Finance

Is It Okay Not To Have Health Insurance?

Published: October 30, 2023

Navigating the world of finance without health insurance: Is it a wise decision? Learn the pros and cons, and take charge of your financial well-being.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Health insurance is a topic that affects millions of people around the world. It provides financial protection for our healthcare needs and offers peace of mind during times of illness or injury. However, not everyone has health insurance coverage. Whether it’s due to financial constraints, personal beliefs, or simply not seeing the need, there are individuals who choose to go without health insurance.

In this article, we will explore the concept of health insurance and delve into the question of whether it is okay not to have health insurance. We will examine the importance of health insurance, the factors to consider when choosing a health insurance plan, and the potential consequences of not having health insurance. Additionally, we will discuss alternative options for accessing healthcare without insurance.

It is essential to note that this article aims to provide information and create awareness around the topic. It is not meant to provide financial or legal advice. If you are facing a decision regarding health insurance, it is always advisable to consult with a licensed professional or an insurance provider to make an informed decision.

Understanding Health Insurance

Health insurance is a type of insurance coverage that helps individuals and families pay for medical expenses. It operates on the principle of risk-sharing, where policyholders pool their resources to protect themselves from the high costs of healthcare. In exchange for regular premium payments, health insurance providers offer financial protection against medical emergencies, preventive care, and various healthcare services.

Health insurance plans typically cover a range of medical services, including doctor’s visits, hospital stays, prescription medications, laboratory tests, and preventive screenings. The coverage and benefits offered can vary significantly depending on the type of plan, insurance provider, and individual policy terms.

Most health insurance plans operate on either a fee-for-service or managed care model. In a fee-for-service model, policyholders have more flexibility in choosing their healthcare providers, but they may have to pay higher out-of-pocket costs. On the other hand, managed care plans, such as health maintenance organizations (HMOs) and preferred provider organizations (PPOs), have a network of healthcare providers that policyholders must choose from to receive the maximum coverage. These plans often include lower out-of-pocket costs but limit provider choice.

It is important to understand the key terms and concepts associated with health insurance, such as deductibles, copayments, and coinsurance. A deductible is the amount that policyholders must pay out-of-pocket before their insurance coverage kicks in. Copayments are fixed amounts individuals must pay for specific services, such as doctor visits or prescription drugs. Coinsurance refers to the percentage of costs policyholders must pay for covered services after meeting their deductible.

Health insurance can be obtained through various sources, including employers, government programs like Medicare and Medicaid, or individual plans purchased directly from insurance companies. Understanding the specifics of one’s health insurance plan is crucial to make informed decisions about healthcare and manage medical expenses effectively.

The Importance of Health Insurance

Health insurance plays a vital role in safeguarding our physical and financial well-being. Here are several reasons why having health insurance is crucial:

- Financial Protection: One of the primary benefits of health insurance is the financial protection it provides. Medical expenses can quickly escalate, especially in the case of emergencies, surgeries, or chronic conditions. Without insurance, these costs may become overwhelming and lead to significant financial strain. Health insurance helps alleviate this burden by covering a portion or the entirety of the medical expenses, depending on the policy’s terms and coverage.

- Access to Quality Healthcare: Having health insurance enables individuals to access a wide range of healthcare services, including preventive care, regular check-ups, screenings, and vaccinations. With insurance coverage, people are more likely to seek timely medical attention, which can detect and treat potential health issues before they become more serious and costly to treat.

- Peace of Mind: Knowing that you have health insurance provides peace of mind. It offers a level of security, knowing that you are protected in case of unexpected medical emergencies or illnesses. This peace of mind can reduce stress and allow individuals to focus on their health without worrying about the financial implications.

- Affordability: Health insurance can make healthcare more affordable by negotiating lower rates with healthcare providers. Insurance providers often have established networks of healthcare professionals and facilities, ensuring that individuals receive services at discounted rates. Additionally, health insurance plans may offer discounts on medications and preventive care services, making healthcare more accessible and affordable for policyholders.

- Preventing Medical Debt: Medical debt is a significant issue for many individuals and families. Without health insurance, individuals may find themselves facing substantial medical bills and the possibility of accumulating debt. Health insurance acts as a buffer, protecting individuals from falling into financial distress due to medical expenses.

In summary, health insurance provides financial protection, access to quality healthcare, peace of mind, affordability, and helps prevent medical debt. It is an essential tool in maintaining physical well-being and financial stability, ensuring individuals can seek necessary medical care without facing significant financial burdens.

