Finance

What Is Cash Management Services In Banking

Published: October 13, 2023

Discover the importance of cash management services in banking and how they can help you effectively manage your finances. Enhance your financial management skills with our expert advice and guidance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Cash management services play a vital role in the banking industry, providing businesses and organizations with efficient and effective tools to optimize their cash flow and financial operations. In today’s fast-paced business environment, managing cash is essential to maintain liquidity, mitigate financial risks, and maximize profitability. By partnering with a bank that offers comprehensive cash management services, businesses can streamline their cash handling processes, reduce costs, and gain better control over their finances.

Cash management services encompass a range of financial solutions designed to facilitate the efficient movement and management of cash within a business. These services focus on optimizing the collection, disbursement, and management of cash through a combination of electronic banking, automated systems, and consultation from banking experts. The primary goal is to help businesses maintain the right level of liquidity while minimizing the challenges associated with cash handling and forecasting.

Businesses of all sizes and industries can benefit from cash management services. Whether it’s a small retail store, a manufacturing company, or a multinational corporation, effective cash management can enhance financial stability and improve business operations.

In this article, we will explore the definition of cash management services, the benefits they offer to businesses, the various services included in cash management, the importance of these services, and the factors businesses should consider when selecting a cash management service provider.

By understanding the fundamentals of cash management services and the advantages they bring, businesses can make informed decisions that align with their financial goals and help them stay ahead in today’s dynamic business landscape.

Definition of Cash Management Services

Cash management services refer to a suite of financial services provided by banks and financial institutions to help businesses effectively manage their cash flow and optimize their financial operations. These services aim to provide businesses with tools and strategies to maximize liquidity, minimize risk, and enhance financial efficiency. Cash management services are tailored to meet the unique needs and requirements of businesses, providing them with a comprehensive set of solutions to streamline their cash handling processes.

At its core, cash management involves the management, collection, disbursement, and investment of cash within a business. Cash management services may include a wide range of offerings, such as:

- Liquidity management: This involves optimizing cash balances to ensure that the business has the necessary funds to meet its immediate and short-term cash needs. Cash management services provide businesses with tools to forecast cash flows, maintain working capital, and avoid cash shortages.

- Electronic funds transfers: These services enable businesses to make quick and secure electronic transactions, such as wire transfers, ACH payments, and online bill payments. Electronic funds transfers allow for efficient and convenient movement of cash, reducing the reliance on manual processes.

- Account reconciliation: Cash management services often include tools and platforms that automate the reconciliation of bank accounts and cash transactions. This helps businesses accurately track their cash inflows and outflows, identify discrepancies, and streamline their financial reporting processes.

- Payment and collection solutions: Cash management services provide businesses with efficient payment and collection methods, such as electronic payment processing, lockbox services, remote deposit capture, and merchant services. These solutions simplify the payment and collection processes, reducing administrative burden and increasing cash flow.

