Finance

What Is Non-Cash Working Capital

Published: December 19, 2023

Learn what non-cash working capital is and how it impacts your finance. Discover its importance and optimize your business's financial management today.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing the financial health of a business, understanding and effectively managing working capital is key. Working capital refers to the funds a company has available to cover its day-to-day operational expenses and obligations. It is an important metric that indicates the liquidity and short-term financial stability of a business.

Within the realm of working capital, there are two main components: cash and non-cash working capital. While cash working capital refers to the amount of cash a company has on hand, non-cash working capital encompasses the portion of working capital that is tied up in assets other than cash.

In this article, we will focus on non-cash working capital and explore its definition, components, and the importance of managing it effectively. We will also discuss some strategies businesses can employ to improve their non-cash working capital management.

Understanding non-cash working capital is crucial for businesses of all sizes, as it directly impacts their ability to meet short-term financial obligations, invest in growth opportunities, and maintain a healthy financial position. By optimizing non-cash working capital, businesses can improve cash flow, reduce financing costs, and enhance overall operational efficiency.

Definition of Non-Cash Working Capital

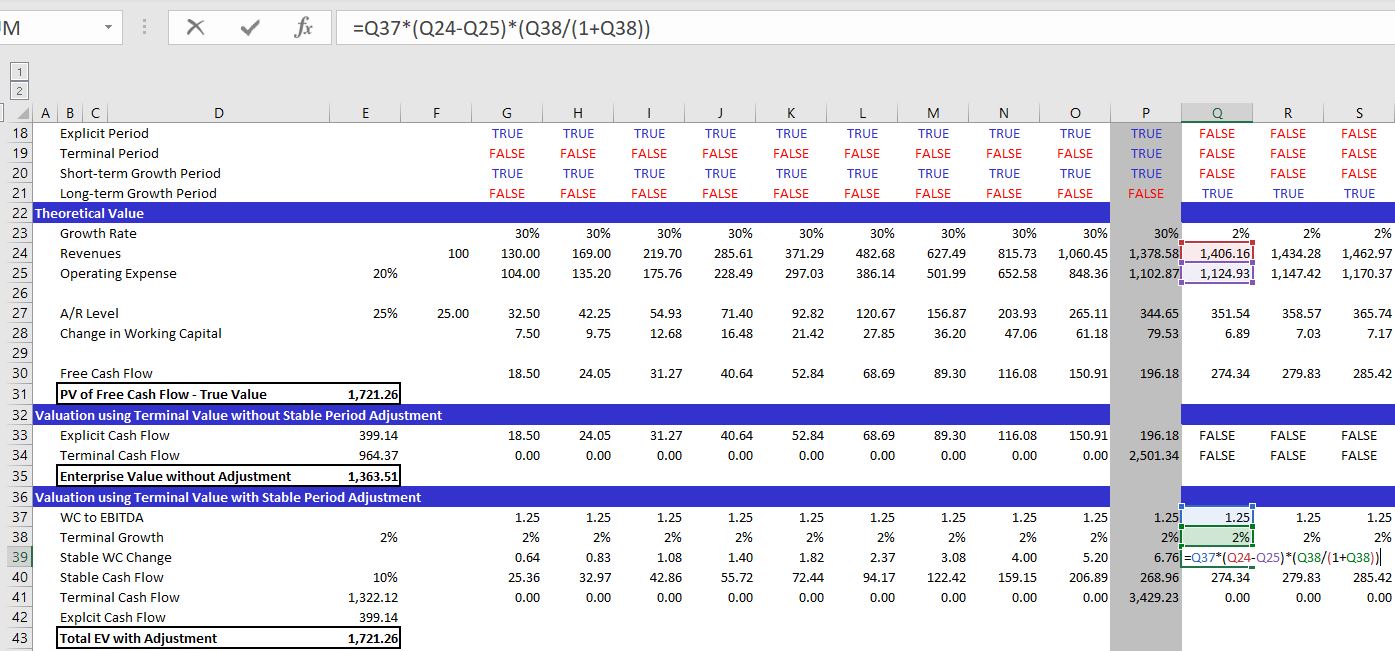

Non-cash working capital refers to the portion of a company’s working capital that is invested in assets other than cash. These assets include accounts receivable, inventory, prepaid expenses, and accrued expenses. While cash is an essential component of working capital, non-cash assets play a crucial role in the day-to-day operations of a business and contribute to its overall financial health.

Non-cash working capital represents the net amount by which a company’s current assets exceed its current liabilities, excluding cash. It is a measure of the company’s operational efficiency and the effectiveness with which it manages its inventory, accounts receivable, and accounts payable.

