Finance

How To Calculate Net Cash Flow

Modified: December 29, 2023

Learn how to calculate net cash flow in finance through this comprehensive guide. Understand the key components involved and make informed decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the financial health of a business is essential for making informed decisions. One key aspect of financial analysis is calculating the net cash flow. Net cash flow provides valuable insights into the cash position of a company and its ability to generate and utilize cash resources.

In simple terms, net cash flow is the difference between cash inflows and cash outflows over a specific period of time. It reflects the net increase or decrease in cash and cash equivalents during that period. By analyzing net cash flow, investors, creditors, and management can assess the company’s liquidity, cash management efficiency, and potential for growth.

Net cash flow analysis is beneficial for various stakeholders. Investors can evaluate the company’s financial stability and its ability to generate returns. Creditors can assess the repayment capacity and financial health of the business. Management can use net cash flow data to make strategic decisions, such as planning investments, managing working capital, and optimizing cash flow.

This article will provide you with a comprehensive understanding of net cash flow and its calculation. We will explore the factors that influence net cash flow and the steps to compute it. Additionally, we will delve into an example calculation and discuss the limitations of net cash flow analysis.

So, whether you are an investor, a creditor, or part of the management team, mastering the calculation of net cash flow is crucial for sound financial decision-making. Let’s dive deeper into this important financial metric.

Definition of Net Cash Flow

Net cash flow is a financial metric that measures the difference between cash inflows and cash outflows during a specific period. It represents the actual amount of cash generated or consumed by a business over that period. Net cash flow is a critical component of cash flow analysis as it provides insights into a company’s cash position and its ability to generate and manage cash resources.

Cash inflows include revenue from sales, interest income, and other sources of cash such as loans or investments. These inflows increase the overall cash balance of a business. On the other hand, cash outflows include expenses such as operating costs, loan repayments, and investments made by the company. These outflows decrease the overall cash balance.

The net cash flow is calculated by subtracting total cash outflows from total cash inflows. If the resulting value is positive, it signifies positive cash flow or net cash inflow. This indicates that the business is generating more cash than it is consuming, which is generally considered favorable. On the other hand, if the net cash flow is negative, it indicates negative cash flow or net cash outflow, suggesting that the business is consuming more cash than it is generating.

Net cash flow is often analyzed on a monthly, quarterly, or annual basis to evaluate the short-term cash position of a company. It provides an indication of whether the company has sufficient cash flow to cover its operating expenses and meet its financial obligations.

It is important to note that net cash flow is different from net income. Net income is a measure of profitability, calculated by subtracting all expenses, including non-cash expenses such as depreciation, from total revenue. On the other hand, net cash flow focuses solely on cash transactions and provides a clearer picture of the company’s liquidity and ability to generate cash.

Now that we have a clear understanding of what net cash flow represents, let’s explore why calculating net cash flow is crucial for financial analysis.

Importance of Calculating Net Cash Flow

Calculating net cash flow is of utmost importance in financial analysis as it provides valuable insights into the cash position and financial health of a business. Here are some key reasons why calculating net cash flow is crucial:

1. Assessing Liquidity: Net cash flow analysis helps evaluate a company’s liquidity, which is its ability to meet short-term financial obligations. Positive net cash flow indicates that the business has sufficient cash resources to cover its operating expenses, repay debts, and invest in growth opportunities. Conversely, negative net cash flow suggests that the company may face liquidity challenges and may need to rely on external financing or reduce expenses to avoid cash shortages.

2. Cash Management and Efficiency: Calculating net cash flow allows businesses to monitor their cash management practices and efficiency. By analyzing the components of cash inflows and outflows, organizations can identify areas where they can optimize cash utilization. This insight helps in reducing unnecessary expenses, improving working capital management, and maximizing the cash resources available for growth and investment.

3. Making Informed Financial Decisions: Net cash flow analysis provides essential information for making sound financial decisions. Investors can gauge a company’s financial stability and its ability to generate returns by examining its net cash flow over time. Creditors can evaluate the repayment capacity of the business by assessing its ability to generate positive cash flow. Management can use net cash flow data to make strategic decisions on capital investments, dividend distributions, and debt repayment.

