Home>Finance>How Many Contracts Are In Corn Futures Contracts

Finance

How Many Contracts Are In Corn Futures Contracts

Published: December 24, 2023

Learn the basics of corn futures contracts and understand how many contracts are involved in the finance industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of corn futures contracts, where traders and investors converge to speculate on the future price of corn. As one of the most widely traded commodities, corn plays a crucial role in global food production, animal feed, and biofuel production. Futures contracts provide a way for market participants to manage price risk and secure future supplies of corn.

In this article, we will delve into the fascinating world of corn futures contracts, exploring their purpose, mechanics, and the factors that influence the number of contracts traded. By understanding these dynamics, traders and investors can make more informed decisions and navigate the ever-changing landscape of the corn futures market.

Before we dive into the details, let’s first establish what a futures contract is. A futures contract is a legally binding agreement to buy or sell a specified quantity of an underlying asset, in this case, corn, at a predetermined price and date in the future. These contracts are standardized and traded on organized exchanges, such as the Chicago Board of Trade (CBOT), providing a transparent and regulated marketplace for buyers and sellers.

The primary purpose of corn futures contracts is to allow market participants to hedge against price fluctuations. Farmers, for example, can lock in a selling price for their corn crop before it’s harvested, protecting themselves from potential price declines. On the other hand, buyers, such as food processors or ethanol producers, can secure a purchase price, safeguarding against price increases.

While hedging is the primary function of corn futures contracts, many market participants, including speculators and investors, engage in trading these contracts with the goal of profiting from price movements. Speculators take advantage of the volatility in corn prices, buying low and selling high, without any intention of physically delivering or taking delivery of the corn.

Now that we have a basic understanding of corn futures contracts, let’s explore the factors that influence the number of contracts traded. Understanding these factors can provide insights into market sentiment and potential price trends.

Understanding Corn Futures Contracts

To fully grasp the dynamics of corn futures contracts, it’s important to understand their key components and mechanics. Let’s break it down:

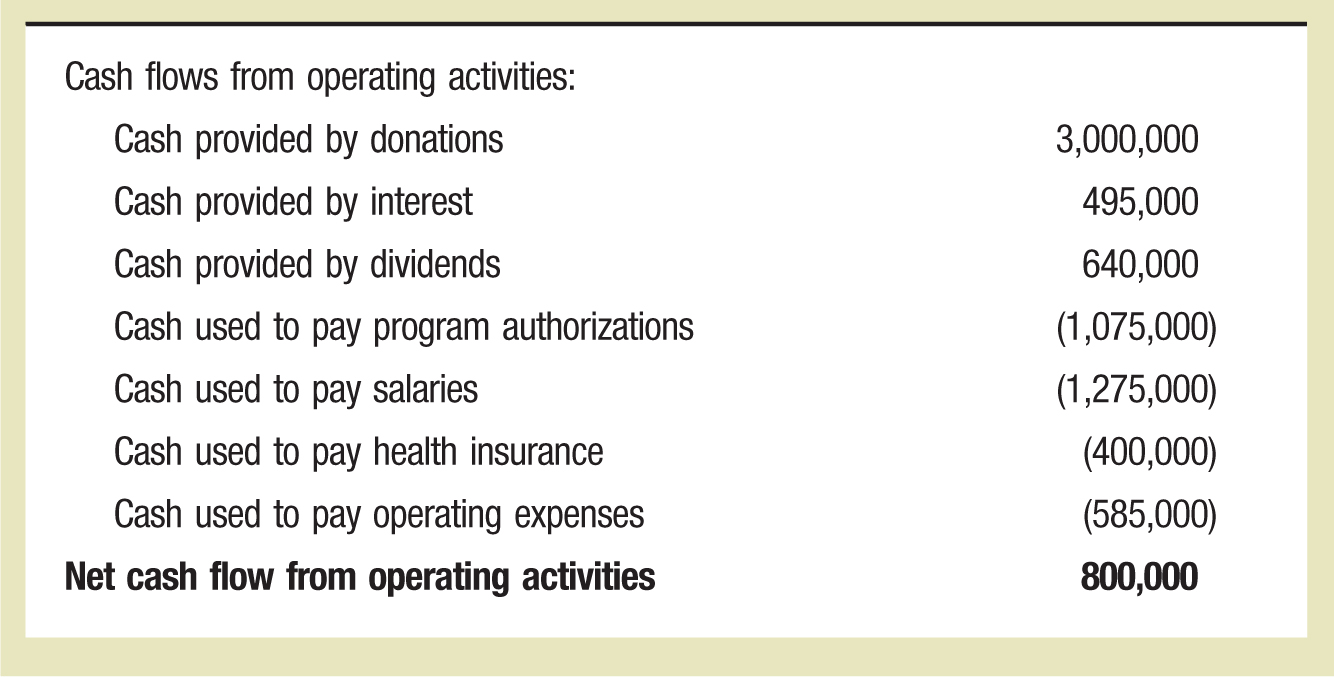

Contract Specifications: Each corn futures contract represents a standardized quantity of corn. In the United States, one contract typically represents 5,000 bushels of corn. It’s essential to note that these contracts are cash-settled, meaning that physical delivery of corn is not required. Instead, the settlement price is determined based on the prevailing market price on the contract’s expiration date.

