Home>Finance>How To Write A Letter To Request A Credit Inquiry Be Dropped

Finance

How To Write A Letter To Request A Credit Inquiry Be Dropped

Published: March 5, 2024

Learn how to write a formal letter to request the removal of a credit inquiry and improve your financial standing. Take control of your finances with our expert tips.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Understanding the Importance of Credit Inquiries

Introduction

When it comes to managing your financial health, your credit score plays a pivotal role. It is a numerical representation of your creditworthiness and is used by lenders to assess the risk of extending credit to you. One crucial factor that influences your credit score is the presence of credit inquiries. These inquiries occur when a potential lender or creditor requests to view your credit report to evaluate your creditworthiness. While some inquiries are initiated by you when applying for credit, others may be generated by lenders when reviewing your credit profile.

It is essential to understand the impact of credit inquiries on your credit score. While a single inquiry may have a minimal effect, multiple inquiries within a short period can significantly lower your score. As a result, it is crucial to monitor and manage the inquiries on your credit report, especially if you believe that some of them are unjustified or inaccurate.

One common scenario that individuals encounter is the presence of unauthorized or erroneous credit inquiries on their credit reports. In such cases, it becomes necessary to take action to rectify the situation and ensure that your credit report accurately reflects your credit history. This often involves writing a formal letter to request the removal of the unjustified credit inquiry.

In this comprehensive guide, we will delve into the intricacies of credit inquiries, explore the reasons for requesting the removal of a credit inquiry, and provide a detailed step-by-step process for crafting an effective letter to address this issue. By the end of this guide, you will be equipped with the knowledge and tools to navigate the process of disputing and resolving unwarranted credit inquiries, empowering you to take control of your credit report and ultimately, your financial well-being.

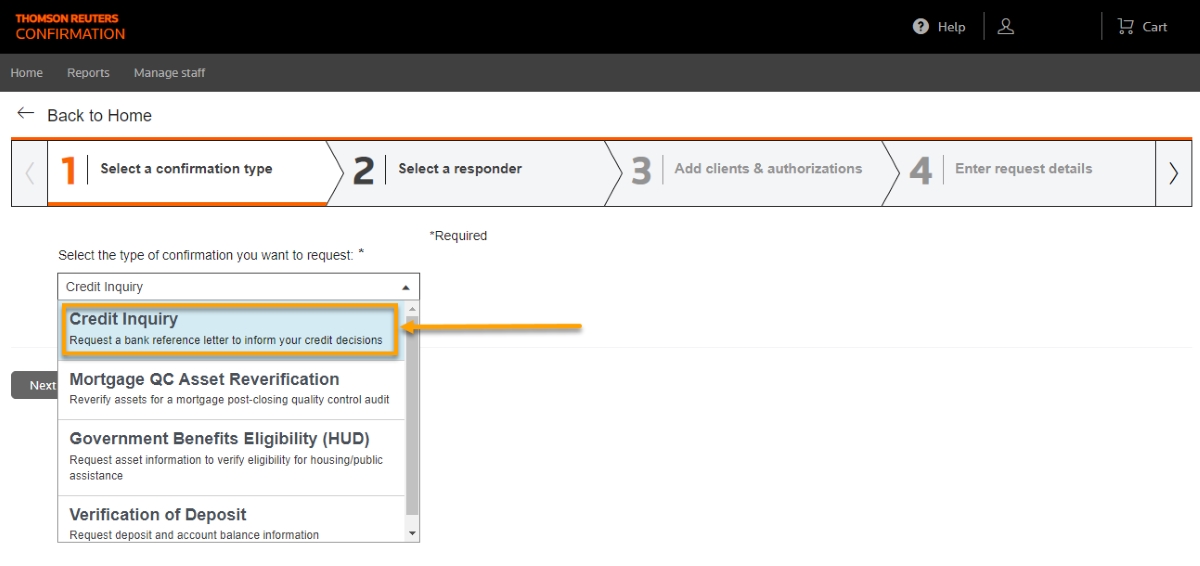

Understanding Credit Inquiries

Before delving into the process of requesting the removal of a credit inquiry, it is essential to grasp the fundamental aspects of credit inquiries. A credit inquiry, also known as a credit check or credit pull, occurs when a third party, such as a lender, creditor, or potential employer, requests to view your credit report from one of the major credit bureaus – Equifax, Experian, or TransUnion.

