Finance

What Is A Good ROI For Investment Property?

Published: October 17, 2023

Discover what is considered a good return on investment (ROI) for investment properties. Learn how to maximize your finance potential with strategic property investments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Investing in property can be a lucrative opportunity for individuals looking to grow their wealth and generate passive income. One key metric that investors use to assess the profitability of an investment property is the Return on Investment (ROI). Understanding what constitutes a good ROI for investment property is essential for making informed decisions and maximizing returns.

Return on Investment (ROI) is a financial indicator that measures the profitability of an investment relative to its cost. It is expressed as a percentage and represents the return an investor can expect to receive on their investment over a specific time period. In the context of investment property, ROI takes into account factors such as rental income, appreciation, expenses, and financing costs.

When considering what constitutes a good ROI for investment property, it’s important to remember that individual goals and market conditions vary. However, there are generally accepted benchmarks and factors to consider when assessing the profitability of an investment property.

In this article, we will delve into the concept of ROI for investment property, explore the factors that affect it, discuss typical benchmarks, and provide strategies for improving ROI.

Understanding Return on Investment (ROI)

Return on Investment (ROI) is a crucial metric for evaluating the financial performance of an investment property. It measures the return generated from the property relative to the initial investment cost. ROI is typically expressed as a percentage and represents the profitability of the investment over a specified period of time.