The management of non-cash working capital is vital for businesses, as it directly affects cash flow, profitability, and liquidity. By optimizing non-cash working capital, companies can ensure they have the necessary resources to meet their short-term obligations and fund their ongoing operations.

It’s important to note that managing non-cash working capital is a delicate balancing act. While it is essential to have enough inventory, accounts receivable, and other assets to support business operations, holding too much can tie up valuable resources and negatively impact cash flow.

By effectively managing non-cash working capital, businesses can improve their financial flexibility, reduce their dependence on external financing, and increase their overall profitability. It allows companies to allocate their resources efficiently, minimize excess inventory or outstanding receivables, and optimize their cash conversion cycle.

Components of Non-Cash Working Capital

Non-cash working capital is comprised of various components that represent the assets and liabilities a business holds, excluding cash. These components play a crucial role in the day-to-day operations of a company and impact its overall financial health. Let’s explore the main components of non-cash working capital:

- Accounts Receivable: Accounts receivable refers to the money owed to a company by its customers for goods or services provided on credit. This component represents the outstanding invoices that have not yet been collected. Effective management of accounts receivable is essential to ensure timely collection, minimize bad debt, and improve cash flow.

- Inventory: Inventory represents the goods a company holds for sale in the ordinary course of business. It includes raw materials, work-in-progress, and finished goods. Efficient management of inventory is crucial to avoid stockouts, minimize carrying costs, and optimize production and sales processes.

- Accounts Payable: Accounts payable denotes the money a company owes to its suppliers for goods or services received on credit. It represents the outstanding invoices that have not yet been paid. Managing accounts payable effectively involves timely payment to suppliers while maximizing available credit terms to preserve cash flow.

- Prepaid Expenses: Prepaid expenses are payments made for goods or services that will be utilized in the future. They represent future expenses that have been paid in advance. Common examples include prepaid insurance, prepaid rent, and prepaid subscriptions. Monitoring and managing prepaid expenses is crucial to ensure proper allocation and avoid wasted resources.

- Accrued Expenses: Accrued expenses are expenses that a company has incurred but has not yet paid for. These expenses, such as salaries, utilities, and taxes, accumulate over time and need to be settled in the future. Proper management of accrued expenses ensures accurate financial reporting and responsible financial planning.

By effectively managing these components of non-cash working capital, businesses can optimize their operational efficiency, improve cash flow, and maintain a healthy financial position. Striking the right balance between these components is vital to ensure a company’s short-term financial stability and long-term success.

Accounts Receivable

Accounts receivable is a key component of non-cash working capital that represents the money owed to a company by its customers for goods or services provided on credit. It is an integral part of the cash conversion cycle and reflects the amount of sales revenue that is yet to be collected.

Effective management of accounts receivable is crucial for maintaining a healthy cash flow and minimizing financial risks. Here are some important aspects related to accounts receivable:

- Invoicing and Credit Terms: Properly structured invoices and clearly defined credit terms are essential for managing accounts receivable. The invoice should include detailed information about the products or services provided, payment due date, and any applicable discounts or penalties. Setting appropriate credit terms, such as net 30 or net 60, helps establish a clear timeline for collecting payments.

- Credit Evaluation: Before extending credit to customers, it is important to conduct a thorough credit evaluation to assess their creditworthiness. This involves reviewing their payment history, financial stability, and credit references. By only offering credit to reliable customers, the risk of late payments or bad debt can be minimized.

- Timely Invoicing and Collection: Promptly issuing invoices and actively following up on outstanding payments is essential for improving cash flow and reducing the time it takes to collect receivables. Implementing automated systems or engaging the services of a collections agency can help streamline the invoicing and collection process.

- Customer Communication: Maintaining open lines of communication with customers is important for managing accounts receivable. Regularly reminding customers of upcoming due dates and sending gentle payment reminders can help encourage timely payments and maintain positive relationships.

- Monitoring and Reporting: Regularly monitoring accounts receivable and generating relevant reports, such as accounts receivable aging reports, enables businesses to track outstanding invoices, identify potential delinquencies, and take appropriate actions. It also assists in accurate financial forecasting and identifying opportunities to improve collection processes.

By effectively managing accounts receivable, businesses can minimize the risk of late payments and bad debt, improve cash flow, and maintain a healthy working capital position. It is essential to strike a balance between offering credit to drive sales and ensuring the timely collection of payments to optimize non-cash working capital.