4. Predicting Future Cash Flow: By tracking and analyzing net cash flow over multiple periods, businesses can predict their future cash flow trends. This helps in developing accurate cash flow forecasts and financial projections. Reliable cash flow forecasts are essential for budgeting, planning for growth, negotiating credit terms, and maintaining financial stability.

5. Monitoring Financial Health: Net cash flow analysis serves as an indicator of a company’s overall financial health. Consistent positive net cash flow demonstrates that the business is generating healthy cash surpluses, which can be used to fuel expansion, reinvest in the company, or distribute to shareholders. On the contrary, a persistent negative net cash flow may indicate underlying financial problems, including excessive debt, declining sales, or inefficient expense management.

Calculating net cash flow, therefore, provides robust insights into a company’s short-term financial position, cash management practices, and overall financial stability. It is an essential tool for financial analysis that assists stakeholders in making informed decisions and ensuring the sustainable growth of a business.

Components of Net Cash Flow

To calculate the net cash flow of a business, it is important to understand the various components that contribute to the cash inflows and outflows. Here are the key components:

1. Cash Inflows: Cash inflows include all sources of cash that increase the overall cash balance of a business. The main components of cash inflows typically include:

– Revenue from sales: This includes cash received from the sale of products or services.

– Interest income: Cash received as interest on investments, loans, or savings accounts.

– Loans or investments: Cash received as a result of obtaining loans or investments from external sources.

2. Cash Outflows: Cash outflows are the expenses and payments that decrease the overall cash balance. The primary components of cash outflows may include:

– Operating expenses: Cash payments for day-to-day business operations, such as rent, salaries, utility bills, and inventory purchases.

– Loan repayments: Cash payments made towards the principal amount and interest on loans or debts.

– Investments: Cash spent on acquiring new assets or making capital investments in the business.

– Taxes: Cash payments made to fulfill tax obligations, including income tax, sales tax, and property tax.

3. Changes in working capital: Changes in working capital can directly impact net cash flow. Working capital represents the difference between current assets (such as cash, inventory, accounts receivable) and current liabilities (such as accounts payable, accrued expenses). An increase in working capital, which requires additional cash to finance, will decrease net cash flow. Conversely, a decrease in working capital will increase net cash flow.

4. Non-cash expenses and revenues: Non-cash expenses, such as depreciation and amortization, do not involve actual cash outflows, but they affect net cash flow indirectly by impacting net income. Similarly, non-cash revenues, like accounts receivable or investment gains, do not involve immediate cash inflows but are recognized as revenue in the financial statements.

To calculate the net cash flow, all cash inflows are summed up, and all cash outflows are totaled separately. The total cash inflows are then subtracted from the total cash outflows to arrive at the net cash flow for the given period.

Understanding the components of net cash flow is essential for accurately analyzing a company’s cash position and evaluating its ability to generate and manage cash resources. By tracking these components, businesses can identify areas of improvement in their cash flow management, make informed decisions, and ensure the financial stability of the organization.