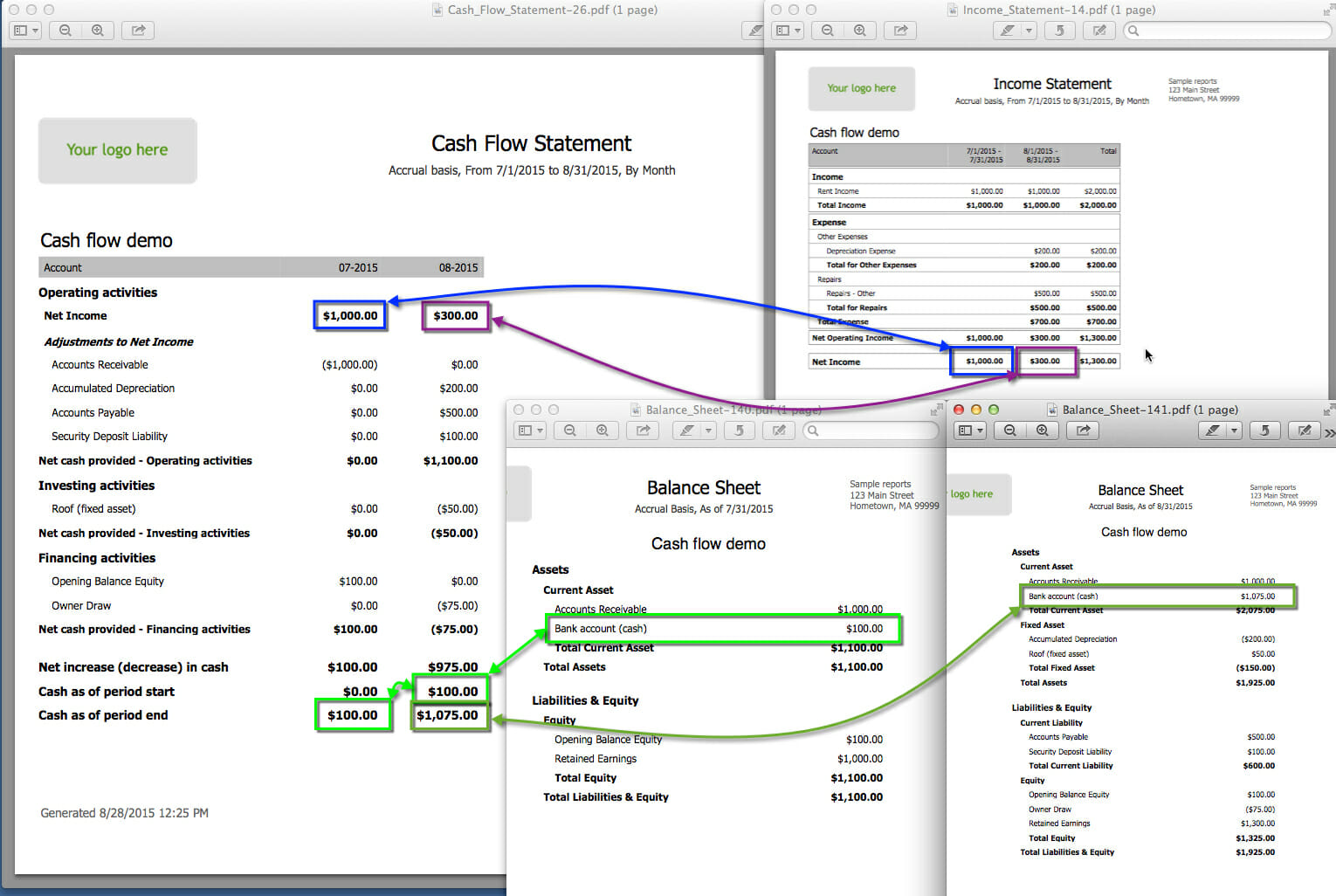

ROI is calculated by dividing the net profit (income minus expenses) generated by the investment property by the initial investment cost, and then multiplying it by 100. The formula can be represented as:

ROI = (Net Profit / Initial Investment Cost) * 100

For instance, if an investor purchased a property for $300,000 and generated a net profit of $30,000 per year, the ROI would be:

ROI = ($30,000 / $300,000) * 100 = 10%

A higher ROI indicates a more profitable investment, as it represents a greater return relative to the initial investment cost. However, it’s important to consider the time frame over which the ROI is calculated. Shorter-term ROIs may provide a snapshot of immediate returns, while longer-term ROIs can reveal the property’s performance over time.

ROI takes into account various factors that contribute to the profitability of an investment property. These include rental income, property appreciation, tax benefits, expenses (such as maintenance, insurance, and property management fees), and financing costs (such as mortgage interest and closing fees).

It’s worth noting that ROI is just one metric used to assess the potential of an investment property. Investors should consider other factors, such as cash flow, market conditions, location, and risk tolerance, when making investment decisions.

Next, we will explore the key factors that can significantly impact the ROI of an investment property.

Factors Affecting ROI for Investment Property

Several factors come into play when determining the return on investment (ROI) for an investment property. Understanding these factors is crucial for evaluating the profitability of a property and making informed investment decisions.

1. Rental Income: The rental income generated by the property is a significant factor influencing the ROI. Higher rental income relative to the property’s cost will result in a higher ROI. It’s essential to analyze the rental market in the property’s location and assess the potential rental income before making a purchase.

2. Property Appreciation: The appreciation of the property’s value over time can greatly impact the ROI. If the property’s value increases significantly, the ROI will reflect the appreciation. However, it’s important to note that property appreciation is not guaranteed and can vary based on market conditions and location.

3. Expenses: The expenses associated with owning and maintaining the property can affect the ROI. These expenses include property taxes, insurance, maintenance costs, property management fees, and utilities. Minimizing expenses and effectively managing them can help improve the ROI.

4. Financing Costs: If the property is financed through a mortgage or loan, the financing costs, such as interest payments and closing fees, will impact the ROI. Higher financing costs can decrease the ROI, so it’s crucial to secure favorable financing terms to optimize returns.

5. Vacancy Rate: The vacancy rate, or the amount of time the property remains unoccupied, can impact the rental income and ultimately the ROI. A higher vacancy rate can reduce the overall income and negatively affect the ROI. Proper tenant screening and proactive management can help minimize vacancy rates.

6. Market Conditions: The overall real estate market conditions, including supply and demand dynamics, interest rates, and economic factors, can impact the ROI. A strong market with high demand and rising property values may contribute to a higher ROI, while a weak market can have the opposite effect.

