your business records are accurate and up to date, avoiding any potential complications or delays.

Note: The process outlined below applies to sole proprietors, partnerships, limited liability companies, corporations, and other organizations. If you operate under an individual taxpayer identification number (ITIN), the process may vary. Please consult the IRS website or seek professional advice for specific instructions related to your circumstances.

Step 1: Gather Required Documents

Before updating your business address with the IRS, it’s important to gather the necessary documents to ensure a smooth and efficient process. Here are the documents you will need:

- EIN Confirmation Letter: You will need your Employer Identification Number (EIN) confirmation letter, which was issued to you by the IRS when you initially registered your business. This letter serves as proof of your business’s identification and is required to update your address.

- Legal Business Name Documentation: Prepare any documentation that proves the legal name of your business. This could include articles of incorporation, partnership agreements, or state-level registration documents. Make sure to have these documents readily available, as they may be requested during the updating process.

- Authorized Representative Information: If you are designating someone else to update the address on behalf of your business, gather their information, including their full name, contact details, and authorization documentation. This individual should have the authority to make changes to your business’s information.

- Proof of New Address: Lastly, gather documentation that demonstrates your new business address. This can include lease agreements, utility bills, or any official document that clearly shows the address change.

By gathering these documents beforehand, you will be well-prepared to accurately update your business address with the IRS. Having all the necessary information readily available will help streamline the updating process and minimize any potential delays or complications.

Step 2: Access the IRS Online System

Once you have gathered the required documents, it’s time to access the IRS online system to update your business address. The IRS provides a secure and convenient online platform called the “Business Services Online (BSO)” where you can make address changes and manage other business-related tasks. Follow these steps to access the system:

- Visit the IRS Website: Go to the IRS official website at www.irs.gov and navigate to the “Businesses” section.

- Access Business Services Online: Under the “Tools” tab, click on “Businesses Online Services” or search for “Business Services Online” in the search bar.

- Create an Account: If you don’t have an account yet, you will need to create one by selecting “New Users” and providing the required information, including your EIN, personal details, and email address.

- Verify Your Identity: After creating the account, you will be prompted to verify your identity. This may involve answering security questions or providing specific information from your prior tax returns.

- Login to Business Services Online: Once your identity is verified, you can log in to the Business Services Online system using your newly created credentials.

By following these steps, you will gain access to the IRS online platform, allowing you to proceed with updating your business address efficiently and securely.

Step 3: Update Business Information

After accessing the IRS Business Services Online (BSO) system, you are now ready to update your business address. Follow these steps to navigate through the process:

- Select “Update a Business Address”: Once logged into the BSO system, look for the option to update your business address. This may be under the “Account Management” or “Business Information” section.

- Provide Required Information: The system will prompt you to enter the necessary information to update your address. This typically includes your EIN, legal business name, and other identifying details.

- Enter New Address: Input your new business address accurately and in the required format. Double-check the entered information to ensure it is error-free.

- Verify the Address: The BSO system may prompt you to verify the entered address using the United States Postal Service (USPS) Address Validation System. This step is crucial to ensure the accuracy of the address and avoid potential errors.

- Confirm the Changes: After reviewing the entered address details, confirm that you want to update your business address with the provided information. Please note that once confirmed, the address change will be processed, and the IRS will be notified.

It is essential to ensure that all the information you provide during the updating process is accurate and up to date. Any inaccuracies or errors may result in delays or complications in the address update.

