Finance

What Is RCV On An Insurance Estimate?

Published: November 16, 2023

Learn about RCV on an insurance estimate and how it impacts your finances. Get expert insights and guidance on maximizing your claim's value.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding RCV (Replacement Cost Value)

- Components of an Insurance Estimate

- Importance of RCV on an Insurance Estimate

- Factors Influencing RCV Calculation

- Benefits of Including RCV in Insurance Estimates

- RCV vs. ACV (Actual Cash Value): Key Differences

- RCV Coverage in Insurance Policies

- How to Determine RCV for Specific Property

- Challenges in Estimating RCV

- Conclusion

Introduction

When it comes to insurance policies, understanding the terminology and jargon can be quite overwhelming. One term commonly used in insurance estimates is RCV, which stands for Replacement Cost Value. RCV plays a crucial role in determining the coverage and compensation provided by an insurance policy in the event of a claim.

Insurance estimates are used to determine the financial value of the property or assets being insured. They serve as a basis for calculating the insurance premiums and the amount of coverage provided. RCV, specifically, refers to the cost of replacing or repairing damaged property with a brand-new equivalent.

For example, if your house was damaged by a fire, the RCV would be the estimated cost of rebuilding and restoring the house to its original condition, including materials, labor, and any associated expenses. It is important to note that RCV is different from ACV (Actual Cash Value), which takes into account depreciation and deducts it from the RCV.

In this article, we will delve deeper into the concept of RCV on an insurance estimate, its importance, the factors that influence its calculation, and the benefits of including it in insurance policies. We will also discuss how RCV differs from ACV and how it is determined for specific properties. Finally, we will explore the challenges involved in estimating RCV accurately.

Having a solid understanding of RCV will empower you to make informed decisions when it comes to choosing the right insurance policy and ensuring adequate coverage for your valuable possessions. So let’s dive in and unravel the mystery of RCV on an insurance estimate.

Understanding RCV (Replacement Cost Value)

Replacement Cost Value (RCV) is a crucial concept in insurance estimates that represents the cost of replacing or repairing damaged property with a brand-new equivalent. It is an important factor in determining the coverage and compensation provided by an insurance policy in the event of a claim.

RCV takes into consideration both the material and labor costs required to rebuild or restore the property to its original condition. This includes not only the actual cost of the materials needed but also any associated expenses such as permits, contractor fees, and debris removal.

Unlike Actual Cash Value (ACV), which factors in depreciation, RCV provides coverage for the full cost of replacing or repairing the damaged property without taking into account any reduction in value due to age, wear and tear, or obsolescence. This means that with RCV coverage, you can receive the necessary funds to rebuild your property or replace your possessions with new ones, ensuring that you are not left out of pocket.

Calculating the RCV requires a thorough assessment of the property or assets being insured. Insurance adjusters or professionals will evaluate various factors such as the current market prices of materials and labor, the size and scope of the property, and any unique features or customizations that may impact the replacement cost. This detailed assessment ensures that the RCV accurately reflects the true cost of bringing the property back to its pre-loss condition.

It is important to note that RCV is specific to each type of property and can vary depending on location, market conditions, and other factors. For example, the RCV of a residential home may differ from the RCV of a commercial building due to variations in construction methods, materials, and specialized features.

Understanding RCV is essential for homeowners and property owners, as it allows them to gauge the level of coverage they need to adequately protect their assets. By ensuring that the insurance policy includes RCV coverage, they can have peace of mind knowing that they will be fully compensated for any damages or losses incurred.

Components of an Insurance Estimate

An insurance estimate is a detailed assessment of the value of property or assets being insured. It comprises several key components that help determine the coverage and premium amount for an insurance policy. Understanding these components is essential for policyholders to ensure they have the right level of coverage and to accurately assess the value of their assets. Let’s explore the main components of an insurance estimate:

- Replacement Cost Value (RCV): As discussed earlier, RCV represents the cost of completely replacing or repairing the damaged property with a brand-new equivalent. It is a key component of an insurance estimate, as it determines the amount of coverage provided under the policy. Including RCV in the estimate helps ensure that policyholders can fully rebuild or restore their assets without incurring substantial out-of-pocket expenses.