Inventory

Inventory is a critical component of non-cash working capital that represents the goods a company holds for sale in the ordinary course of business. It includes raw materials, work-in-progress, and finished goods. Efficient management of inventory is essential for businesses to meet customer demand, control costs, and optimize cash flow.

Here are some key considerations related to inventory management:

- Demand Forecasting: Accurate demand forecasting is crucial for optimizing inventory levels. By analyzing historical data, market trends, and customer behavior, businesses can estimate future demand and adjust inventory levels accordingly. This helps prevent stockouts or overstocking, which can tie up valuable resources or result in lost sales.

- Inventory Classification: Categorizing inventory based on factors like demand patterns, value, and perishability can streamline inventory management. Common classification methods include ABC analysis, where items are classified as A, B, or C based on their contribution to revenue or cost.

- Just-in-Time (JIT) Inventory: JIT inventory management aims to minimize inventory levels by establishing efficient supply chain practices. This approach involves ordering and receiving raw materials or finished goods just in time for production or delivery. It reduces inventory carrying costs while ensuring the availability of inventory when needed.

- Inventory Turnover: Monitoring and improving inventory turnover ratio is vital for efficient inventory management. A higher turnover ratio signifies that inventory is sold quickly, demonstrating effective utilization of resources and better cash flow. Calculating inventory turnover ratio involves dividing the cost of goods sold by the average inventory value.

- Supplier Relationships: Building strong relationships with suppliers is important for inventory management. Negotiating favorable terms, such as extended payment terms or bulk discounts, can help reduce procurement costs and increase cash flow. Regular communication with suppliers also aids in accurate inventory planning and resolving any potential supply chain issues.

By effectively managing inventory, businesses can optimize cash flow, reduce carrying costs, and ensure timely product availability. Striking the right balance between inventory levels and customer demand is crucial for maintaining a healthy non-cash working capital position and supporting overall business growth.

Accounts Payable

Accounts payable is a significant component of non-cash working capital that represents the money a company owes to its suppliers for goods or services received on credit. It is an essential part of managing cash flow and maintaining positive vendor relationships. Effectively managing accounts payable allows businesses to optimize working capital and ensure the timely payment of obligations.

Here are some key considerations related to accounts payable management:

- Clear Payment Terms: Establishing clear payment terms with suppliers is crucial for managing accounts payable effectively. This includes specifying the payment due date, any applicable discounts for early payment, and any penalties for late payment. Consistently adhering to payment terms helps maintain a positive rapport with suppliers.

- Invoice Verification: Verifying the accuracy and legitimacy of supplier invoices is vital. This involves comparing the invoice details with purchase orders and receiving documents to ensure correct quantity and pricing. Implementing automated accounts payable systems can streamline the verification process and minimize errors.

- Payment Prioritization: Prioritizing payment based on available resources and vendor relationships is essential. Identifying critical suppliers and ensuring timely payments to maintain a smooth supply chain is important for uninterrupted business operations. Negotiating favorable payment terms, such as extended payment periods, can also help manage cash flow more effectively.

- Budgeting and Cash Flow Forecasting: Incorporating accounts payable into budgeting and cash flow forecasting is necessary for effective financial planning. Projecting payment obligations and aligning them with anticipated cash inflows ensures the availability of funds to meet payment deadlines. This also helps identify potential cash flow gaps and seek appropriate financing options if needed.

- Vendor Communication: Regular and transparent communication with vendors is crucial for smooth accounts payable management. Communicating any invoice discrepancies, payment delays, or changes in payment terms proactively helps maintain trust and cooperative relationships with suppliers.

By managing accounts payable effectively, businesses can optimize working capital, preserve cash flow, and strengthen supplier relationships. Striking a balance between timely payments and utilizing available credit terms helps maintain financial stability and fosters long-term partnerships with suppliers.

Prepaid Expenses

Prepaid expenses are a component of non-cash working capital that represents payments made for goods or services that will be utilized in the future. They represent future expenses that have been paid in advance and are considered as assets on the company’s balance sheet until the goods or services are consumed.

Managing prepaid expenses effectively is important for optimizing non-cash working capital and ensuring the appropriate allocation of resources. Here are some key considerations related to prepaid expenses:

- Identification and recording: Properly identifying and recording prepaid expenses is crucial for accurate financial reporting. This involves categorizing expenses that provide future benefits, such as prepaid insurance, prepaid rent, or prepaid subscriptions.

- Amortization and expense recognition: Prepaid expenses need to be amortized or gradually expensed over the period when the goods or services are consumed. Allocating the prepaid amount over the appropriate time frame ensures that the expenses are recognized in the corresponding accounting periods.

