Finance

How To Read Auto Insurance Policy

Published: November 19, 2023

Learn how to read your auto insurance policy and understand the finance terms. Gain knowledge about coverage, limits, and deductibles.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to auto insurance, having a solid understanding of your policy is crucial. Reading through the fine print and deciphering the complex terms and coverage options can be overwhelming, but it’s essential for making informed decisions and ensuring you have the right insurance protection.

In this article, we will guide you through the process of reading your auto insurance policy. We will explain the key terms, coverage types, policy limits, exclusions, and additional benefits. By the end, you’ll feel more confident in understanding the details of your auto insurance coverage.

Understanding your auto insurance policy is not only important for managing your financial risk but also for knowing your rights and obligations should an accident or incident occur. Being familiar with the terms and conditions of your policy will give you peace of mind and help you navigate the claims process with ease.

Whether you’re a new driver or have had auto insurance for years, this comprehensive guide will provide you with the knowledge to read and understand your auto insurance policy effectively.

Understanding the Key Terms

Auto insurance policies can be filled with industry jargon and technical terms that may seem confusing at first. However, familiarizing yourself with these key terms will go a long way in helping you decode your policy. Here are some essential terms you should know:

- Premium: The amount you pay to the insurance company for your coverage, usually paid monthly or annually.

- Deductible: The out-of-pocket amount you are responsible for paying before your insurance coverage kicks in. For example, if you have a $500 deductible and file a claim for $2,000 in damages, you will pay the first $500, and your insurance will cover the remaining $1,500.

- Policy period: The specific duration for which your policy is in effect. It is typically for a six-month or one-year term.

- Liability coverage: This type of coverage protects you if you cause an accident and are held responsible for bodily injury or property damage to others.

- Collision coverage: Collision coverage pays for damage to your vehicle if it collides with another object, such as a car or a tree. This coverage is subject to your deductible.

- Comprehensive coverage: Comprehensive coverage covers damage to your vehicle caused by incidents other than a collision, such as theft, vandalism, fire, or natural disasters.

- Uninsured/underinsured motorist coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or whose insurance coverage is insufficient to cover your damages.

- Policy limits: The maximum amount your insurance company will pay for a covered claim. For example, if your liability coverage has a limit of $100,000, that is the maximum amount your insurer will pay for bodily injury or property damage resulting from an accident.

These are just a few key terms to get you started. Your auto insurance policy may contain additional terms specific to your coverage and state regulations. Take the time to read through your policy carefully, highlighting and researching any terms or phrases you are unsure about. A clear understanding of these terms will enable you to make better decisions about your coverage and ensure you are adequately protected.

Coverage Types Explained

Auto insurance policies offer various types of coverage to protect you and your vehicle from different risks. Understanding these coverage types will help you determine the level of protection you have and whether any additional coverage is necessary. Here are some common coverage types explained:

- Liability coverage: Liability coverage is required in most states and helps cover the costs associated with injuries or property damage you cause to others in an accident. It typically consists of two parts: bodily injury liability and property damage liability.

- Collision coverage: Collision coverage pays for the repair or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. It is usually subject to a deductible.

- Comprehensive coverage: Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Uninsured/underinsured motorist coverage: This coverage kicks in if you are involved in an accident with a driver who either doesn’t have insurance or doesn’t have enough insurance to cover your injuries or property damage.

- Medical payments coverage: Medical payments coverage, also known as personal injury protection (PIP), helps pay for medical expenses resulting from an accident, regardless of who is at fault. It may also cover lost wages and funeral expenses.

- Rental reimbursement coverage: Rental reimbursement coverage provides compensation for the cost of renting a car while your vehicle is being repaired after an accident.

- Towing and labor coverage: This coverage reimburses you for the cost of towing your vehicle to a repair shop and any roadside assistance services, such as changing a flat tire or unlocking your car.

Keep in mind that the specific coverage types and limitations may vary depending on your insurance company and state regulations. It’s essential to review your policy and consult with your insurance agent to ensure you have the appropriate coverage for your needs.

Understanding the different coverage types will enable you to assess your current policy and make informed decisions about whether you need to adjust your coverage to better protect yourself and your vehicle.

Policy Limits and Deductibles

When reviewing your auto insurance policy, it’s important to pay attention to both the policy limits and deductibles associated with your coverage. Understanding these terms will help you determine the maximum amount your insurance company will pay for a claim and the out-of-pocket expenses you’ll be responsible for.

