Finance

How To Address The IRS In A Letter

Published: October 31, 2023

Learn how to properly address the IRS in a letter to ensure your financial matters are handled effectively and professionally. Expert tips and guidelines for addressing your finance-related concerns.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to addressing the Internal Revenue Service (IRS) in a letter, proper formatting and professional tone are essential. Whether you are seeking clarification on a tax issue, disputing a tax assessment, or requesting an installment agreement, it is crucial to approach your correspondence with the IRS in a clear and concise manner. By following a few guidelines, you can ensure that your letter effectively conveys your message and elicits a prompt response.

In this article, we will outline the necessary steps to format and address a letter to the IRS. From including your contact information and the date to crafting a well-structured body and closing paragraph, we will provide you with a comprehensive guide to successfully communicate with the IRS through written correspondence.

While writing a letter to the IRS may seem like a daunting task, it is important to remember that clear and concise communication is key. By following the guidelines outlined in this article, you can effectively address your concerns and receive the necessary assistance from the IRS. So, let’s get started with formatting the letter properly.

Formatting the Letter

Proper formatting is crucial when writing a letter to the IRS. It establishes a professional tone and ensures that your message is conveyed effectively. Here are some essential formatting considerations:

- Font and Font Size: Use a standard font such as Times New Roman or Arial, with a font size of 12. This ensures readability and consistency.

- Margins: Set margins of 1 inch on all sides of the page to maintain a clean and organized appearance.

- Spacing: Use single line spacing for the body of the letter. However, leave a blank line between paragraphs for clarity.

- Alignment: Align the text to the left, creating a professional and easy-to-read format.

- Length: Keep the letter concise and to the point. Aim for one to two pages, if possible, but only include relevant information.

Adhering to these formatting guidelines helps the IRS easily review and process your letter, leading to a quicker and more efficient resolution of your tax issue. Now, let’s move on to the next important aspect: including your contact information.

Contact Information

When writing a letter to the IRS, it is important to include your contact information at the top of the letter. This helps the IRS to identify and respond to your inquiry promptly. Here’s what you should include:

- Your Full Name: Begin by providing your full legal name. Make sure to use the name that corresponds with your tax records to avoid any confusion.

- Address: Include your complete mailing address, including the street address, city, state, and ZIP code. This ensures that the IRS can send any necessary correspondence to the correct location.

- Phone Number: Provide a working phone number where you can be reached. This allows the IRS to contact you if they need additional information or have questions regarding your letter.

- Email Address: While not mandatory, including your email address can be helpful in case the IRS prefers to communicate with you electronically.

By including your contact information, you establish clear lines of communication with the IRS and ensure that they can reach you easily. Providing accurate and up-to-date contact details is crucial for effective correspondence. Now, let’s move on to the next section: the date.

Date

The date is an essential component of any formal letter, including a letter to the IRS. It provides a reference point for both you and the IRS to track the timeline of your communication. Here are a few guidelines for including the date in your letter:

- Placement: The date should be located at the top right or left corner of your letter, below your contact information.

- Format: The date should be written in month, day, and year format (e.g., January 15, 2022) or in a numeric format (e.g., 01/15/2022).

- Consistency: Ensure that the date is consistent with the date of mailing and any other documentation you may be submitting. This helps to establish a clear timeline of events.

By including the date in your letter, you provide the IRS with a reference point for tracking and responding to your request. It also adds a level of professionalism and organization to your correspondence. Now that we have addressed the importance of the date, let’s move on to the next section: the IRS address.

