Home>Finance>Notional Principal Amount: Definition, Calculations, Example

Finance

Notional Principal Amount: Definition, Calculations, Example

Published: January 2, 2024

Learn the Definition, Calculations, and Example of Notional Principal Amount in Finance. Master this key concept to navigate the world of finance effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Notional Principal Amount in Finance

When it comes to the world of finance, there are several complex concepts and terms to understand. One such term is the notional principal amount. In this article, we will explore what the notional principal amount is, how it is calculated, and provide a real-life example to help you grasp this concept more easily.

Key Takeaways:

- The notional principal amount represents the hypothetical amount of underlying assets or liabilities in a financial contract.

- It is used to calculate payments, interest, and other financial obligations associated with the contract.

Defining Notional Principal Amount

The notional principal amount, also known as the notional value or face value, is a notional or hypothetical amount used in financial contracts. It does not reflect the actual amount of money exchanged but serves as a reference to determine payments, interest, and other financial obligations.

Think of the notional principal amount as a benchmark or reference point for calculating the financial aspects of a contract. It provides a standardized measure and allows parties to determine their obligations and entitlements based on this notional amount.

Notional principal amounts are commonly used in various financial instruments, such as interest rate swaps, options, and futures contracts. These contracts establish the notional amount on which the financial terms are based, without the need for an actual exchange of the full principal.

Calculating Notional Principal Amount

The calculation of notional principal amount depends on the specific financial instrument or contract in question. Here are a few examples:

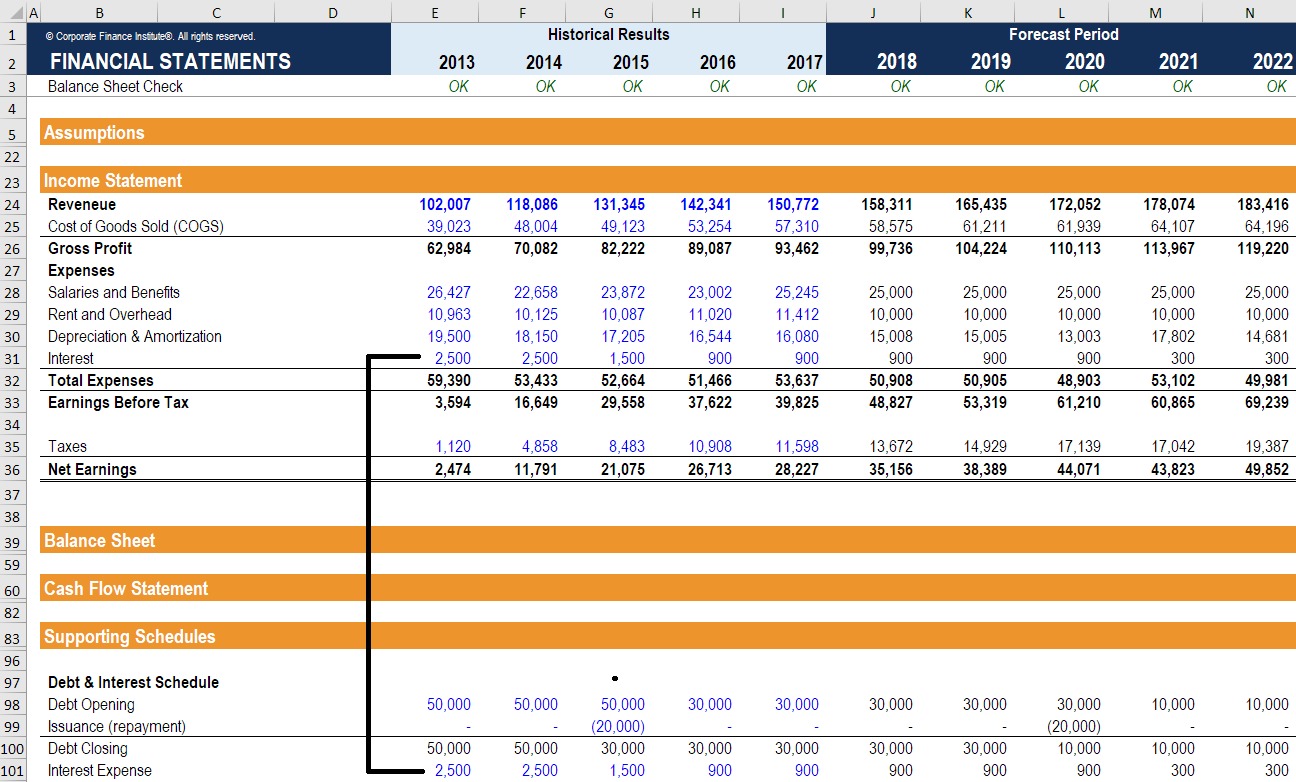

- Interest Rate Swaps: In an interest rate swap, two parties agree to exchange interest rate payments based on a notional principal amount. The notional principal amount is typically multiplied by an interest rate, and the payment obligations are calculated based on this result.

- Options Contracts: Options contracts provide the right to buy or sell an underlying asset at a predetermined price within a specified timeframe. The notional principal amount in options contracts represents the value of the underlying asset, and the contract’s financial aspects are based on this hypothetical value.

- Futures Contracts: Futures contracts involve buying or selling a specific asset at a future date. The notional principal amount in futures contracts determines the quantity or size of the asset being traded. The financial obligations and potential gains or losses are calculated based on this notional amount.

Example of Notional Principal Amount

Let’s consider an example:

Company X enters into an interest rate swap with Company Y. The notional principal amount agreed upon is $10 million. The interest rate agreed upon is 5%. Based on these terms, Company X would pay Company Y an amount calculated by multiplying the notional principal amount ($10 million) by the interest rate (5%). Thus, Company X would be obligated to pay Company Y $500,000 annually.

It’s important to note that no actual exchange of $10 million occurs in this scenario, but the notional principal amount serves as the basis for the calculation of payments.

Conclusion

The notional principal amount is a crucial concept in the world of finance. While it may seem complex at first, understanding its definition, calculation methods, and example can help demystify this concept. Whether you’re engaging in interest rate swaps, options contracts, or futures contracts, the notional principal amount provides a benchmark for calculating payments and obligations in financial contracts.

Key Takeaways:

- The notional principal amount represents the hypothetical amount of underlying assets or liabilities in a financial contract.

- It is used to calculate payments, interest, and other financial obligations associated with the contract.

By grasping the concept of notional principal amount, you can navigate the world of finance with greater confidence and understanding.