Home>Finance>Long-Legged Doji: Definition, Significance, And How To Trade

Finance

Long-Legged Doji: Definition, Significance, And How To Trade

Modified: February 21, 2024

Learn the definition, significance, and how to trade the long-legged doji in finance. Enhance your trading skills with this comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding the Long-Legged Doji: A Powerful Tool in Financial Trading

When it comes to financial trading, having the right tools and strategies in your arsenal is crucial. One such tool that experienced traders swear by is the Long-Legged Doji. This candlestick pattern is highly significant in technical analysis and can provide valuable insights into market trends and potential trading opportunities. In this blog post, we will explore the definition, significance, and how to trade the Long-Legged Doji.

Key Takeaways:

- The Long-Legged Doji is a candlestick pattern characterized by a small body and long upper and lower shadows.

- This pattern indicates indecision in the market and potential for a reversal or continuation of the trend.

Defining the Long-Legged Doji

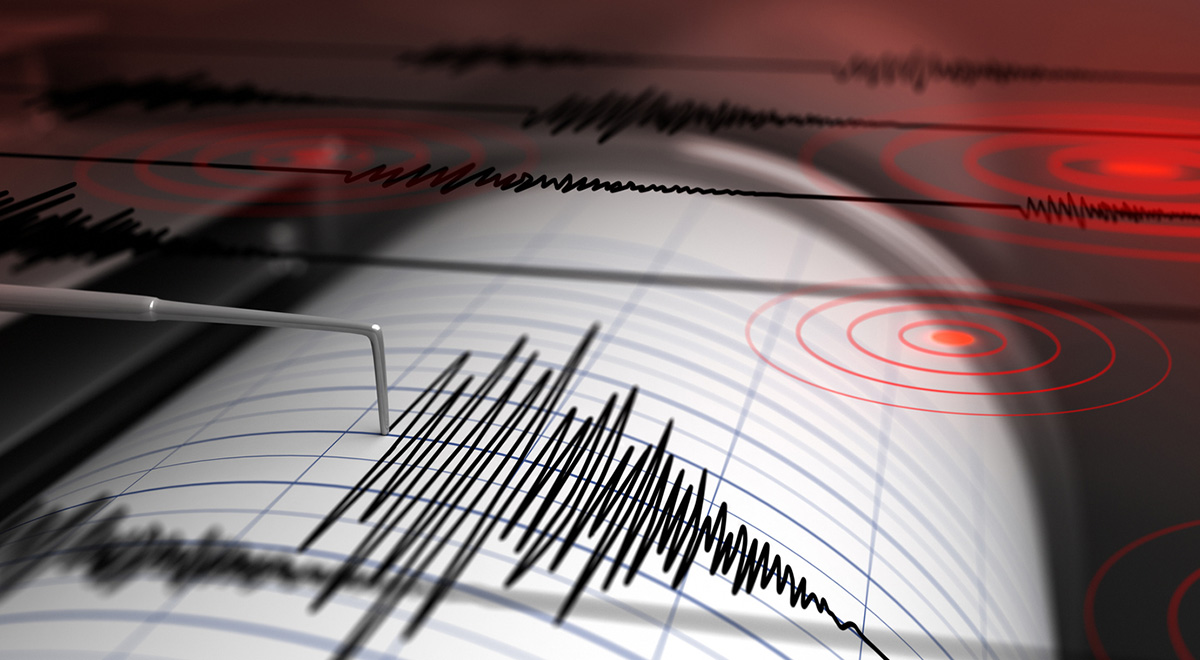

The Long-Legged Doji is a unique candlestick pattern that is identified by its distinct shape. It has a small body, which means that the opening and closing prices are very close to each other. However, what sets it apart are its long upper and lower shadows, also known as wicks or legs. These shadows indicate significant price movement in both directions during the trading session.

Traders often interpret the Long-Legged Doji as a sign of market indecision. It suggests that neither buyers nor sellers have the upper hand, resulting in a stalemate. This pattern is usually found at key support or resistance levels, indicating a potential reversal or continuation of the prevailing trend.

The Significance of the Long-Legged Doji

The Long-Legged Doji is highly significant in technical analysis due to its implications for market sentiment. Its appearance on a price chart can provide valuable insights into the balance of power between buyers and sellers.

Here are some key points to consider when analyzing the significance of the Long-Legged Doji:

- Indecision: The presence of this candlestick pattern suggests that the market is undecided about its next move. It indicates a period of consolidation where neither the bulls nor the bears have control.

- Trend Reversal: The Long-Legged Doji can be a powerful signal for a trend reversal, especially when it forms at a significant support or resistance level. It suggests that the prevailing trend is losing momentum and a reversal may be imminent.

- Trend Continuation: In some cases, the Long-Legged Doji can also indicate a continuation of the existing trend. When this pattern forms within a strong trend, it suggests that the temporary consolidation is a pause before the trend resumes.

- Confirmation: To confirm the significance of a Long-Legged Doji, traders often look for additional technical indicators or patterns. For example, a bullish or bearish engulfing candlestick pattern that forms after a Long-Legged Doji can strengthen its signal.

Trading the Long-Legged Doji

Now that you understand the definition and significance of the Long-Legged Doji, let’s discuss how you can incorporate it into your trading strategy:

- Identify the Pattern: Use technical analysis tools and charts to identify the Long-Legged Doji pattern. Look for a small body with prominent upper and lower shadows.

- Confirm with Indicators: Consider using other technical indicators or patterns to confirm the signal provided by the Long-Legged Doji. This can help reduce false signals and increase the probability of successful trades.

- Set Entry and Exit Points: Determine your entry and exit points based on the Long-Legged Doji pattern and any additional confirming indicators you have identified. This can help you establish a trading plan and manage your risk effectively.

- Practice Risk Management: As with any trading strategy, it’s crucial to practice proper risk management. Set stop-loss orders to protect your capital and consider using a trailing stop to lock in profits as the trade moves in your favor.

- Backtest and Analyze: Test your trading strategy using historical data to assess its performance. This will help you refine your approach and identify any potential weaknesses or areas for improvement.

Remember, trading involves risks, and no strategy can guarantee success. It’s essential to stay disciplined, informed, and adaptive when using the Long-Legged Doji or any other trading tool.

By understanding the definition, significance, and how to trade the Long-Legged Doji, you can add a powerful tool to your trading arsenal. Incorporate this pattern into your analysis and develop a well-rounded trading strategy that can help you navigate the ups and downs of the financial markets.