Finance

What Is Common Stock Accounting

Published: October 10, 2023

Learn about common stock accounting and its importance in finance. Gain insight into the methods and practices used to track and report on common stock transactions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance! In this article, we will explore the fascinating world of common stock accounting. Whether you are a finance professional, a business owner, or simply curious about how companies account for their common stock, this article will provide you with a comprehensive understanding of the topic.

Common stock is one of the most widely known and commonly used forms of equity. It represents ownership in a company and gives shareholders the right to vote on corporate matters, as well as the opportunity to participate in its profits through dividends and capital gains.

Understanding how common stock is accounted for is essential for accurate financial reporting and analysis. Proper accounting for common stock ensures transparency, reliability, and compliance with accounting standards and regulations. It provides stakeholders and investors with crucial information regarding the financial health and performance of a company.

In this article, we will delve into the intricacies of common stock accounting, including how common stock issuances are recorded, the valuation of common stock, and how common stock is reported on financial statements. We will also explore the disclosure requirements surrounding common stock, ensuring that companies provide the necessary information to users of financial statements.

By the end of this article, you will have a thorough understanding of the accounting principles and practices associated with common stock. So, let’s get started on our journey into the world of common stock accounting!

Definition of Common Stock

Before we dive into the accounting aspects of common stock, let’s first understand its basic definition. Common stock represents ownership in a corporation and is one of the main types of equity that companies can issue to raise capital.

When a company issues common stock, it is essentially selling a portion of its ownership to investors, who become shareholders. Each share of common stock represents a fraction of the company’s ownership. Shareholders are entitled to certain rights, such as voting at shareholder meetings and receiving dividends.

Unlike other types of securities, such as preferred stock, common stockholders do not have preferential treatment when it comes to dividend payments or liquidation proceeds. Instead, their returns are based on the company’s profitability and the overall performance of its shares in the stock market.

Common stock also carries a certain level of risk. If a company faces financial difficulties or goes bankrupt, common stockholders are the last to receive any remaining assets after all debts and obligations are paid to creditors and preferred stockholders.

Common stockholders also have the potential for capital appreciation. If the company grows and its shares increase in value, common stockholders can sell their shares at a higher price, realizing a capital gain.

In summary, common stock represents ownership in a corporation, giving shareholders the right to vote, receive dividends, and participate in the company’s growth. It offers the potential for capital gains but carries a higher level of risk compared to other types of securities.

Now that we understand the basic definition of common stock, let’s explore how its accounting is recorded and reported.

Accounting for Common Stock

Accounting for common stock involves recording and reporting the issuance and valuation of common stock. It is crucial to accurately capture these transactions in a company’s financial statements to provide stakeholders with clear and transparent information.

When a company issues common stock, it must record the transaction by debiting the cash or the value received and crediting the common stock account for the par value, or stated value, of the shares issued. The par value is a nominal value assigned to each share of stock and is typically set at a low amount, such as $0.01 per share.

In addition to the par value, companies may also issue shares at a premium or a discount to their par value. If shares are sold above par value, the excess amount is recorded as additional paid-in capital in the shareholders’ equity section. Conversely, if shares are sold below par value, the difference is recorded as a discount on the common stock account. However, it’s important to note that many companies nowadays issue shares without a par value. In such cases, the entire proceeds are recorded as common stock or additional paid-in capital.

The accounting treatment for common stock can also vary depending on whether the issuance is made for cash or in exchange for non-cash assets or services. When common stock is issued for non-cash assets or services, the value of the consideration received is recorded at the fair market value of the assets or services exchanged.

Furthermore, if a corporation repurchases its own common stock, the transaction is recorded as a reduction in stockholders’ equity. The cost of the repurchased shares is debited to the treasury stock account, which is a contra-equity account. This account offsets the common stock and additional paid-in capital accounts, reducing the overall shareholders’ equity.

Overall, accounting for common stock requires careful documentation and adherence to accounting principles to accurately reflect the issuance, valuation, and repurchase of shares. By properly recording these transactions, companies can provide stakeholders with meaningful and reliable information about the company’s capital structure and ownership.

Next, we will explore how the valuation of common stock is determined.

Recording Common Stock Issuances

When a company issues common stock, it is important to accurately record these transactions to reflect the increase in the company’s equity and the entry of new shareholders. The recording process involves various steps that ensure the proper documentation and reporting of common stock issuances.

The first step in recording common stock issuances is to determine the number of shares being issued and the par value of each share. The par value represents the nominal value assigned to each share and is typically set at a low amount, such as $0.01 per share.