Policy Limits:

Policy limits refer to the maximum amount your insurance company will pay for a covered claim. There are typically two types of policy limits:

- Bodily injury liability limit: This is the maximum amount your insurance company will pay for injuries sustained by others in an accident for which you are found liable. For example, if you have a bodily injury liability limit of $100,000 per person and $300,000 per accident, your insurance company will pay up to $100,000 per person and up to $300,000 total for all injured parties in the accident.

- Property damage liability limit: This is the maximum amount your insurance company will pay for damage to other people’s property caused by you in an accident. For example, if you have a property damage liability limit of $50,000, your insurance company will pay up to $50,000 for property damage repairs or replacement.

It’s important to consider your assets and potential liability when selecting policy limits. If your limits are too low, you may be personally responsible for any amounts that exceed your coverage in the event of an accident. Consult with your insurance agent to determine the appropriate policy limits for your circumstances.

Deductibles:

Deductibles are the out-of-pocket expenses you must pay before your insurance coverage starts. Here are two common types of deductibles:

- Collision deductible: This is the amount you must pay if you file a claim for collision coverage. For example, if you have a $500 collision deductible and your repairs cost $2,000, you will pay the $500 deductible, and your insurance company will cover the remaining $1,500.

- Comprehensive deductible: This is the amount you must pay if you file a claim for comprehensive coverage. Similar to collision coverage, you are responsible for paying the deductible amount, and your insurance company pays for the rest of the repair or replacement costs.

Choosing a higher deductible often results in lower premium costs, but it also means you’ll have to pay more out of pocket in the event of a claim. Consider your budget and risk tolerance when selecting deductibles.

Review your policy to ensure you understand the specific policy limits and deductibles associated with your coverage. If you have any questions or want to make changes to your limits or deductibles, reach out to your insurance agent who can assist you in navigating these options.

Exclusions and Limitations

While auto insurance provides coverage for a range of risks, it’s important to be aware of the exclusions and limitations stated in your policy. Exclusions are specific situations or circumstances that are not covered by the insurance policy, while limitations set boundaries on the coverage provided. Understanding these exclusions and limitations will give you a clear understanding of what may not be covered under your policy. Here are some common exclusions and limitations to look out for:

Exclusions:

Exclusions vary depending on the insurance company and policy type, but some common exclusions in auto insurance policies include:

- Intentional acts: Damage or injuries caused intentionally by the policyholder or insured individuals are typically not covered.

- Racing or illegal activities: Any accidents or damages that occur while participating in racing events or engaging in illegal activities are usually excluded.

- Using the vehicle for commercial purposes: If you use your vehicle for commercial purposes, such as delivery services or ride-sharing, your personal auto insurance policy may not cover any damages or accidents that occur during those activities.

- Wear and tear: Normal wear and tear of the vehicle, including mechanical breakdowns or maintenance-related issues, are generally excluded.

Limitations:

Limitations are restrictions or conditions placed on certain coverage types. Some common limitations include:

- Named drivers: If your policy specifies certain drivers, such as only yourself and your spouse, coverage may not extend to other individuals who drive your vehicle.

- Geographic limits: Some policies may have limitations on coverage outside of a specified geographic area, whether within the country or abroad.

- Vehicle use restrictions: Certain policy limitations may apply if the vehicle is used for particular activities, such as driving for hire or off-road use.

- Modifications or customizations: Modifications made to your vehicle that are not disclosed or approved by the insurance company may be excluded from coverage.

It’s crucial to carefully review these exclusions and limitations in your auto insurance policy to understand the extent of your coverage. If you have any questions or concerns, reach out to your insurance agent for clarification. They can provide guidance on potential exclusions and offer coverage options to address any specific needs or concerns you might have.

Additional Benefits and Riders

Auto insurance policies often have additional benefits and optional coverage riders that can enhance your overall protection. These benefits and riders provide added peace of mind and customization to meet your specific needs. Here are some common additional benefits and riders you may come across:

- Roadside Assistance: Many insurance companies offer roadside assistance coverage, which provides services such as towing, battery jump-start, fuel delivery, and lockout assistance. This coverage can be a lifesaver in unexpected situations.

