Home>Finance>How Two Boston Grads Are Disrupting The Auto Insurance Industry

Finance

How Two Boston Grads Are Disrupting The Auto Insurance Industry

Published: November 19, 2023

Discover how two Boston graduates are shaking up the finance industry with their groundbreaking approach to auto insurance. Learn how their innovation is revolutionizing the way we think about insurance coverage.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Background of the Auto Insurance Industry

- The Problem with Traditional Insurance Models

- Meet the Boston Grads: A Fresh Perspective

- The Disruptive Approach: Technology-based Solutions

- Case Study 1: Usage-Based Insurance

- Case Study 2: Peer-to-Peer Insurance

- The Benefits of Disrupting the Auto Insurance Industry

- Challenges and Obstacles Faced by the Boston Grads

- Conclusion

Introduction

The auto insurance industry has remained largely unchanged for decades, with traditional models focusing on premiums based on demographics and historical data. However, two Boston graduates have emerged with a fresh perspective, challenging the status quo and disrupting the entire industry.

Their approach involves leveraging technology and innovative solutions to revolutionize the way auto insurance is approached, providing customers with more personalized offerings and improved experiences. By harnessing the power of data analytics, artificial intelligence, and other cutting-edge technologies, these disruptors are reshaping the insurance landscape and redefining the relationship between insurers and policyholders.

In this article, we will delve into the background of the auto insurance industry, explore the limitations of traditional models, and highlight the groundbreaking solutions offered by these Boston grads. We will also examine real-life case studies that demonstrate the effectiveness of their disruptive approach and discuss the benefits and challenges associated with shaking up the auto insurance industry.

By the end of this article, you will gain a deeper understanding of the potential impact these innovators could have on the auto insurance sector and the transformative power of embracing technology in an industry ripe for change.

Background of the Auto Insurance Industry

The auto insurance industry has been a cornerstone of the financial sector for decades. It serves as a means of financial protection for vehicle owners against potential risks and liabilities. Traditional auto insurance models have primarily relied on demographic factors such as age, gender, and location, along with historical data, to calculate premiums. This one-size-fits-all approach has often resulted in high costs and limited customization for policyholders. Furthermore, the current auto insurance industry faces several challenges. Fraudulent claims, outdated processes, and an overall lack of transparency have created a sense of distrust among customers. Additionally, the traditional model tends to penalize safe drivers who fall within higher risk categories due to no fault of their own. These challenges have paved the way for disruption in the auto insurance industry. By leveraging advancements in technology and data analytics, innovative companies are seeking to address the limitations of traditional models and provide customers with more personalized, affordable, and transparent insurance solutions.

The Problem with Traditional Insurance Models

Traditional auto insurance models have long been criticized for their limitations and drawbacks. One of the main issues is the lack of customization and personalization. Premiums are often calculated based on generalized demographic factors such as age, gender, and location, without taking into account individual driving habits and behavior. This leads to higher costs for safe drivers who are grouped into higher risk categories based on these demographic factors.

Another problem with traditional models is the lack of transparency and customer engagement. Policyholders typically have limited visibility into how their premiums are calculated and are not actively involved in the decision-making process. This can create a sense of mistrust and dissatisfaction among customers, who may feel that they are being unfairly treated or overcharged.

Fraudulent claims are also a significant issue in the auto insurance industry. Traditional models often rely heavily on manual processes, making it easier for fraudsters to manipulate the system and file false claims. This not only results in financial losses for insurance companies but also drives up premiums for honest policyholders.

Lastly, the lengthy and cumbersome claims process is another pain point for customers. From filing a claim to receiving reimbursement, the entire process is often slow, complex, and frustrating. This leads to delays in getting the necessary repairs or replacements, causing inconvenience and dissatisfaction for policyholders.

These issues highlight the need for a disruptive approach in the auto insurance industry. Companies are now exploring technology-based solutions to overcome these shortcomings and provide customers with more personalized, transparent, and efficient insurance experiences.