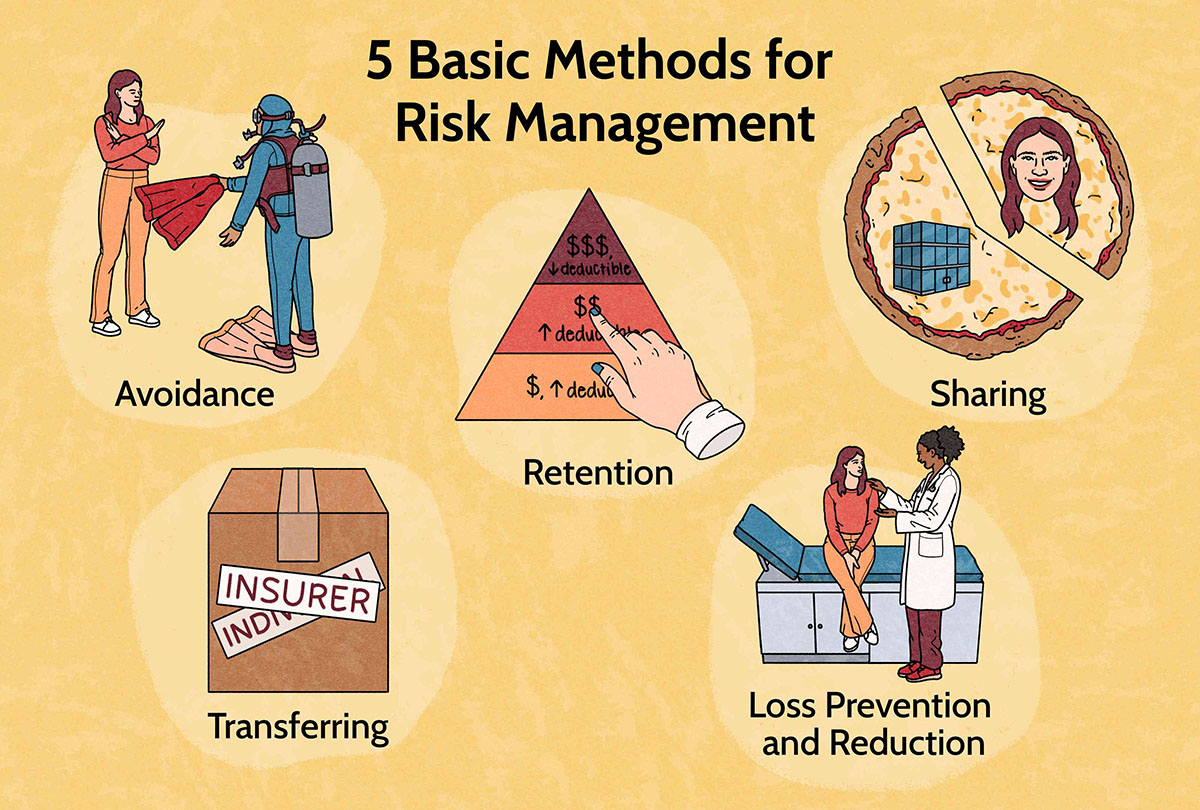

- Risk management: Cash management services also focus on mitigating financial risks associated with cash handling, such as fraud, counterfeit checks, and unauthorized transactions. Banks offer risk management solutions, such as positive pay, fraud detection systems, and secure payment platforms, to protect businesses from financial loss.

Overall, cash management services empower businesses to optimize their cash flow, reduce costs, and improve financial control. By leveraging these services, businesses can enhance their financial operations, increase profitability, and gain a competitive edge in the market.

Benefits of Cash Management Services in Banking

Cash management services offered by banks provide a range of benefits to businesses, regardless of their size or industry. By leveraging these services, businesses can optimize their cash flow and financial operations, resulting in increased efficiency, reduced costs, and improved overall financial performance. Here are some key benefits of cash management services in banking:

- Improved Cash Flow: Cash management services help businesses enhance their cash flow by providing them with tools and strategies to effectively manage their receivables and payables. By streamlining the collections process and automating payments, businesses can receive funds faster and optimize their working capital.

- Enhanced Liquidity: Cash management services assist businesses in maintaining the right level of liquidity. By offering liquidity management tools, such as cash flow forecasting and concentration services, businesses can ensure they have enough cash on hand to meet their ongoing financial obligations.

- Reduced Costs: Efficient cash management can lead to cost savings for businesses. By automating payment processes, businesses can reduce check processing costs and eliminate manual errors. Banks also offer electronic payment solutions that are faster and more cost-effective compared to traditional methods.

- Risk Mitigation: Cash management services help businesses mitigate financial risks associated with cash handling. Banks provide fraud prevention tools, such as positive pay and fraud detection systems, to safeguard businesses from unauthorized transactions and fraudulent activities.

- Increased Efficiency: Cash management services streamline cash handling processes, reducing manual effort and increasing operational efficiency. Automation tools, such as electronic funds transfers and account reconciliation platforms, eliminate the need for manual intervention, saving time and reducing the likelihood of errors.

- Better Financial Control: By leveraging cash management services, businesses gain better control over their financial operations. They have access to real-time cash position information, transaction history, and comprehensive reporting tools, enabling them to make informed financial decisions and monitor their cash flow effectively.