- Actual Cash Value (ACV): While RCV represents the cost of replacing the property with a brand-new equivalent, ACV takes into account depreciation. ACV is calculated by subtracting the depreciation of the property from the RCV. Depreciation is determined based on factors such as the age, condition, and market value of the property. Insurance policies that include ACV coverage provide compensation based on the current value of the property, taking into consideration its depreciation over time.

- Deductible: The deductible is the amount of money that the policyholder pays out of pocket before the insurance policy coverage kicks in. It is an important component of the insurance estimate, as it impacts the premium amount. Higher deductibles typically result in lower premiums, while lower deductibles result in higher premiums. Policyholders should carefully consider their financial situation and risk tolerance when choosing the deductible amount.

- Additional Coverage: Insurance estimates may include optional coverage that goes beyond the basic policy. Additional coverage can include add-ons such as earthquake coverage, flood insurance, or coverage for high-value items like jewelry or artwork. These additional coverages come with their own specific limits and may require an additional premium.

- Endorsements: Endorsements are amendments or modifications to the standard insurance policy that provide additional coverage or specific protections tailored to the policyholder’s needs. These endorsements can include coverage for home-based businesses, home renovations, or personal liability protection. Including endorsements in the insurance estimate ensures that policyholders have the necessary coverage for their unique circumstances.

By understanding the components of an insurance estimate, policyholders can work closely with their insurance provider to ensure they have the right level of coverage and protection for their valuable assets. It is crucial to review the estimate carefully and ask questions to clarify any doubts or uncertainties before finalizing the policy.

Importance of RCV on an Insurance Estimate

The Replacement Cost Value (RCV) plays a crucial role in an insurance estimate as it determines the coverage and compensation provided by the insurance policy in the event of a claim. Understanding the importance of RCV can help policyholders make informed decisions and ensure adequate coverage for their assets. Let’s explore why RCV is essential:

Accurate Coverage: Including RCV in an insurance estimate ensures that policyholders have the appropriate level of coverage to fully rebuild or repair their property in case of damage or loss. Without RCV, policyholders may only receive compensation based on the Actual Cash Value (ACV), which factors in depreciation. This can leave them with insufficient funds to cover the cost of replacement or repair.

Preventing Out-of-Pocket Expenses: By including RCV in the insurance estimate, policyholders can avoid substantial out-of-pocket expenses for rebuilding or repairing their damaged property. RCV coverage ensures that policyholders can receive the necessary funds to restore their assets to their pre-loss condition without facing significant financial burdens.

Peace of Mind: Knowing that their insurance policy includes RCV coverage provides peace of mind to policyholders. They can have confidence that their insurance will fully compensate them for the cost of replacing or repairing their damaged property, allowing them to resume their lives and businesses as quickly as possible.

Protecting Investments: For most people, a home or property is one of their biggest investments. RCV coverage helps protect this investment by ensuring that policyholders do not suffer substantial financial losses in the event of damage or loss. By providing the necessary financial resources to rebuild or repair, RCV coverage safeguards the value of the assets.

Eliminating Depreciation: Unlike ACV, which considers depreciation, RCV coverage eliminates the impact of age, wear and tear, and obsolescence. This ensures that policyholders are compensated for the full cost of replacing or repairing their damaged property, regardless of its original value or how long they have owned it.

Promoting Financial Recovery: After experiencing a loss or damage, financial recovery plays a crucial role in moving forward. RCV coverage facilitates a quicker and smoother recovery process by providing the necessary funds to cover the cost of replacement or repair. This allows policyholders to rebuild their lives, businesses, and properties without unnecessary delays or financial strain.

Understanding the importance of RCV on an insurance estimate is critical for policyholders to ensure they have the right level of coverage and protection for their assets. By including RCV in their insurance policies, individuals and businesses can confidently face unexpected events and have the financial resources necessary for a full recovery.

Factors Influencing RCV Calculation

The calculation of Replacement Cost Value (RCV) in an insurance estimate is influenced by several key factors. These factors play a significant role in determining the accurate cost of replacing or repairing damaged property. Insurance adjusters and professionals take these factors into account to ensure that the RCV reflects the true cost involved. Let’s explore the factors that influence RCV calculation:

- Materials and Labor Costs: The prices of materials and labor required for rebuilding or repairing the damaged property significantly impact the RCV calculation. The current market rates for building materials, such as lumber, bricks, or concrete, as well as the cost of skilled labor, are considered to determine the replacement cost accurately.