- Monitoring expiration dates: Keeping track of the expiration dates of prepaid expenses is important to avoid wasting resources. For example, prepaid insurance premiums need to be monitored to ensure coverage for the intended period and avoid overlapping or gaps in coverage.

- Budgeting and forecasting: Incorporating prepaid expenses into budgeting and forecasting processes helps in accurate financial planning. It allows businesses to anticipate future expenses, manage cash flow, and make informed decisions regarding resource allocation.

- Renegotiating contracts or subscriptions: Periodically reviewing and renegotiating prepaid contracts or subscriptions can help optimize non-cash working capital. Assessing the value and necessity of prepaid expenses and exploring opportunities for cost savings can result in more efficient resource utilization.

By managing prepaid expenses effectively, businesses can maximize non-cash working capital and ensure the proper utilization of resources. Careful monitoring of expiration dates, accurate expense recognition, and incorporating prepaid expenses into financial planning processes contribute to overall financial stability and operational efficiency.

Accrued Expenses

Accrued expenses are a component of non-cash working capital that represents expenses that a company has incurred but has not yet paid for. They accumulate over time and are typically recorded as liabilities on the company’s balance sheet until they are settled.

Managing accrued expenses effectively is crucial for accurate financial reporting and responsible financial planning. Here are some key considerations related to accrued expenses:

- Accurate expense recognition: Accurately recognizing and recording accrued expenses is essential for financial reporting. This involves identifying and estimating the amount of expenses that have been incurred but not yet paid, such as utilities, salaries, taxes, or interest expenses.

- Timely reporting and monitoring: Regularly reporting and monitoring accrued expenses ensures that they are appropriately accounted for and that the financial statements reflect the actual obligations of the company. Accurate and up-to-date information helps in making informed financial decisions.

- Budgeting and forecasting: Including accrued expenses in budgeting and forecasting processes is necessary for effective financial planning. Anticipating the impact of accrued expenses on future cash flow allows businesses to allocate resources and manage short-term financial obligations efficiently.

- Vendor communication and negotiation: Communicating with vendors and service providers about outstanding accrued expenses is important for maintaining positive relationships and ensuring timely payment. Regular communication and negotiation regarding payment terms or installment plans can help manage cash flow and minimize any strain on working capital.

- Financial statement analysis: Analyzing trends and changes in accrued expenses over time provides valuable insights into a company’s financial health and operational efficiency. It assists in identifying any significant fluctuations, potential risks, or opportunities for improvement.

By managing accrued expenses effectively, businesses can ensure accurate financial reporting, plan for future expenses, and maintain a healthy non-cash working capital position. Proactive monitoring, clear communication with vendors, and incorporating accrued expenses into budgeting and forecasting processes contribute to overall financial stability and responsible financial management.

Importance of Managing Non-Cash Working Capital

Managing non-cash working capital is of utmost importance for businesses as it directly impacts their financial health, operational efficiency, and overall sustainability. Here are several key reasons why effective management of non-cash working capital is crucial:

- Cash Flow Optimization: Non-cash working capital management plays a crucial role in optimizing cash flow. By efficiently managing accounts receivable, inventory, accounts payable, prepaid expenses, and accrued expenses, businesses can maintain a healthy cash flow position. This allows them to meet their short-term obligations, pay suppliers on time, invest in growth opportunities, and withstand unexpected financial challenges.

- Liquidity and Short-Term Financial Stability: Non-cash working capital reflects a company’s ability to cover its short-term financial obligations. Without proper management, a business may face liquidity issues or struggle to meet its payment commitments, leading to strained relationships with creditors and suppliers. Effectively managing non-cash working capital ensures that a company remains financially stable in the short term.

- Reduced Financing Costs: By optimizing non-cash working capital, businesses can minimize their reliance on external financing options, such as loans or lines of credit. When a company effectively manages its accounts receivable and accounts payable, it can improve cash flow and reduce the need for costly financing, resulting in lower interest expenses and improved profitability.

- Operational Efficiency: Efficient management of non-cash working capital contributes to overall operational efficiency. By properly controlling inventory levels, businesses can minimize carrying costs, reduce the risk of obsolete inventory, and improve production and sales processes. Effective management of accounts receivable and accounts payable ensures timely payments and collections, reducing administrative burden and improving the overall efficiency of financial operations.

- Financial Decision Making: Sound non-cash working capital management provides businesses with accurate and reliable financial information. This enables informed decision making regarding resource allocation, production planning, pricing strategies, and investment opportunities. Reliable financial data also enhances the company’s credibility with stakeholders, such as investors and lenders.

