Home>Finance>Nigerian Naira (NGN): Definition, History, Forex Example

Finance

Nigerian Naira (NGN): Definition, History, Forex Example

Published: December 31, 2023

Learn about the Nigerian Naira (NGN), its definition, history, and explore a forex example. Enhance your understanding of finance with this informative guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Nigerian Naira (NGN): Definition, History, Forex Example

Welcome to the Finance category on our page! Today, we are going to dive into the world of the Nigerian Naira (NGN). If you’re wondering what the Nigerian Naira is, its history, and how it operates in the forex market, you’ve come to the right place. In this blog post, we will explore all these aspects and provide you with a comprehensive understanding of the Nigerian Naira.

Key Takeaways:

- The Nigerian Naira (NGN) is the official currency of Nigeria.

- NGN has a long and interesting history, reflecting the economic development and challenges that Nigeria has faced over the years.

What is the Nigerian Naira?

The Nigerian Naira (NGN) is the official currency of Nigeria, a country located in West Africa. It is abbreviated as NGN, and its symbol is ₦. The Central Bank of Nigeria is responsible for issuing and managing the Naira. The currency is denominated in banknotes of various denominations, including 5, 10, 20, 50, 100, 200, 500, and 1000 Naira.

History of the Nigerian Naira

The history of the Nigerian Naira can be traced back to 1959 when it was first introduced as a replacement for the West African Pound. At that time, Nigeria was a British colony, and the West African Pound was the official currency. However, when Nigeria gained independence in 1960, it decided to establish its own national currency, leading to the birth of the Nigerian Naira.

Over the years, the Nigerian Naira has faced various challenges due to economic factors such as inflation, oil price fluctuations, and political instability. These challenges have influenced exchange rates and impacted the purchasing power of the Naira. In response, the Central Bank of Nigeria has implemented different policies and measures to stabilize the currency and foster economic growth.

Nigerian Naira in the Forex Market: An Example

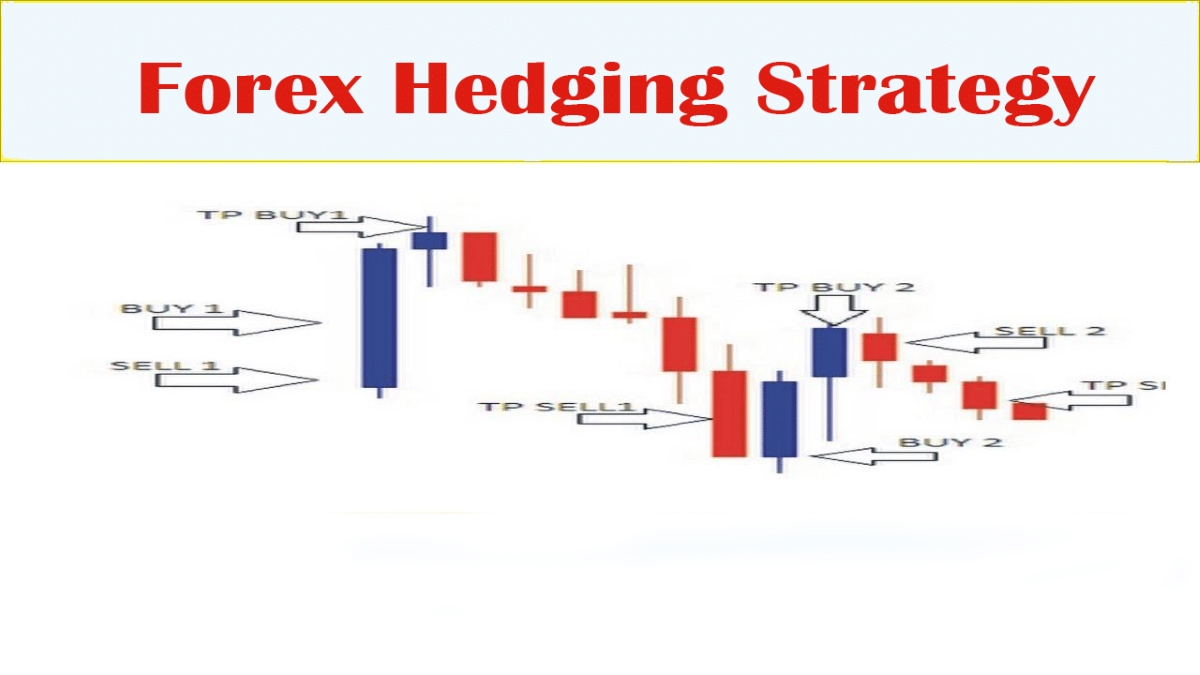

The Nigerian Naira is actively traded in the forex market, which allows individuals and businesses to exchange NGN for other currencies such as the US Dollar, Euro, or British Pound. Let’s take a simple example to illustrate how forex trading involving the Nigerian Naira works:

- Imagine you are a Nigerian exporter who sells goods to a buyer in the United States. The payment for your goods is in US Dollars.

- Once you receive the payment in US Dollars, you need to convert it into Nigerian Naira to use it in your local economy.

- You can approach a bank or a forex bureau to exchange your US Dollars for Nigerian Naira. The exchange rate will determine how many Nairas you will receive for your US Dollars.

- Depending on the prevailing exchange rate, you will receive the equivalent amount of Naira, which you can use to pay for local expenses or convert into other currencies if needed.

It’s important to note that exchange rates can fluctuate in response to various factors such as economic indicators, geopolitical events, and market sentiment. These fluctuations impact the value of the Nigerian Naira against other currencies, influencing the outcome of forex transactions.

In conclusion

The Nigerian Naira is the official currency of Nigeria, and it plays a vital role in the country’s economy and international trade. Its history, challenges, and forex market dynamics are all factors that shape the value and usage of the Naira. As an exporter, importer, or someone interested in Nigeria’s economy, understanding the Nigerian Naira and its workings can help you navigate the financial landscape more effectively.