- Rental Car Reimbursement: If your vehicle is in the shop for repairs due to a covered claim, rental car reimbursement coverage helps cover the cost of renting a replacement vehicle.

- Accident Forgiveness: Accident forgiveness is a feature that allows you to avoid premium rate increases after your first at-fault accident. It’s a valuable benefit for drivers seeking long-term savings and protection.

- New Car Replacement: This coverage provides reimbursement for the cost of replacing your vehicle with a brand-new one of similar make and model if it is totaled within a certain period (usually one or two years) of purchase.

- Gap Insurance: Gap insurance covers the difference between the actual cash value of your vehicle and the remaining balance on your car loan or lease if your vehicle is totaled. It can help ensure you are not left with a significant financial burden.

- Custom Equipment Coverage: If you have made modifications or added custom equipment to your vehicle, custom equipment coverage can reimburse you for the cost of repairing or replacing it in the event of damage or theft.

- Full Glass Coverage: Full glass coverage typically covers the repair or replacement of your vehicle’s windshield or other glass components without a deductible.

It’s important to review the specific additional benefits and riders offered by your insurance company and assess whether they align with your needs and budget. Adding these coverages or benefits to your policy may result in a slightly higher premium, but they can provide valuable protection and peace of mind in specific situations.

Consult with your insurance agent to explore the available options and understand the potential benefits and costs associated with these additional coverages and riders. They can help you choose the ones that best suit your individual circumstances and provide the necessary guidance to customize your auto insurance policy.

