Finance

E-Micro Forex Futures Definition

Published: November 15, 2023

Learn about the definition of E-Micro Forex Futures in the world of finance and how they can benefit your investment strategy.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

E-Micro Forex Futures Definition: A Beginner’s Guide to Understanding the Basics

Are you curious about the world of forex trading but find it overwhelming? Well, fear not! We’re here to demystify a specific aspect of forex trading – E-Micro Forex Futures. In this blog post, we’ll provide you with a comprehensive explanation of what E-Micro Forex Futures are and why they are gaining popularity among traders.

Key Takeaways:

- E-Micro Forex Futures are smaller-sized contracts that allow traders to participate in the forex market with lower capital requirements.

- These futures contracts provide traders with more flexibility and accessibility compared to standard Forex contracts.

What are E-Micro Forex Futures?

Forex trading involves the buying and selling of currencies, and it is typically done using currency pairs such as EUR/USD or GBP/JPY. E-Micro Forex Futures are smaller-sized contracts that allow traders to participate in the forex market with lower capital requirements compared to standard Forex contracts. These futures contracts are offered by various exchanges, including the Chicago Mercantile Exchange (CME).

So, why consider trading E-Micro Forex Futures?

Reasons to Trade E-Micro Forex Futures

1. Lower Capital Requirements: One of the significant benefits of E-Micro Forex Futures is that they require lower capital compared to standard Forex contracts. This means that traders with smaller trading accounts can still participate in the forex market. For beginners or those looking to test their strategies, E-Micro Forex Futures offer an excellent entry point.

2. Flexibility and Accessibility: Another advantage of E-Micro Forex Futures is the flexibility and accessibility they provide. Traders can choose to trade smaller contract sizes, which allows them to manage their risk more effectively. The smaller contract sizes also make it easier to diversify a trading strategy across multiple currency pairs.

How do E-Micro Forex Futures work?

Similar to other futures contracts, E-Micro Forex Futures have an expiration date and a predetermined contract size. For example, a typical E-Micro Euro/US Dollar futures contract might have a contract size of 12,500 Euros. This means that the value of each tick, the minimum price movement, is $0.125 per contract.

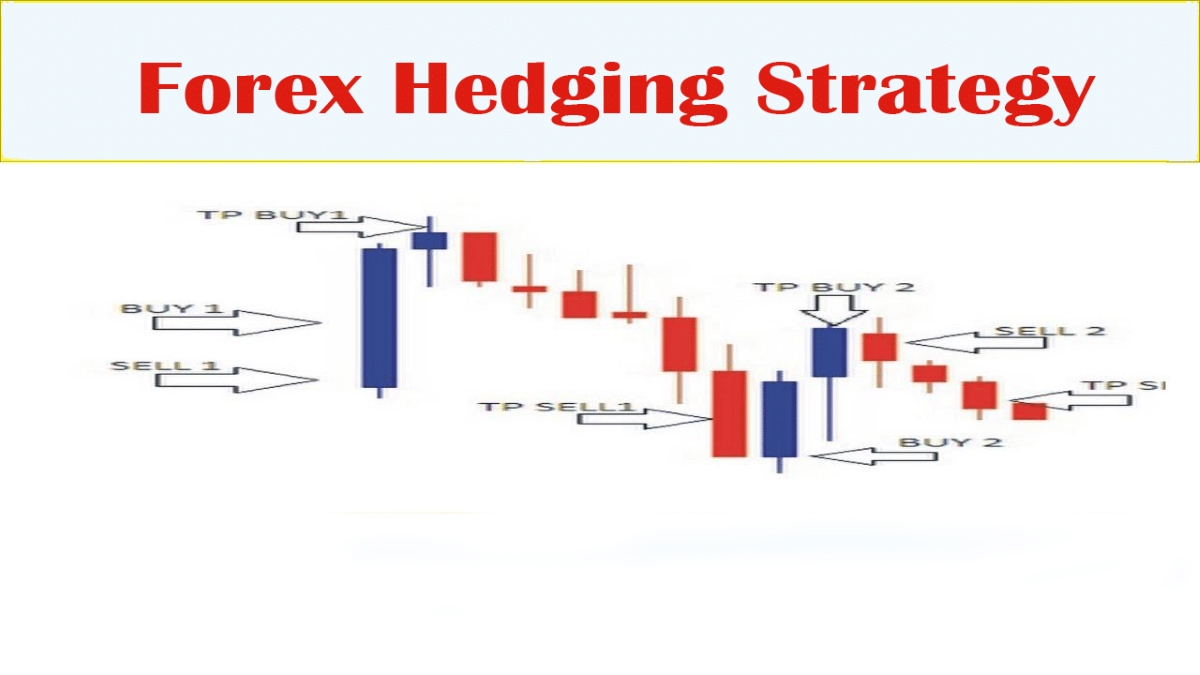

Trading E-Micro Forex Futures involves speculating on the future price movements of currency pairs. Traders can take both long (buy) and short (sell) positions to profit from both upward and downward price movements. It’s important to note that like any trading instrument, E-Micro Forex Futures involve risks and it’s essential to have a solid understanding of the market before trading.

Conclusion

Trading E-Micro Forex Futures can be an attractive option for traders who want to participate in the forex market but have smaller trading accounts. The lower capital requirements and flexibility they offer make them accessible to a wider range of traders. However, it’s crucial to keep in mind that trading any financial instrument involves risks, and it’s advisable to seek professional advice or educate yourself thoroughly before entering the market.

So, if you are looking to explore the forex market but have limited capital, consider diving into the world of E-Micro Forex Futures. It might just be the stepping stone you need to embark on a successful trading journey.