Home>Finance>Option Margin: Definition, Requirements, How To Calculate

Finance

Option Margin: Definition, Requirements, How To Calculate

Published: January 4, 2024

Learn all about option margin in finance: its definition, requirements, and how to calculate it.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Option Margin: Definition, Requirements, and How to Calculate

Welcome to our Finance category where we dive into the world of investments, trading, and all things related to money management. In this blog post, we will discuss an essential aspect of options trading – option margin. Whether you’re a seasoned investor or just starting to explore the world of trading options, understanding option margins is crucial. So, let’s delve right in!

Key Takeaways:

- Option margin is the collateral or security deposit required by a broker to cover potential losses.

- Option margin requirements vary based on the underlying asset, volatility, and your trading strategy.

What is Option Margin?

Option margin refers to the collateral or security deposit required by a broker to cover any potential losses that may occur during options trading. It acts as a safety net for both the investor and the broker, ensuring that there are sufficient funds available in case the market moves against the position.

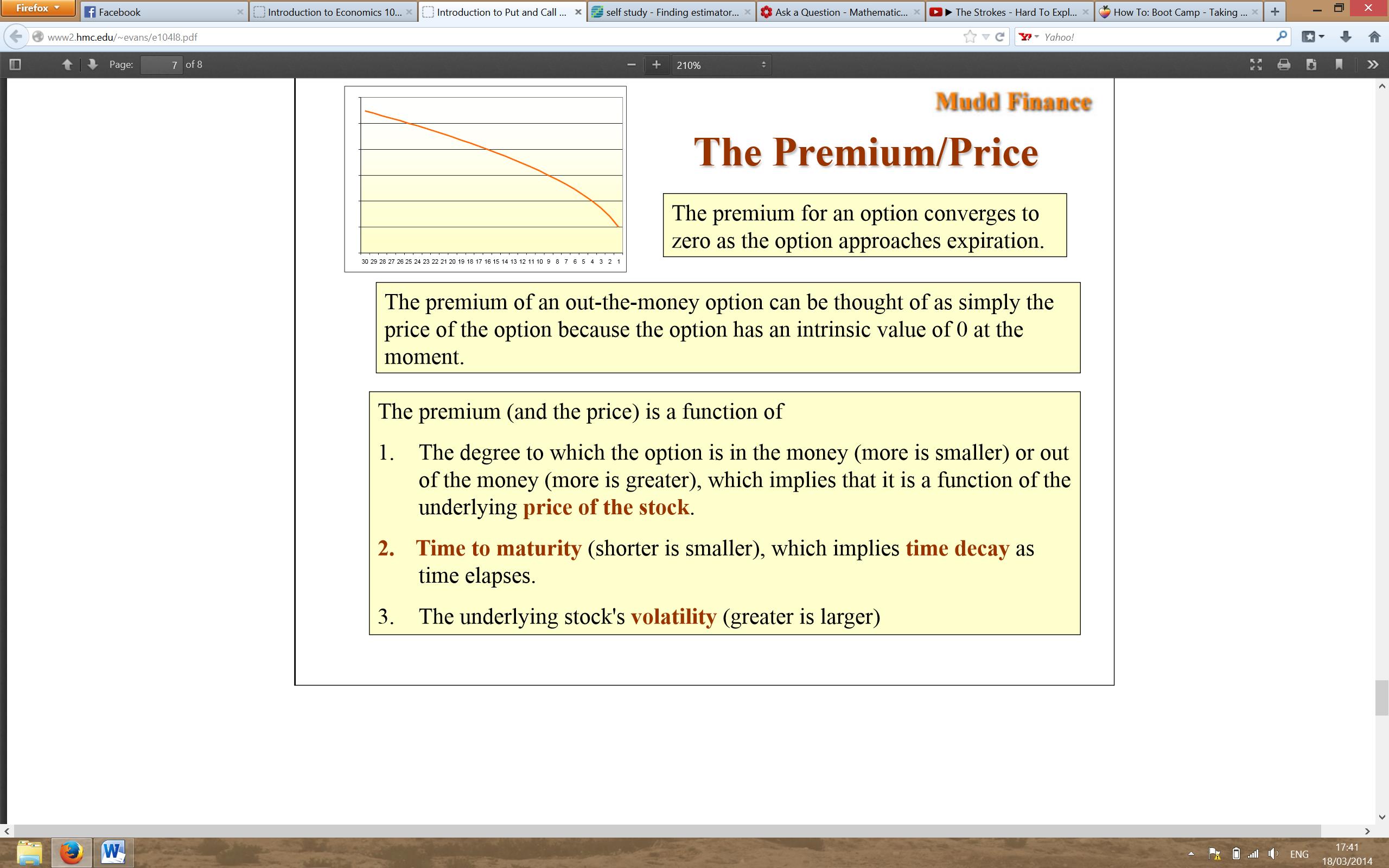

Option margin requirements are determined by factors such as the underlying asset, market volatility, and the trading strategy employed. By imposing margin requirements, brokers can protect themselves and their clients from excessive risk exposure.

Option Margin Requirements

The specific option margin requirements can vary based on multiple factors, such as:

- The underlying asset: Different assets exhibit varying levels of volatility and risk.

- Volatility: Higher market volatility may require higher margin requirements.

- Trading strategy: Certain strategies may involve higher risks, which may be reflected in the margin requirements.

It’s important to note that each brokerage firm may have its own specific margin requirements, so make sure to check with your broker for the exact details.

How to Calculate Option Margin

Calculating option margin is essential for understanding the amount of collateral required for a particular options trade. While the specific formula can be complex, here’s a simplified way to calculate option margin:

- Determine the underlying asset of the option.

- Identify the margin requirement percentage set by your broker.

- Multiply the underlying asset’s value by the margin requirement percentage.

- The result will give you the option margin, which represents the collateral required for the trade.

Remember to consult your broker’s guidelines and any applicable regulatory requirements when calculating option margins.

Final Thoughts

Understanding option margin is vital for any options trader. By knowing the definition, requirements, and how to calculate option margins, you can make informed decisions and manage your risk effectively in the fast-paced world of options trading.

Always stay up-to-date with the latest margin requirements from your broker and continuously monitor your positions to maintain sufficient margin coverage. Proper risk management is key to long-term success in options trading.

We hope this article has provided you with a clear understanding of option margin and its significance in options trading. If you have any questions or would like to learn more about any finance-related topics, feel free to explore our Finance category for more valuable insights!