Finance

How To Use Statement Credit

Published: January 9, 2024

Learn how to effectively use statement credit to manage your finances and maximize your savings. Discover expert tips and strategies for leveraging statement credits to your advantage.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of statement credit! If you’re looking for ways to save money and get the most out of your credit card, statement credit is a powerful tool to have in your financial arsenal. It’s a simple and convenient way to offset your credit card expenses and put some extra cash back in your pocket.

Statement credit is essentially a refund or credit applied to your credit card account. It can be earned through various means, such as signing up for a new credit card, meeting specific spending thresholds, or participating in promotional offers. The great thing about statement credit is that it can be used to reduce your outstanding balance or future purchases, depending on the terms and conditions set by your credit card issuer.

Statement credit is a win-win situation. Not only does it help you save money, but it also encourages responsible credit card usage. By taking advantage of statement credit opportunities, you can make your purchases more affordable and potentially avoid paying interest on your credit card balance.

In this article, we will dive deep into the world of statement credit. We’ll explore the different ways you can earn statement credit, the eligibility criteria for specific transactions, and how to make the most of this valuable credit card benefit. Whether you’re a novice or a seasoned credit card user, this guide will provide you with the information you need to make the most of statement credit.

So, let’s get started and unlock the potential of statement credit!

Understanding Statement Credit

Statement credit is a financial perk offered by credit card issuers that allows you to reduce your credit card balance or future purchases. Instead of receiving cash back or rewards points, you receive a credit applied directly to your credit card statement.

Statement credit is typically earned through specific transactions, promotions, or as part of a credit card rewards program. It can be a percentage of your total spending or a fixed amount, depending on the terms and conditions set by your credit card issuer.

One important thing to note is that statement credit is different from a cash refund. While a cash refund usually involves returning a product or requesting a refund for a specific transaction, statement credit is a general credit applied to your overall credit card balance. This means you can use it towards any future purchases or as a way to reduce your outstanding balance.

Statement credit can be a valuable benefit for credit card users. It allows you to offset the cost of purchases, effectively reducing the amount you need to pay. For example, if you earn $100 in statement credit and have a $500 credit card balance, the credit will reduce your balance to $400. This can make a significant difference in managing your finances and reducing your debt.

It’s important to keep in mind that statement credit does have limitations. It may have an expiration date, so be sure to check the terms and conditions of the credit card issuer. Additionally, statement credit cannot be converted into cash and typically cannot be transferred to another credit card account.

To take full advantage of statement credit, it’s important to understand the eligibility criteria for earning and redeeming it. In the next sections, we’ll explore the transactions that are usually eligible for statement credit and the different ways you can earn and redeem it with your credit card.

Eligible Transactions for Statement Credit

Not all transactions are eligible for statement credit. Credit card issuers specify certain categories or types of transactions that qualify for earning statement credit. While the specific eligibility criteria may vary depending on your credit card and issuer, here are some common examples of transactions that often qualify:

- Supermarket Purchases: Many credit cards offer statement credit for grocery store purchases. This can be a percentage back on your total spending or a fixed amount for reaching a specific spending threshold.

- Gas Station Purchases: Fuel purchases at gas stations are often eligible for statement credit. This can be a great way to offset the cost of your regular fill-ups and save some money in the process.

- Travel Expenses: Some credit cards provide statement credit for travel-related expenses, such as airline tickets, hotel stays, or rental cars. This can be a valuable perk for frequent travelers and can help reduce the overall cost of your trips.

- Dining and Entertainment: Credit cards may offer statement credit for dining out at restaurants, attending concerts, or going to the movies. This allows you to enjoy your favorite activities while earning credit towards your credit card balance.

- Online Shopping: Some credit cards partner with specific online retailers to offer statement credit for purchases made on their platforms. This is a great way to get rewarded for your online shopping habits.

These are just a few examples of eligible transactions that can earn you statement credit. It’s important to review the terms and conditions of your specific credit card to determine which transactions qualify and to what extent. Keep in mind that some credit cards may have spending thresholds or limits on the amount of statement credit that can be earned in a certain period.

Additionally, credit card issuers may exclude certain transactions from earning statement credit. These exclusions may include cash advances, balance transfers, and transactions that violate the credit card’s terms and conditions. It’s crucial to familiarize yourself with these exclusions to ensure you’re making eligible transactions to earn statement credit.

Now that you have an understanding of the transactions that typically qualify for statement credit, let’s explore how you can actually earn this valuable financial perk with your credit card.