Factors to Consider When Choosing Health Insurance

Choosing the right health insurance plan requires careful consideration of various factors. Here are some key factors to keep in mind when evaluating different health insurance options:

- Coverage and Benefits: Assess the coverage and benefits offered by each health insurance plan. Look into the specific services and treatments covered, including doctor visits, hospital stays, prescription medications, preventive care, and specialist consultations. Consider your healthcare needs and ensure that the plan adequately addresses them.

- Network of Providers: Check the network of healthcare providers associated with each health insurance plan. Determine if your preferred doctors, specialists, and hospitals are included in the network. Consider the proximity and accessibility of providers within the network to ensure convenient access to healthcare services.

- Costs: Evaluate the costs associated with each health insurance plan. Consider the premium, deductible, copayments, and coinsurance. Assess your budget and determine what you can afford in terms of monthly premiums and out-of-pocket expenses. Balance the costs with the level of coverage and benefits provided.

- Prescription Drug Coverage: If you regularly take prescription medications, review the plan’s prescription drug coverage. Check if your current medications are covered and at what cost. Assess the copayments or coinsurance for prescription drugs and consider any limitations or requirements for coverage.

- Additional Services: Some health insurance plans may offer additional services such as dental, vision, mental health, or alternative medicine coverage. Evaluate these additional services and consider their importance to your overall healthcare needs. Assess the extent of coverage and any associated costs.

- Flexibility: Consider the flexibility and freedom to choose healthcare providers. Some plans, such as HMOs, require individuals to choose healthcare providers within the plan’s network. Others, like PPOs, offer more flexibility in selecting out-of-network providers but may involve higher costs. Assess your preference for provider choice and determine the level of flexibility required.

- Customer Service and Reputation: Research the reputation and customer service of the health insurance providers. Read reviews, check ratings, and seek recommendations from trusted sources. A reputable and reliable insurance provider with excellent customer service can ensure a smooth experience when dealing with claims, inquiries, or any issues that may arise during your policy term.

Taking the time to evaluate these factors and compare different health insurance plans will help you make an informed decision. It is essential to choose a plan that aligns with your healthcare needs, budget, and preferences to ensure optimal coverage and satisfaction.