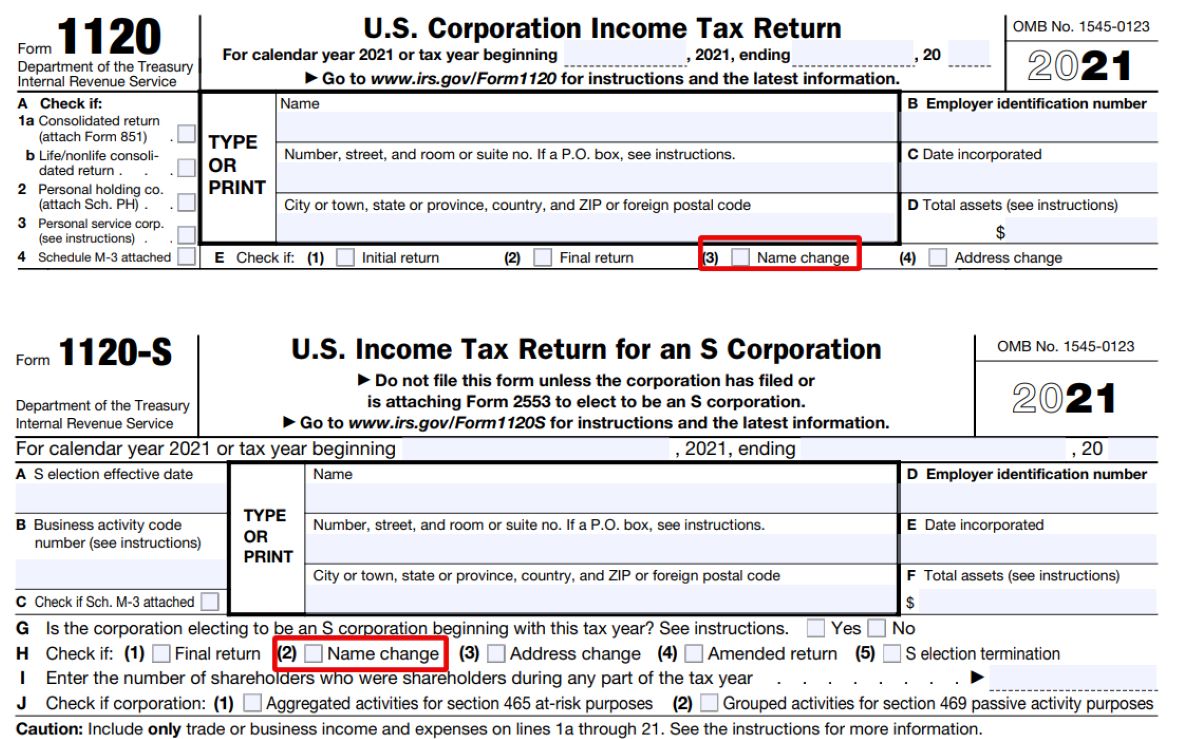

Keep in mind that the IRS may have additional steps or requirements, depending on your business entity type. Some entities, such as partnerships or corporations, may require additional documentation or authorization to update the address. If you encounter specific instructions or requests during the updating process, follow them accordingly to successfully complete the address change.

Step 4: Verify and Confirm Changes

Once you have entered the new business address and confirmed the updates, it is crucial to verify the changes before finalizing the process. Follow these steps to ensure the accuracy of the updated information:

- Review the Entered Address: Take a moment to carefully review the new business address you provided. Check for any typographical errors, misspellings, or missing information. It is essential that the address is entered correctly to avoid any potential issues.

- Confirm Accuracy with USPS Validation: The IRS online system may provide an option to validate the entered address using the USPS Address Validation System. This step helps ensure that the address is recognized and considered valid by the postal service. Verify and correct any discrepancies or errors indicated by the validation system.

- Double-Check Other Updates: Apart from the address, review any other business information that may have been updated during the process. This can include changes to your business name or contact details. Make sure all the updated information is accurate and reflects your current business status.

- Save or Print Confirmation: Once you have reviewed and confirmed the changes, the system may provide you with a confirmation page or a reference number. It is recommended to save or print this confirmation for your records. This document serves as proof that you have successfully updated your business address with the IRS.

By taking the time to verify and confirm the changes, you can ensure that the updated business address is accurate and prevent potential issues or delays in the future. It is crucial to keep a record of the confirmation as proof of the address update.

Step 5: Print Confirmation Certificate

After successfully updating your business address with the IRS, it is important to obtain a printed confirmation certificate. This document serves as proof of the address change and can be useful for various purposes, such as updating business records or providing documentation to other entities. Follow these steps to print your confirmation certificate:

- Access Confirmation Page: Once you have completed the process of updating your business address, the IRS online system will typically provide you with a confirmation page or a reference number. Make sure to access this page before proceeding to the next steps.

- Select Print Option: On the confirmation page, look for an option to print the certificate. This is usually located at the top or bottom of the page and may be labeled as “Print Certificate” or a similar phrase. Click on this option to initiate the printing process.

- Set Printer Preferences: Before printing, ensure that your printer settings are configured correctly. Verify that the paper size and orientation are appropriate for the document, and make any necessary adjustments to ensure the confirmation certificate is printed clearly and accurately.

- Print the Certificate: Once you have confirmed the printer preferences, click on the print button to begin printing the confirmation certificate. Make sure to have enough paper and ink or toner in your printer to complete the printing process successfully.

- Review the Printed Certificate: Once the certificate is printed, carefully review it to ensure that all the information is clear and legible. Check that the updated business address is accurately reflected on the certificate, along with any other relevant details.

