Home>Finance>What Federal Banking Regulation Prohibits Depositing Cash Into An Account Not In Your Name?

Finance

What Federal Banking Regulation Prohibits Depositing Cash Into An Account Not In Your Name?

Modified: December 30, 2023

Discover the federal banking regulation that restricts the deposit of cash into accounts not owned by you. Unlock key insights into the world of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Federal banking regulations play a crucial role in maintaining the integrity and security of the financial system in the United States. These regulations establish a framework that governs various aspects of banking, including account ownership and transactional practices. One such regulation pertains to the depositing of cash into an account not held in the depositor’s name.

With the rise of digital banking and the convenience it offers, it is important to understand the restrictions and guidelines imposed by federal banking regulations to ensure compliance and avoid potential penalties. This article will provide an overview of the regulation that prohibits depositing cash into an account not in the account holder’s name, explore the exceptions to this prohibition, discuss the penalties for non-compliance, and shed light on the impact of this regulation on financial institutions and their customers. Additionally, we will explore the compliance measures that both banks and account holders can take to navigate this regulation.

Understanding the intricacies of federal banking regulations is essential for individuals and businesses alike, as it enables them to make informed decisions while managing their financial affairs. By familiarizing ourselves with these regulations, we can navigate the banking system more effectively and ensure compliance with the laws governing the industry.

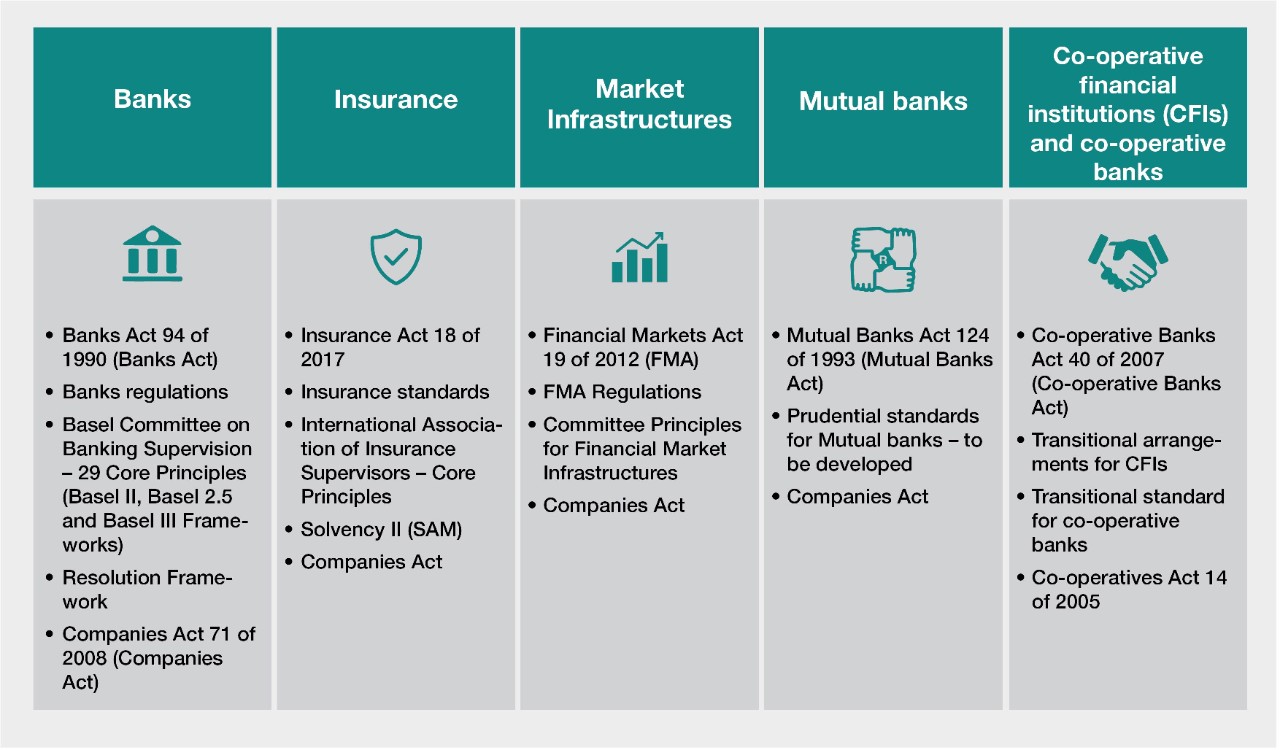

Overview of Federal Banking Regulation

Federal banking regulation refers to a set of laws, rules, and guidelines established by government agencies, such as the Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the Consumer Financial Protection Bureau (CFPB). These regulations are designed to safeguard the stability of the banking system, protect consumers, and promote fair and transparent financial practices.

