Finance

Basic Premium Factor Defined

Published: October 14, 2023

Learn about the basic premium factor and its significance in finance. Understand how this vital element impacts your financial decisions and strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What is Basic Premium Factor Defined?

When it comes to finance, understanding the various terms and concepts is crucial for making informed decisions. One such term that plays a significant role in insurance is the Basic Premium Factor. In this blog post, we will delve into the details of what Basic Premium Factor Defined means and how it impacts your insurance premiums.

Key Takeaways:

- The Basic Premium Factor is a coefficient assigned by insurance providers that determines the base premium rate for a specific policy.

- It takes into account various factors such as the coverage amount, duration of the policy, and the insured individual’s risk profile.

Insurance premiums are the amount policyholders pay to the insurance company in exchange for coverage. These premiums are influenced by different factors, including the Basic Premium Factor. Let’s take a closer look at what Basic Premium Factor Defined entails:

Factors Influencing Basic Premium Factor Defined

The Basic Premium Factor is determined by insurance providers based on several important factors:

- Coverage Amount: The higher the coverage amount, the higher the Basic Premium Factor. This is because higher coverage involves a greater potential risk for the insurer.

- Policy Duration: The duration of the policy also affects the Basic Premium Factor. A longer policy duration may result in a higher Basic Premium Factor to account for the increased overall risk exposure over time.

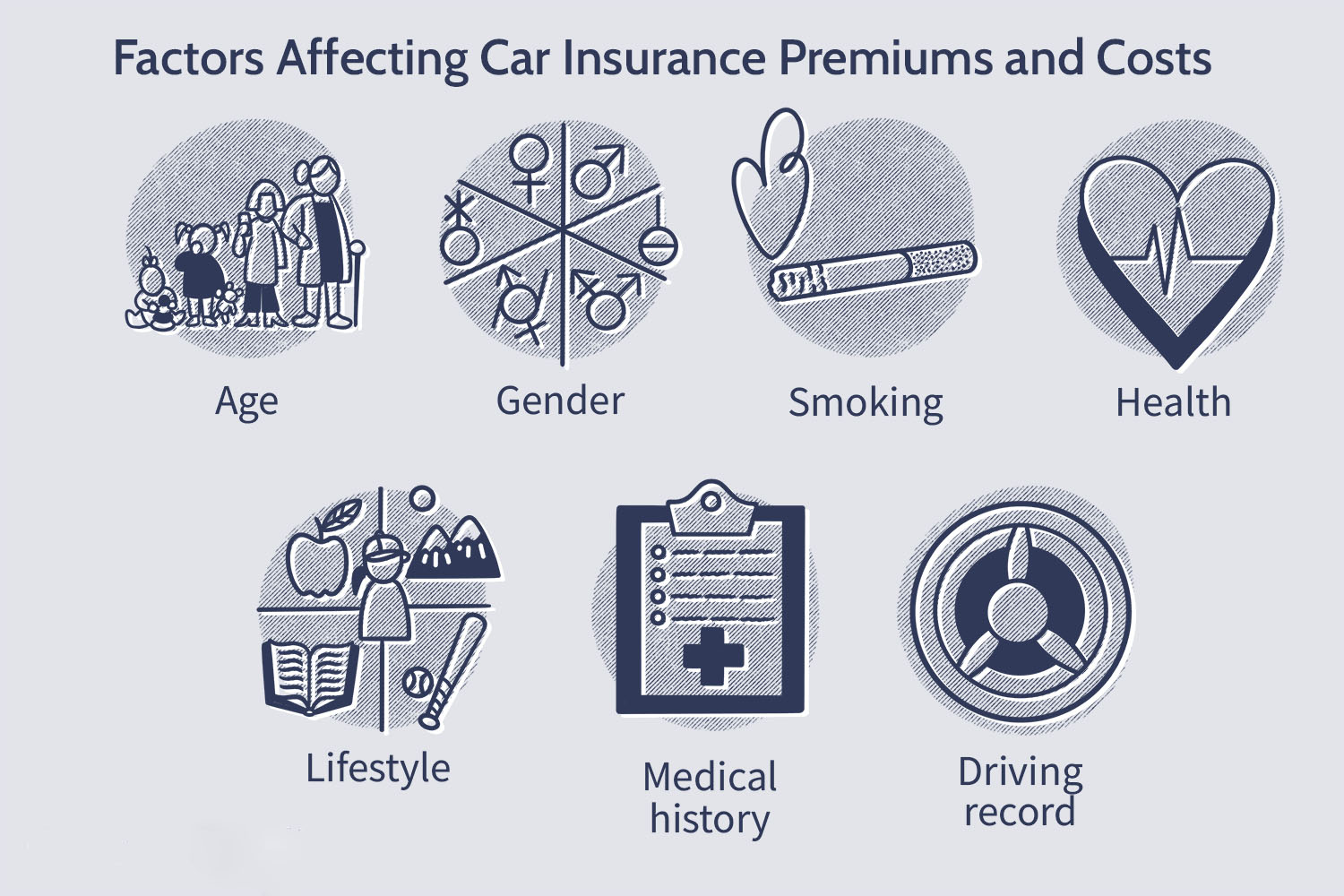

- Insured Individual’s Risk Profile: Insurance companies assess the risk profile of the insured individual, which includes factors such as age, health condition, occupation, and lifestyle habits. Those with higher risk profiles may face a higher Basic Premium Factor.

The Importance of Basic Premium Factor Defined

The Basic Premium Factor serves as the foundation for calculating insurance premiums. It determines the base rate at which policyholders will be charged for coverage. Understanding the Basic Premium Factor Defined can help you grasp the factors that influence your insurance costs and enable you to make informed decisions when choosing a policy. Knowing how insurance companies assess risk and establish premium rates is invaluable in ensuring you receive appropriate coverage at a fair price.

Conclusion

When it comes to insurance, the Basic Premium Factor Defined plays a crucial role in determining the base premium rate for a specific policy. It takes into account factors such as coverage amount, policy duration, and the insured individual’s risk profile. By understanding the Basic Premium Factor, you can have a better grasp of how insurance premiums are calculated and make informed decisions when choosing the right coverage for your needs.