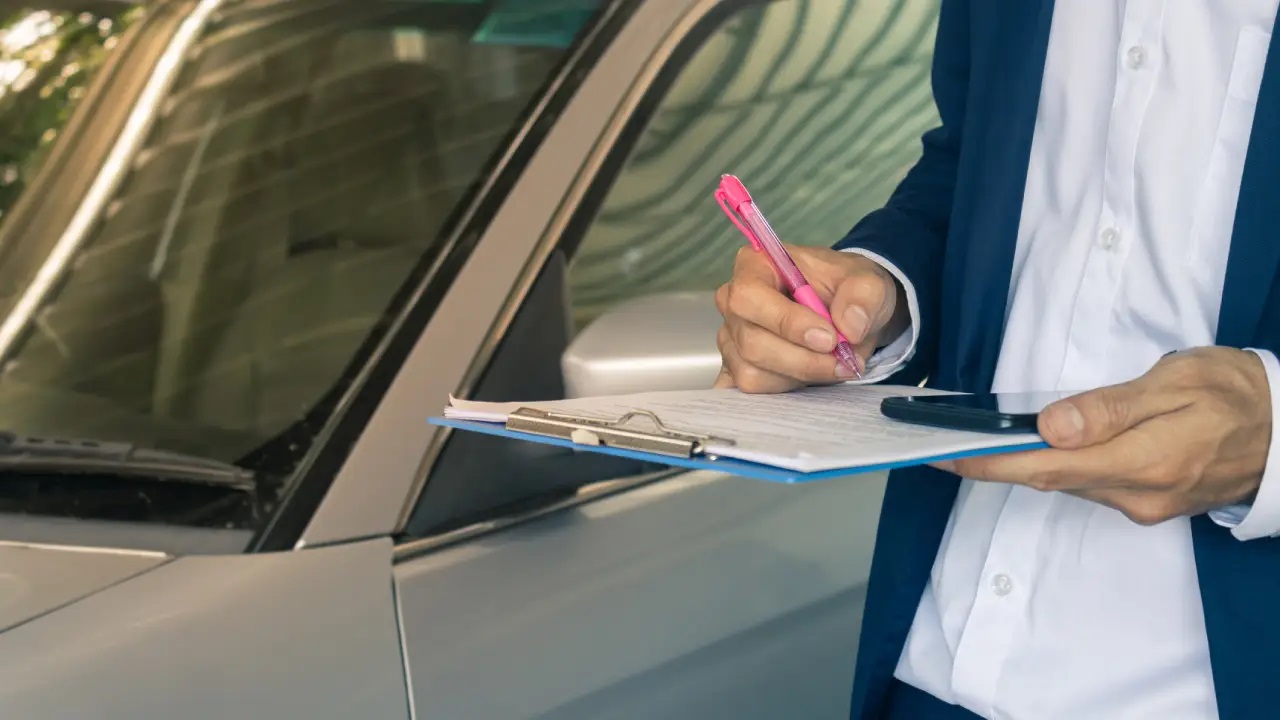

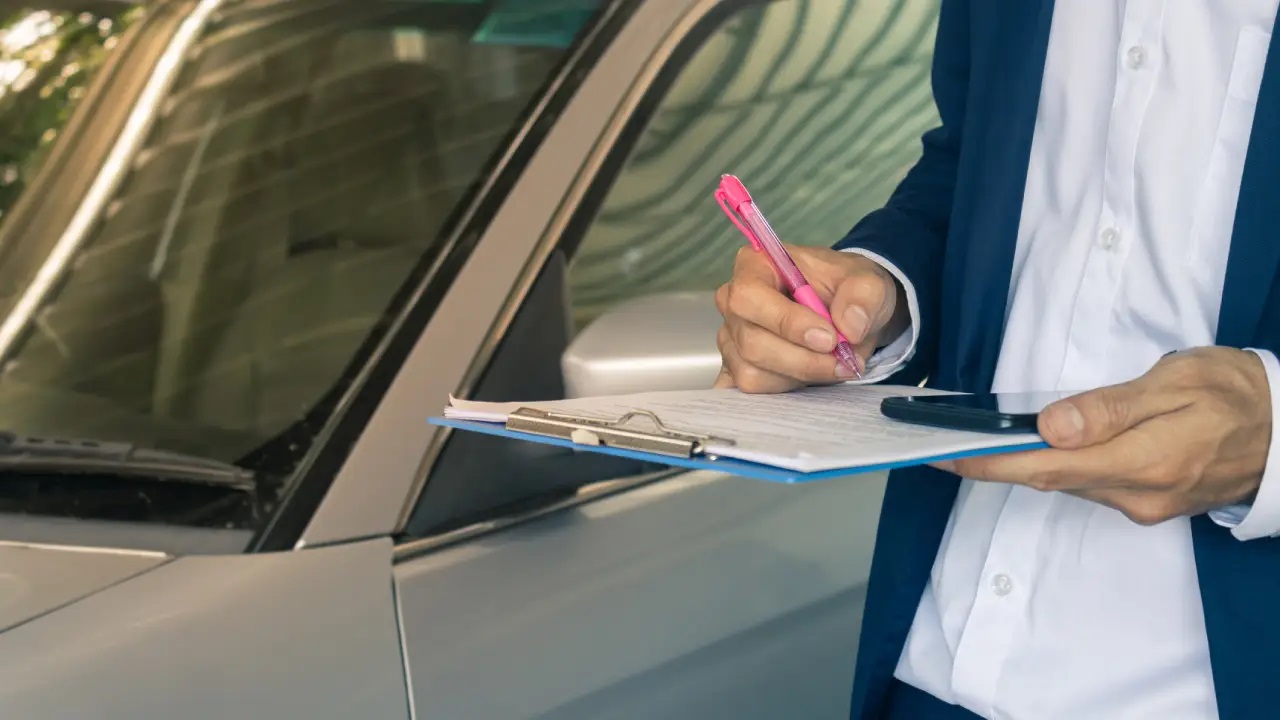

Filing a Claim

Knowing how to file a claim is essential when it comes to utilizing your auto insurance policy. When an accident occurs or when your vehicle suffers damage, follow these steps to ensure a smooth claims process:

- Report the incident: Contact your insurance company as soon as possible to report the accident or damage. Be prepared to provide details about the incident, including the date, time, location, and a description of what happened.

- Document the scene: If it is safe to do so, take photos or videos of the accident scene and any damage to your vehicle. This documentation can serve as evidence during the claims process.

- Exchange information: Gather information from the other parties involved in the accident, including their names, contact information, driver’s license numbers, and insurance details.

- File a police report: In some cases, it may be necessary to file a police report, especially if there are injuries or significant property damage. Contact the local authorities and provide them with the necessary details.

- Provide accurate information: When filing your claim, make sure to provide accurate and detailed information to your insurance company. Be honest and forthcoming about the circumstances surrounding the incident.

- Cooperate with the claims adjuster: Expect to work with a claims adjuster who will investigate the claim. Cooperate fully with their requests for information, documentation, or evidence to support your claim.

- Get repair estimates: If your vehicle requires repairs, obtain estimates from reputable repair shops. Your insurance company may have preferred providers or guidelines for selecting repair facilities.

