Home>Finance>Net Foreign Factor Income (NFFI) Definition, Equation, Importance

Finance

Net Foreign Factor Income (NFFI) Definition, Equation, Importance

Published: December 30, 2023

Learn the definition, equation, and importance of Net Foreign Factor Income (NFFI) in finance. Enhance your understanding of this crucial concept.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Net Foreign Factor Income (NFFI)

When it comes to the realm of finance, there are various concepts and terms that can seem quite complex to the average person. One such concept is Net Foreign Factor Income (NFFI). In this blog post, we will delve into the definition, equation, and importance of NFFI, providing you with an in-depth understanding of this crucial financial indicator.

Key Takeaways:

- NFFI represents the difference between payments received from abroad and payments made to foreign investors and businesses.

- The NFFI equation is calculated by subtracting payments made to foreign factors of production from payments received from foreign sources.

Defining Net Foreign Factor Income (NFFI)

Net Foreign Factor Income (NFFI) is a measure that reflects the difference between payments received from abroad and payments made to foreign investors and businesses. It encompasses the income earned by domestic factors of production located in foreign countries, such as profits, dividends, interest, and wages.

Essentially, NFFI tracks the flow of income between a country and the rest of the world, capturing both the inflows and outflows of funds. It provides valuable insights into a nation’s economic performance and its relationship with the global economy.

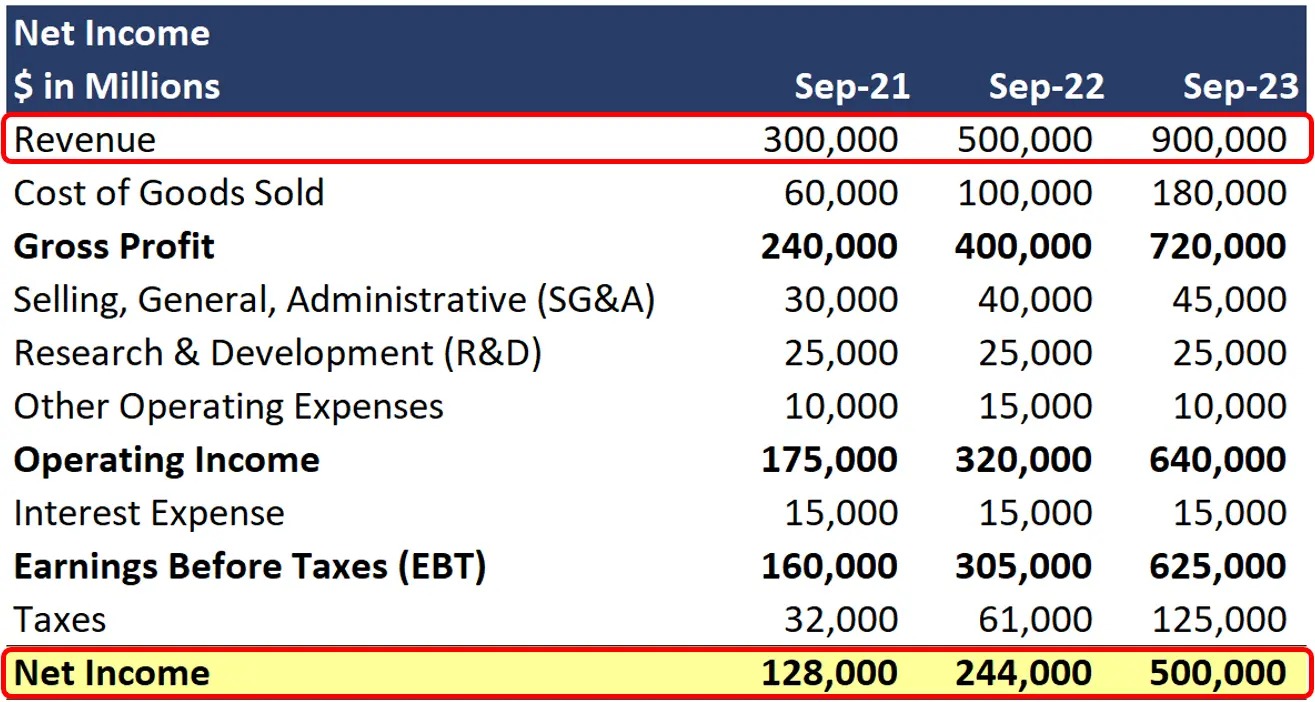

The NFFI Equation

The NFFI equation helps calculate this crucial financial indicator. It is derived by subtracting payments made to foreign factors of production from payments received from foreign sources.

NFFI = Payments Received from Abroad – Payments Made to Foreign Factors of Production

By computing this equation, economists and analysts can gain a comprehensive understanding of a country’s net income transfer with the rest of the world. This information can influence monetary and fiscal policies, as well as aid in assessing a nation’s overall economic health.

The Importance of Net Foreign Factor Income (NFFI)

The calculation and analysis of NFFI hold significant importance for several reasons. Let’s explore a few key reasons why NFFI is a vital indicator in the world of finance:

- Evaluating Economic Performance: NFFI offers insights into a nation’s economic performance by assessing the income generated from foreign investments and businesses. It helps gauge the country’s economic relations with other nations and provides a broader perspective on its overall financial health.

- Influencing Policies: Understanding NFFI allows policymakers to identify the impact of foreign investments and transactions on the domestic economy. It aids in formulating effective fiscal and monetary policies by providing crucial data on income flows, facilitating informed decision-making.

In conclusion, Net Foreign Factor Income (NFFI) is a fundamental concept in finance that measures the difference between payments received from abroad and payments made to foreign investors and businesses. By providing insights into a nation’s economic performance and aiding in policy formation, NFFI plays a crucial role in understanding a country’s financial landscape.

Stay tuned to our finance category for more articles that shed light on various aspects of the financial world!