Home>Finance>ECN Broker: Definition, How It Works, Benefits, And Downsides

Finance

ECN Broker: Definition, How It Works, Benefits, And Downsides

Published: November 16, 2023

Looking for an ECN Broker in the finance industry? Discover the definition, benefits, and downsides of ECN brokers and how they work.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding ECN Broker: Boosting Your Financial Success

When it comes to managing your finances and making sound investment decisions, understanding the different financial tools available to you is vital. In the world of trading and investing, one such tool that has gained significant popularity is the ECN broker. But what exactly is an ECN broker? How does it work? And what are the benefits and downsides of using one? In this article, we will delve into the details of ECN brokers to provide you with a comprehensive understanding of this financial platform.

Key Takeaways:

- An ECN broker, short for Electronic Communication Network broker, is a type of financial brokerage that connects traders directly to the interbank market, allowing for faster and more efficient trade execution.

- ECN brokers provide traders with increased transparency, lower trading costs, and access to a wide range of liquidity providers.

What is an ECN Broker?

An ECN broker, short for Electronic Communication Network broker, is a type of financial brokerage that connects traders directly to the interbank market. Unlike traditional market makers or dealing desk brokers, ECN brokers act as intermediaries, matching buy and sell orders from different market participants, including banks, financial institutions, and individual traders. By eliminating the need for a middleman, ECN brokers create a more direct and efficient trading environment.

ECN brokers operate on a system where traders’ orders are executed at the best available prices and spreads, with minimal to no re-quotes. This is achieved through the aggregation of liquidity from multiple market participants, resulting in better pricing and faster trade execution.

How Does an ECN Broker Work?

When a trader places an order through an ECN broker, the order is sent to the broker’s network of liquidity providers, which includes major banks, financial institutions, and other traders connected to the same network. The order is then matched with the best available prices and executed automatically. This process ensures that traders receive competitive spreads and quick execution, eliminating the delays or conflicts of interest often associated with traditional brokers.

ECN brokers also provide traders with access to the order book, allowing them to see the real-time bid and ask prices of all market participants within the network. This transparency helps traders make more informed decisions and take advantage of market liquidity.

The Benefits of Using an ECN Broker

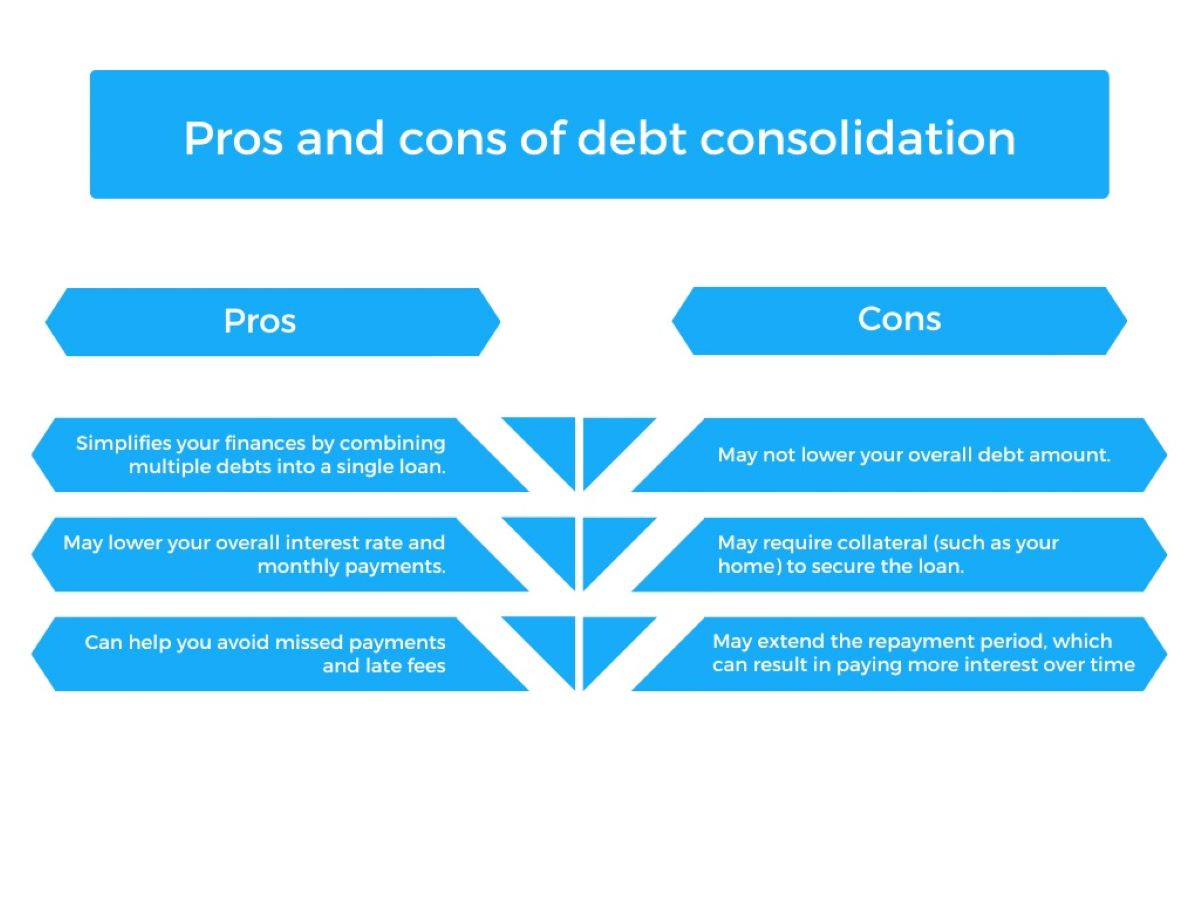

Using an ECN broker can offer several advantages for traders and investors:

- Increased Transparency: ECN brokers provide traders with a transparent trading environment where they can see the real-time bid and ask prices of all participants. This transparency helps eliminate any conflicts of interest and ensures fair pricing.

- Lower Trading Costs: ECN brokers typically charge traders a small commission per trade instead of relying on spreads. This commission-based model often leads to lower trading costs, especially for high-volume traders.

- Access to Liquidity Providers: By connecting traders to a network of liquidity providers, ECN brokers offer access to a deep pool of liquidity. This means traders can execute trades at better prices and enjoy faster execution, even during volatile market conditions.

The Downsides of Using an ECN Broker

While ECN brokers offer numerous benefits, it’s important to consider some potential downsides:

- Higher Minimum Deposit Requirements: Some ECN brokers may have higher minimum deposit requirements compared to traditional brokers. This can be a barrier for new or smaller traders who have limited capital.

- Variable Spreads: Since ECN brokers source liquidity from multiple providers, spreads can vary depending on market conditions. This means that spreads might widen during times of low liquidity or high volatility, resulting in higher trading costs.

- Complex Trading Platforms: ECN brokers often provide traders with advanced and feature-rich trading platforms. While these platforms offer enhanced functionality, they can also be overwhelming for beginners or traders who prefer simplicity.

Now that you have a better understanding of ECN brokers, their workings, benefits, and downsides, you can make an informed decision when choosing a broker for your financial needs. Remember, each individual trader has different requirements and preferences, so it’s essential to evaluate your own trading style and goals before selecting an ECN broker.