- Review the settlement: Once the claims adjuster evaluates the claim, they will present a settlement offer. Review it carefully to ensure it covers the necessary repairs or replacements. Ask questions if you are unsure about any aspect of the settlement.

- Approve the settlement: If you agree with the settlement offer, give your approval to proceed with the claim. Once approved, the insurance company will provide the funds necessary to repair or replace your vehicle.

- Follow up: Stay in contact with your insurance company throughout the claims process. Keep copies of all documents, correspondence, and receipts related to the claim for your records.

Remember to familiarize yourself with your insurance company’s specific claims procedures and requirements. Adhering to the established guidelines will help streamline the claims process and ensure a prompt resolution to your claim.

In the unfortunate event of an accident or damage, your auto insurance policy provides a safety net and financial protection. Being prepared and knowledgeable about the claims process will aid in minimizing stress and getting your vehicle back on the road.

Reviewing and Renewing Your Policy

Regularly reviewing and renewing your auto insurance policy is essential to ensure that you have adequate coverage and are getting the best value for your premium. Here are some important steps to consider when reviewing and renewing your policy:

- Assess your coverage needs: Take the time to evaluate your current coverage and assess whether it aligns with your needs. Consider factors such as changes in your driving habits, vehicle value, and financial situation.

- Review policy limits and deductibles: Examine your policy limits and deductibles to ensure they still provide the appropriate level of protection. Adjust them if necessary to better suit your circumstances.

- Check for any changes in discounts: Insurance companies offer various discounts that can help lower your premium. Check if you qualify for any new discounts since your last policy renewal.

- Compare quotes from multiple insurers: It’s a good practice to shop around and get quotes from different insurance companies. This allows you to compare coverage options, pricing, and customer reviews to ensure you’re getting the best deal.

- Consider additional coverage: Evaluate if there are any additional coverage options or riders you may need to add to your policy. This could include coverage for a new vehicle, added protection for specific risks, or enhancements to existing coverage.

- Review your driving record: Keep track of any changes in your driving record, such as accidents or violations. This information may impact your premium and insurability.

- Ensure accurate vehicle information: Review the details of your insured vehicles, including make, model, and mileage. Make sure all the information is accurate and up to date.

- Read the policy renewal documents: Carefully read through the renewal documents provided by your insurance company. Pay attention to any changes in coverage, terms, or conditions.

- Contact your insurance agent: If you have any questions or concerns about your policy or the renewal process, reach out to your insurance agent. They can provide guidance, clarification, and assist you in making any necessary adjustments.

- Renew your policy in a timely manner: Make sure to renew your policy well before the expiration date to avoid any coverage gaps. Failure to renew your policy can lead to a lapse in coverage and potential penalties.

By following these steps, you can ensure that your auto insurance policy remains up to date and meets your evolving needs. Regularly reviewing and renewing your policy allows you to have peace of mind knowing that you have the right coverage in place to protect yourself and your vehicle on the road.

Tips for Reading Your Auto Insurance Policy

Reading through your auto insurance policy may seem overwhelming due to the technical language and fine print. However, by following these tips, you can navigate your policy effectively and have a clear understanding of your coverage:

- Read the entire policy: Take the time to read the entire policy document thoroughly. It may be tempting to skim through, but understanding all aspects of your coverage is crucial.

- Pay attention to definitions: Familiarize yourself with the definitions section of the policy. Terms like “insured,” “covered auto,” or “named driver” may have specific meanings that affect your coverage.

- Highlight important sections: Use highlighters or sticky notes to mark important sections or terms you want to revisit or clarify later.

- Understand the coverage details: Review each coverage type and understand what is covered and what is excluded. Pay attention to the policy limits, deductibles, and any restrictions that may apply.

- Note any exclusions: Identify any exclusions listed in the policy that may limit your coverage, such as clauses related to intentional acts, vehicle modifications, or specific usage restrictions.

- Review endorsements or riders: Take note of any endorsements or optional riders that have been added to your policy. Some endorsements provide additional coverage, while others may restrict or modify certain aspects of your policy.

- Look for any discounts: Verify if you are eligible for any discounts mentioned in the policy, such as safe driver discounts, multi-vehicle discounts, or bundled insurance discounts.

- Know the claims process: Understand the steps involved in filing a claim and the contact information for your insurance company’s claims department. Being familiar with the process in advance can help minimize stress during a claim.