- Property Size and Complexity: The size and complexity of the property being insured are also important factors in RCV calculation. Larger properties or those with unique features and specialized construction methods may require additional materials, labor, or expertise, resulting in a higher replacement cost.

- Location: The location of the property can influence the RCV calculation. Construction costs can vary significantly from one geographic area to another. Factors such as regional building codes, availability of skilled labor, and transportation costs for construction materials can all impact the replacement cost.

- Architectural Details and Customizations: Architectural details, unique design elements, and customizations present in the property can also affect RCV calculation. These features may require specialized expertise or materials, increasing the cost of replacement or repair.

- Permits and Fees: The cost of obtaining permits and paying associated fees for rebuilding or repairing the property is considered in the RCV calculation. These additional costs, such as building permits or inspection fees, are necessary expenses that contribute to the overall replacement cost.

- Debris Removal: The removal of debris resulting from damage or loss is an important consideration in RCV calculation. The cost of safely clearing and disposing of debris is factored into the replacement cost, as it is an essential step in the rebuilding or repair process.

It is important to note that these factors may vary depending on the type of property and its specific requirements. Insurance professionals and adjusters carefully evaluate these factors to ensure an accurate and comprehensive RCV calculation tailored to each individual case.

Understanding the factors influencing RCV calculation allows policyholders to be aware of the various elements considered in determining the replacement cost. By having a clear understanding of these factors, policyholders can have confidence that the RCV accurately represents the true cost of replacement or repair for their insured property.

Benefits of Including RCV in Insurance Estimates

Including Replacement Cost Value (RCV) in insurance estimates offers several important benefits to policyholders. RCV provides more comprehensive coverage and ensures that policyholders have the necessary financial resources to rebuild or repair their damaged property. Let’s explore the key benefits of including RCV in insurance estimates:

- Accurate Compensation: RCV provides policyholders with the most accurate compensation for their damaged property. Unlike Actual Cash Value (ACV), which takes into consideration depreciation, RCV covers the full cost of replacement or repair without deducting for age, wear and tear, or obsolescence. This ensures that policyholders receive the necessary funds to restore their property to its pre-loss condition.

- Complete Rebuilding or Repair: By including RCV in the insurance estimate, policyholders can ensure that they have the financial means to fully rebuild or repair their damaged property. RCV covers not only the material costs but also factors in labor, permits, and other associated expenses. This means policyholders can restore their property to its original state without facing significant out-of-pocket expenses.

- Protection Against Inflation: RCV takes into account the current market prices of materials and labor, protecting policyholders against inflation. As the cost of construction materials and labor increases over time, having RCV coverage ensures that policyholders are adequately compensated, regardless of when a claim is filed.

- Peace of Mind: Including RCV in insurance estimates provides policyholders with peace of mind, knowing that their insurance coverage will fully protect their assets. It eliminates the worry of not having enough funds to rebuild or repair their damaged property. Policyholders can focus on the recovery process without the added stress of financial burdens.

- Easier Claims Process: RCV simplifies the claims process for policyholders. Since it accurately reflects the replacement or repair cost, there is no need for lengthy negotiations or discussions regarding the value of the property. Policyholders can receive prompt and fair compensation, allowing them to initiate the necessary steps to restore their property.

Including RCV in insurance estimates provides policyholders with comprehensive coverage and financial security. It ensures that they have the necessary funds to fully recover from damage or loss, allowing them to rebuild their lives, homes, and businesses effectively.

Understanding the benefits of including RCV in insurance estimates empowers policyholders to make informed decisions when selecting their insurance coverage. By opting for RCV, individuals and businesses can protect their valuable assets with confidence and have peace of mind in the face of unexpected events.