Expiration Dates: Corn futures contracts have specific expiration dates, usually falling within a designated delivery month. For example, a particular contract may expire in December, indicating that the buyer must settle the contract by the end of December.

Price Fluctuations: Corn futures prices are influenced by various factors, including supply and demand dynamics, weather conditions, government policies, and market speculation. The prices are quoted in cents per bushel, with each one-cent move representing a $50 gain or loss per contract.

Margin Requirements: When trading futures contracts, participants are required to post margin, which serves as a performance bond and collateral. Margin requirements vary but are typically a fraction of the contract’s total value, allowing traders to control a larger position with a smaller upfront capital requirement. Margin calls may be issued if the market moves against a trader, requiring additional funds to maintain the position.

Liquidity and Volume: Liquidity is a crucial factor when trading any financial instrument, including corn futures contracts. High liquidity ensures that there are enough buyers and sellers in the market, providing ample opportunities to enter or exit positions. Volume represents the total number of contracts traded during a specific time period and is often used as a gauge of market activity and interest.

By understanding these key components, traders and investors can navigate the corn futures market with greater confidence. However, it’s important to acknowledge that trading futures contracts involves a certain degree of risk and should be approached with proper risk management and a thorough understanding of market dynamics.

Factors Influencing the Number of Contracts

Multiple factors come into play when assessing the number of corn futures contracts traded. Here are some of the key influencers:

Market Volatility: Higher volatility tends to attract more participants to the market as it presents greater profit opportunities. When corn prices are experiencing significant fluctuations, traders and investors are more inclined to trade futures contracts to capitalize on these price movements.

Supply and Demand Fundamentals: The balance between corn supply and demand heavily impacts the number of contracts traded. When demand for corn is robust, driven by factors such as population growth and increased consumption, traders may anticipate higher prices and engage in more futures trading. Conversely, if there are concerns about oversupply or weak demand, trading activity may decline.

Weather Conditions: As corn is an agricultural commodity, weather conditions have a direct impact on its production. Unfavorable weather events such as droughts, floods, or excessive rainfall can lead to reduced crop yields and subsequent price volatility. Traders closely monitor weather forecasts and adjust their trading strategies accordingly, affecting the number of contracts traded.

Government Policies and Regulations: Government policies, such as subsidies, tariffs, and import/export regulations, can significantly influence corn prices and trading activity. Changes in these policies may prompt traders to adjust their positions, resulting in fluctuations in the number of contracts traded.

Market Sentiment and Investor Confidence: The overall sentiment and confidence of market participants have a substantial impact on trading activity. Positive market sentiment, driven by factors like economic growth prospects or favorable trade agreements, can lead to increased participation and higher contract volumes. Conversely, negative sentiment, such as geopolitical tensions or economic uncertainty, may deter traders and reduce trading volumes.

Technological Advancements: The advancements in technology, particularly electronic trading platforms, have revolutionized the futures markets. Easy access to real-time market data, efficient order execution, and the ability to trade remotely have attracted more participants to the corn futures market. These technological enhancements have contributed to increased trading volumes and the overall number of contracts traded.

It’s important to note that these factors are interrelated and can influence each other. For example, drought conditions can lead to a decrease in corn supply, which in turn affects market sentiment and trading volume. Traders and investors need to monitor these factors closely to make informed trading decisions.

Historical Data Analysis

An analysis of historical data can provide valuable insights into the trends and patterns of corn futures contract trading. By examining past market behavior, traders and investors can gain a better understanding of potential future price movements and trading activity.

One of the key aspects of historical data analysis is examining trading volume. Volume represents the total number of contracts traded during a specific time period, such as a day, week, or month. By analyzing volume patterns, traders can identify periods of increased market activity and potential price trends.

Historical data analysis can also reveal seasonal trends in corn futures trading. For example, during planting and harvesting seasons, trading volumes tend to increase as farmers and market participants adjust their positions based on crop progress and weather conditions. By recognizing these seasonal patterns, traders can anticipate potential price movements during specific periods of the year.