Steps to Calculate Net Cash Flow

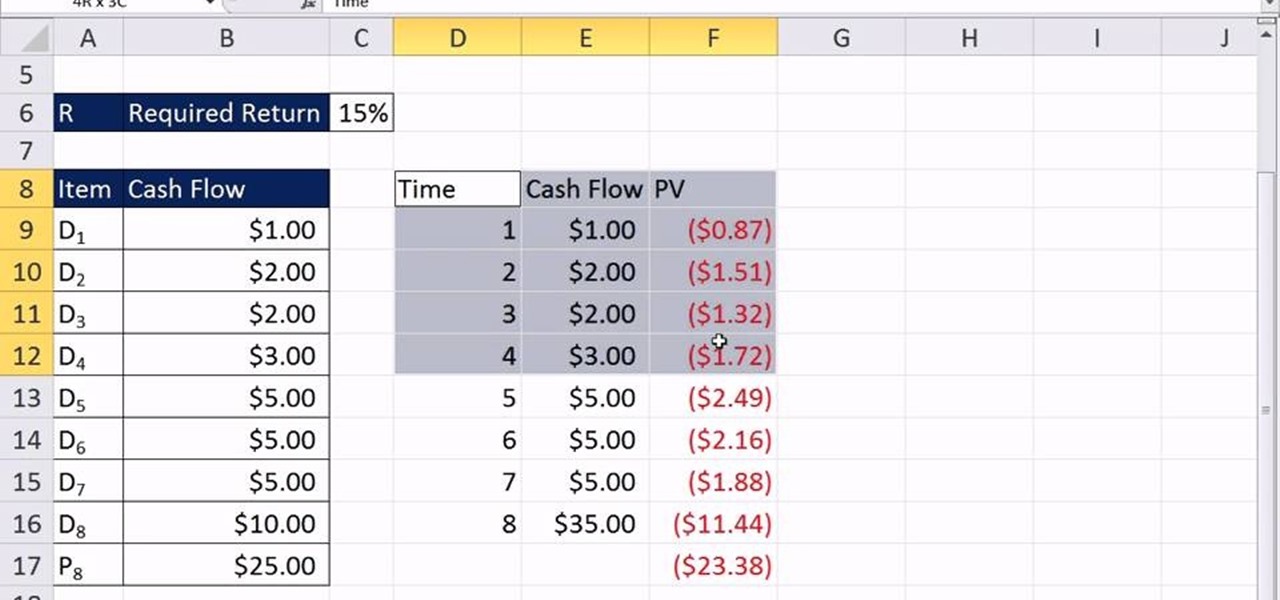

Calculating net cash flow involves a straightforward process that requires gathering relevant financial information and following a few key steps. Here is a step-by-step guide on how to calculate net cash flow:

Step 1: Gather Financial Statements: Collect the necessary financial statements, such as the Statement of Cash Flows, Income Statement, and Balance Sheet, for the specific period you want to calculate the net cash flow. These statements provide the required information to determine the cash inflows and outflows.

Step 2: Identify Cash Inflows: Review the Statement of Cash Flows to identify the sources of cash inflows. These can include revenue from sales, interest income, and loans or investments received during the period.

Step 3: Determine Cash Outflows: Analyze the Statement of Cash Flows and the Income Statement to identify the cash outflows. These may include operating expenses, loan repayments, investments made, and taxes paid during the period.

Step 4: Calculate Operating Cash Flow: Determine the operating cash flow by subtracting non-cash expenses, such as depreciation and amortization, from net income. Non-cash revenues should also be included if they were initially excluded from net income.

Step 5: Include Changes in Working Capital: Consider the changes in working capital, which can impact the net cash flow. Calculate the changes by comparing the current period’s working capital with the previous period. Include any increase or decrease in working capital in the net cash flow calculation.

Step 6: Summarize Cash Inflows and Outflows: Sum up the total cash inflows and total cash outflows separately, considering all the identified components of each category.

Step 7: Calculate Net Cash Flow: Finally, subtract the total cash outflows from the total cash inflows. If the resulting value is positive (more cash inflows than outflows), it signifies positive net cash flow. If the value is negative (more cash outflows than inflows), it indicates negative net cash flow.

By following these steps, businesses can accurately calculate their net cash flow for a specific period. This information is crucial for assessing the cash position, liquidity, and financial health of the company. Additionally, it helps stakeholders make informed decisions about investment, financing, and overall financial management.

Example Calculation

Let’s walk through an example to better understand how to calculate net cash flow. Assume we have the following financial information for a business for a specific period:

- Cash inflows from sales: $50,000

- Interest income: $2,000

- Loan received: $10,000

- Operating expenses: $25,000

- Loan repayment: $5,000

- Investments made: $8,000

To calculate the net cash flow, we will follow the steps outlined earlier:

Step 1: Gather the financial statements for the specific period.

Step 2: Identify the cash inflows. In our example, we have the following cash inflows:

$50,000 (sales) + $2,000 (interest income) + $10,000 (loan received) = $62,000.

Step 3: Determine the cash outflows. In our example, the cash outflows are:

$25,000 (operating expenses) + $5,000 (loan repayment) + $8,000 (investments made) = $38,000.

Step 4: Calculate the operating cash flow. Since we don’t have specific information about non-cash expenses and revenues, let’s assume they are negligible. Therefore, the operating cash flow would be equal to the net income.

Step 5: Consider any changes in working capital. For simplicity, let’s assume there were no significant changes in working capital during the period.