7. Location: The location of the investment property plays a vital role in determining its ROI. Properties in desirable locations with amenities, good schools, and access to transportation tend to have higher rental demand and potential for appreciation, leading to a better ROI.

8. Taxes and Incentives: Tax considerations and incentives can affect the ROI of an investment property. Understanding the local tax laws, deductions, and incentives available for property investments can impact the overall returns.

By considering these factors and conducting thorough due diligence, investors can gain a better understanding of the potential ROI for an investment property and make informed investment decisions.

Evaluating ROI for Rental Properties

When evaluating the Return on Investment (ROI) for rental properties, it’s important to consider specific metrics and calculations to gain a comprehensive understanding of the property’s profitability. By analyzing these key factors, investors can make informed decisions and assess the potential returns of their rental property investments.

1. Cash Flow: Cash flow is a fundamental consideration when evaluating the ROI of a rental property. It refers to the net income generated from the property after deducting all expenses, including mortgage payments, property management fees, maintenance costs, and vacancies. Positive cash flow indicates that the property is generating more income than expenses and contributes to a higher ROI.

2. Cap Rate: The Capitalization Rate, or cap rate, is a commonly used metric for evaluating rental properties. It is calculated by dividing the net operating income (NOI) by the property’s purchase price. The cap rate provides a measure of the property’s return on investment without factoring in financing costs. A higher cap rate indicates a higher potential ROI.

3. Gross Rent Multiplier (GRM): The Gross Rent Multiplier is another useful tool for evaluating rental properties. It is calculated by dividing the property’s sale price by the annual rental income. The GRM provides a quick estimate of the property’s value relative to its rental income. A lower GRM suggests a potentially better ROI.

4. Return on Equity (ROE): Return on Equity measures the return earned on the amount of equity invested in the property. It is calculated by dividing the annual return after expenses by the equity invested. A higher ROE signifies a higher ROI and demonstrates the effectiveness of leveraging equity to generate returns.

5. Cash-on-Cash Return (CCR): Cash-on-Cash Return calculates the percentage return generated on the cash invested in the rental property. It is calculated by dividing the annual cash flow by the cash invested. A higher CCR indicates a higher ROI and demonstrates the property’s ability to generate income relative to the initial investment.

6. Break-Even Ratio: The Break-Even Ratio determines the minimum occupancy rate needed for the rental property to cover all expenses and break even. It is calculated by dividing the sum of all expenses by the annual rental income. A lower break-even ratio suggests a higher potential for positive cash flow and ROI.

When evaluating the ROI for rental properties, it’s important to consider these metrics in conjunction with other factors such as market conditions, location, and potential for appreciation. Each metric provides a unique perspective on the property’s financial performance and can help investors make informed decisions based on their investment goals and risk tolerance.

Typical ROI Benchmarks for Investment Properties

When assessing the Return on Investment (ROI) for investment properties, it’s valuable to have benchmarks for comparison. While ROI benchmarks can vary depending on factors such as the property type, location, and market conditions, there are some typical ranges that investors can use as a reference point. It’s important to keep in mind that these benchmarks should serve as a guideline and not as rigid rules.

1. Cash-on-Cash Return: A typical range for cash-on-cash return is between 6% to 10%. This metric measures the annual cash flow relative to the amount of cash invested in the property. An investor seeking higher cash flow might aim for a higher cash-on-cash return, while those prioritizing long-term appreciation might accept a lower range.

2. Cap Rate: The Capitalization Rate typically falls within the range of 4% to 10%. This metric calculates the property’s net operating income (NOI) as a percentage of the purchase price. A higher cap rate indicates a potentially higher ROI, but it’s important to consider other factors such as market conditions and property type when evaluating cap rates.

3. Return on Investment (ROI): A typical ROI for investment properties can range from 8% to 12%. This metric considers both cash flow and property appreciation relative to the initial investment. Achieving a higher ROI may require meticulous property selection, effective management, and favorable market conditions.

