Home>Finance>Confirmed Letter Of Credit: Definition, Example, Vs. Unconfirmed

Finance

Confirmed Letter Of Credit: Definition, Example, Vs. Unconfirmed

Modified: January 10, 2024

Looking for information on Confirmed Letter of Credit? Explore the definition, example, and difference between Confirmed and Unconfirmed letters of credit in the finance industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Confirmed Letter of Credit: Definition, Example, vs. Unconfirmed

Welcome to our FINANCE blog category, where we explore various financial topics to help you understand and navigate the complex world of finance. In this article, we will be focusing on Confirmed Letters of Credit, their definition and examples, and how they differ from Unconfirmed Letters of Credit.

Key Takeaways:

- A Confirmed Letter of Credit provides an additional level of security by involving a second bank that guarantees payment to the beneficiary.

- Unconfirmed Letters of Credit do not involve a second bank and are reliant solely on the issuing bank’s commitment to payment.

What is a Confirmed Letter of Credit?

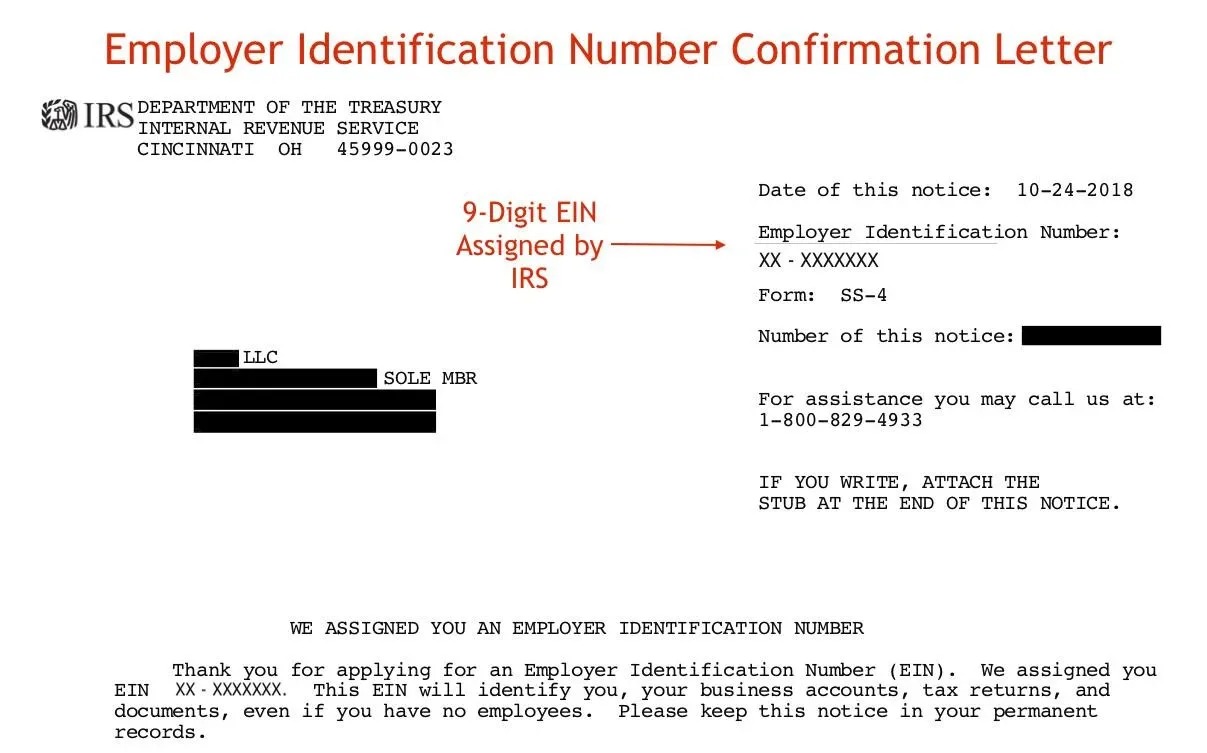

A Confirmed Letter of Credit is a financial instrument issued by a bank on behalf of a buyer to guarantee payment to a seller. It involves the involvement of two banks – the issuing bank and a confirming bank. The confirming bank adds an additional layer of security for the seller, guaranteeing payment in case the issuing bank fails to fulfill its payment obligation.

Let’s look at an example to better understand how a Confirmed Letter of Credit works:

Example: Company A wants to purchase goods from Company B, but Company B is unsure about Company A’s ability to make payment. In order to reassure Company B, Company A obtains a Confirmed Letter of Credit from its bank (the issuing bank). The issuing bank then contacts a confirming bank to confirm the Letter of Credit. Company B can now confidently ship the goods because they know that even if Company A fails to make payment, they will still receive payment from the confirming bank.

Key Point: The confirming bank’s commitment to payment acts as a guarantee for the seller, reducing the risk of non-payment.

Unconfirmed Letters of Credit

Now that we understand what a Confirmed Letter of Credit is, let’s discuss Unconfirmed Letters of Credit.

An Unconfirmed Letter of Credit, as the name suggests, does not involve a confirming bank. It relies solely on the commitment of the issuing bank to make payment to the seller. This means that if the issuing bank fails to fulfill its payment obligation, the seller is left with limited recourse.

While Unconfirmed Letters of Credit are still widely used, they carry a higher risk for the seller as there is no second bank guaranteeing payment. Sellers may require additional assurances or prefer Confirmed Letters of Credit to minimize their risk.

Conclusion

Understanding the difference between Confirmed and Unconfirmed Letters of Credit is crucial for both buyers and sellers involved in international trade. A Confirmed Letter of Credit provides an extra level of security for sellers by involving a confirming bank that guarantees payment, while an Unconfirmed Letter of Credit solely relies on the issuer’s commitment to payment.

If you are a buyer or seller involved in international trade, carefully consider the type of Letter of Credit that best suits your needs and risk appetite. And always remember, when in doubt, consult with financial professionals or experienced trade advisors who can provide guidance tailored to your specific situation.