Once the par value is determined, the company needs to decide on the price at which the shares will be sold. This can be done through a public offering, private placement, or another method of raising capital. The price per share is usually above the par value and is determined based on market conditions, company performance, and investor demand.

After finalizing the pricing, the company records the common stock issuance by debiting the cash account for the total amount received from the sale of the shares. Simultaneously, the common stock account is credited for the par value of the shares issued. If the shares are sold above par value, the excess amount is recorded as additional paid-in capital.

For example, let’s say a company issues 10,000 shares of common stock with a par value of $0.01 per share at a price of $10 per share. The company would debit the cash account for $100,000 ($10 x 10,000) and credit the common stock account for $100 ($0.01 x 10,000). If the shares were sold at a premium of $2 per share, an additional credit of $20,000 ($2 x 10,000) would be recorded in the additional paid-in capital account.

In the case of non-cash transactions, where common stock is issued in exchange for assets or services, the value of the consideration received is recorded at the fair market value of the assets or services exchanged. The accounting treatment for such transactions may require additional analysis and valuation to determine the appropriate amount to be recorded as common stock and additional paid-in capital.

It is crucial for companies to maintain proper documentation of all common stock issuances, including the number of shares, the price per share, and any premiums or discounts involved. This information should be supported by contracts, subscription agreements, or other legal documents.

By accurately recording common stock issuances, companies provide stakeholders with transparent information about the increase in equity and the entry of new shareholders. It also ensures compliance with accounting principles and regulations, contributing to the overall integrity and reliability of financial statements.

Next, we will explore how the valuation of common stock is determined.

Valuation of Common Stock

The valuation of common stock is crucial for determining the fair value of a company’s equity and assessing the potential returns and risks associated with owning its shares. While common stock is often traded in the stock market and its value is influenced by supply and demand, there are several methods to estimate its worth.

One commonly used method to value common stock is the market approach, which considers the stock’s trading price in the open market. By analyzing recent transactions and comparing the company’s stock price to its industry peers, investors and analysts can gain insights into the perceived value of the stock. However, it’s important to note that the market price may not always reflect the intrinsic value of the stock and can be influenced by market sentiment and other factors.

The intrinsic valuation approach is another method used to estimate the value of common stock. This approach involves analyzing the underlying factors that contribute to a company’s value, such as its financial performance, competitive position, growth prospects, and industry trends. Investors and analysts use various models, such as discounted cash flow (DCF) analysis and price-to-earnings (P/E) ratios, to estimate the future cash flows and profitability of the company, which in turn influence the value of its common stock.

Furthermore, book value can be used as an indicator of the value of common stock. The book value is calculated by subtracting a company’s total liabilities from its total assets, and dividing the result by the number of outstanding shares. It represents the net worth of the company on its balance sheet and can provide insight into the value of the company’s underlying assets and retained earnings. However, book value does not account for factors such as growth potential and intangible assets, which can affect the true value of the common stock.

It’s important to note that the valuation of common stock is subjective and can vary based on individual opinions and market conditions. Investors and analysts may use a combination of valuation methods and factors to arrive at a fair estimate of the stock’s value. Additionally, the valuation of common stock can change over time as new information becomes available and market conditions fluctuate.

Ultimately, the valuation of common stock plays a vital role in investment decision-making and determining the attractiveness of a company’s shares. It provides investors with insights into the potential returns and risks associated with owning the stock, helping them make informed investment choices.

Now that we have explored the valuation of common stock, let’s move on to how common stock is reported on financial statements.

Reporting Common Stock on Financial Statements

Reporting common stock on financial statements is an essential aspect of financial reporting for companies. It provides stakeholders with crucial information about the company’s capital structure and ownership, which is important for assessing its financial health and performance.