Pricing patterns can also be identified through historical data analysis. For instance, traders may observe price trends during specific economic events or government report releases. News about crop yields, demand projections, or weather updates can affect corn futures prices and trading activity. By examining historical data during these events, traders can better gauge the potential impact on the market.

Historical data analysis can also help traders identify support and resistance levels. These levels represent price levels where the market has historically shown a strong buying (support) or selling (resistance) interest. By identifying these levels, traders can make more informed decisions on entry and exit points for their trades.

Additionally, historical data analysis can reveal correlations between corn futures contracts and other related markets. For example, corn prices often have a significant relationship with crude oil prices due to the use of corn in biofuel production. By analyzing historical data, traders can gain insights into these relationships and use them to inform their trading strategies.

It’s important to remember that while historical data analysis can provide valuable insights, it is not a guaranteed predictor of future market behavior. Market dynamics can change, and new factors may come into play that were not present in the historical data. Therefore, it’s crucial to combine historical data analysis with real-time market information and a comprehensive understanding of current market conditions.

Overall, historical data analysis serves as a valuable tool for traders and investors. By understanding past market behavior and trends, market participants can make more informed decisions when trading corn futures contracts.

Current Market Trends

The corn futures market is continuously evolving, influenced by various factors and market trends. Let’s explore some of the current trends shaping the market:

Increasing Demand for Corn: The global demand for corn continues to grow, driven by factors such as population growth, changing dietary habits, and the increasing use of corn in biofuel production. This rising demand has led to increased trading activity in corn futures contracts as market participants seek to capitalize on potential price increases.

Weather-related Concerns: Weather conditions play a significant role in corn production, and concerns about adverse weather events can impact the market. Droughts, floods, or extreme temperatures can affect crop yields, leading to increased price volatility and trading activity. Traders closely monitor weather forecasts to gauge potential supply disruptions and adjust their positions accordingly.

Trade and Economic Policies: Trade agreements, tariffs, and other economic policies can have a significant impact on corn prices and trading activity. Changes in government policies can alter corn import and export volumes, impacting supply and demand dynamics. Traders closely follow these developments and their potential impact on the market.

Sustainable and Ethical Sourcing: There is a growing trend towards sustainable and ethically sourced agricultural products, including corn. This trend is driven by consumer demand for transparency and environmental responsibility. Market participants are increasingly focusing on corn sourced from sustainable farming practices, which may impact trading volumes and price differentials between conventional and sustainable corn futures contracts.

Technological Advancements: The advancement of technology continues to shape the corn futures market. Electronic trading platforms, algorithmic trading strategies, and access to real-time market data have increased trading efficiency and attracted a broader range of participants. These technological advancements have contributed to higher trading volumes and increased liquidity in the market.

Environmental and Climate Concerns: Environmental and climate-related issues are gaining more attention globally. As corn is a vital agricultural commodity, market participants are increasingly focusing on the potential impact of climate change on corn production. This heightened awareness may lead to increased trading activity as traders and investors assess and manage climate-related risks.

Government Support for Biofuels: Many governments worldwide are promoting the use of biofuels as a more sustainable alternative to fossil fuels. This support has a direct impact on the corn market, as corn is a major feedstock for bioethanol production. Traders monitor government policies and incentives related to biofuels, as they can influence the demand and price of corn futures contracts.

It’s essential for market participants to stay abreast of these current market trends and understand how they may affect the corn futures market. By keeping a finger on the pulse of these trends, traders and investors can make more informed decisions and adapt their strategies to capitalize on emerging opportunities.

Conclusion

The world of corn futures contracts offers traders and investors a platform to manage price risk, speculate on future price movements, and participate in the ongoing global demand for corn. Understanding the intricacies of corn futures contracts, including contract specifications, expiration dates, and price fluctuations, is crucial for navigating this market successfully.

Various factors influence the number of corn futures contracts traded, such as market volatility, supply and demand fundamentals, weather conditions, government policies, market sentiment, and technological advancements. Traders must stay informed about these factors to make well-informed trading decisions.

Historical data analysis provides valuable insights into past market behavior, seasonal trends, pricing patterns, support and resistance levels, and correlations with other markets. While historical data is not a crystal ball for future market movements, it helps traders identify potential opportunities and risks.

Currently, the corn futures market is shaped by increasing global demand for corn, weather-related concerns, trade and economic policies, sustainable sourcing trends, technological advancements, environmental and climate concerns, and government support for biofuels. Traders should closely monitor these current market trends to capitalize on emerging opportunities.

In conclusion, trading corn futures contracts requires a comprehensive understanding of contract mechanics, market dynamics, and current trends. By combining fundamental analysis, technical analysis, and real-time market information, traders can make more informed decisions and navigate the corn futures market with confidence.