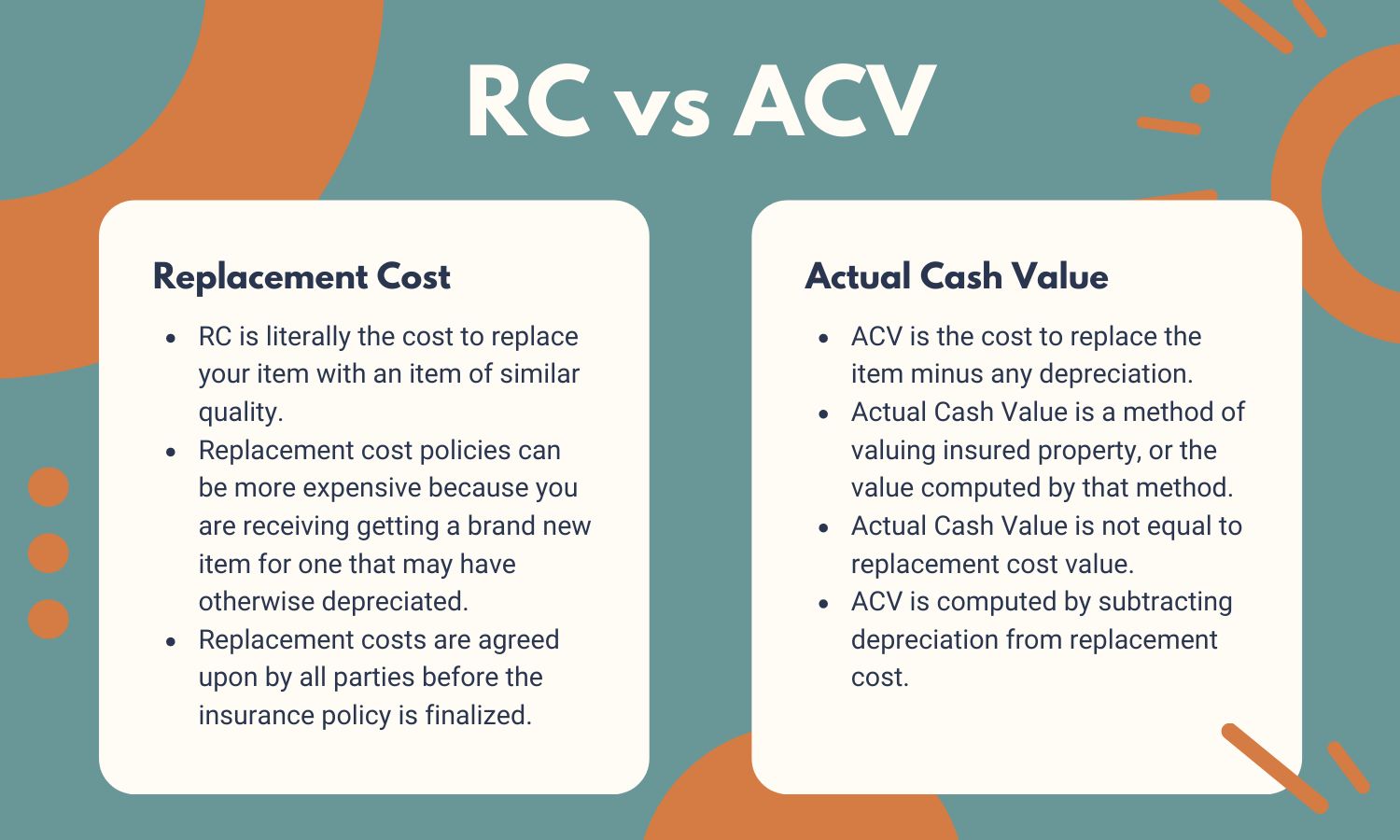

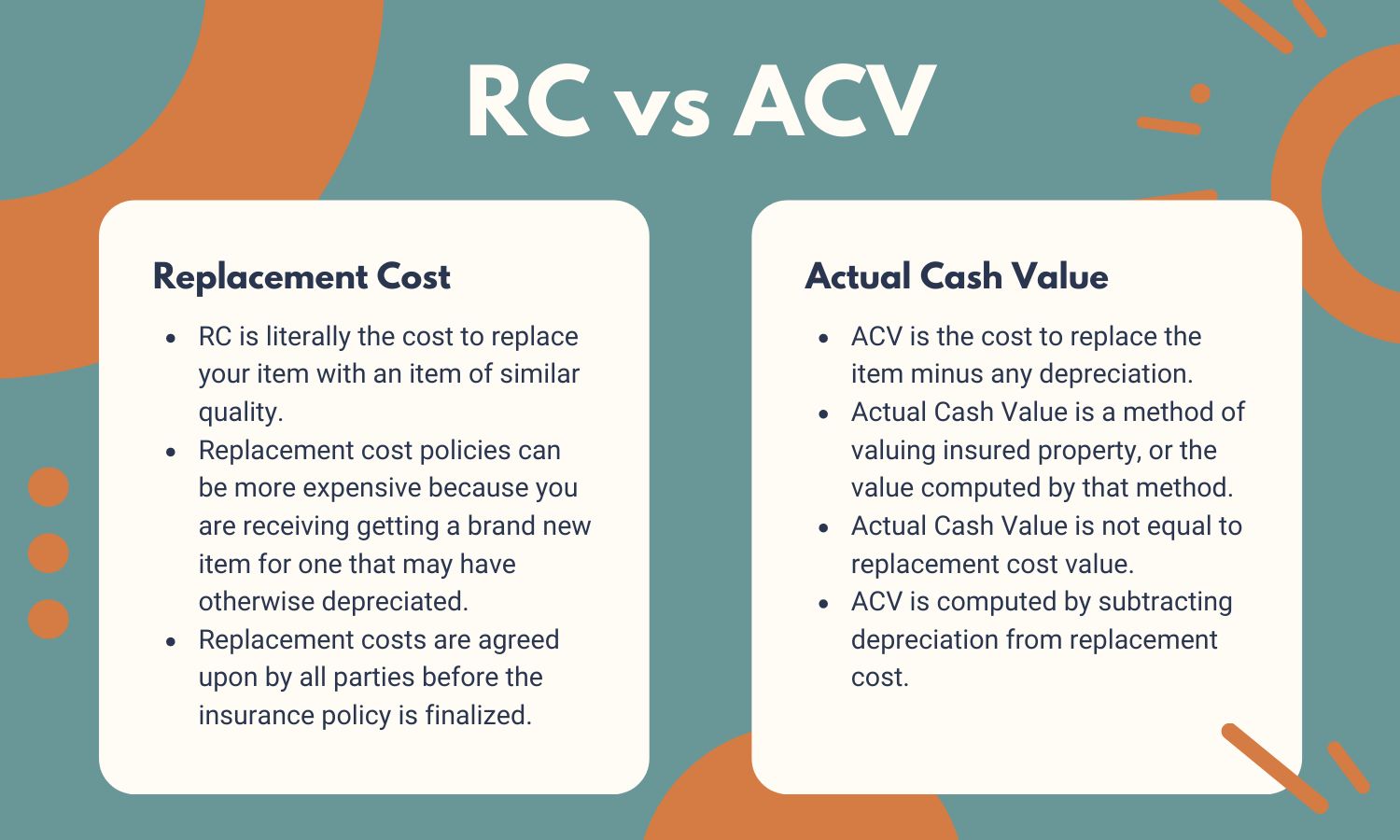

RCV vs. ACV (Actual Cash Value): Key Differences

When it comes to insurance estimates, two commonly used terms are Replacement Cost Value (RCV) and Actual Cash Value (ACV). Both RCV and ACV play significant roles in determining the coverage and compensation provided by an insurance policy, but they differ in how they calculate the value of the insured property. Let’s explore the key differences between RCV and ACV:

Definition: RCV represents the cost of completely replacing or repairing the damaged property with a brand-new equivalent, without considering depreciation. ACV, on the other hand, takes into account depreciation and calculates the value of the property based on its current market worth.

Depreciation: RCV does not consider depreciation, while ACV factors it in. Depreciation accounts for the value that is lost due to factors such as age, wear and tear, and obsolescence. ACV deducts the depreciation from the replacement cost to determine the actual cash value of the property.

Compensation: RCV provides compensation to policyholders based on the full cost of replacement or repair, without deducting for depreciation. It ensures that policyholders receive the necessary funds to restore their property to its pre-loss condition. ACV offers compensation based on the current market value of the property, considering its depreciation over time. As a result, the payout for an ACV claim is generally lower than that of an RCV claim.

Premiums: RCV coverage typically comes with higher premiums than ACV coverage. This is because RCV provides more comprehensive coverage and offers compensation without factoring in depreciation. ACV coverage, with its lower payout potential due to depreciation deduction, generally translates to lower premiums.

Property Age and Condition: RCV is particularly advantageous for properties that are newer or well-maintained, as their replacement costs are likely to be higher. ACV coverage may be more suitable for older properties, as their value has likely depreciated over time.