Meet the Boston Grads: A Fresh Perspective

In the midst of the challenges faced by the auto insurance industry, two Boston graduates have emerged with a fresh perspective and a drive to disrupt the status quo. Armed with their knowledge and innovative ideas, these disruptors bring a new approach to the table.

With a deep understanding of technology and a passion for improving the insurance experience, these Boston grads recognized the need for a more customer-centric approach in the auto insurance industry. They saw an opportunity to leverage technology to provide personalized insurance solutions that take into account individual driving habits and behaviors.

These forward-thinking individuals understand that safe drivers should be rewarded, regardless of their demographic characteristics. By utilizing advanced data analytics and artificial intelligence, they have developed algorithms that assess driving patterns, such as speed, acceleration, and braking, to determine an individual’s risk profile more accurately.

Their aim is not only to provide fair and customized insurance premiums but also to create a more engaging and transparent experience for policyholders. Through user-friendly mobile applications and intuitive dashboards, customers can actively track their driving behaviors, monitor their progress, and understand how it affects their premiums.

Additionally, these Boston grads have taken a holistic approach to insurance by integrating other factors, such as vehicle maintenance and driver education, into their offerings. By encouraging proactive maintenance and safe driving practices, they are not only reducing the risk of accidents but also promoting a safer and more responsible driving culture.

Their commitment to innovation and customer empowerment has garnered attention within the industry. Their disruptive approach has not gone unnoticed, as they have attracted substantial investments and partnerships with influential players in the insurance sector.

In the next sections, we will explore the specific technology-based solutions that these Boston grads have introduced to the auto insurance industry. Through real-life case studies, we will highlight the impact of their disruptive approach and the benefits it brings to both policyholders and insurers.

The Disruptive Approach: Technology-based Solutions

The Boston grads’ disruptive approach to the auto insurance industry centers around the use of technology to revolutionize the way insurance is approached and delivered. By harnessing the power of data analytics, artificial intelligence, and other cutting-edge technologies, they have introduced innovative solutions that provide a more personalized and efficient insurance experience.

One of their key technology-based solutions is the implementation of usage-based insurance (UBI). UBI utilizes telematics devices or mobile apps to track and monitor driving behavior in real-time. By collecting data on factors such as speed, acceleration, braking, and time of day, insurers can determine the level of risk associated with an individual driver. This data-driven approach allows for more accurate, personalized premium calculations, rewarding safe driving habits and encouraging responsible behavior on the road.