IRS Address

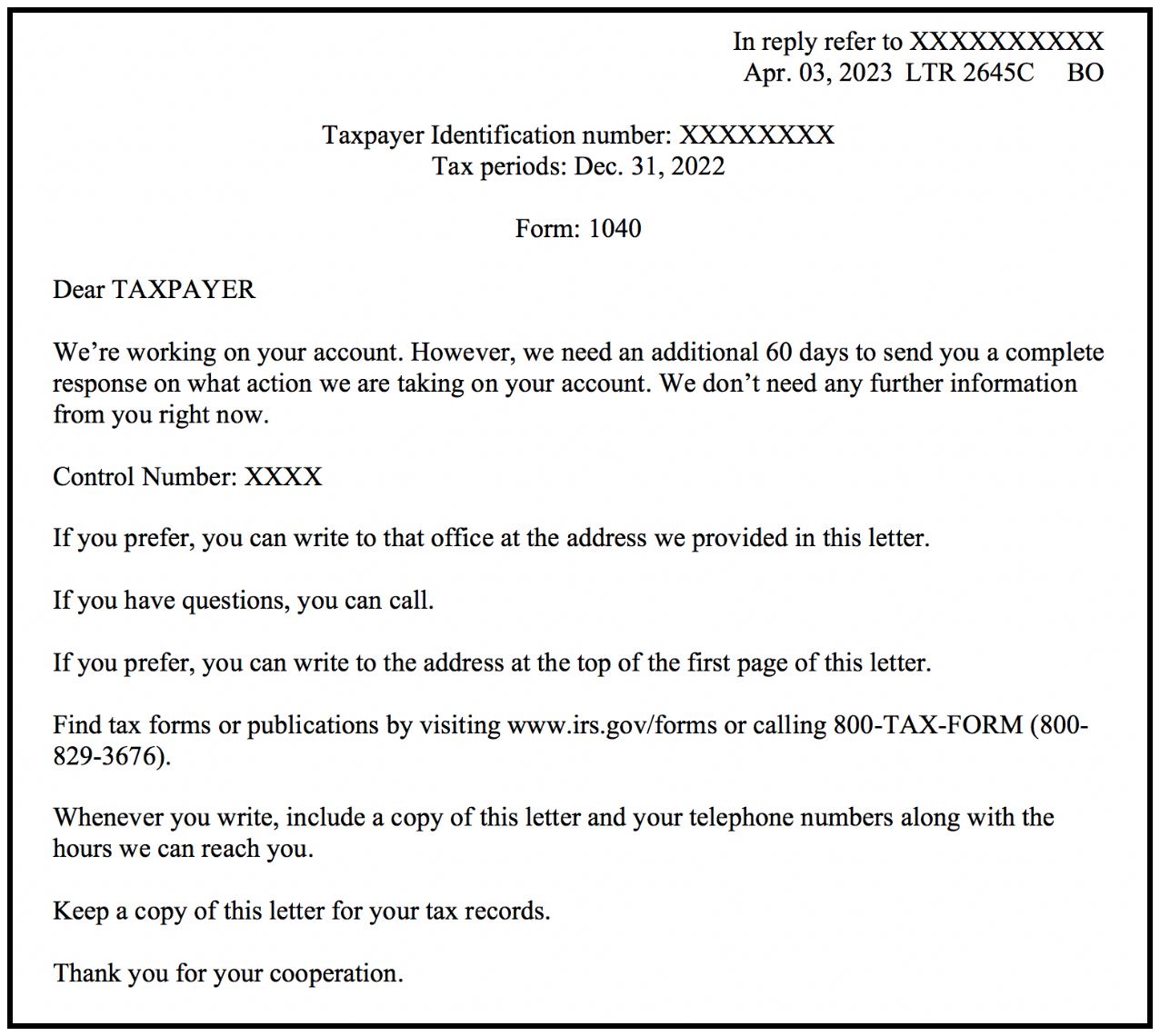

Knowing the correct address for sending your letter to the IRS is crucial to ensure that it reaches the appropriate department and is processed efficiently. The address you use will vary depending on the purpose of your letter and your specific tax issue. Here are some guidelines for finding and using the correct IRS address:

- IRS Website: The best and most reliable source for finding the correct IRS address is the official IRS website. Visit the IRS website and search for the specific department or office that handles your tax issue. They will provide you with the correct mailing address.

- Form Instructions: If you are responding to a notice or using a specific IRS form, check the instructions provided. They often include the correct mailing address for that particular form or notice.