The regulatory framework covers various aspects of banking, including capital requirements, risk management, consumer protection, anti-money laundering measures, and account ownership. While specific regulations may vary, depending on the country and jurisdiction, the focus of federal banking regulations remains consistent:

- Ensuring the safety and soundness of financial institutions: Banks are required to maintain adequate capital levels to withstand financial shocks and unexpected losses. This helps to protect depositors and maintain overall financial stability.

- Protecting consumer rights: Banking regulations aim to safeguard the interests of customers by enforcing fair lending practices, prohibiting discriminatory practices, and ensuring transparent disclosure of financial terms and conditions.

- Promoting financial transparency and integrity: Regulations help prevent money laundering, fraud, and illicit activities by imposing strict reporting and due diligence requirements on financial institutions.

- Maintaining market stability: Banking regulations include provisions to prevent excessive risk-taking, monitor systemic risks, and provide mechanisms for resolving financial crises.

These regulations are enforced through audits, examinations, and supervision conducted by regulatory agencies. Non-compliance with banking regulations can result in severe penalties, such as fines, regulatory restrictions, or even the revocation of banking licenses.

While federal banking regulations pertain to a wide range of activities, one specific restriction focuses on depositing cash into an account not in the depositor’s name. Understanding this prohibition is crucial to avoid unintended violations and to ensure compliance with the law.

Prohibition on Depositing Cash into an Account Not In Your Name

One important federal banking regulation that individuals must be aware of is the prohibition on depositing cash into an account that is not in their name. This restriction is in place to prevent money laundering, fraud, and other illegal activities.

Under this regulation, individuals are only allowed to deposit cash into an account that bears their name as either the primary account holder or a joint account holder. Depositing cash into an account held by another individual or entity can raise suspicions and potentially violate anti-money laundering laws.

The prohibition on depositing cash into an account not in your name applies to both personal and business accounts. It is essential to remember that the aim of this regulation is to promote transparency and accountability in the banking system and protect the integrity of financial transactions.

By strictly enforcing this prohibition, regulators can better trace the source of funds and identify any potential illicit activity. It also helps financial institutions fulfill their obligations under anti-money laundering laws by ensuring that deposits are appropriately tracked and attributed to the rightful account holder.

To comply with this regulation, individuals should ensure that cash deposits are made into an account bearing their name. If an individual wishes to deposit cash into someone else’s account, they should consider alternative methods such as writing a check or using an electronic funds transfer.

It is important to note that financial institutions are obligated to adhere to this prohibition as well. Banks and other financial service providers have stringent policies and procedures in place to detect and prevent unauthorized cash deposits into accounts that do not match the depositor’s name.

While the prohibition on depositing cash into an account not in the account holder’s name may inconvenience some individuals, it plays a crucial role in preserving the integrity of the financial system and protecting the interests of all stakeholders involved.

Exceptions to the Prohibition

While the federal banking regulation generally prohibits depositing cash into an account not in the depositor’s name, there are certain exceptions to this rule. These exceptions accommodate legitimate scenarios where individuals may need to make cash deposits into someone else’s account:

- Joint Accounts: In the case of joint accounts, where two or more individuals share ownership of the account, each account holder is allowed to make cash deposits into the joint account. This exception acknowledges the shared ownership and control of the account.

- Power of Attorney: If an individual holds a valid power of attorney (POA) for another person, they may be authorized to make cash deposits on behalf of the account holder. The POA document grants the designated individual the legal authority to act on behalf of the account holder in financial matters.

- Trust Accounts: Trust accounts, which are established for the benefit of a beneficiary, may allow cash deposits by individuals other than the primary account holder. However, the specific rules governing trust accounts can vary, so it is important to consult the terms of the trust and any applicable regulations.

- Cash Deposits as a Gift: In certain cases, individuals may make cash deposits into another person’s account as a gift. However, it is important to note that larger sums of money may trigger reporting requirements under anti-money laundering regulations.