- Ask for clarification: If there are any terms or provisions you don’t understand, reach out to your insurance agent or company for clarification. They can provide the necessary explanations to help you make informed decisions.

- Compare with other policies: If you have multiple insurance options, compare the terms, coverage, and exclusions of each policy. This will help you make an informed decision based on your specific needs.

Remember, you are not alone in deciphering your auto insurance policy. If you need assistance or have questions, reach out to your insurance agent. They are there to help you understand the policy and ensure you have the right coverage for your needs.

By following these tips, you can navigate through your policy with confidence, making you better prepared to handle any situation and utilize your coverage effectively.

Frequently Asked Questions

Here are some commonly asked questions about auto insurance policies:

1. What factors affect my auto insurance premiums?

Several factors can impact your auto insurance premiums, including your driving record, age, vehicle make and model, location, credit score, and the coverage limits and deductibles you choose.

2. Can I transfer my auto insurance to a new vehicle?

Yes, you can typically transfer your auto insurance to a new vehicle. Notify your insurance company about the change and provide details about the new vehicle to ensure you have the proper coverage.

3. Do I need auto insurance if I don’t own a car but still drive?

If you frequently drive borrowed or rented vehicles, you may want to consider obtaining non-owner car insurance. This coverage provides liability protection when you are driving a vehicle that you don’t own.

4. How long does an auto insurance claim take to process?

The time it takes to process an auto insurance claim can vary depending on the complexity of the claim and the responsiveness of all parties involved. Simple claims may be processed within a few days, while more complex claims can take several weeks.

5. Can I cancel my auto insurance policy anytime?

In most cases, yes, you can cancel your auto insurance policy at any time. However, you may be subject to penalties or fees depending on your insurance company’s policies. It’s best to review your policy terms and contact your insurer to understand the cancellation process.

6. What should I do if I’m involved in an accident?

If you’re involved in an accident, make sure everyone is safe and seek medical attention if needed. Exchange information with the other parties involved, take photos of the accident scene, and notify your insurance company to begin the claims process.

7. Can I add additional drivers to my auto insurance policy?

Yes, most auto insurance policies allow you to add additional drivers to your policy, such as family members or household members. However, adding additional drivers may affect your premium.

8. How often should I review my auto insurance policy?

It’s recommended to review your auto insurance policy at least once a year or whenever significant changes occur, such as buying a new vehicle, moving to a new location, or experiencing life changes that may impact your coverage needs.

9. Will my auto insurance cover me if I’m driving for a rideshare service?

Standard personal auto insurance policies typically do not cover accidents or damages that occur while driving for a rideshare service. Many insurance companies offer additional coverage options specifically designed for rideshare drivers to fill this coverage gap.

10. Can my auto insurance policy cover rental cars?

In most cases, your auto insurance policy extends coverage to rental cars. However, it’s important to review your policy or contact your insurance agent to verify the specifics of your coverage for rental vehicles.

Remember, these are general answers, and coverage can vary depending on your insurance policy and state regulations. For specific questions about your auto insurance policy, contact your insurance company or agent for accurate and personalized information.

Conclusion

Reading and understanding your auto insurance policy is vital for ensuring you have the right coverage and protection. By familiarizing yourself with the key terms, coverage options, policy limits, and exclusions, you can make informed decisions about your insurance needs. Remember to review and renew your policy regularly to keep it up to date.

Throughout this article, we have provided you with valuable information to help you navigate your auto insurance policy. We covered the key terms to know, explained common coverage types, discussed policy limits and deductibles, explored exclusions and limitations, highlighted additional benefits and riders, and provided guidance on filing a claim.

We also shared tips for reading your policy effectively, including highlighting important sections, understanding definitions, and seeking clarification when needed. Additionally, we addressed frequently asked questions to provide further clarity on common concerns related to auto insurance.

Remember, your insurance agent is a valuable resource for answering any specific questions you may have about your policy. They can guide you through the process, help you customize your coverage, and ensure you have the necessary protection to drive with confidence.

So, take the time to thoroughly read and comprehend your auto insurance policy. It will equip you with the knowledge needed to make informed decisions, take advantage of available benefits, and navigate potential claims smoothly. Ultimately, being well-informed about your coverage will provide you with the peace of mind and financial security you need on the road.