4. Break-Even Ratio: The Break-Even Ratio typically ranges from 70% to 80%. This metric determines the minimum occupancy rate needed for the rental property to cover all expenses. A lower break-even ratio suggests a greater potential for positive cash flow and a higher ROI.

5. Return on Equity (ROE): Return on Equity targets can vary, but a typical range is between 10% and 15%. This metric measures the return earned on the amount of equity invested in the property. A higher ROE indicates a higher return on the invested equity and a potentially better ROI.

While these benchmarks provide a general indication of what investors can strive for, it’s important to consider individual goals, risk tolerance, and market conditions. Investors may have different expectations and strategies based on their investment objectives, whether it’s cash flow, appreciation, or a combination of both.

Remember, the benchmarks should be used as a starting point for evaluating the potential ROI of investment properties, but thorough analysis and consideration of specific property and market factors is key to making informed investment decisions.

Factors to Consider for a Good ROI in Investment Property

When aiming for a good Return on Investment (ROI) in investment property, several essential factors come into play. These factors play a crucial role in determining the profitability and success of the investment. By carefully considering these factors, investors can increase their chances of achieving a favorable ROI.

1. Location: The location of the investment property is paramount. Properties in desirable neighborhoods with access to amenities, good schools, and transportation tend to have higher rental demand and potential for appreciation. A well-chosen location can positively impact rental income and property value, contributing to a higher ROI.

2. Market Conditions: Keeping an eye on market conditions is crucial. An investor should assess factors such as supply and demand dynamics, economic growth, and future development plans in the area. Favorable market conditions, such as low vacancy rates and increasing property values, can contribute to a good ROI.

3. Rental Income Potential: Analyzing the rental income potential is a key consideration. It’s essential to research rental rates in the area and determine if they align with the property’s cost. Higher rental income relative to the investment cost results in a better ROI.

4. Property Appreciation: Property appreciation is another critical factor when considering ROI. While not guaranteed, investing in areas with a history of property value appreciation can increase the likelihood of obtaining a good ROI. Researching historical trends and working with real estate experts can provide insight into a property’s potential appreciation.

5. Cash Flow: Positive cash flow is vital for a good ROI. It’s essential to carefully analyze the property’s expenses, including mortgage payments, property management fees, taxes, insurance, and maintenance costs. Ensuring that the rental income exceeds these expenses will contribute to a favorable ROI.

6. Property Management: Effective property management is instrumental in maximizing ROI. Professional property management can help ensure optimal occupancy rates, timely rental payments, efficient maintenance, and tenant retention. Outsourcing property management to experienced professionals can be an investment worth considering for a good ROI.

7. Financing Options: Exploring different financing options is necessary for optimizing ROI. Securing favorable financing terms with low interest rates and reasonable loan terms can reduce financing costs and increase cash flow, ultimately contributing to a higher ROI.

8. Risk Management: Mitigating risk is crucial for a good ROI. This involves conducting thorough due diligence, getting proper property inspections, obtaining appropriate insurance coverage, and being prepared for unforeseen circumstances. Accurately assessing and managing risks can safeguard the return on the investment.

By considering these factors, investors can make informed decisions and increase the likelihood of achieving a good ROI in their investment properties. It’s crucial to conduct thorough research, seek professional advice when needed, and continuously evaluate and adapt investment strategies to optimize ROI.

Strategies to Improve ROI for Investment Properties

To improve the Return on Investment (ROI) for investment properties and maximize profitability, investors can employ various strategies. These strategies focus on increasing rental income, reducing expenses, and enhancing property value. By implementing these strategies, investors can optimize their ROI and achieve greater financial success.

1. Increase Rental Income: One way to boost ROI is to increase rental income. This can be achieved by conducting thorough market research to determine rental rates in the area and ensuring that the property is competitively priced. Additionally, investors can consider adding value to the property through renovations or upgrades, such as improving amenities or increasing living space, which can justify higher rental rates.

