Home>Finance>Non-Cash Item Definition In Banking And Accounting

Finance

Non-Cash Item Definition In Banking And Accounting

Published: December 31, 2023

Learn the definition of non-cash items in banking and accounting and how they impact your finances. Dive into the world of finance with our comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Non-Cash Items in Banking and Accounting

When it comes to banking and accounting, there are various terms that might seem confusing at first. One such term is non-cash items. But fear not, as we are here to break it down for you. In this blog post, we will explain what non-cash items are, how they are used in banking and accounting, and their significance in financial reporting.

Key Takeaways:

- Non-cash items are accounting entries that do not involve the physical exchange of cash.

- Non-cash items play a vital role in financial reporting as they provide a more accurate picture of a company’s financial position.

So, what exactly are non-cash items? In simple terms, non-cash items are accounting entries that do not involve the physical exchange of cash. It means that while these transactions affect the financial statements, they do not involve an actual inflow or outflow of cash. In other words, they consist of items that affect a company’s financial position without directly impacting its cash flow.

Now, you might be wondering why non-cash items are important. Here are two key reasons:

- Accurate Representation: Non-cash items help in providing a more accurate representation of a company’s financial position. By accounting for transactions that do not involve cash, financial statements reflect the true economic value of the company.

- Comparability: Non-cash items allow for better comparability between different companies and industries. Since non-cash items are excluded from cash flow statements, comparing cash flows alone might not provide an accurate comparison.

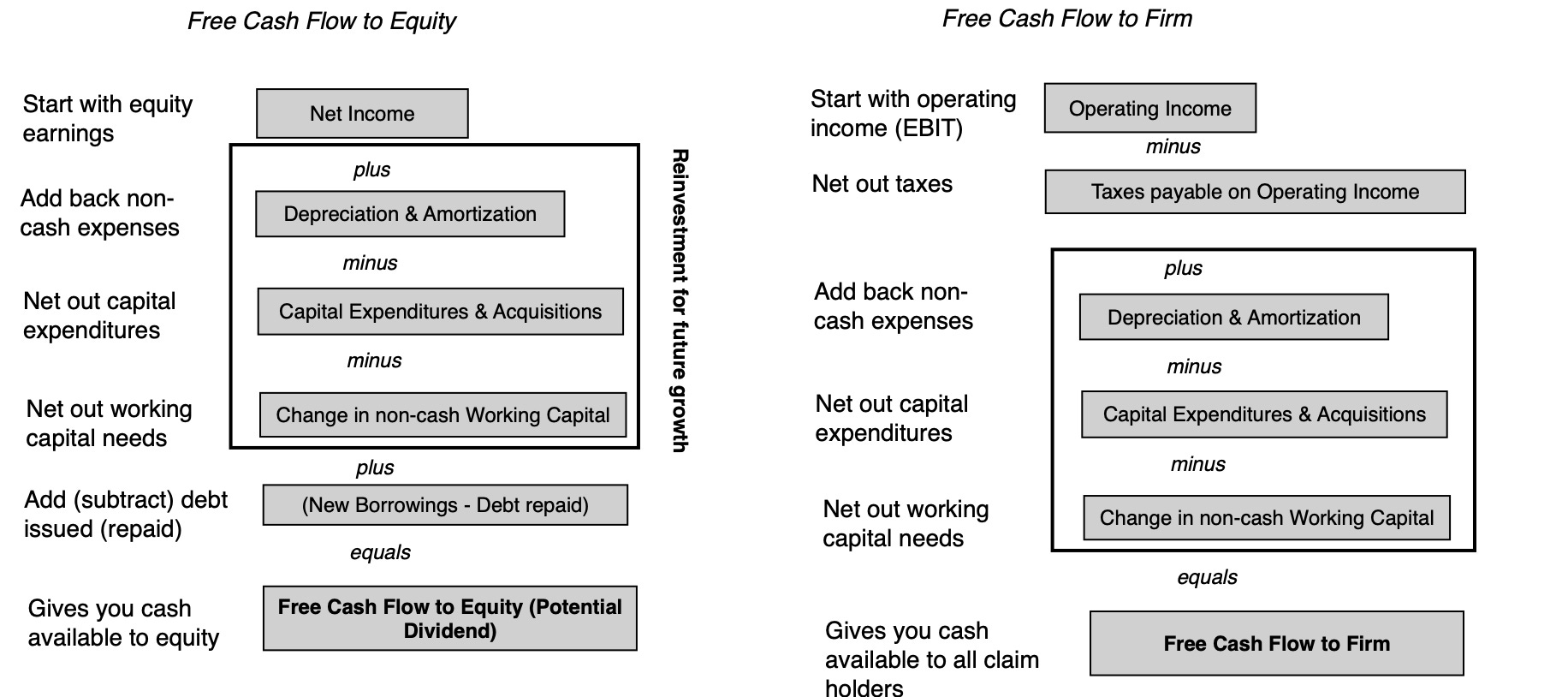

Non-cash items can come in various forms depending on the nature of the transaction. Some common examples of non-cash items include depreciation expenses, stock-based compensation, write-offs, provisions for bad debts, and unrealized gains or losses from investments.

In financial reporting, non-cash items are usually noted separately to ensure transparency. Companies typically disclose these items in footnotes to their financial statements or provide additional details in the Management Discussion and Analysis (MD&A) section of annual reports.

Non-cash items can also be relevant in banking, especially when it comes to measuring a bank’s performance and assessing its risk levels. For example, when analyzing a bank’s financial health, analysts often consider non-cash items such as unrealized gains or losses on investments, loan loss provisions, or changes in fair value of financial instruments.

In conclusion, non-cash items are an integral part of banking and accounting. They provide a more accurate picture of a company’s financial position and allow for better comparability between different companies. By understanding the concept of non-cash items, you can navigate through financial statements and reports with ease, gaining insights into the true financial health of a company or bank.