- Business Growth and Expansion: Effective management of non-cash working capital positions businesses for sustainable growth and expansion. By optimizing cash flow and maintaining a healthy working capital position, companies have the financial flexibility to invest in research and development, enter new markets, acquire assets, and explore growth opportunities.

In summary, managing non-cash working capital is essential for businesses to maintain financial stability, optimize cash flow, improve operational efficiency, and support sustainable growth. By implementing effective strategies and practices, businesses can ensure they have the necessary resources to meet their short-term obligations and achieve long-term success.

Ways to Improve Non-Cash Working Capital Management

Improving non-cash working capital management is crucial for businesses to enhance their financial stability, optimize cash flow, and drive overall operational efficiency. Here are several strategies that can help improve non-cash working capital management:

- Streamline Accounts Receivable: Implement efficient processes for invoicing, collections, and credit evaluation. Set clear credit terms, follow up on outstanding invoices, and consider offering discounts for early payment to incentivize prompt payments.

- Optimize Inventory Levels: Utilize effective demand forecasting techniques to avoid overstocking or stockouts. Regularly analyze inventory turnover ratio and classify inventory items to ensure optimal stock levels, minimize carrying costs, and improve production and sales processes.

- Negotiate Favorable Payment Terms: Establish good relationships with suppliers and negotiate extended payment terms or discounts for early settlement. This allows for better cash flow management and improved utilization of available credit.

- Monitor and Control Prepaid Expenses: Regularly review prepaid expenses and avoid unnecessary prepaid commitments. Evaluate the value and necessity of prepaid expenses to allocate resources more effectively.

- Accurately Track and Report Accrued Expenses: Have robust systems in place to accurately track and report accrued expenses. Regularly review and update the accrued expenses to ensure accurate financial reporting and responsible financial planning.

- Improve Working Capital Forecasting: Enhance forecasting capabilities to accurately project future cash flows and working capital requirements. This helps businesses anticipate short-term financial needs, plan for growth, and optimize resource allocation.

- Implement Efficient Financial Systems: Utilize advanced accounting software and technology solutions to automate and streamline financial processes. This includes implementing accounts payable/receivable systems, inventory management systems, and cash flow forecasting tools.

- Strengthen Supplier and Customer Relationships: Foster strong relationships with suppliers and customers to negotiate favorable terms, enhance cooperation, and improve overall supply chain management. Effective communication and collaboration help streamline processes and facilitate mutual success.

- Continuously Monitor and Evaluate: Regularly review key performance indicators, such as cash conversion cycle, days sales outstanding, and inventory turnover ratio. Continuously monitor and refine non-cash working capital management strategies to adapt to changing business conditions and improve overall performance.

By implementing these strategies, businesses can enhance their non-cash working capital management, improve cash flow, reduce financing costs, and drive operational efficiencies. Remember that each business is unique, so it’s important to assess specific circumstances and tailor these strategies to suit individual needs and objectives.

Conclusion

Effectively managing non-cash working capital is a critical aspect of financial management for businesses. It encompasses various components, including accounts receivable, inventory, accounts payable, prepaid expenses, and accrued expenses. By optimizing these components, businesses can enhance their financial stability, cash flow, and operational efficiency.

Proper management and control of non-cash working capital contribute to improved cash flow optimization, reduced financing costs, and enhanced liquidity. It allows businesses to meet their short-term obligations, invest in growth opportunities, and maintain a healthy financial position. Additionally, effective management of non-cash working capital helps businesses make informed financial decisions, strengthen relationships with suppliers and customers, and support sustainable business growth.

Implementing strategies such as streamlining accounts receivable, optimizing inventory levels, negotiating favorable payment terms, monitoring prepaid and accrued expenses, and improving working capital forecasting can greatly improve non-cash working capital management. Utilizing advanced financial systems and continuously evaluating key performance indicators further enhances management efforts.

By adopting these strategies and tailoring them to their specific circumstances, businesses can navigate challenges, mitigate risks, and seize opportunities for growth. Non-cash working capital management is a constant process that requires ongoing monitoring, adjustment, and proactive decision-making to ensure financial success in the short and long term.

In conclusion, efficient management of non-cash working capital is vital for businesses’ financial health, operational efficiency, and sustainable growth. By actively managing accounts receivable, inventory, accounts payable, prepaid expenses, and accrued expenses, businesses can optimize cash flow, reduce financing costs, and strengthen their overall financial position.