Finance

Limited Discretionary Account Definition

Modified: December 30, 2023

Learn more about the limited discretionary account definition in the field of finance, ensuring effective management and control over your investments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Limited Discretionary Account for Enhanced Financial Management

Welcome to our Finance blog section, where we dive into various topics that can help you better manage your finances. Today, we are going to discuss the concept of a limited discretionary account, its definition, and how it can benefit you as an investor or account holder.

Key Takeaways:

- A limited discretionary account allows the account manager to make investment decisions on behalf of the account holder but with certain restrictions.

- The account holder maintains control over key decisions such as asset allocation, risk tolerance, and investment strategy.

Now, let’s delve into the definition of a limited discretionary account and explore how it can empower you to achieve your financial goals.

In the realm of finance, a limited discretionary account provides the account manager with the authority to execute investment transactions on behalf of the account holder, but with certain limitations. Unlike a fully discretionary account where the manager has full control, a limited discretionary account allows the account holder to maintain control over specific areas.

So, what does this mean for you as an investor? Let’s break it down into two key aspects:

1. Retaining Control

When you opt for a limited discretionary account, you maintain control over essential decisions that impact your investments. Some of the key areas where you have control include:

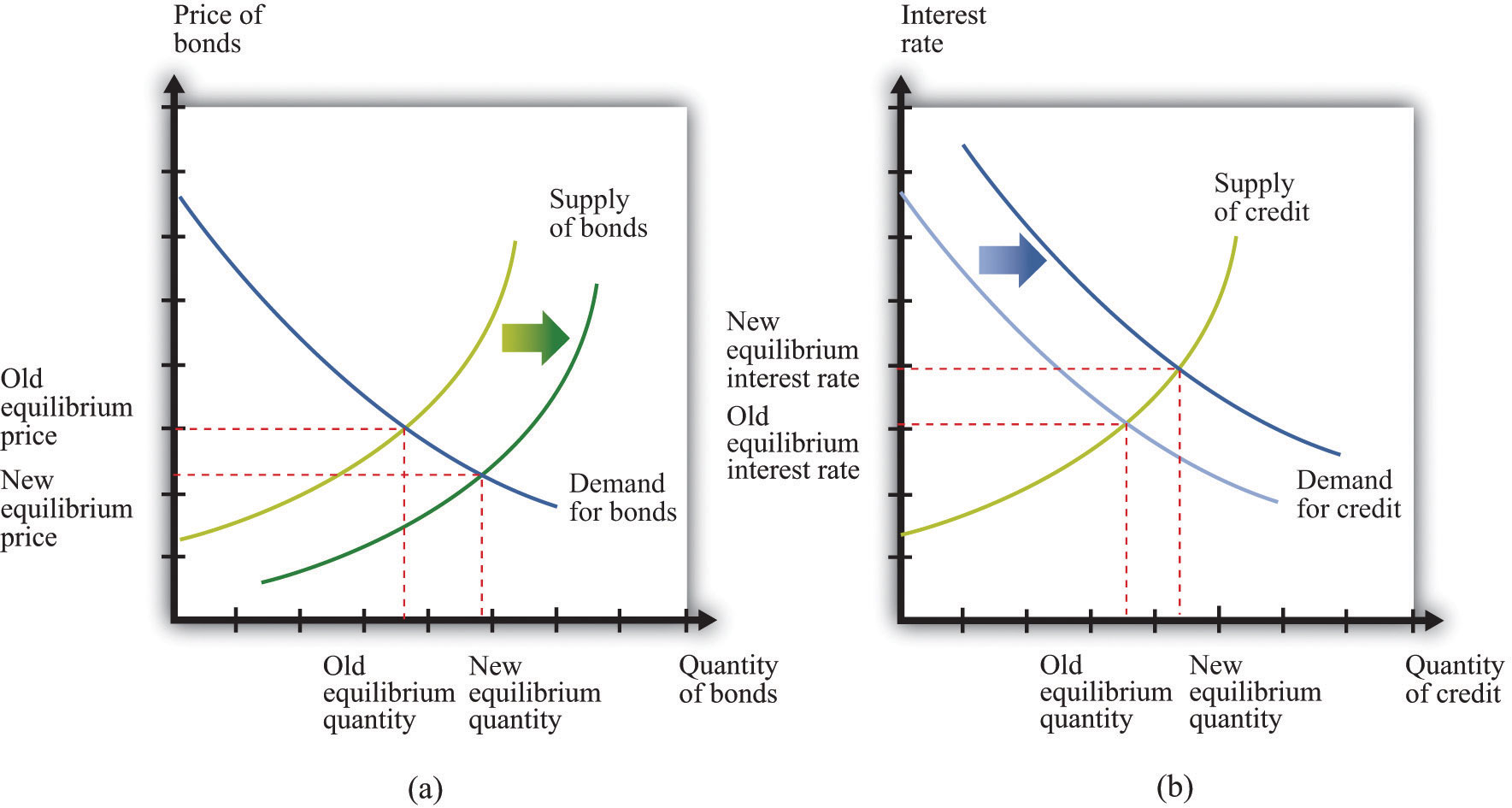

- Asset Allocation: You have the authority to determine the allocation of your investment portfolio across various asset classes based on your risk profile and financial goals.

- Risk Tolerance: You can define your risk tolerance level, ensuring that your investments align with your comfort level and long-term objectives.

- Investment Strategy: You have the flexibility to choose the investment strategy that matches your financial goals, whether it be growth-oriented, income-focused, or a combination thereof.

The above control over critical decisions empowers you to align your investments with your unique financial circumstances and aspirations.

2. Expertise and Assistance

While you maintain control over key aspects, opting for a limited discretionary account also allows you to leverage the expertise and assistance of a qualified investment professional. The account manager takes into account your defined parameters and restrictions, making day-to-day investment decisions on your behalf within those boundaries.

Having a skilled and experienced professional managing your investment transactions can provide several advantages, such as:

- Time-Saving: By delegating the execution of routine investment transactions, you can free up your time to focus on other important aspects of your life.

- Expertise: Benefit from the knowledge and expertise of an investment professional, who can guide you through market trends, analyze potential investment opportunities, and ensure your portfolio is well-balanced.

- Diversification: The account manager can assist in diversifying your portfolio, spreading risk across multiple assets or investment classes, which is an essential risk management strategy.

In summary, a limited discretionary account empowers you to maintain control over significant investment decisions while leveraging the expertise and assistance of a capable investment professional. This combination can help you navigate the complex world of finance and potentially enhance your investment outcomes.

We hope this article shed some light on the concept of limited discretionary accounts and their benefits. If you have any questions or would like to explore further, feel free to reach out to our finance experts who are here to assist you on your financial journey.