- Expert Guidance: Banks providing cash management services often have experienced financial professionals who can offer valuable advice and guidance on cash management strategies. They can help businesses assess their cash flow needs, develop customized solutions, and optimize their financial processes.

Overall, cash management services in banking provide businesses with the tools, expertise, and technological solutions to optimize their cash flow, reduce costs, and improve financial control. By leveraging these services, businesses can enhance their financial performance and focus on their core operations, ultimately leading to growth and success.

Services Offered by Cash Management

Cash management services encompass a wide range of offerings provided by banks and financial institutions to help businesses effectively manage their cash flow and financial operations. These services are tailored to meet the unique needs and requirements of businesses, providing them with the tools and strategies to streamline their cash handling processes. Here are some common services offered by cash management:

- Liquidity Management: Cash management services include liquidity management tools that help businesses optimize their cash balances. These tools allow businesses to forecast their cash flows, maintain working capital, and ensure they have enough liquidity to meet their ongoing financial obligations.

- Electronic Funds Transfers: Electronic funds transfer services enable businesses to make quick and secure electronic transactions. This includes services such as wire transfers, Automated Clearing House (ACH) payments, online bill payments, and funds transfers between accounts. Electronic funds transfers offer businesses a convenient and efficient way to move cash, reducing dependency on manual processes.

- Account Reconciliation: Cash management services often provide businesses with tools and platforms to automate the reconciliation of their bank accounts and cash transactions. Automated account reconciliation helps businesses accurately track their cash inflows and outflows, identify discrepancies, and streamline their financial reporting processes.

- Payment and Collection Solutions: Cash management services offer businesses efficient payment and collection methods. This includes electronic payment processing, allowing businesses to accept credit card and online payments, as well as lockbox services, remote deposit capture, and merchant services. These solutions simplify the payment and collection processes, reducing administrative burden and improving cash flow.

- Risk Management: Cash management services focus on mitigating financial risks associated with cash handling. Banks offer risk management solutions such as positive pay, which allows businesses to match issued checks against cleared checks to detect any fraudulent or unauthorized transactions. Additionally, banks provide fraud detection systems and secure payment platforms to protect businesses from financial loss.

- Cash Forecasting: Cash management services often provide businesses with cash forecasting tools and services. These tools utilize historical data, market trends, and other factors to help businesses predict their future cash flows and maintain adequate liquidity. Accurate cash forecasting enables businesses to make informed financial decisions and effectively plan for any cash shortages or surpluses.

- Information Reporting: Cash management services offer businesses access to real-time cash position information and comprehensive reporting tools. This allows businesses to monitor their cash flows, track transaction history, and generate customized reports, providing them with better financial control and visibility.

These are just some of the services offered by cash management. Depending on the specific needs of businesses, banks may provide additional tailored solutions and services to optimize cash flow, financial efficiency, and risk management.

Importance of Cash Management Services for Businesses

Cash management services play a crucial role in the financial health and success of businesses. Effective cash management is essential for maintaining liquidity, mitigating financial risks, and optimizing financial operations. Here are some key reasons why cash management services are important for businesses:

- Optimizing Cash Flow: Cash management services help businesses optimize their cash flow by providing tools and strategies to streamline the collection, disbursement, and management of cash. By effectively managing cash inflows and outflows, businesses can ensure that they have enough liquidity to meet their financial obligations, invest in growth opportunities, and avoid unnecessary financing costs.

- Enhancing Financial Stability: By effectively managing their cash, businesses can achieve greater financial stability. Cash management services provide businesses with the tools to forecast cash flows, maintain adequate working capital, and identify potential cash shortages in advance. This allows businesses to proactively take measures to address any liquidity challenges and maintain financial stability.

- Reducing Financial Risks: Cash management services help mitigate financial risks associated with cash handling. Banks offer risk management solutions, such as fraud detection systems and secure payment platforms, to protect businesses from unauthorized transactions and fraudulent activities. By implementing these tools, businesses can minimize the risk of financial loss and safeguard their assets.