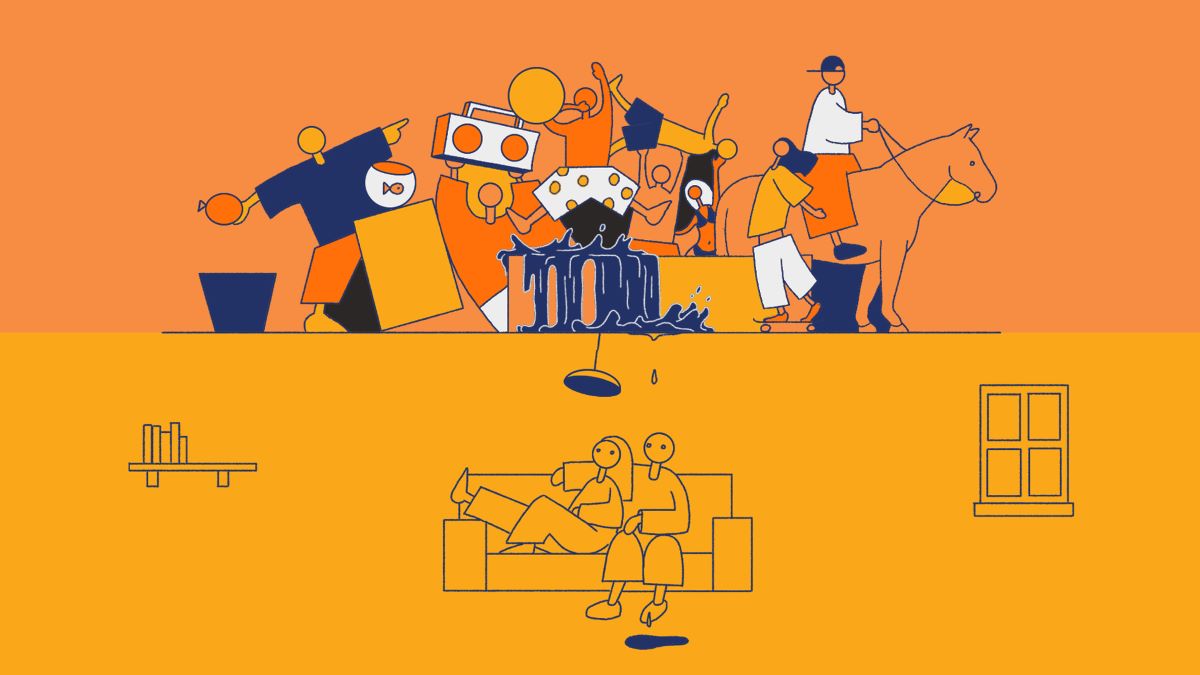

Another disruptive solution introduced by these Boston grads is peer-to-peer insurance. This model leverages the power of social connections and trust within communities. It allows individuals to form small groups or “pools” with friends, family, or colleagues and contribute to a shared insurance fund. Claims are then paid out from this pool, eliminating the need for traditional insurance intermediaries. By using smart contracts on a blockchain platform, the process becomes transparent and more efficient, ensuring that claims are paid out fairly and promptly.

Additionally, these disruptors are embracing artificial intelligence to streamline the claims process. By leveraging AI algorithms, they can automate claims assessment and streamline the verification process, significantly reducing the time and effort required for both policyholders and insurers. This automation also helps to mitigate fraudulent claims and improve overall efficiency and customer satisfaction.

Their tech-based solutions extend beyond policy offerings and claims processing. These innovators are also utilizing chatbots and virtual assistants to enhance customer support and engagement. By leveraging natural language processing and machine learning, they can provide instant responses to customer inquiries, offering a seamless and efficient customer service experience.

Overall, the disruptive approach of the Boston grads has brought technology to the forefront of the auto insurance industry. Their use of data analytics, AI, and other innovative technologies has reshaped the way insurance is delivered, making it more personalized, transparent, and efficient.

Case Study 1: Usage-Based Insurance

One of the innovative solutions introduced by the Boston grads is usage-based insurance (UBI). To understand its impact, let’s take a closer look at a real-life case study.

Sarah, a young driver, was frustrated with the high insurance premiums she was paying, despite being a safe and responsible driver. She felt that her age and location were unfairly influencing her insurance costs. However, when she discovered a UBI program offered by the Boston grads’ insurance company, she decided to give it a try.

Sarah was provided with a small telematics device to install in her car. The device collected data on her driving habits, including speed, acceleration, and braking. This data was then analyzed by advanced algorithms to determine Sarah’s risk profile more accurately.

Over the course of a few months, Sarah noticed a substantial difference in her insurance premiums. As she practiced safe driving habits, such as maintaining a steady speed, avoiding sudden accelerations or harsh braking, and driving during less congested times, her premiums gradually decreased.

The UBI program allowed Sarah to have greater control over her insurance costs and be rewarded for her safe driving practices. She received regular feedback through a mobile app, which provided insights into her driving habits and suggestions on how to improve. This helped Sarah become an even better and safer driver over time.

Not only did Sarah benefit from this UBI program, but the insurance company also reaped the rewards. By accurately assessing individual risk based on real-time data, the company was able to differentiate between safe and risky drivers more effectively. This allowed them to price premiums more fairly and minimize unnecessary costs associated with higher-risk policyholders.

The case study of Sarah and UBI demonstrates the effectiveness of technology-based solutions in the auto insurance industry. Through the use of telematics devices and advanced analytics, UBI programs offer a more personalized and fair insurance experience for policyholders, while also benefiting insurers by reducing risk and improving profitability.

This approach not only incentivizes safe driving practices but also promotes a shift in behavior and a greater sense of responsibility on the road. With UBI, policyholders like Sarah have the opportunity to take control of their insurance premiums and be rewarded for their safe driving habits, ultimately improving the overall safety of our roads.