It is crucial to understand that these exceptions are subject to specific conditions and may require documentation or authorization to ensure compliance. Financial institutions typically have policies in place to verify the validity of these exceptions and to prevent misuse or fraudulent transactions.

While these exceptions provide flexibility in certain situations, individuals should exercise caution and ensure that their actions align with the intended purpose of the exception. Unlawful activities, such as attempting to evade reporting requirements or disguising illicit funds as legitimate cash deposits, are strictly prohibited and can lead to severe legal consequences.

It is recommended to consult with a banking representative or legal professional to understand the specific requirements and procedures for making cash deposits under these exceptions.

Penalties for Violating the Regulation

Violation of the federal banking regulation that prohibits depositing cash into an account not in the depositor’s name can result in severe penalties for all parties involved. These penalties serve as a deterrent against illicit financial activities and help maintain the integrity of the banking system.

Financial institutions are responsible for monitoring and enforcing compliance with this regulation. They are required to implement robust systems and procedures to detect and prevent unauthorized cash deposits into accounts that do not match the depositor’s name. If a violation is identified, the financial institution is obligated to report the incident to the appropriate regulatory authorities.

Penalties for violation of the prohibition on depositing cash into an account not in your name can include:

- Financial Penalties: Violators may be subject to substantial financial penalties imposed by regulatory agencies. These penalties can range from fines levied against the account holder to monetary sanctions imposed on the financial institution that facilitated the unauthorized transaction.

- Legal Consequences: Violations of banking regulations can also result in legal consequences, including civil lawsuits or criminal charges. The severity of these consequences depends on the nature and extent of the violation.

- Loss of Banking Services: Financial institutions may choose to terminate their relationship with account holders found in violation of the regulations. This can result in the closure of accounts and the loss of access to banking services, which can have significant implications for individuals and businesses.

- Reputational Damage: Violations of banking regulations can tarnish an individual’s or a business’s reputation, leading to potential difficulties in obtaining credit, establishing new banking relationships, or securing business partnerships.

It is crucial to note that penalties may vary depending on the jurisdiction and the specific circumstances surrounding the violation. Regulatory agencies have the authority to determine the appropriate penalties based on the severity of the violation and the intent of the parties involved.

To ensure compliance and avoid penalties, individuals and businesses should familiarize themselves with banking regulations, maintain accurate financial records, and engage in transparent and lawful financial transactions.

Financial institutions also play a vital role in preventing violations of the regulation. By implementing robust compliance measures, conducting thorough due diligence, and fostering a culture of adherence to regulations, banks can protect themselves, their customers, and the overall stability of the financial system.

Impact on Financial Institutions and Customers

The prohibition on depositing cash into an account not in the depositor’s name has significant implications for both financial institutions and their customers. Understanding the impact of this regulation is crucial for all parties involved in the banking system.

For financial institutions, compliance with the regulation is essential to maintain their integrity and reputation. They are responsible for implementing robust anti-money laundering measures and monitoring transactions to identify any potential violations. Non-compliance can lead to severe penalties, legal consequences, and reputational damage. Additionally, financial institutions need to invest in technology and resources to enhance their systems and ensure efficient compliance with the regulation.

Customers, on the other hand, may experience changes in their banking experiences due to the regulation. Here are some potential impacts:

- Increased Scrutiny: Financial institutions may subject cash deposits to increased scrutiny to prevent unauthorized transactions. This may result in longer processing times for cash deposits and additional documentation requirements to verify the identity of the depositor.

- Limited Convenience: Customers may find it inconvenient to deposit cash into accounts not bearing their name. This can impact individuals who manage financial affairs for family members or use joint accounts for shared expenses. They may need to explore alternative methods, such as electronic transfers or checks, for these transactions.

- Enhanced Security: The regulation aims to enhance the security and transparency of financial transactions by minimizing the risk of fraudulent activities. This provides customers with greater confidence in the banking system and the assurance that their funds are being handled in a legal and accountable manner.

- Improved Anti-Money Laundering Measures: The prohibition on depositing cash into an account not in the depositor’s name helps financial institutions in their fight against money laundering and other illicit financial activities. This ensures that the banking system remains a safe and secure place for customers to conduct their financial transactions.