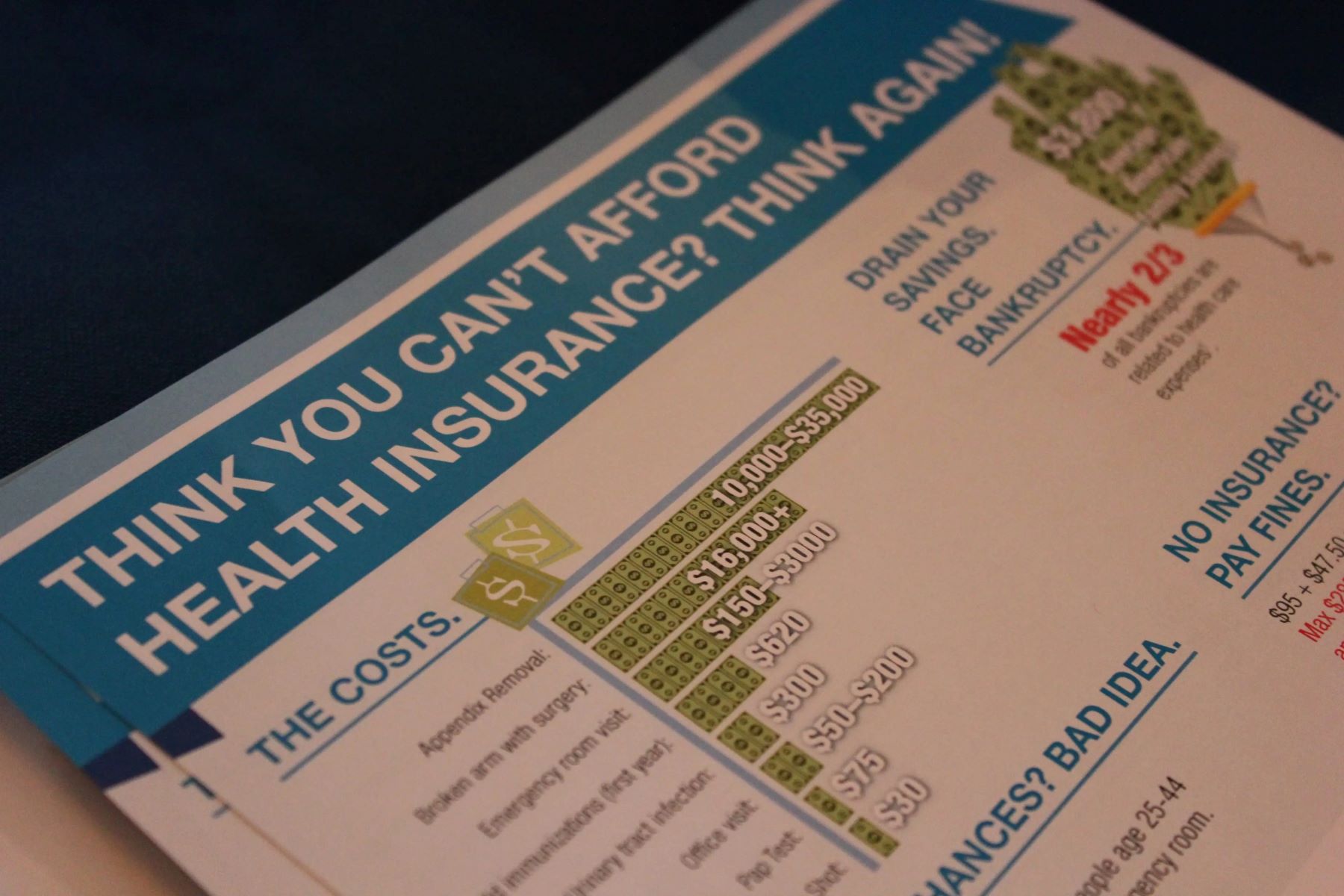

Consequences of Not Having Health Insurance

While some individuals may choose not to have health insurance, it is important to understand the potential consequences that can arise from being uninsured. Here are some of the possible effects of not having health insurance:

- Financial Risk: Without health insurance, individuals are exposed to substantial financial risk. Medical expenses can be exorbitant, especially for emergency procedures, surgeries, or chronic conditions. Without insurance coverage, individuals may face the burden of paying for medical bills out-of-pocket, potentially leading to significant debt or financial hardship.

- Limited Access to Healthcare: Not having health insurance can limit access to necessary healthcare services. Many healthcare providers require insurance coverage or upfront payment before providing services. Without insurance, individuals may have difficulty seeing specialists, receiving necessary treatments, or accessing preventive care. This can result in delayed or inadequate healthcare, potentially negatively impacting health outcomes.

- Missed Preventive Care: Without health insurance, individuals may forgo preventive care, such as regular check-ups, screenings, vaccinations, and early disease detection. By skipping these necessary healthcare services, individuals may miss the opportunity to identify and address potential health issues before they develop into more severe conditions. This can lead to compromised health and increased healthcare costs in the long run.

- Limited Treatment Options: Health insurance often provides coverage for a wide range of healthcare services and treatments. Without insurance, individuals may have limited choices when it comes to treatment options. They may be unable to afford or access certain medications, therapies, or surgeries that could significantly improve their health outcomes. This lack of treatment options can have a negative impact on overall well-being and quality of life.

- Individual Mandate Penalties: In some countries, there may be penalties or fines imposed for not having health insurance. This is often implemented through the individual mandate, which requires individuals to maintain health insurance coverage. Failure to comply with this requirement may result in financial penalties, further exacerbating the financial burden of being uninsured.

It is important to note that the consequences of not having health insurance can vary depending on individual circumstances, including health status, income level, and access to other healthcare resources. While some individuals may not experience immediate repercussions from being uninsured, unforeseen health issues or emergencies can quickly amplify the negative consequences.

Considering the potential financial risks, limited access to healthcare, missed preventive care, limited treatment options, and possible penalties, it is advisable to carefully weigh the decision of not having health insurance and explore alternative options to ensure access to necessary healthcare services and financial protection.

Is It Ever Okay to Not Have Health Insurance?

The decision of whether it is okay not to have health insurance is a complex and personal one. While health insurance provides numerous benefits, there may be unique situations where individuals might consider forgoing coverage. Here are a few scenarios where not having health insurance might be deemed acceptable:

- Financial Limitations: For some individuals, the cost of health insurance premiums may be prohibitively expensive. When faced with limited financial resources, individuals may need to prioritize other essential expenses, such as housing and food, over health insurance. However, it is important to explore alternative options for accessing healthcare and consider government programs or low-cost clinics that may offer affordable healthcare services.

- Eligibility for Public Programs: In some cases, individuals may be eligible for government-run healthcare programs, such as Medicaid, which provides coverage for low-income individuals and families. If qualified for these programs, individuals may find adequate healthcare coverage without the need for private health insurance.

- Minimal Healthcare Needs: Young, healthy individuals who rarely require medical care may consider forgoing health insurance. If an individual does not have any significant health concerns and does not foresee the need for frequent medical services, they might choose to rely on savings to cover healthcare costs on an as-needed basis.

