Home>Finance>Net Premium Definition, Calculation, Vs. Gross Premium

Finance

Net Premium Definition, Calculation, Vs. Gross Premium

Published: December 30, 2023

Learn about net premium in finance, its definition, calculation, and how it compares to gross premium in the insurance industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Net Premium and Gross Premium in Finance

When it comes to the world of finance, there are many concepts that can seem complex and confusing. One such concept is the difference between net premium and gross premium. In this blog post, we will explore what net premium and gross premium are, how they are calculated, and the key differences between the two. By the end of this article, you’ll have a clear understanding of these terms and their significance in the financial landscape.

Key Takeaways:

- Net premium represents the actual amount of money an insurer receives after deducting expenses and commissions, while gross premium refers to the total premium amount charged to the policyholder.

- Calculating net premium involves subtracting expenses, commissions, and other deductions from the gross premium.

Defining Net Premium

Net premium is the amount of money an insurance company receives after deducting certain costs associated with underwriting and administering the insurance policy. These expenses may include commissions paid to agents, underwriting costs, administrative fees, and other operational expenses. Net premium is the actual revenue earned by the insurer for assuming the risk and providing coverage to the policyholder.

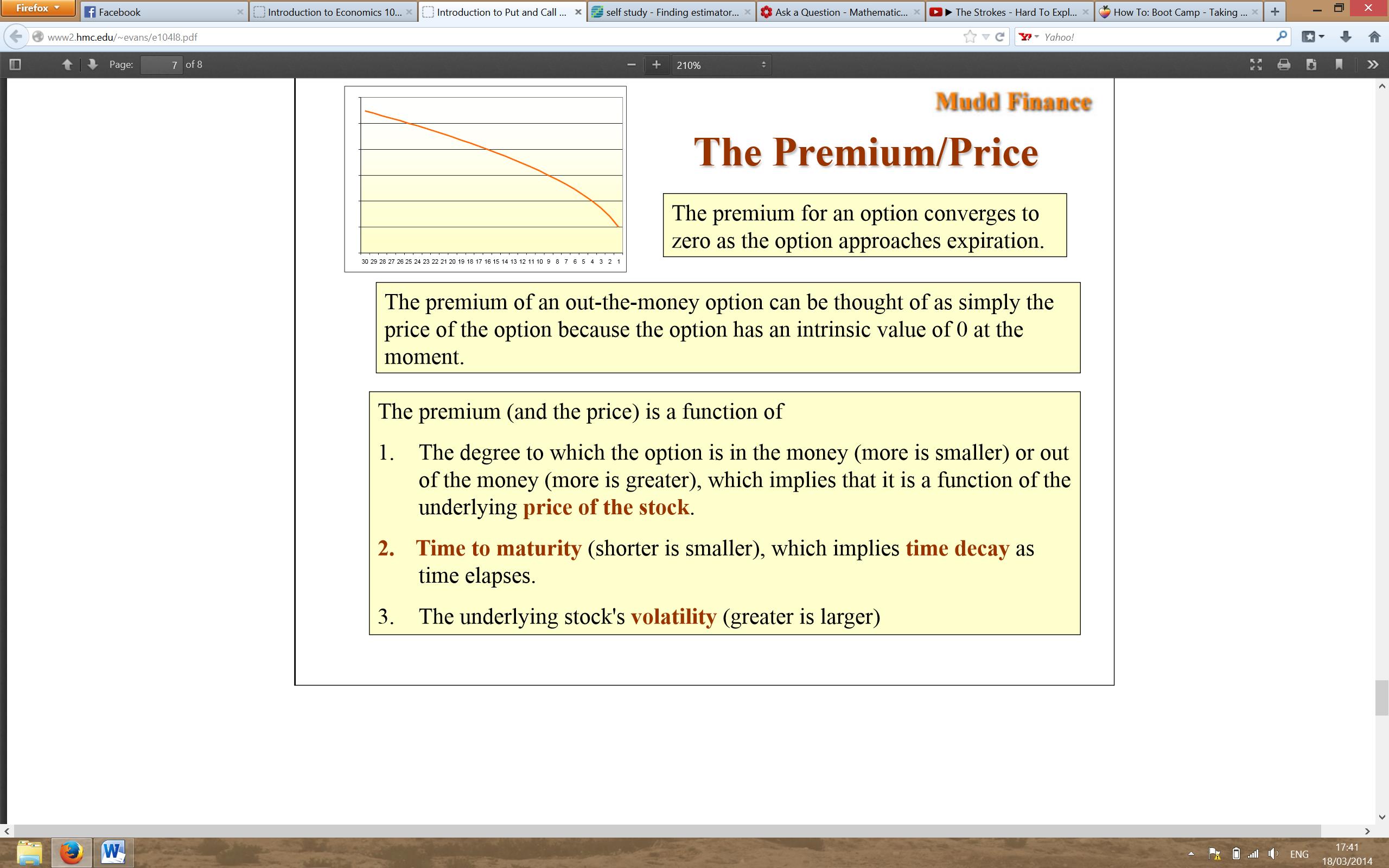

To calculate net premium, the insurer subtracts all relevant costs and expenses from the gross premium collected from policyholders. The resulting amount is the net premium, which represents the insurer’s profit from the policy.

Understanding Gross Premium

Gross premium, on the other hand, refers to the total premium amount charged to the policyholder before any expenses or deductions are taken into account. It represents the initial revenue generated by the insurance company from policyholders.

Gross premium is the base amount on which calculations for net premium and other policy-related costs are based. It includes the actual risk premium, as well as loadings and other factors that allow insurers to cover expenses and generate profit.

Differences between Net Premium and Gross Premium

Now that we have defined both net premium and gross premium, let’s highlight the key differences between the two:

- Calculation: Net premium is calculated by subtracting expenses, commissions, and other deductions from the gross premium, while gross premium is the actual premium charged to the policyholder.

- Purpose: Net premium represents the income earned by the insurer, while gross premium is the starting point for determining the net premium and other policy-related costs.

- Transparency: Net premium is not openly disclosed to policyholders, as it is an internal calculation made by the insurer. On the other hand, gross premium is the amount policyholders are aware of and pay for their insurance coverage.

In Summary

In the world of finance, understanding the difference between net premium and gross premium is essential. Net premium represents the revenue an insurance company earns after deducting expenses, while gross premium is the total amount charged to policyholders. Calculating net premium involves subtracting expenses and commissions from the gross premium. By grasping these concepts, you will be better equipped to navigate the intricacies of the insurance industry and make informed financial decisions.

Key Takeaways:

- Net premium represents the actual amount of money an insurer receives after deducting expenses and commissions, while gross premium refers to the total premium amount charged to the policyholder.

- Calculating net premium involves subtracting expenses, commissions, and other deductions from the gross premium.