Home>Finance>Net Income After Taxes (NIAT): Definition, Calculation, Example

Finance

Net Income After Taxes (NIAT): Definition, Calculation, Example

Published: December 30, 2023

Learn the definition, calculation, and example of net income after taxes (NIAT) in finance. Understand how to calculate and interpret this essential financial metric.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Net Income After Taxes (NIAT): Definition, Calculation, Example

Welcome to our finance category, where we dive deep into various topics related to managing your money and making informed financial decisions. In this blog post, we are going to explore the concept of Net Income After Taxes (NIAT) and its significance in assessing the financial health of a business or individual.

Key Takeaways:

- Net Income After Taxes (NIAT) is the amount of money left after deducting taxes from gross income.

- NIAT is a critical metric used to evaluate the profitability and sustainability of a business or an individual’s financial status.

So, what exactly is Net Income After Taxes (NIAT)? NIAT is the final amount of money that remains after deducting taxes from the gross income of a business or individual. It represents the actual income earned or received after all tax obligations are fulfilled.

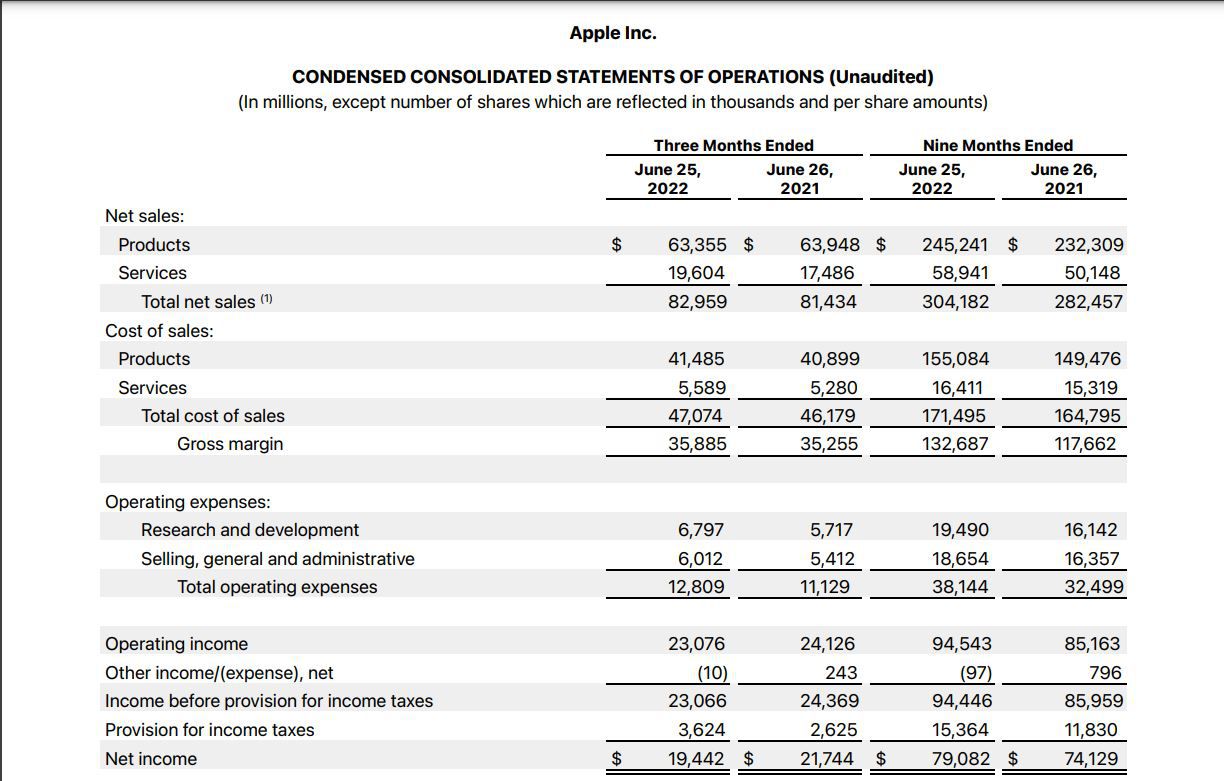

To calculate NIAT, you need to follow a simple formula:

NIAT = Gross Income – Taxes

Let’s break it down further with an example. Suppose a business has a gross income of $100,000 for a given period, and it has a tax liability of $20,000. To find the NIAT, subtract the tax amount from the gross income:

NIAT = $100,000 – $20,000

NIAT = $80,000

In this example, the Net Income After Taxes (NIAT) is $80,000.

Understanding NIAT is crucial because it provides valuable insights into the financial performance and profitability of a business or individual. Here are a few key reasons why NIAT is important:

- Assessing Profitability: NIAT helps in assessing the profitability of a business by indicating how much profit is left after fulfilling tax obligations. It allows you to measure the success or failure of your financial operations.

- Evaluating Financial Health: NIAT serves as an indicator of the financial health of a business or individual. It helps in analyzing the sustainability and long-term viability of their financial situation.

- Making Informed Decisions: By knowing your NIAT, you can make informed decisions about budgeting, investment, or expansion plans. It provides a clear picture of your available resources and helps in planning for the future.

In conclusion, Net Income After Taxes (NIAT) is a crucial metric for measuring profitability and assessing the financial health of a business or individual. It indicates the amount of money left after deducting taxes from gross income. Understanding NIAT allows you to make informed financial decisions and plan for a secure and successful financial future.