- Reliance on Alternative Healthcare Models: Some individuals may opt for alternative healthcare models, such as direct primary care or healthcare sharing ministries. These models operate outside of traditional health insurance and offer cost-effective alternatives for accessing healthcare services. However, it is crucial to thoroughly research and understand the limitations and coverage offered by these alternatives.

While there may be exceptional cases where going without health insurance is deemed acceptable, it is important to recognize the potential risks and consequences involved. It is always advisable to have some form of healthcare coverage, even if basic, to protect against unexpected medical emergencies and ensure access to essential healthcare services.

Furthermore, regulations and laws regarding health insurance may vary by country and region. It is crucial to research and understand the legal obligations and consequences of not having health insurance in your specific jurisdiction.

Ultimately, the decision of whether it is okay not to have health insurance should be carefully evaluated based on individual circumstances, healthcare needs, and available alternatives. Consulting with a licensed insurance professional or healthcare advisor can provide valuable guidance in making an informed decision.

Alternative Options for Accessing Healthcare without Insurance

While having health insurance is the ideal way to access healthcare, there are alternative options available for individuals who do not have insurance coverage. These options can help provide access to essential medical services, preventive care, and assistance with managing healthcare costs. Here are some alternatives to consider:

- Government Programs: Depending on your country of residence, there may be government-run healthcare programs available for those without insurance. Programs such as Medicaid, Medicare, or state-sponsored healthcare initiatives can provide coverage to eligible individuals based on income, age, or specific health conditions. Research and determine if you qualify for any government-sponsored healthcare programs in your area.

- Community Health Centers: Community health centers and clinics offer affordable or free healthcare services to individuals without insurance. These centers provide comprehensive medical services, including primary care, dental care, prenatal care, and mental health services. They operate on a sliding fee scale based on income, making healthcare more accessible and affordable for low-income individuals and families.

- Prescription Assistance Programs: Prescription medications can be expensive, but there are prescription assistance programs that can help reduce the cost. Pharmaceutical companies, nonprofit organizations, and government agencies offer programs that provide discounted or free medications to individuals in need. These programs often have eligibility criteria based on income and specific medical conditions.

- Healthcare Cost Negotiation: Many healthcare providers, particularly hospitals and clinics, are willing to negotiate medical bills and payment plans for uninsured patients. Reach out to the healthcare provider’s billing department and explain your situation. They may be able to offer discounts or set up a payment plan that is more manageable for you.

- Healthcare Sharing Programs: Healthcare sharing programs operate on a cooperative basis, where members contribute monthly fees that are then used to cover each other’s medical expenses. These programs are not insurance, but they can help share the costs of healthcare among a community of members. It is important to thoroughly research and understand the specifics, limitations, and coverage offered by healthcare sharing programs before considering enrollment.

It is crucial to emphasize that these alternative options may vary in availability and eligibility based on your location and personal circumstances. Additionally, they may not provide the same level of comprehensive coverage as traditional health insurance. It is essential to assess your specific healthcare needs, financial situation, and research the options available to determine which alternative option best suits your needs.

While accessing healthcare without insurance may require additional effort and research, it is important to prioritize your health and seek necessary medical care when needed. Delaying or avoiding healthcare due to lack of insurance can lead to more severe health problems and higher healthcare costs in the long run. Remember to explore all avenues for assistance and consult with healthcare professionals to ensure you receive the care you need.

Conclusion

Health insurance is a crucial component of financial and healthcare planning. While there may be certain circumstances where individuals consider not having health insurance, it is important to carefully weigh the potential risks and consequences. Health insurance offers financial protection, access to healthcare services, peace of mind, and affordability. It helps individuals manage medical expenses, access preventive care, and alleviate the financial burden of unexpected health issues.

Factors to consider when choosing health insurance include coverage and benefits, network of providers, costs, prescription drug coverage, additional services, flexibility, and customer service. Understanding these factors and comparing different options will help individuals make informed decisions that align with their healthcare needs and budget.

Not having health insurance can lead to significant financial risk, limited access to healthcare, missed preventive care, limited treatment options, and possible penalties. However, in some instances, financial limitations, eligibility for public programs, minimal healthcare needs, or reliance on alternative healthcare models may justify the choice to not have health insurance. It is crucial to thoroughly research alternative options for accessing healthcare and consider government programs, community health centers, prescription assistance programs, healthcare cost negotiation, or healthcare sharing programs.

In conclusion, while there may be exceptional circumstances where not having health insurance is deemed acceptable, it is important to prioritize healthcare and explore all available options for ensuring access to necessary medical services. Individual circumstances, such as financial situation, health needs, and the availability of alternative options, must be considered when making a decision about health insurance. Consulting with professionals and trusted advisors can provide valuable guidance in navigating the complex landscape of healthcare and insurance.