Overall, the impact of the regulation on financial institutions and customers is aimed at strengthening the integrity of the banking system and safeguarding against financial crimes. While it may introduce certain inconveniences, the regulation ultimately contributes to a more secure and trustworthy financial environment for all stakeholders.

Compliance Measures for Banks and Account Holders

To ensure compliance with the regulation that prohibits depositing cash into an account not in the depositor’s name, both financial institutions and account holders must take proactive measures. These compliance measures help maintain the integrity of the banking system and minimize the risk of fraudulent activities. Here are some recommended steps for banks and account holders:

Compliance Measures for Banks:

- Robust Monitoring Systems: Financial institutions should implement advanced monitoring systems to detect unauthorized cash deposits and suspicious transactions. These systems use data analytics and machine learning algorithms to identify patterns and anomalies that may signal potential violations.

- Employee Training and Education: Banks should ensure that their employees are well-trained on the regulations, including the prohibition on depositing cash into an account not in the depositor’s name. Regular training programs should be conducted to keep employees informed about the latest compliance requirements.

- Enhanced Customer Due Diligence: Financial institutions should conduct thorough due diligence when onboarding new customers and regularly review the information provided by existing account holders. This helps verify the identity of the account holder and mitigate the risk of fraud or money laundering.

- Notification and Reporting: Banks should have clear policies and procedures in place to promptly identify and report any potential violations of the regulation to the appropriate regulatory authorities. Timely reporting helps facilitate investigations and maintain the integrity of the financial system.

- Periodic Compliance Audits: Regular internal and external audits should be conducted to ensure adherence to the regulation and assess the effectiveness of the bank’s compliance program. These audits help identify any gaps or weaknesses in the compliance measures and facilitate timely corrective actions.

Compliance Measures for Account Holders:

- Understanding the Regulation: Account holders should familiarize themselves with the regulation that prohibits depositing cash into an account not in the depositor’s name. Awareness of the rules helps them make informed decisions and avoid unintentional violations.

- Alternative Deposit Methods: Account holders can explore alternative methods for making transfers or deposits, such as electronic funds transfers, mobile banking solutions, or issuing checks. Utilizing these methods can help ensure compliance with the regulation while providing flexible and convenient banking options.

- Maintaining Accurate Records: It is essential for account holders to maintain accurate and organized financial records. This includes documenting the source and purpose of funds, especially when making cash deposits into joint accounts or trust accounts to satisfy compliance requirements.

- Seeking Professional Advice: If account holders have any doubts or concerns about complying with the regulation, it is advisable to seek guidance from banking representatives or legal professionals who can provide accurate and up-to-date information.

By implementing these compliance measures, both banks and account holders can contribute to the overall integrity and transparency of the banking system, ensuring that financial transactions are conducted in a legal and accountable manner.

Conclusion

The regulation that prohibits depositing cash into an account not in the depositor’s name serves as an important safeguard in the banking system. It aims to prevent money laundering, fraud, and other illegal activities by ensuring transparency and accountability in financial transactions. Compliance with this regulation is crucial for both financial institutions and account holders to maintain the integrity of the banking system and mitigate the risk of fraudulent activities.

Financial institutions play a vital role in enforcing this regulation by implementing robust monitoring systems, conducting employee training, and enhancing customer due diligence. Adhering to compliance measures helps banks detect and prevent unauthorized cash deposits, facilitating the reporting of potential violations to regulatory authorities.

Account holders, too, must be aware of the regulation and take proactive steps to comply with its requirements. Understanding the prohibited practices and exploring alternative deposit methods can help account holders avoid unintended violations while ensuring smooth and convenient banking experiences.

The impact of this regulation on both financial institutions and customers is centered around the overarching goal of maintaining the integrity of the financial system. While it may introduce certain inconveniences, such as increased scrutiny and limited convenience for account holders, these measures are necessary to protect against illicit financial activities and maintain trust in the banking system.

By working together to comply with the regulation, financial institutions and account holders contribute to a more secure and transparent banking environment. Ongoing education, periodic audits, and open communication between banks and account holders are key to ensuring continued compliance and adapting to any changes in regulatory requirements.

In conclusion, the prohibition on depositing cash into an account not in the depositor’s name is a critical component of federal banking regulation. By adhering to this regulation, we contribute to a financial system that is fair, transparent, and accountable to all stakeholders.