There are two primary types of credit inquiries: hard inquiries and soft inquiries. Hard inquiries typically occur when you apply for credit, such as a mortgage, auto loan, credit card, or personal loan. These inquiries are initiated with your consent and are included in your credit report. Lenders often consider hard inquiries as a reflection of your active pursuit of credit and may impact your credit score, albeit minimally, especially if multiple inquiries are made within a short timeframe.

On the other hand, soft inquiries are generated for informational or promotional purposes and do not impact your credit score. These inquiries may occur when a potential employer conducts a background check, when you check your own credit report, or when a credit card issuer pre-approves you for an offer. It is important to note that soft inquiries are not visible to lenders and do not affect your credit score.

Understanding the distinction between hard and soft inquiries is crucial when assessing the impact of credit inquiries on your credit score. While hard inquiries can influence your score, they are generally necessary when seeking new credit. However, it is imperative to monitor and address any unauthorized or erroneous hard inquiries that may appear on your credit report.

Furthermore, it is essential to recognize that credit inquiries remain on your credit report for a certain period. Typically, hard inquiries are visible to lenders for up to two years, while they impact your credit score for the first 12 months. Soft inquiries, however, are only visible to you and do not impact your credit score.

By comprehending the nature and implications of credit inquiries, you can make informed decisions regarding your credit management and take appropriate action when addressing unjustified or inaccurate inquiries on your credit report.

Reasons for Requesting a Credit Inquiry Be Dropped

There are several valid reasons why an individual may need to request the removal of a credit inquiry from their credit report. Understanding these reasons is essential when preparing to craft a compelling letter to address the issue effectively.

Unauthorized Inquiries: One of the most common reasons for disputing a credit inquiry is the presence of unauthorized inquiries on your credit report. These inquiries may appear as a result of identity theft, where an unauthorized party has attempted to apply for credit using your personal information. In such cases, it is crucial to take immediate action to dispute these inquiries and prevent further fraudulent activity.

Erroneous Inquiries: Inaccuracies on credit reports can also lead to the inclusion of erroneous credit inquiries. This may occur due to administrative errors, data inaccuracies, or misunderstandings between creditors and credit bureaus. If you believe that a credit inquiry has been included in error, it is essential to address the issue promptly to ensure the accuracy of your credit report.

Impact on Credit Score: Multiple unjustified inquiries, especially hard inquiries, can have a detrimental impact on your credit score. If you notice a significant drop in your score due to unwarranted inquiries, it is crucial to take steps to rectify the situation. By requesting the removal of these inquiries, you can mitigate the negative impact on your creditworthiness and improve your overall credit standing.

Financial Implications: Inaccurate or unauthorized credit inquiries can have broader financial implications beyond affecting your credit score. They may hinder your ability to secure favorable loan terms, result in higher interest rates, or even lead to credit denials. Addressing these inquiries is vital to safeguarding your financial well-being and ensuring fair and accurate representation of your credit history to potential lenders and creditors.

By understanding these reasons, individuals can effectively articulate their concerns and motivations when drafting a letter to request the removal of a credit inquiry. Providing clear and compelling explanations for disputing the inclusion of specific inquiries is crucial in garnering the attention of credit bureaus and achieving a favorable resolution to the matter.

Steps to Write a Letter to Request a Credit Inquiry Be Dropped

Crafting a well-structured and persuasive letter to request the removal of a credit inquiry requires careful attention to detail and a clear articulation of your concerns. By following a systematic approach, you can effectively communicate your reasons for disputing the inquiry and increase the likelihood of a favorable resolution. Here are the essential steps to consider when writing a letter for this purpose:

- Review Your Credit Report: Before initiating the letter-writing process, obtain a copy of your credit report from the relevant credit bureau. Identify the specific inquiry that you intend to dispute and gather any supporting documentation that validates your claim of its unauthorized or erroneous nature.

- Format Your Letter: Begin by formatting your letter in a professional and business-appropriate manner. Include your name, address, and contact information at the top, followed by the date of the letter. Address the letter to the credit bureau responsible for the inclusion of the disputed inquiry.

- Clearly State Your Dispute: In the opening paragraph, clearly and concisely state the purpose of your letter – to dispute and request the removal of a specific credit inquiry from your credit report. Provide the details of the inquiry, including the date it appeared and the name of the creditor or entity associated with it.

- Explain Your Reasons: In the subsequent paragraphs, elaborate on the reasons for disputing the inquiry. Whether it is an unauthorized inquiry, an administrative error, or a misunderstanding, provide a detailed explanation supported by any relevant documentation or evidence. Clearly articulate the impact of the inquiry on your credit score and financial well-being.

- Request Action: Clearly state your request for the credit bureau to investigate the disputed inquiry and, if found to be unjustified, to remove it from your credit report. Specify a reasonable timeframe within which you expect a response and resolution to the matter.