- Search Online: If you are unable to find the address through the IRS website or form instructions, a simple online search using relevant keywords like “IRS address for [specific tax issue]” can often yield the correct address.

It is important to ensure that you use the correct IRS address to avoid any delays or miscommunication. Double-check the address before mailing your letter to ensure its accuracy. With the correct address in hand, let’s move on to the next section: the salutation.

Salutation

The salutation is the greeting you use to address the recipient of your letter. When writing to the IRS, it is important to maintain a professional tone and use the appropriate salutation. Here are some guidelines to follow when addressing the IRS in your letter:

- Dear: Begin your salutation by using the term “Dear” followed by the appropriate title. If you are unsure of the specific recipient’s name, you can use a general salutation such as “Dear IRS Representative” or “Dear Sir/Madam.”

- Specific Individual: If you have been in direct contact with an IRS agent or representative, and they have provided you with their name, it is appropriate to use it in your salutation. For example, “Dear Mr. Smith” or “Dear Ms. Johnson.”

- Avoid Informal Greetings: While it may be tempting to use more informal greetings, such as “Hi” or “Hello,” it is important to maintain a professional tone when addressing the IRS.

By using a proper salutation, you show respect and professionalism in your letter. Remember to double-check the spelling and title of the recipient’s name if you are addressing a specific individual. Now that we have covered the salutation, let’s move on to crafting the opening paragraph of your letter.

Opening Paragraph

The opening paragraph of your letter is where you introduce the purpose of your communication and set the overall tone for your message. It is important to start your letter with a concise and clear statement that clearly outlines the reason for writing to the IRS. Here are some guidelines to follow when crafting the opening paragraph:

- State Your Purpose: Begin by briefly stating the reason for writing to the IRS. For example, if you are seeking clarification on a tax issue, you could write, “I am writing to seek clarification regarding the calculation of my income tax for the year [year].” If you are disputing a notice or assessment, state that clearly in this paragraph.

- Provide Relevant Information: In this paragraph, you can also include any relevant reference numbers, such as an IRS notice number or tax return identification number, to help the IRS identify your specific case.

- Keep it Concise: Remember to keep your opening paragraph to the point and concise. Avoid unnecessary details or long explanations at this stage. You will have the opportunity to provide more specific information in the body of the letter.

By crafting a clear and concise opening paragraph, you effectively communicate the purpose of your letter and capture the IRS’s attention. Now that we have established the purpose of your letter, let’s explore the body of the letter and its structure in the next section.

Body of the Letter

The body of your letter is where you provide the necessary details and information to support your purpose or address your tax issue. It is essential to organize your thoughts and present your arguments or inquiries in a clear and logical manner. Here are some guidelines to follow when writing the body of your letter to the IRS:

- Paragraphs: Divide your letter into paragraphs, each addressing a specific point or topic. This helps to maintain clarity and readability.

- Use Clear and Concise Language: Be clear and concise in explaining the details of your case or inquiry. Use simple language and avoid unnecessary jargon.

- Support your Claims: If you are disputing a tax assessment or providing explanations for certain deductions or credits, provide supporting documentation or references to relevant tax laws or regulations.

- Chronological Order: If there is a timeline or sequence of events related to your tax issue, present the information in chronological order. This helps the IRS understand the progression of your case.

Take the time to carefully organize and structure the body of your letter, ensuring that all relevant information is included and presented logically. By doing so, you enhance the clarity and effectiveness of your communication with the IRS. In the next section, we will discuss addressing a specific tax issue within the body of the letter.

Specific Tax Issue

If you are addressing a specific tax issue in your letter to the IRS, it is important to clearly and concisely explain the situation. Providing accurate and detailed information about the issue at hand will help the IRS better understand your perspective and respond appropriately. Here’s how you can address a specific tax issue in your letter:

- Provide Background: Start by briefly explaining the background of the tax issue you are addressing. Include relevant dates, tax years, and any previous correspondence or interactions with the IRS regarding the issue.

- Explain Your Position: Clearly articulate your position on the tax issue. If you believe there has been an error in the calculation, provide supporting evidence or documentation to substantiate your claim.