Rebuilding or Repair: RCV coverage ensures that policyholders have the necessary funds to fully rebuild or repair their damaged property, whereas ACV coverage may not provide enough compensation to cover the full cost of replacement or repair. With ACV, policyholders may need to contribute out-of-pocket funds to complete the restoration process.

Understanding the differences between RCV and ACV helps policyholders to make informed decisions when selecting their insurance coverage. RCV provides more extensive coverage and eliminates the impact of depreciation, providing policyholders with more comprehensive compensation in the event of damage or loss.

RCV Coverage in Insurance Policies

RCV (Replacement Cost Value) coverage is an essential component of many insurance policies, particularly those covering property damage or loss. RCV coverage ensures that policyholders are adequately compensated for the cost of replacing or repairing damaged property with a brand-new equivalent, without deducting for depreciation. Let’s take a closer look at RCV coverage in insurance policies:

Property Insurance Policies: RCV coverage is commonly included in property insurance policies, such as homeowners insurance or commercial property insurance. These policies protect property owners against a wide range of perils, including fire, theft, vandalism, natural disasters, and more. RCV coverage in property insurance ensures that policyholders can fully rebuild or repair their property without facing significant out-of-pocket expenses.

Contents Insurance Policies: Contents insurance policies, also known as personal property insurance, cover the belongings and possessions inside a property. RCV coverage in contents insurance provides reimbursement for the full cost of replacing damaged or stolen items, without accounting for depreciation. This ensures that policyholders can replace their belongings with new ones similar to the ones lost.

Specialized Insurance Policies: RCV coverage is also prevalent in specialized insurance policies that cover specific types of property or assets. For example, RCV coverage may be included in insurance policies for high-value items like jewelry, artwork, or collectibles. In these cases, the policyholder is protected by ensuring that they can replace these valuable items with similar ones without incurring financial losses.

Builders Risk Insurance: Builders risk insurance covers buildings or structures during the construction phase. RCV coverage in builders risk insurance ensures that the various parties involved in construction projects, such as the owner, contractor, or lender, are protected against unforeseen events. RCV allows for the full coverage of damages or losses, enabling the property to be restored to its intended condition.

Business Interruption Insurance: Business interruption insurance provides coverage for lost income and additional expenses when a business operation is interrupted due to a covered peril. RCV coverage in business interruption insurance ensures that the business can recover and resume operations quickly without bearing the financial burden of the necessary repairs or replacements.

RCV coverage in insurance policies is crucial for policyholders, as it provides them with the necessary financial resources to fully rebuild, repair, or replace their damaged property. It eliminates the worry of facing substantial out-of-pocket expenses and allows policyholders to get back on track after a loss or damage event.

How to Determine RCV for Specific Property

Determining the Replacement Cost Value (RCV) for a specific property requires a thorough assessment of various factors that contribute to the cost of replacement or repair. Insurance adjusters or professionals use specific methods and considerations to calculate the RCV accurately. Let’s explore the steps involved in determining the RCV for a specific property:

- Property Evaluation: An initial evaluation of the property is conducted to assess its size, structure, and unique features. This examination provides a baseline understanding of the property and lays the foundation for the RCV calculation.

- Market Research: Market research is conducted to gather current pricing data for building materials, labor costs, and associated expenses. This research ensures that the RCV reflects the current market rates, providing an accurate estimation of the replacement or repair cost.

- Material Quantities: The quantities of materials required for replacement or repair are determined based on the property evaluation. This includes assessing the needs for building materials, such as roofing, flooring, siding, etc., as well as any additional materials necessary for specialized features or customization.

- Labor Costs: Labor costs are determined by evaluating the scope of work needed for the replacement or repair process. Skilled labor rates, including contractors or tradespeople, are considered based on the specific requirements of the property.

- Associated Expenses: Associated expenses such as permits, contractor fees, debris removal, and any other necessary expenditures are factored into the RCV calculation. These expenses contribute to the overall cost of replacement or repair and need to be considered to ensure an accurate estimation.

- Adjustment for Unique Features or Upgrades: Unique features or upgrades that enhance the value of the property, such as high-end fixtures or custom finishes, are evaluated separately. An adjustment is made to the RCV calculation to account for these additional costs.

- Documentation and Documentation: The assessment of the property and all the factors considered in the RCV calculation are documented thoroughly. This includes measurements, materials and labor estimates, market research data, and any other relevant information to support the RCV determination.