By printing the confirmation certificate, you have tangible proof of the updated business address with the IRS. It is advisable to keep this document in a safe and easily accessible place for future reference and documentation purposes.

Step 6: Notify Other Government Agencies

Updating your address with the IRS is an important step, but it’s equally crucial to notify other relevant government agencies of the change. By keeping all government entities informed, you ensure that your business information is accurate across the board. Here are some key government agencies to notify of your updated business address:

- State Revenue Departments: Contact your state’s revenue department or tax agency to update your address with them. This ensures that your state tax returns, licenses, and other state-level documents are sent to the correct location.

- Department of Labor: If your business is subject to federal labor laws, such as the Fair Labor Standards Act (FLSA), it’s important to inform the Department of Labor about your address change. This helps ensure that they have accurate information for any future correspondence or audits.

- Social Security Administration (SSA): If you have employees and are responsible for deducting Social Security taxes, you must inform the SSA of your updated address. This ensures that W-2 forms and other important payroll-related documents are sent to the correct location.

- Department of Homeland Security (DHS): Notify the DHS if your business is enrolled in any programs or has relationships with this agency. This is especially important if you participate in programs such as E-Verify or if your business is subject to immigration-related regulations.

- State Licensing Agencies: If your business holds any professional licenses or permits issued by your state, notify the respective licensing agencies to update your address. This includes licenses for professions such as real estate, medical, legal, and more.

- Local and Municipal Governments: Depending on your business’s location, you may need to inform local and municipal government entities of your address change. This can include city hall, the county clerk’s office, or any other relevant local agencies.

It’s important to research and identify the relevant government agencies based on your business type and location. Each agency may have specific guidelines and procedures for updating your address, so be sure to follow their instructions to ensure a seamless transition.

By notifying these government agencies promptly, you can avoid potential miscommunications, ensure the smooth processing of any paperwork or permits, and maintain compliance with relevant regulations.

Step 7: Keep Updated Records

Once you have completed the process of updating your business address with the IRS and other government agencies, it is essential to maintain updated records for future reference. Keeping accurate and organized records helps ensure that you have proof of the address change and can easily access the information when needed. Here are some tips for effectively managing your updated records:

- Save Confirmation Documents: As mentioned earlier, save any confirmation certificates or reference numbers provided by the IRS or other government agencies. Store them in a secure location, such as a digital folder or a physical file, along with other important business documents.

- Create a Recordkeeping System: Establish a system to organize your business records, including documents related to the address change. Consider using digital tools or software that allow you to easily categorize and store important files, ensuring they can be retrieved whenever necessary.

- Maintain a Log: Keep a log or spreadsheet that tracks the dates and details of each communication made regarding the address change. This can include the agencies notified, the date of notification, and any reference numbers or confirmation received.

- Update Internal Systems: Update your internal business systems, databases, and records to reflect the new address. This includes updating customer databases, vendor information, and any other platforms or software that may hold your business address.

- Set Reminders: It’s a good practice to set reminders to periodically review and update your business address if necessary. This helps ensure that your records stay current and that any future changes can be easily managed.

- Consolidate Other Address Changes: If your business has multiple locations or if you have made any personal address changes, consider consolidating all address updates to minimize administrative burdens. This helps streamline the process and ensures that all relevant parties are notified of the changes.

By keeping updated records, you can maintain a clear and organized documentation trail of your business’s address change. This can potentially save you time and effort in the future when dealing with legal, financial, or compliance-related matters.

Remember to consult with a tax professional or legal advisor if you have any specific concerns or questions regarding recordkeeping or updating your business address.

Conclusion

Updating your business address with the IRS is a vital task to ensure compliance with tax obligations and maintain clear communication with government entities. By following the step-by-step process outlined in this article, you can successfully update your business address and ensure that your records are accurate and up to date.

Remember to gather the required documents, access the IRS online system, and update your business information accurately. Take the time to verify and confirm the changes, and don’t forget to print a confirmation certificate for your records. Additionally, notify other relevant government agencies of the address change to ensure consistency across all platforms.

Lastly, maintain updated records of the address change and store important documents and confirmations in a secure location. Keeping organized records will prove valuable for future reference and provide peace of mind in case of any inquiries or audits.

Always make sure to consult with a tax professional or legal advisor if you have any specific questions or concerns regarding updating your business address with the IRS or any other related matters.

By diligently updating your business address with the IRS and staying proactive in keeping government agencies informed, you can ensure smooth operations, stay compliant with regulatory requirements, and maintain a strong foundation for your business’s continued success.