- Cite Applicable Laws or Regulations: If relevant, refer to specific tax laws, regulations, or IRS publications that support your position. This demonstrates your knowledge of the tax code and strengthens your argument.

- Ask for Resolution: Clearly state what you are seeking from the IRS regarding the specific tax issue. Whether it is a revised tax assessment, a refund, or a request for further explanation, make your desired resolution clear.

By addressing the specific tax issue in a clear and concise manner, you provide the IRS with the necessary information to understand your position. Including supporting documentation and references to relevant laws or regulations further enhance your case. In the next section, we will discuss the importance of including supporting documents with your letter.

Supporting Documents

When addressing a tax issue in your letter to the IRS, including supporting documents can strengthen your case and provide evidence to support your claims. Supporting documents can include various forms, receipts, invoices, bank statements, or any other relevant paperwork that substantiates the information you provided in your letter. Here’s how you can effectively include supporting documents with your letter:

- Relevance: Only include supporting documents that are directly relevant to the tax issue you are addressing. Make sure that the documents clearly support the claims or explanations you have provided in your letter.

- Organize and Label: Arrange the supporting documents in a logical order and label them appropriately. Use clear and concise labels that correspond to the information or argument they support.

- Provide Copies: Always provide copies of the supporting documents and retain the originals for your records. Do not send original documents to the IRS as they might not be returned.

- Referencing: In your letter, refer to the specific supporting documents by their labels or descriptions. Clearly indicate which documents correspond to the points you are making in your letter.

By including relevant and well-organized supporting documents, you provide the IRS with tangible evidence to consider alongside your letter. This can strengthen your case and increase the chances of a favorable resolution. In the next section, we will discuss crafting the closing paragraph of your letter.

Closing Paragraph

The closing paragraph of your letter serves as a summary of your main points and a call to action for the IRS. It is your final opportunity to convey your desired outcome and request a specific action from the IRS. Here are some guidelines for crafting an effective closing paragraph:

- Summarize: Provide a concise summary of the main points you have discussed in the body of your letter. Restate your position and any supporting evidence you have provided.

- Specific Request: Clearly state what action you are requesting from the IRS. Whether it is a revised tax assessment, an explanation of a particular calculation, or any other resolution, be explicit in your request.

- Contact Information: Reiterate your contact information such as your phone number and email address, so the IRS can easily reach out to you if needed.

- Gratitude: Express appreciation for the IRS’s attention to your letter and for their timely response. This showcases your professionalism and gratitude for their consideration.

The closing paragraph is your final opportunity to make a positive impression and clearly convey your expectations to the IRS. By summarizing your main points and making a specific request, you provide clarity and direction to the IRS, increasing the likelihood of a satisfactory response. In the following sections, we will discuss other important elements to include in your letter, such as a signature and enclosures.

Signature

A proper signature at the end of your letter adds a personal touch and validates your correspondence. It is essential to include a signature to confirm the authenticity of the letter and signify your agreement with its contents. Here are some guidelines for including a signature in your letter:

- Handwritten Signature: Ideally, you should physically sign the letter with your handwritten signature. Use a dark pen or ink to ensure clarity.

- Typed Signature: If you are unable to provide a handwritten signature, a typed signature is acceptable. Simply type your full name followed by “/s” to indicate that it is a typed signature.

- Title: Beneath your signature, you can optionally include your job title or position, especially if you are representing a business or organization.

By including a proper signature, you add a level of authenticity and professionalism to your letter. It represents your agreement with the content and signifies that you stand behind the information provided. In the next section, we will discuss the enclosures that you may need to include with your letter.

Enclosures

Enclosures refer to any additional documents or forms that you want to include with your letter to provide further information or support your claims. When sending enclosures, it is essential to mention them in your letter to ensure that the IRS is aware of their presence and can review them accordingly. Here are some guidelines for including enclosures with your letter:

- List of Enclosures: Create a list of enclosures and include it below your signature in the closing section of your letter. Clearly label each enclosure with a brief description or title.