Case Study 2: Peer-to-Peer Insurance

Another disruptive solution introduced by the Boston grads is peer-to-peer insurance. Let’s delve into a case study to understand the impact of this innovative approach.

John and his group of friends were dissatisfied with the traditional insurance options available to them. They felt that the premiums were too high and didn’t accurately reflect their driving abilities. When they heard about a peer-to-peer insurance platform offered by the Boston grads, they decided to form a pool and give it a try.

Through the platform, John and his friends contributed to a shared insurance fund, pooling their resources together. They were able to define the terms and conditions of their group policy, including the coverage limits, deductible amounts, and rules for claims settlement.

John’s friend, Lisa, unfortunately, had an accident. She filed a claim with the peer-to-peer insurance platform, which went through a transparent and automated verification process. The claim was approved based on the predefined rules set by the group, and Lisa received the necessary funds for repairs.

What makes the peer-to-peer insurance model unique is that it removes the traditional intermediaries and allows the group members to have more control over their insurance. By utilizing blockchain technology and smart contracts, the process becomes transparent and efficient, ensuring that claims are settled fairly and promptly.

In this case study, John and his friends experienced several benefits from the peer-to-peer insurance model. Firstly, they were able to customize their insurance coverage to meet their specific needs. Instead of a one-size-fits-all approach, the group could collectively decide on the terms that worked best for them.

Secondly, the peer-to-peer model promoted a sense of trust and shared responsibility within the group. Knowing that they were all contributing to the insurance fund and sharing the risks and rewards, there was a greater sense of accountability and collaboration.

Lastly, the transparency and automated claims process streamlined the entire experience for John and his friends. Claims were settled promptly without the need for extensive paperwork or lengthy verification processes. This efficiency not only reduced the frustration of claimants but also minimized the administrative burdens on insurers.

This case study highlights the potential of peer-to-peer insurance as a disruptive solution in the auto insurance industry. By leveraging the power of communities and utilizing blockchain technology, this model offers more control, transparency, and efficiency for policyholders, while also reducing costs and improving customer satisfaction for insurers.

The Benefits of Disrupting the Auto Insurance Industry

The disruptive approach introduced by the Boston grads brings several key benefits to the auto insurance industry. Let’s explore these advantages:

- Personalization: By leveraging technology and data analytics, the disruptors are able to offer more personalized insurance solutions. This means that policyholders are no longer treated as part of a homogeneous group based on demographics, but rather as individuals with unique driving habits and behaviors. Personalized policies lead to fairer premiums and a tailored insurance experience.

- Improved Risk Assessment: Traditional models often rely on generalized demographic factors to determine risk. However, technology-based solutions allow for more accurate risk assessment based on real-time data. This means that safe drivers who fall into higher-risk categories due to demographic factors can now receive more favorable premiums based on their actual driving habits.

- Transparency: Disruptive approaches prioritize transparency, which has long been lacking in the insurance industry. Through the use of technology, policyholders can now have greater visibility into how their premiums are calculated, what factors contribute to their risk profile, and how their driving habits affect their rates. This transparency builds trust and improves customer satisfaction.

- Efficiency: Technology-based solutions streamline processes and eliminate unnecessary bureaucracy. Claims processing, which has historically been a tedious and time-consuming task, can now be automated and expedited. This improves the overall efficiency of the insurance process, reducing delays and frustrations for policyholders.

- Cost Savings: Disruptive approaches can lead to cost savings for both policyholders and insurers. By accurately assessing risk and providing personalized policies, policyholders can save money by paying premiums based on their actual driving behaviors. Insurers, on the other hand, can reduce costs associated with fraudulent claims, administrative overhead, and inefficient processes.

- Safety Promotion: By encouraging safe driving habits and providing incentives for responsible behavior on the road, disruptive approaches contribute to improving overall road safety. This not only benefits policyholders but also the community at large by reducing accidents, injuries, and fatalities.