Step 6: Summarize the cash inflows and outflows. We have:

Total cash inflows = $62,000

Total cash outflows = $38,000

Step 7: Calculate the net cash flow. Subtract the total cash outflows from the total cash inflows:

$62,000 – $38,000 = $24,000

Based on this calculation, the net cash flow for the specific period is $24,000. A positive net cash flow indicates that the company generated more cash than it spent during that period. This suggests a healthy cash position and the ability to cover expenses and invest in growth opportunities.

It’s important to remember that this is just a simplified example, and in practice, net cash flow calculations may involve more complex components and considerations.

Limitations of Net Cash Flow Analysis

While net cash flow analysis is a valuable tool for assessing a company’s cash position and financial health, it is important to be aware of its limitations. Here are some key limitations to consider:

1. Timing of Cash Flows: Net cash flow analysis focuses on the timing of cash inflows and outflows without considering the specific time at which revenue is earned or expenses are incurred. It does not take into account the cash flow pattern or fluctuations within the reporting period, which may lead to inaccuracies in analyzing the actual cash position.

2. Non-Cash Transactions: Net cash flow analysis does not consider non-cash transactions, such as transactions involving accruals, provisions, or non-cash expenses like depreciation. While these items may impact net income and financial statements, they do not have a direct impact on cash flow.

3. Cash Flow Volatility: Net cash flow analysis may not accurately reflect the underlying volatility of cash inflows and outflows. In certain industries, cash flows may be highly variable due to seasonality, market conditions, or project-based activities. Net cash flow analysis provides an average measure, which may not capture these fluctuations accurately.

4. Capital Expenditures and Financing Activities: Net cash flow analysis primarily focuses on operating cash flows, neglecting the impact of capital expenditures and financing activities such as loan repayments or equity issuances. These activities can significantly influence a company’s overall cash position and its ability to fund investments or meet financial obligations.

5. Lack of Context: Net cash flow analysis alone may not provide a comprehensive understanding of a company’s financial performance. It is essential to consider other financial metrics and qualitative factors to gain a complete picture. Factors such as market conditions, competitive landscape, and industry trends can impact a company’s overall financial health.

6. Quality of Financial Statements: The accuracy and reliability of the financial statements used for net cash flow analysis are essential. Inaccurate or incomplete financial statements can lead to incorrect calculations and misleading interpretations of the cash flow position.

7. Future Cash Flow Estimation: While net cash flow analysis provides insights into historical cash flows, it may not accurately predict future cash flows. Changes in market conditions, customer behavior, or internal operations can significantly impact future cash flow dynamics.

Despite these limitations, net cash flow analysis remains a valuable tool for understanding a company’s short-term cash position and its ability to generate and manage cash resources. It should be used in conjunction with other financial analysis techniques to gain a comprehensive understanding of a company’s financial performance and prospects.

Conclusion

Net cash flow analysis is a vital component of financial analysis, providing insights into a company’s cash position, liquidity, and ability to generate and manage cash resources. By calculating net cash flow, stakeholders can evaluate the financial health of the business, make sound financial decisions, and ensure sustainability and growth.

Throughout this article, we have explored the definition of net cash flow and its importance in financial analysis. We have discussed the components involved in calculating net cash flow, including cash inflows, cash outflows, changes in working capital, and non-cash transactions.

We have also delved into the step-by-step process of calculating net cash flow, emphasizing the need to gather accurate financial statements and consider relevant factors such as operating cash flow and changes in working capital. Additionally, we provided an example calculation to illustrate the practical application of net cash flow analysis.

However, it’s crucial to acknowledge the limitations of net cash flow analysis, including its focus on timing, exclusion of non-cash transactions, and the need for context and consideration of other financial metrics. By being aware of these limitations, stakeholders can use net cash flow analysis as part of a comprehensive financial analysis approach.

In conclusion, net cash flow analysis is an essential tool for evaluating a company’s cash position and financial health. It enables stakeholders to assess liquidity, make informed financial decisions, and predict future cash flow trends. While net cash flow analysis has its limitations, when used in conjunction with other financial analysis techniques, it contributes to a robust understanding of a company’s financial performance and prospects.