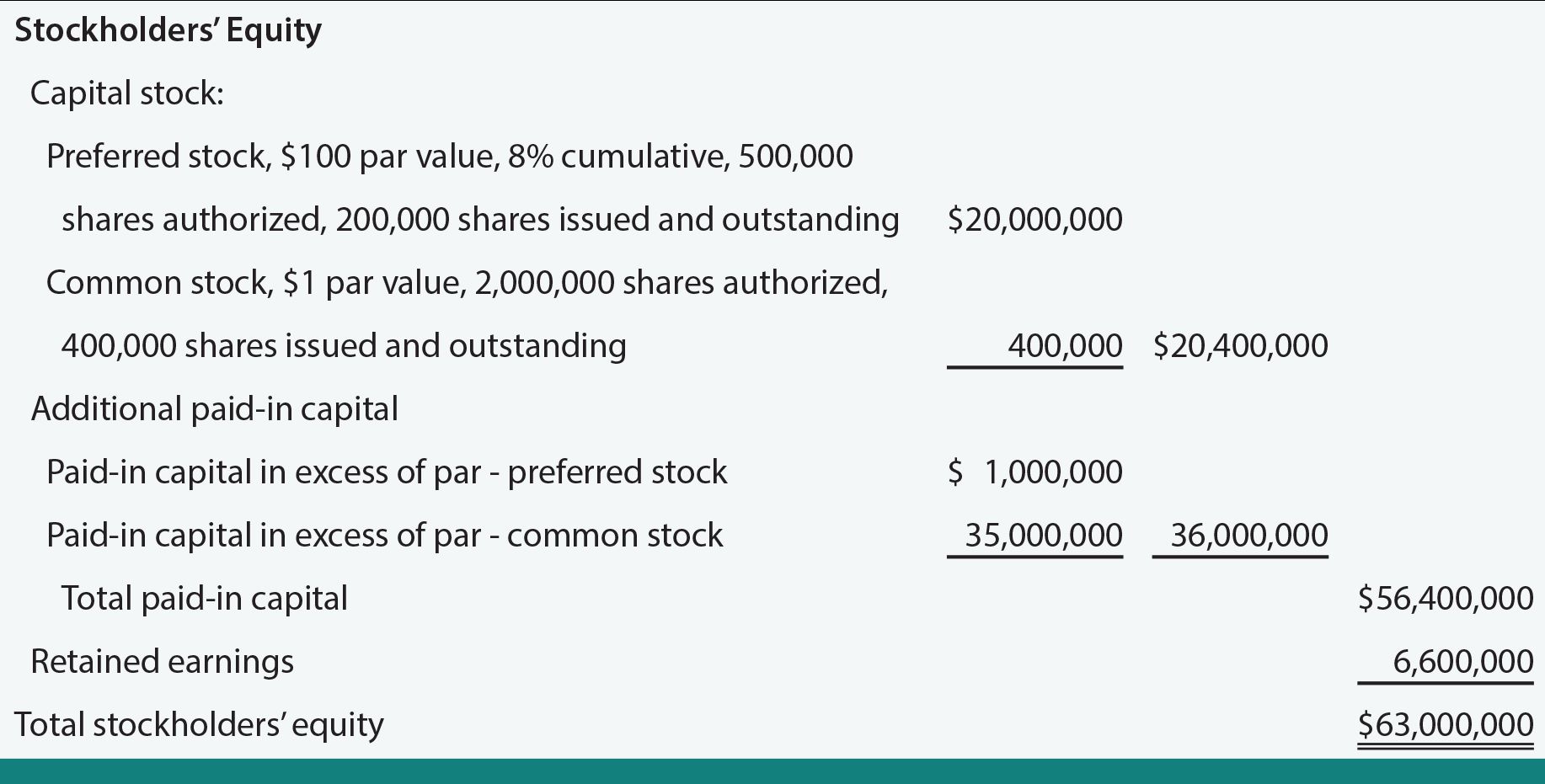

Common stock is typically reported on the balance sheet under the shareholders’ equity section. Within the shareholders’ equity section, common stock is presented as a separate line item, indicating the total number of shares outstanding and their par value. For example, if a company has issued 100,000 shares of common stock with a par value of $0.01 per share, the balance sheet would show “Common Stock: 100,000 shares at $0.01 par value.”

In addition to the common stock line item, the balance sheet may also include additional paid-in capital and retained earnings, which represent the amounts invested by shareholders above the par value and the accumulated profits/losses of the company, respectively. These components of shareholders’ equity are important for understanding the total value contributed by shareholders and the company’s overall financial position.

Common stock may also be disclosed in the notes to the financial statements, providing further detail on the terms and conditions of the stock issuances, including any additional paid-in capital, stock options, or warrants outstanding. These disclosures ensure transparency and provide stakeholders with a comprehensive understanding of the company’s capital structure.

When companies report their financial results, they may also disclose the earnings per share (EPS) figure, which is calculated by dividing the company’s net income by the weighted average number of common shares outstanding during the reporting period. EPS provides information about the profitability and the value generated for each share of common stock.