Professional insurance adjusters, contractors, or other qualified experts typically conduct the process of determining RCV for a specific property. Their expertise ensures that all relevant factors are taken into account, resulting in an accurate calculation of the replacement or repair cost.

It is essential for policyholders to work closely with their insurance provider and provide accurate information during the evaluation process to ensure that the RCV accurately reflects their property’s replacement or repair cost.

Challenges in Estimating RCV

Estimating the Replacement Cost Value (RCV) for property can be a complex task, as several challenges can arise during the process. These challenges must be addressed to ensure an accurate assessment of the cost of replacement or repair. Let’s explore some common challenges in estimating RCV:

- Property Complexity: Properties with unique features, intricate designs, or customizations can pose challenges in estimating RCV. Determining the cost of replacing or repairing these specialized aspects requires careful evaluation and consideration, as standard cost estimation methods may not suffice.

- Outdated or Unavailable Materials: In some cases, properties may have construction materials that are no longer available or have become obsolete. Estimating RCV for such properties requires finding suitable alternatives or considering the cost of custom fabrication, which can affect the accuracy of the estimate.

- Market Fluctuations: The fluctuating nature of construction material prices and labor costs can impact the accuracy of RCV estimates. Rapid changes in market conditions can make it challenging to obtain up-to-date pricing data, potentially leading to an over- or underestimation of the replacement cost.

- Lack of Documentation: Insufficient documentation or incomplete records of the property’s features, materials, or customizations can complicate the RCV estimation process. Without detailed information, it becomes challenging to accurately assess the cost of replacement or repair, potentially leading to an inaccurate estimation.

- Permitting and Code Compliance: Ensuring that the replacement or repair process complies with local building codes and obtains the necessary permits is crucial. The cost of compliance may vary depending on the specific requirements, which can pose challenges in accurately estimating the RCV.

- Exclusions or Limitations in Insurance Policies: Some insurance policies may have exclusions or limitations that impact the RCV estimation. For example, certain high-value items may have specified limits on coverage that do not reflect their full replacement cost. Understanding the policy coverage and limitations is crucial for an accurate RCV estimation.

Addressing these challenges requires the expertise of insurance adjusters, contractors, or other qualified professionals who can navigate the complexities of estimating RCV accurately. It is crucial for insurance policyholders to communicate openly with their insurance provider and provide as much information as possible to overcome these challenges effectively.

By recognizing and addressing these challenges in estimating RCV, policyholders can ensure that they have the appropriate coverage and financial resources to fully rebuild or repair their property in the event of damage or loss.

Conclusion

Understanding the concept of Replacement Cost Value (RCV) on an insurance estimate is crucial for policyholders to ensure adequate coverage and protection for their assets. RCV represents the cost of replacing or repairing damaged property with a brand-new equivalent, without deducting for depreciation. By including RCV in insurance policies, policyholders can receive the necessary funds to fully rebuild, repair, or replace their damaged property.

RCV plays a significant role in determining the coverage and compensation provided by insurance policies. It eliminates the impact of depreciation and ensures accurate compensation based on the cost of replacement or repair. RCV coverage provides policyholders with peace of mind and eliminates the worry of facing substantial out-of-pocket expenses when dealing with damage or loss.

Factors such as property size, materials and labor costs, location, and unique features influence the calculation of RCV. These factors, along with accurate documentation and market research, contribute to a precise estimation of the replacement or repair cost.

RCV coverage offers numerous benefits, such as accurate compensation, complete rebuilding or repair, protection against inflation, peace of mind, and a smoother claims process. By including RCV in their insurance policies, policyholders can ensure that their valuable assets are fully protected and that they have the necessary financial resources to recover quickly after a loss or damage event.

It is important to note that obstacles may arise in estimating RCV, such as property complexity, outdated or unavailable materials, market fluctuations, lack of documentation, permitting issues, and policy limitations. Overcoming these challenges requires the expertise of professionals who can navigate these complexities and provide an accurate assessment of the RCV.

In conclusion, understanding RCV and its significance in insurance estimates empowers policyholders to make informed decisions when selecting their insurance coverage. By choosing policies that include RCV, individuals and businesses can confidently protect their assets and ensure a smooth recovery process in the face of unexpected events.