- Provide Supporting Documents: If available, include copies of any supporting documents, such as correspondence with the creditor, identity theft reports, or any other evidence that strengthens your case. Ensure that these documents are clearly labeled and organized for easy reference.

- Close Professionally: Conclude the letter with a professional closing, such as “Sincerely,” followed by your signature and printed name. Ensure that you retain a copy of the letter for your records before sending it via certified mail with a return receipt requested for documentation purposes.

By following these steps and presenting your case in a clear, organized, and compelling manner, you can increase the effectiveness of your letter in prompting the credit bureau to investigate and address the disputed credit inquiry. Additionally, maintaining thorough documentation and adhering to professional communication standards can bolster the credibility and impact of your dispute.

Sample Letter to Request a Credit Inquiry Be Dropped

Below is a sample template for a letter to request the removal of a credit inquiry from your credit report. It is essential to customize the details according to your specific situation and ensure that the letter accurately reflects your circumstances.

[Your Name]

[Your Address]

[City, State, Zip Code]

[Your Email Address]

[Your Phone Number]

[Date]

[Credit Bureau Name]

[Credit Bureau Address]

[City, State, Zip Code]

Dear Sir/Madam,

I am writing to formally dispute and request the removal of an unauthorized credit inquiry that appeared on my credit report. Upon reviewing my credit history, I discovered the presence of a hard inquiry dated [Date of Inquiry] from [Creditor’s Name] that I did not authorize or initiate.

The inclusion of this inquiry has raised significant concerns as it has adversely impacted my credit score and financial standing. I have attached supporting documentation, including copies of my credit report highlighting the unauthorized inquiry, as well as evidence of my non-engagement with the aforementioned creditor during the stated timeframe.

I urge [Credit Bureau Name] to conduct a thorough investigation into this matter and promptly remove the disputed inquiry from my credit report. Given the potential implications on my creditworthiness and financial well-being, I request that this issue be addressed within [Specify Reasonable Timeframe] to ensure the accuracy and fairness of my credit report.

I appreciate your prompt attention to this matter and request that all relevant updates and correspondence regarding this dispute be directed to the address provided above. I trust that [Credit Bureau Name] will handle this dispute with the utmost diligence and transparency to achieve a swift and equitable resolution.

Thank you for your cooperation and understanding in addressing this issue. I look forward to a timely resolution and the restoration of the accuracy of my credit report. Please feel free to contact me if further information or clarification is required regarding this dispute.

Sincerely,

[Your Signature]

[Your Printed Name]

By customizing and personalizing this sample letter to align with your specific circumstances and reasons for disputing the credit inquiry, you can effectively convey your concerns and motivations to the credit bureau. Ensuring clarity, conciseness, and professionalism in your communication can enhance the impact of your dispute and increase the likelihood of a favorable outcome.

Conclusion

Navigating the process of disputing and requesting the removal of a credit inquiry from your credit report is a critical step in safeguarding your financial well-being and maintaining the accuracy of your credit history. By understanding the nature of credit inquiries, recognizing valid reasons for disputing them, and following a systematic approach to crafting a compelling letter, you can effectively address unjustified or erroneous inquiries and mitigate their impact on your credit score and financial standing.

It is essential to approach the dispute process with diligence, attention to detail, and a clear articulation of your concerns. Reviewing your credit report, gathering relevant documentation, and customizing your letter to reflect the specifics of your dispute are pivotal in increasing the effectiveness of your communication with the credit bureau. By adhering to professional communication standards and providing a comprehensive explanation of your dispute, you can enhance the credibility and impact of your request for the removal of the disputed credit inquiry.

Furthermore, maintaining open communication with the credit bureau and promptly responding to any requests for additional information or documentation can expedite the resolution process. While the timeline for addressing credit inquiry disputes may vary, ensuring that your letter is clear, concise, and supported by relevant evidence can significantly contribute to a favorable outcome.

Ultimately, by taking proactive steps to dispute unwarranted credit inquiries, you assert your rights as a consumer and advocate for the accuracy and fairness of your credit report. This, in turn, can positively influence your credit score, financial opportunities, and overall peace of mind. By leveraging the insights and guidance provided in this comprehensive guide, you are empowered to navigate the dispute process with confidence and achieve a resolution that aligns with your financial well-being and credit management goals.

Embracing a proactive and informed approach to credit inquiry disputes enables you to assert control over your credit history and reinforces the integrity of your financial profile, ultimately contributing to a stronger and more secure financial future.