2. Reduce Vacancy Rates: Vacancies can significantly impact ROI. Minimizing vacancy rates involves effective tenant screening, promptly addressing maintenance issues, and providing excellent tenant service. Additionally, offering incentives such as lease renewal discounts or referral programs can help retain tenants and reduce turnover, ultimately improving ROI.

3. Implement Cost-Effective Maintenance: Proper maintenance is crucial for preserving the property’s value and minimizing expenses. Regular inspections and proactive maintenance can prevent costly repairs and ensure that the property remains attractive to tenants, reducing tenant turnover and vacancy rates. By partnering with reliable and cost-effective contractors, investors can optimize maintenance costs and improve ROI.

4. Control Operating Expenses: Evaluating and minimizing operating expenses is essential to improve ROI. Carefully reviewing utility costs, insurance plans, property management fees, and other recurring expenses can reveal potential areas for cost reduction. Negotiating better terms with service providers and exploring cost-effective alternatives can help lower ongoing expenses and increase overall profitability.

5. Leverage Tax Benefits: Taking advantage of applicable tax benefits can positively impact ROI. Investors should consult with tax professionals to ensure they are maximizing deductions, such as depreciation, property taxes, and mortgage interest. These tax savings can free up additional funds that can be reinvested into the property or used to improve cash flow.

6. Enhance Property Value: Increasing the value of the investment property can lead to a higher ROI. This can be achieved through strategic renovations and upgrades that improve the property’s functionality, appeal, and market value. Examples include kitchen remodels, bathroom renovations, landscaping improvements, or energy-efficient upgrades. Enhancing the property’s curb appeal and overall aesthetic can attract higher-quality tenants and justify higher rental rates.

7. Consider Short-Term Rentals or Airbnb: In certain markets, exploring the option of short-term rentals or listing the property on platforms like Airbnb can significantly increase rental income. However, it’s essential to understand local regulations and potential risks associated with short-term rentals before pursuing this strategy.

8. Refinance or Optimize Financing: Evaluating financing options and refinancing the property when favorable rates are available can help reduce financing costs and improve cash flow. Exploring different loan options, negotiating interest rates, or adjusting loan terms can contribute to a higher ROI by reducing annual mortgage payments.

Ultimately, improving ROI for investment properties requires a combination of strategizing, optimizing income, reducing expenses, and enhancing the property’s value. By implementing these strategies and continuously evaluating the investment, investors can maximize their returns and achieve long-term financial success.

Conclusion

Assessing and achieving a good Return on Investment (ROI) is crucial when investing in properties. Understanding the factors that influence ROI and implementing effective strategies can greatly enhance the profitability of investment properties. By considering factors such as rental income potential, property appreciation, location, market conditions, and expense management, investors can make informed decisions and optimize their ROI.

Successful evaluation of ROI requires thorough analysis and consideration of various metrics, including cash flow, cap rate, return on equity, and cash-on-cash return. These metrics provide valuable insights into the property’s financial performance and help investors assess the potential returns.

In addition to analyzing the numbers, it’s important to consider qualitative factors such as location, potential for property appreciation, and rental demand. A well-chosen location, favorable market conditions, and property value appreciation can greatly contribute to a good ROI.

Implementing strategies to increase rental income, reduce expenses, and enhance the property’s value can further optimize ROI. These strategies include raising rental rates, minimizing vacancy rates, conducting cost-effective maintenance, controlling operating expenses, leveraging tax benefits, enhancing property value through renovations, and exploring short-term rental options depending on market feasibility.

It’s worth noting that while there are typical benchmarks for ROI and standardized strategies to improve profitability, every investment is unique. Investors should evaluate their specific goals, risk tolerance, and market conditions in order to make informed decisions and customize their approach to maximize ROI.

In conclusion, achieving a good ROI for investment properties requires careful analysis, informed decision-making, and continuous evaluation. By considering the factors that affect ROI and implementing appropriate strategies, investors can increase their chances of realizing substantial returns and building long-term wealth through property investments.