The benefits of disrupting the auto insurance industry go beyond the immediate advantages for policyholders and insurers. These innovative approaches have the potential to reshape the entire concept of insurance, promoting a more customer-centric and data-driven approach. By embracing technology, the industry can become more efficient, transparent, and fair, ushering in a new era of insurance experiences for all stakeholders involved.

Challenges and Obstacles Faced by the Boston Grads

The Boston grads, as disruptors in the auto insurance industry, face several challenges and obstacles in their journey to revolutionize the traditional models. Let’s explore some of the key hurdles they encounter:

- Resistance to Change: Traditional insurance companies are often resistant to adopting new technologies and disrupting established practices. This can pose a challenge for the Boston grads as they try to gain market acceptance and build partnerships within the industry.

- Data Privacy and Security Concerns: As technology-based solutions rely heavily on collecting and analyzing a vast amount of data, ensuring data privacy and security becomes paramount. The Boston grads must navigate the complexities of data protection regulations and develop robust cybersecurity measures to address any potential risks.

- Regulatory Compliance: The insurance industry is subject to strict regulations, making it important for the Boston grads to navigate and comply with various legal and regulatory frameworks. This compliance can pose challenges in terms of meeting the requirements while still delivering innovative and disruptive solutions.

- Technical Infrastructure: Implementing technology-based solutions requires a robust technical infrastructure. The Boston grads need to invest in scalable systems, reliable data analytics platforms, and secure cloud storage to handle the vast amount of data collected. Building and maintaining this infrastructure can be a significant challenge.

- Customer Adoption: Convincing customers to embrace new insurance models and trust technology-based solutions can be a hurdle. Some individuals may be hesitant to share driving data or may have concerns about the perceived intrusiveness of telematics devices. The Boston grads must educate potential customers about the benefits and address any objections or misconceptions they may have.

- Competitive Landscape: The auto insurance industry is highly competitive, with well-established companies dominating the market. The Boston grads face the challenge of differentiating themselves from the competition and convincing customers and insurers of the advantages of their disruptive solutions.

- Limited Resources: As start-ups or relatively new players in the industry, the Boston grads may face resource constraints such as funding and limited operational capacity. Scaling their business and investment in research and development to stay ahead of the market can be challenging.

Despite these obstacles, the Boston grads are determined to overcome them and pave the way for a more innovative and customer-centric insurance industry. They continue to forge partnerships, invest in technology, and educate stakeholders about the benefits of their disruptive approaches.

By addressing these challenges head-on, the Boston grads have the opportunity to create lasting change in the industry, improving the overall insurance experience for policyholders and driving the adoption of technology-driven solutions in the auto insurance sector.

Conclusion

The auto insurance industry is experiencing a transformative shift, thanks to the disruptive approaches introduced by the Boston grads. By leveraging technology and innovative solutions, they are challenging the limitations of traditional insurance models and reshaping the entire industry.

Their fresh perspective brings numerous benefits to both policyholders and insurers. Personalization, improved risk assessment, transparency, efficiency, cost savings, and safety promotion are just a few of the advantages that technology-based solutions offer. By utilizing data analytics, artificial intelligence, and other cutting-edge technologies, the Boston grads are creating a more customer-centric, fair, and transparent insurance experience.

However, they face several challenges along the way. Resistance to change, data privacy concerns, regulatory compliance, technical infrastructure requirements, customer adoption obstacles, competitive pressures, and limited resources are among the hurdles they must overcome. Despite these challenges, the Boston grads remain committed to their mission and continue to innovate and educate the industry and customers about the benefits of their disruptive solutions.

The potential impact of disrupting the auto insurance industry is significant. By driving change and challenging established models, the Boston grads are shaping an industry that has long been resistant to transformation. Their innovative approaches have the power to not only improve the insurance experience but also promote safer roads and more responsible driving behavior.

In conclusion, the Boston grads’ disruptive approach is revolutionizing the auto insurance industry. By infusing technology, data analytics, and customer-centricity, they are redefining the relationship between insurers and policyholders. As their solutions gain traction and industry acceptance, we can expect to witness a fundamental shift in how auto insurance is approached and delivered, creating a brighter and more innovative future for the industry as a whole.