- Relevance: Only include enclosures that are directly relevant to your tax issue and support the points you have made in your letter. Avoid including excessive or unnecessary documents.

- Organization: Make sure the enclosures are well-organized and presented in a logical order. Label each document clearly to correspond with the list of enclosures provided in your letter.

- Copies: Always provide copies of the enclosures. Keep the original documents for your records, as the IRS might not return them.

By including relevant and well-organized enclosures, you provide additional evidence or information that can support your case or clarify any concerns. Clearly mentioning the enclosures in your letter ensures that the IRS is aware of the supporting documents you have included. In the next sections, we will outline two important aspects of sending a letter to the IRS: creating a copy for your records and proof of mailing.

Copy of Letter and Documentation

When sending a letter to the IRS, it is crucial to keep a copy of the letter and any supporting documentation for your records. This serves as a reference point and ensures that you have a complete record of the information you have provided. Here’s why creating and retaining copies is important:

- Record Keeping: Keeping a copy of your letter and supporting documentation allows you to refer back to it in the future. It provides a reference of the information you provided and any actions you have taken regarding your tax issue.

- No Misplacement: In case the IRS misplaces or loses your original letter, having a copy serves as proof that you indeed sent the correspondence and can help to resolve any disputes or issues that may arise.

- Future Communication: If you need to follow up or provide additional information to the IRS, having a copy of your original letter and documentation ensures that you can easily refer back to what you previously submitted.

It is recommended to make copies of your letter and supporting documentation before sending them to the IRS. Store these copies in a safe and organized manner, such as in a designated folder or electronically. This helps to safeguard your information and ensures easy access when needed. In the next section, we will discuss the importance of retaining proof of mailing when sending your letter to the IRS.

Proof of Mailing

Retaining proof of mailing is an important step when sending a letter to the IRS. It serves as evidence that you have sent the letter and can be crucial in case any issues or disputes arise regarding the delivery or receipt of your correspondence. Here’s why retaining proof of mailing is important:

- Confirmation of Delivery: Proof of mailing provides confirmation that your letter was sent to the IRS. This can be helpful if there are any questions or concerns about whether the IRS received your correspondence.

- Timeline of Communication: By retaining proof of mailing, you have a record of the date when your letter was sent. This proves that you have timely initiated communication with the IRS, which can be important when dealing with deadlines or time-sensitive matters.

- Evidence in Disputes: In case of any disputes or discrepancies, proof of mailing can serve as evidence that you fulfilled your obligation to send the letter to the IRS. This can help protect your rights and interests in case of any issues that may arise.

To obtain proof of mailing, it is recommended to use certified mail, registered mail, or a mail service that provides a physical receipt or tracking number. These services offer a level of security and can confirm the delivery of your letter. Keep the receipt or tracking information in a safe place along with your copy of the letter for future reference if needed.

Retaining proof of mailing adds an extra layer of security and ensures that you have evidence of the communication between you and the IRS. It provides peace of mind and protection in case any problems may arise. In the next section, we will conclude our discussion and summarize the key points covered in this article.

Conclusion

Writing a letter to the IRS can be a complex process, but with the proper formatting and attention to detail, you can effectively address your tax issues and communicate your concerns. In this article, we discussed the essential components of a letter to the IRS, including formatting, contact information, date, IRS address, salutation, opening and closing paragraphs, and the body of the letter.

We explored the importance of maintaining a professional tone, providing clear and concise information, and including supporting documents to strengthen your case. Additionally, we emphasized the significance of creating copies of your letter and documentation and retaining proof of mailing to ensure a comprehensive record of your communication with the IRS.

By following the guidelines outlined in this article, you can approach your correspondence with the IRS in a structured and organized manner, increasing the likelihood of a prompt and satisfactory response. Remember, clear communication and attention to detail are key when addressing the IRS in a letter.

Thank you for reading this guide on how to address the IRS in a letter. We hope that this information has been helpful in navigating the process of communicating with the IRS effectively. Good luck with your tax matters!