It’s worth noting that the reporting of common stock is subject to accounting principles and regulations, such as the Generally Accepted Accounting Principles (GAAP) in the United States or International Financial Reporting Standards (IFRS) globally. These standards prescribe the required disclosures and presentation formats to ensure consistency and comparability across different companies.

By properly reporting common stock on financial statements, companies provide stakeholders with clear and transparent information about their capital structure, ownership, and the value contributed by shareholders. This information is crucial for investors, creditors, and other users of financial statements to assess the company’s financial position, make informed investment decisions, and evaluate the company’s ability to meet its obligations.

Now that we have covered the reporting of common stock on financial statements, let’s explore the disclosure requirements surrounding common stock.

Disclosure Requirements for Common Stock

Disclosure requirements for common stock are a crucial aspect of financial reporting, ensuring transparency and providing stakeholders with meaningful information about a company’s capital structure, ownership, and potential risks and uncertainties. These disclosure requirements help users of financial statements make informed decisions and assess the company’s financial health and performance.

One important disclosure requirement for common stock is the disclosure of the terms and conditions of the stock issuances. Companies are required to provide details about the number of shares outstanding, the par value of the shares, and any additional paid-in capital or premiums received. This information allows stakeholders to understand the ownership rights associated with common stock and the capital contributions made by shareholders.

In addition to the basic information about common stock issuances, companies may also be required to disclose any stock options, warrants, or other equity instruments outstanding. This includes information about the terms, exercise prices, and expiration dates of these instruments. These disclosures provide insight into potential dilution effects on the ownership and earnings per share calculation.

Companies are also required to disclose any restrictions or limitations on the ownership or transfer of common stock. This includes information about any lock-up agreements, voting agreements, or shareholder rights plans that may affect the liquidity or control of the company’s shares.

Furthermore, companies must disclose any material events or transactions related to their common stock, such as stock splits, reverse stock splits, stock repurchases, or major changes in the ownership structure. These disclosures provide stakeholders with important information about the company’s capital transactions and any significant changes that may affect the value or availability of common stock.

Companies are also required to disclose any significant risks and uncertainties related to their common stock. This includes information about market risks, regulatory risks, and any potential events or conditions that may have a material impact on the value or trading of the common stock. These disclosures help stakeholders understand the potential risks associated with investing in the company’s shares.

Furthermore, companies may be required to provide additional information about their common stock in the management discussion and analysis (MD&A) section of their financial reports. This includes discussions about the company’s strategic use of common stock, any pending or potential stock issuances, and any planned capital actions or financing activities.

Overall, disclosure requirements for common stock ensure that companies provide stakeholders with clear and comprehensive information about their capital structure, ownership, risks, and potential events that may impact the value or trading of their shares. These disclosures promote transparency, enhance investor confidence, and facilitate accurate evaluation of a company’s financial position and prospects.

Now that we have covered the disclosure requirements for common stock, let’s wrap up our article.

Conclusion

In conclusion, understanding common stock accounting is essential for accurately reporting a company’s financial position and providing stakeholders with transparent and meaningful information. Common stock represents ownership in a company and gives shareholders the right to vote on corporate matters while providing the potential for capital gains and dividends.

Accounting for common stock involves recording the issuance, valuation, and repurchase of shares. Companies must properly document these transactions to ensure accurate financial reporting and compliance with accounting standards and regulations. The recording process includes debiting the cash account for the amount received and crediting the common stock account for the par value of the shares, with any premium or discount recorded as additional paid-in capital.

The valuation of common stock can be determined through various methods, such as the market approach, intrinsic valuation, and consideration of book value. These methods provide insights into the perceived value and potential returns of the stock, taking into account factors such as financial performance, industry trends, and growth prospects.

When reporting common stock on financial statements, companies present it as a separate line item under the shareholders’ equity section. Additional disclosures may include details about stock options, warrants, restrictions on ownership or transfer, and significant events or transactions. These disclosures ensure transparency and provide stakeholders with a comprehensive understanding of the company’s capital structure and ownership.

By meeting the disclosure requirements and accurately reporting common stock, companies provide stakeholders with the necessary information to assess the company’s financial health, make informed investment decisions, and evaluate its ability to meet its obligations. Furthermore, transparent and reliable reporting enhances investor confidence and promotes a well-functioning capital market.

In conclusion, understanding common stock accounting and adhering to accounting principles and disclosure requirements play a critical role in maintaining the integrity and reliability of financial reporting. By doing so, companies can effectively communicate their capital structure and ownership to stakeholders, fostering trust and facilitating informed decision-making.