How to Earn Statement Credit

Earning statement credit with your credit card can be a straightforward process, provided you meet the requirements set by your credit card issuer. Here are some common ways to earn statement credit:

- Sign-Up Bonuses: Many credit cards offer a sign-up bonus in the form of statement credit. These bonuses are typically awarded after you meet a specific spending threshold within a certain timeframe. For example, you may earn $200 in statement credit after spending $1,000 on purchases within the first three months of opening the account.

- Promotional Offers: Credit card issuers may periodically run promotional offers that allow you to earn statement credit. These offers may be targeted to specific spending categories or retailers. Keep an eye out for these promotions and make sure to opt-in to take advantage of the statement credit rewards.

- Rewards Programs: Some credit card rewards programs offer the option to redeem your rewards points for statement credit. This allows you to convert the accumulated points into credit that can be applied to your credit card balance.

- Spending Thresholds: Certain credit cards offer statement credit when you reach a specific spending threshold. For example, you may earn $50 in statement credit for every $500 spent on eligible purchases. This can provide an incentive to use your credit card for everyday expenses and earn credit along the way.

- Credit Card Partnerships: Credit card issuers often partner with retailers or brands to offer exclusive statement credit rewards. These partnerships may grant you special offers or higher statement credit rates when making purchases from their partner merchants.

When it comes to earning statement credit, it’s essential to understand the terms and conditions set by your credit card issuer. Make sure to review the benefits guide or contact the credit card customer service to learn about any specific earning opportunities or limitations associated with your credit card.

In addition to understanding how to earn statement credit, it’s equally important to keep track of the statement credit you’ve accumulated. This will ensure that you don’t miss out on utilizing the credit and maximize its benefits. In the next section, we’ll explore how you can easily track your statement credit with your credit card issuer.

Tracking Statement Credit

Keeping track of your statement credit is crucial to ensuring that you don’t miss out on redeeming it. Fortunately, tracking your statement credit is typically a straightforward process. Here are some ways you can easily monitor your statement credit:

- Online Account Management: Most credit card issuers provide an online portal or mobile app that allows you to manage your credit card account. Through these platforms, you can easily view your current statement credit balance and see how much you have accumulated.

- Monthly Statements: Your credit card statement will usually include a section that details any statement credit you have earned. Take the time to review your statements each month to ensure that you are aware of your current statement credit balance.

- Credit Card Apps: If your credit card issuer has a dedicated mobile app, it can be a convenient way to track your statement credit. These apps often provide real-time updates on your account balance, including any statement credit you have earned.

- Customer Service: If you have any questions or concerns about your statement credit, don’t hesitate to contact the customer service team of your credit card issuer. They can provide you with information about your current statement credit balance and any upcoming promotional offers.

By regularly checking your statement credit balance, you can have a clear overview of the rewards you have earned and plan your future spending accordingly. This will help ensure that you make the most of your statement credit and avoid missing out on any valuable benefits.

Once you have accumulated a significant amount of statement credit, it’s time to explore how you can redeem it and make the most of these valuable financial perks. In the next section, we’ll discuss the various ways to redeem statement credit with your credit card.

Redeeming Statement Credit

Redeeming your hard-earned statement credit can be an exciting and rewarding experience. The redemption process may vary depending on the credit card issuer and the specific terms and conditions of your credit card. Here are some common ways to redeem statement credit:

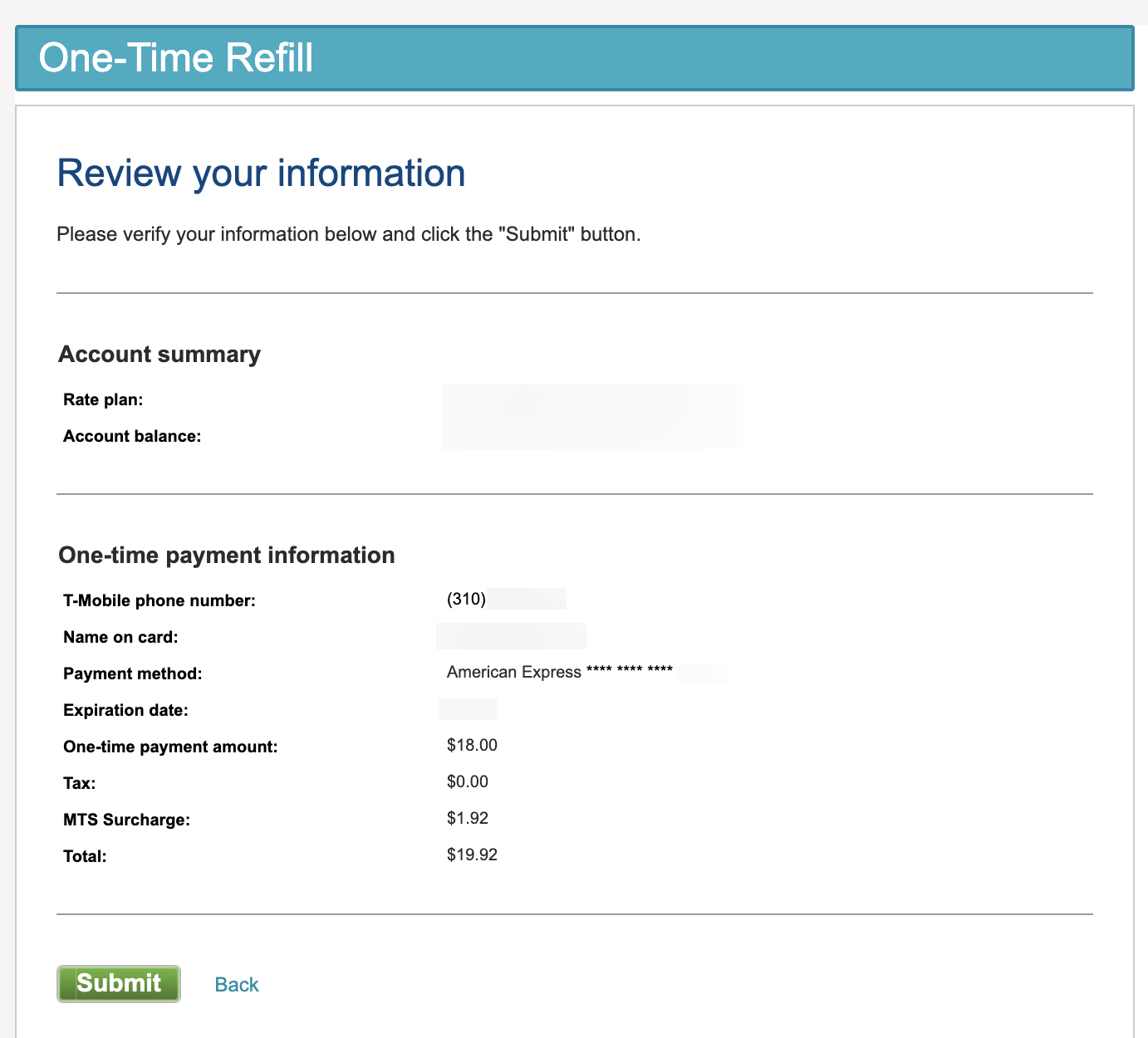

- Application Credit: When you redeem statement credit through application credit, the credit is applied directly to your outstanding balance. This reduces the amount you owe on your credit card and helps you save money by lowering your overall debt.

- Future Purchases: Some credit card issuers allow you to use your statement credit as a payment method for future purchases. When making a purchase, you can choose to apply your statement credit to offset the cost, effectively reducing the amount you need to pay.

- Gift Cards and Merchandise: Some credit card rewards programs offer the option to redeem your statement credit for gift cards or merchandise. This can be a great way to use your credit towards something you need or want, providing extra value beyond simply reducing your outstanding balance.

- Travel Expenses: If your credit card offers travel rewards, you may be able to redeem your statement credit for travel expenses such as airline tickets, hotel stays, or car rentals. This can help offset the cost of your next trip and make travel more affordable.

- Charitable Donations: In some cases, credit card issuers offer the option to donate your statement credit to a charity of your choice. This allows you to support causes you care about while utilizing your rewards in a meaningful way.

Before redeeming your statement credit, it’s essential to review the redemption options and any associated terms and conditions. Some credit cards may have minimum redemption amounts or specific redemption processes to follow. Make sure to familiarize yourself with the requirements to ensure a smooth and hassle-free redemption experience.

It’s worth noting that statement credit has an expiration date in some cases. If you let your statement credit expire, you will lose the opportunity to benefit from the credit. Therefore, it’s important to regularly check your statement credit balance and plan your redemptions accordingly.

Now that you have a good understanding of how to redeem your statement credit, let’s explore some tips for maximizing the value of your credits in the next section.

Tips for Maximizing Statement Credit

To make the most of your statement credit and maximize its value, consider these tips and strategies:

- Track your spending: Keep a close eye on your spending to ensure you meet the requirements for earning statement credit. Monitor your progress towards spending thresholds and take advantage of bonus categories to earn more credit.

- Combine statement credit offers: Look for opportunities to combine multiple statement credit offers. For example, if you have offers for supermarket purchases and dining out, try to use your credit card at a restaurant located in a supermarket to earn statement credit for both categories.

