Finance

Pro-Forma Earnings Definition

Published: January 12, 2024

Discover the definition of pro-forma earnings in finance. Gain a clear understanding of this important financial metric and its implications.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Pro-Forma Earnings: Unveiling the Veil of Financial Projections

Welcome to the world of finance, where numbers rule and projections drive decisions. In today’s blog post, we will delve into the concept of pro-forma earnings—what they are, why they matter, and how they can help you unlock the secrets behind financial projections. So, fasten your seatbelts and join us on this informative journey!

Key Takeaways:

- Pro-forma earnings are financial projections that exclude certain one-time or non-recurring charges, providing a clearer picture of a company’s ongoing profitability.

- Investors and analysts utilize pro-forma earnings to understand a company’s core operational performance without the noise and distortion caused by extraordinary events.

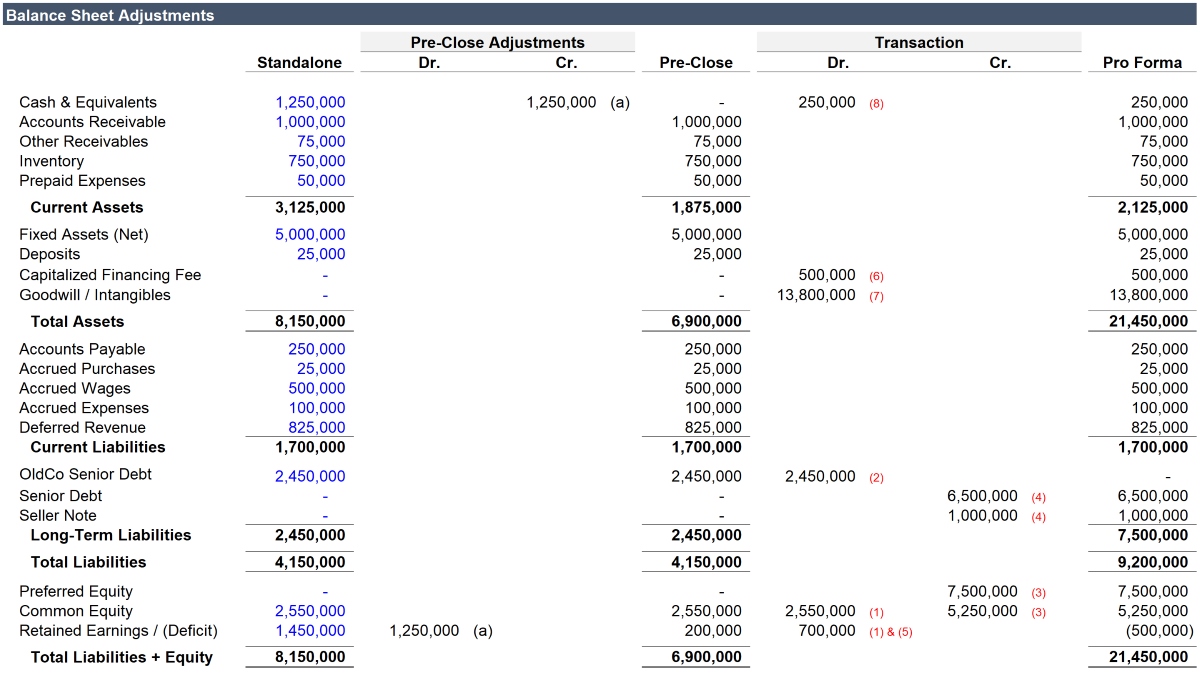

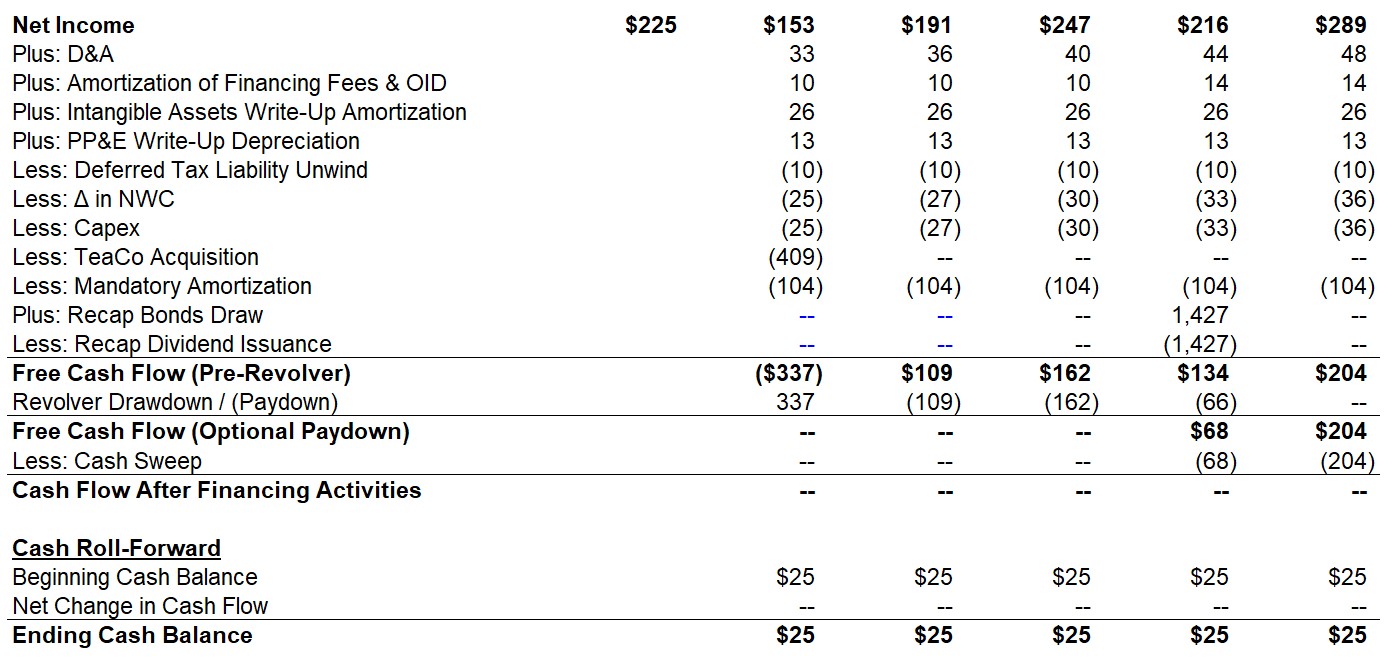

First things first, let’s tackle the fundamental question: What exactly are pro-forma earnings? In the realm of finance, pro-forma earnings refer to the financial performance of a company that excludes certain one-time or non-recurring charges. These charges can include items such as restructuring costs, legal settlements, or expenses related to mergers and acquisitions.

Why does this matter, you might ask? Well, traditional accounting methods can sometimes mask a company’s true ongoing profitability. By stripping away these one-time charges, pro-forma earnings provide a clearer and more accurate picture of a company’s core operational performance. This allows investors and analysts to better evaluate the health and future prospects of a business.

Now that we understand the essence of pro-forma earnings, let’s examine how they can benefit us:

1. Insight into Operational Performance:

Pro-forma earnings give us a valuable glimpse into a company’s underlying operational performance. By excluding one-time charges, these projections enable us to assess a company’s ongoing profitability and evaluate its ability to generate sustainable earnings.

2. Comparable Analysis:

Pro-forma earnings also serve as a basis for comparing companies within the same industry. By eliminating extraordinary events, they provide a level playing field and allow for a more accurate comparison of financial performance. This allows investors to make more informed decisions when choosing where to allocate their precious capital.

Understanding pro-forma earnings is essential for anyone involved in finance, whether you are an investor, analyst, or simply curious about how businesses operate. These financial projections empower us with the knowledge to make informed decisions and navigate the complex world of finance.

So, the next time you come across those intriguing pro-forma earnings figures, remember that they hold the key to unlocking the secrets behind financial projections, peering beyond the veil and revealing the true story of a company’s profitability.