- Improving Efficiency: Effective cash management improves operational efficiency. Cash management services automate cash handling processes, reducing manual effort and the likelihood of errors. By leveraging electronic funds transfers, online payments, and account reconciliation tools, businesses can save time, reduce administrative costs, and streamline their financial operations.

- Enabling Strategic Decision Making: Cash management services provide businesses with real-time cash position information and detailed financial reporting tools. By having a clear view of their cash flow, businesses can make informed financial decisions and allocate resources effectively. This enables businesses to prioritize investments, manage working capital, and plan for future growth.

- Access to Expertise: Cash management services provide businesses with access to banking experts who can offer valuable advice and guidance on cash flow management, financial planning, and risk mitigation. These experts can help businesses develop customized cash management strategies and provide insights into industry trends and best practices.

Ultimately, cash management services are vital for businesses to maintain financial stability, optimize cash flow, and make informed strategic decisions. By leveraging these services, businesses can improve their financial performance, increase profitability, and gain a competitive advantage in the market.

Factors to Consider when Choosing Cash Management Services

When selecting cash management services, businesses need to consider several key factors to ensure they choose the right service provider that meets their specific needs and requirements. Here are some important factors to consider when choosing cash management services:

- Business Needs and Objectives: It’s essential for businesses to assess their specific cash management needs and objectives. Consider the size of your business, industry requirements, and the complexity of your cash handling processes. Identify the key areas where you need assistance and choose a service provider that offers solutions aligned with your needs.

- Service Offerings: Evaluate the range of services offered by cash management providers. Consider whether they offer the specific tools and solutions you require, such as liquidity management, electronic funds transfers, payment and collection solutions, risk management, and information reporting. Ensure that the provider can cater to your unique cash management requirements.

- Technology and Integration: Assess the technological capabilities of the cash management service provider. Look for tools and platforms that are user-friendly, secure, and easily integrated with your existing systems. Consider features such as mobile access, automation, and scalability to accommodate your business growth.

- Security Measures: Security is of utmost importance when it comes to cash management. Check if the service provider has robust security measures in place to protect your funds and sensitive financial information. Look for features such as encryption, multi-factor authentication, and fraud prevention tools to safeguard your cash transactions.

- Financial Institution Stability: Consider the stability and reputation of the financial institution offering cash management services. Look for a trusted and reputable bank that has a strong track record in providing reliable and secure financial services. Evaluate their financial strength and their ability to support your business in the long run.

- Customer Support: Assess the level of customer support provided by the cash management service provider. Make sure they offer responsive and knowledgeable support to address any issues or concerns that may arise. Look for a provider that offers 24/7 customer support to ensure prompt assistance when needed.

It’s also helpful to seek recommendations and feedback from other businesses in your industry who have used the same cash management services. Their experiences and insights can provide valuable information to aid in your decision-making process.

By carefully considering these factors and selecting a cash management service provider that aligns with your business needs, you can ensure a seamless integration of the services and maximize the benefits of efficient cash management.

Conclusion

Cash management services are integral to the financial success of businesses, providing them with the tools and strategies to optimize their cash flow, enhance financial stability, and mitigate financial risks. By partnering with a trusted banking institution that offers comprehensive cash management services, businesses can streamline their cash handling processes, reduce costs, and gain better control over their finances.

Through liquidity management, electronic funds transfers, account reconciliation, payment and collection solutions, risk management, cash forecasting, and information reporting, cash management services enable businesses to optimize their cash flow, improve efficiency, and make informed financial decisions. These services provide businesses with the necessary infrastructure and expertise to manage their cash effectively, navigate complex financial landscapes, and stay ahead in a competitive market.

When choosing a cash management service provider, businesses should consider factors such as their specific needs and objectives, the range of services offered, technology integration, security measures, financial institution stability, and customer support. By doing so, businesses can select a provider that aligns with their unique requirements and provides the tools, expertise, and support necessary to maximize the benefits of efficient cash management.

In conclusion, cash management services offered by banks play a crucial role in optimizing financial operations, improving cash flow, and enhancing overall financial performance. By leveraging these services, businesses can achieve greater financial stability, reduce risk, increase efficiency, and make strategic decisions to drive growth and success in today’s dynamic business landscape.