Home>Finance>Net Income (NI) Definition: Uses, And How To Calculate It

Finance

Net Income (NI) Definition: Uses, And How To Calculate It

Published: December 30, 2023

Learn the definition and uses of Net Income (NI) in finance. Discover how to calculate it and gain a better understanding of this crucial financial metric.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Net Income (NI) Definition: Uses, and How to Calculate It

Welcome to our Finance category blog post where we dive into the fascinating world of Net Income (NI) and its importance in business and personal finance. In this article, we will explore the definition of Net Income, its uses, and provide you with a step-by-step guide on how to calculate it. So, let’s get started and unravel the mystery of Net Income!

Key Takeaways:

- Net Income is a measure of profitability and represents the amount of money a business or an individual earns after deducting all expenses from total revenue.

- Understanding Net Income is crucial for financial decision-making, evaluating the performance of a company, and assessing an individual’s financial health.

What is Net Income?

Net Income, also known as net profit, is a fundamental financial metric that demonstrates the profitability of a business or an individual. It is the amount of money remaining after deducting all expenses from total revenue.

Net Income serves as a yardstick to gauge the financial success and viability of an enterprise. It provides valuable insights into the financial health of a business and its ability to generate profits.

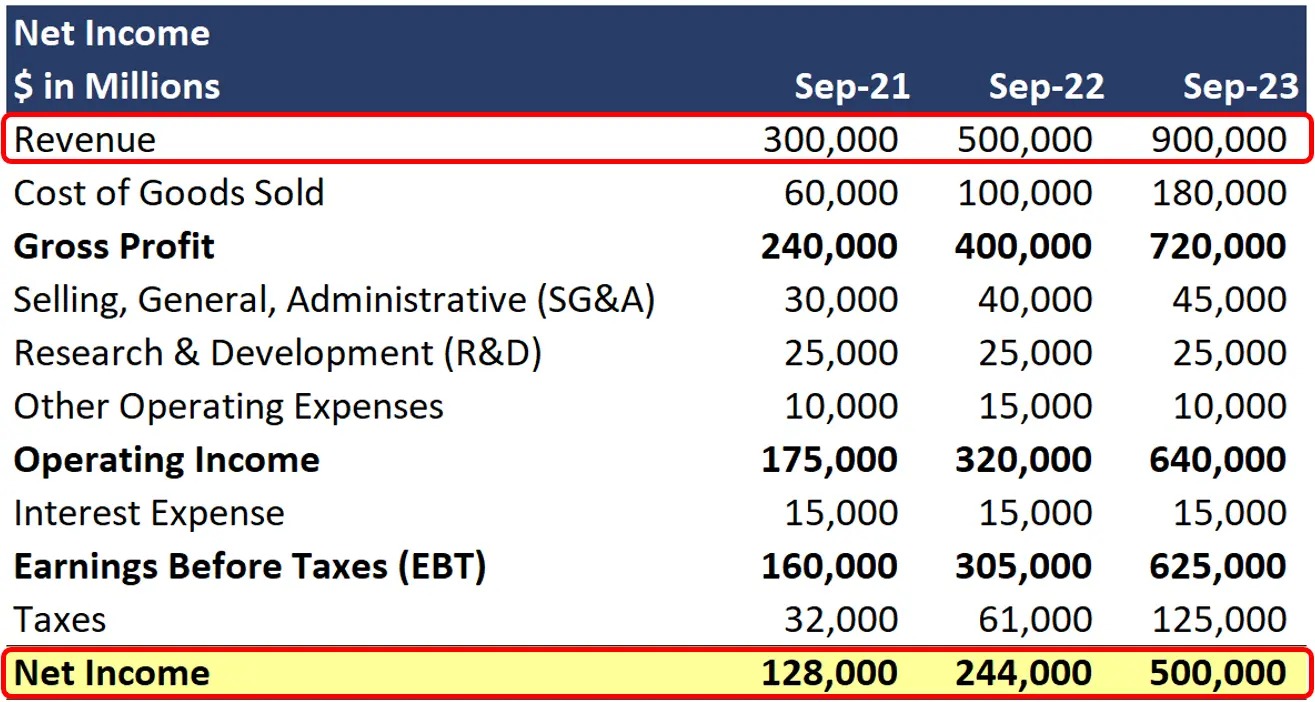

How is Net Income Calculated?

Calculating net income involves subtracting all expenses from total revenue. Here’s a step-by-step guide on how to calculate Net Income:

- Gather financial statements: Collect the income statement (also known as the profit and loss statement) and the accompanying documents.

- Deduct cost of goods sold (COGS): Calculate the cost of goods sold, including the expenses directly related to product/service creation.

- Subtract operating expenses: Subtract all operating expenses, such as salaries, rent, insurance, utilities, and marketing costs.

- Add or deduct non-operating income/expenses: Include any non-operating income, like interest income or gains from investments, and subtract non-operating expenses, such as interest paid on loans or losses from investments.

- Consider taxes: Deduct taxes from the total after accounting for any tax credits, deductions, or deferred tax assets/liabilities.

- Final calculation: Subtract all expenses and taxes from total revenue. The resulting amount is the Net Income.

Uses of Net Income:

Net Income plays a crucial role in various aspects of finance, including:

- Financial Decision-Making: Net Income helps businesses make informed decisions regarding investments, expansion, and business strategies. It provides a snapshot of the company’s profitability and financial viability.

- Performance Evaluation: Net Income is used to assess a company’s performance over a specific period. It enables investors, shareholders, and analysts to determine if the company has been generating consistent profits.

- Loan Approvals: Lenders often evaluate a borrower’s Net Income to assess their ability to repay loans. A higher Net Income indicates a stronger financial position, which increases the likelihood of loan approval.

- Personal Financial Health: Individuals can use Net Income to evaluate their financial position and determine if they are saving enough, managing expenses effectively, or need to make any adjustments to their financial goals.

Understanding Net Income and its uses is essential for making informed financial decisions and evaluating the financial health of a business or an individual. By calculating Net Income, you gain valuable insights into profitability, performance, and financial viability, allowing you to navigate the intricate world of finance with confidence.

So, the next time you come across the term Net Income, remember its significance and the valuable role it plays in financial management.