- Optimize your redemption: Choose the most beneficial redemption option for you. If you have a high outstanding balance, it may be more advantageous to apply your statement credit directly towards reducing your balance. If you have upcoming travel plans, consider redeeming your credit for travel expenses.

- Plan ahead for large purchases: If you have a substantial purchase coming up, check if your credit card offers statement credit for that category. It can be a great opportunity to earn significant credit and offset the cost.

- Take advantage of promotional offers: Stay updated on the promotional offers provided by your credit card issuer. These offers can provide higher statement credit rates, bonus rewards, or targeted earning opportunities in specific spending categories.

- Don’t forget about your rewards program: If your credit card has a rewards program, explore other redemption options beyond statement credit. You may find opportunities to convert your rewards points into travel miles, merchandise, or even cash back.

- Pay attention to expiration dates: Statement credits often come with expiration dates, so make sure to use them before they expire. Regularly check your credit card statement or online account to stay informed and avoid missing out on valuable credits.

By following these tips, you can make the most of your statement credit, save money on your credit card expenses, and potentially enjoy extra perks or rewards along the way.

While statement credit can be an excellent way to offset your credit card costs, it’s important to be aware of common mistakes that can hinder your ability to maximize its benefits. Let’s explore these mistakes in the next section.

Common Mistakes to Avoid with Statement Credit

While statement credit can be a valuable benefit, it’s essential to avoid common mistakes that could limit your ability to maximize its benefits. Here are some common pitfalls to watch out for:

- Forgetting to check for offers: Don’t miss out on statement credit opportunities by neglecting to check your credit card issuer’s website, promotional emails, or mobile app. Stay informed about offers and take advantage of them to earn more credit.

- Ignoring the terms and conditions: Familiarize yourself with the terms and conditions for earning and redeeming statement credit. Pay attention to spending thresholds, expiration dates, and any exclusions for certain transactions or categories to ensure you meet the requirements.

- Carrying a high balance: If you have a significant outstanding balance on your credit card, it’s wise to prioritize paying it off rather than focusing solely on earning statement credit. The interest charges on your balance may outweigh the benefits of statement credit.

- Not tracking your statement credit: Failure to track your statement credit balance can result in missed opportunities to use it effectively. Regularly monitor your credit card statements, online account, or mobile app to stay on top of your accumulated credit.

- Letting statement credit expire: Be mindful of the expiration dates for your statement credit. Make a note of when your credits will expire and plan your redemptions accordingly to avoid losing out on valuable benefits.

- Overlooking other rewards options: While statement credit can be enticing, don’t forget to explore other redemption options offered by your credit card rewards program. Depending on your preferences, you may find more value in redeeming for travel, merchandise, or cash back.

- Maximizing spending unnecessarily: Avoid the temptation to overspend just to earn more statement credit. Stick to your budget and spend responsibly, making sure your purchases align with your needs and financial goals.

By being aware of these common mistakes and taking steps to avoid them, you can make the most of statement credit and avoid any potential setbacks or missed opportunities.

Now that you have a comprehensive understanding of statement credit and how to maximize its benefits, you can confidently utilize this powerful tool to save money and offset your credit card expenses. With careful planning and consideration, statement credit can be a valuable addition to your financial strategy.

Remember to always review the specific terms and conditions of your credit card issuer and stay informed about any updates or changes that may affect your statement credit. By staying proactive and informed, you can make the most of this financial perk and optimize your credit card usage.

Conclusion

Statement credit is a beneficial feature that can help you save money and make your credit card usage more rewarding. By earning statement credit through eligible transactions, sign-up bonuses, promotions, and rewards programs, you can offset your credit card expenses and potentially reduce your outstanding balance. By tracking and redeeming your statement credit wisely, you can make the most of this financial perk and maximize its benefits.

Remember to review your credit card’s terms and conditions to understand the eligibility criteria, expiration dates, and redemption options associated with statement credit. Keep track of your statement credit balance through online account management, monthly statements, or credit card apps. This will ensure you don’t miss out on using your earned credits and can plan your redemptions effectively.

Implementing strategies such as tracking your spending, combining offers, optimizing redemptions, and paying attention to promotional opportunities can help you make the most of your statement credit. Avoid common mistakes such as neglecting to check for offers, carrying high balances, and letting statement credit expire.

While statement credit offers an excellent way to offset your credit card costs and enhance your financial management, it’s crucial to find the right balance. Prioritize responsible credit card usage, budgeting, and managing your outstanding balances effectively.

With the knowledge gained from this guide, you are well-equipped to navigate the world of statement credit. By applying these tips and strategies, you can take full advantage of the benefits, save money, and enjoy the rewards that come with your credit card usage. Make the most of your statement credit and take control of your finances to achieve your financial goals.