Finance

How To Create A Pro Forma Balance Sheet

Modified: December 30, 2023

Learn how to create a pro forma balance sheet in finance with our comprehensive guide. Improve your financial planning and analysis skills today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Creating a pro forma balance sheet is an essential task for any business, whether you’re starting a new venture or analyzing the financial health of an existing company. A pro forma balance sheet is a projected financial statement that provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time.

Unlike a regular balance sheet, which reflects the actual financial position of a company, a pro forma balance sheet helps you forecast and plan for future financial scenarios. By projecting different assumptions and inputting estimated values, you can gain insights into how changes in revenue, expenses, and investments will impact your financial position.

Pro forma balance sheets are commonly used for a variety of purposes, such as securing funding from investors or lenders, evaluating the financial feasibility of a new project, or planning for mergers and acquisitions. They provide stakeholders with a clear picture of the financial viability and potential risks of a business initiative.

In this article, we will guide you through the process of creating a pro forma balance sheet. We will explain the importance of pro forma balance sheets, outline the steps involved in their creation, and provide tips for analyzing and interpreting the results. Whether you’re a business owner, investor, or financial professional, understanding how to create and interpret a pro forma balance sheet is crucial for making informed financial decisions.

What is a Pro Forma Balance Sheet?

A pro forma balance sheet is a financial statement that showcases a company’s projected financial position based on certain assumptions and estimates. It provides a snapshot of a business’s assets, liabilities, and equity at a specific point in time, but with the inclusion of future projections.

Unlike an actual balance sheet, which reflects the historical financial data of a company, a pro forma balance sheet is forward-looking and helps businesses plan for the future. It allows you to anticipate changes in your financial position and make informed decisions that will impact your business’s profitability and growth.

A pro forma balance sheet typically includes three main sections: assets, liabilities, and equity. The assets section represents what the company owns, including cash, accounts receivable, inventory, and fixed assets like buildings and equipment. The liabilities section represents what the company owes, such as accounts payable, loans, and other outstanding debts. Lastly, the equity section represents the shareholder’s investment in the business.

By using a pro forma balance sheet, you can forecast various financial scenarios and evaluate the impact of potential changes to your business. For example, you can project how an increase in sales or a decrease in expenses will affect your cash flow and overall financial performance. This allows you to plan strategically and make data-driven decisions to optimize your business’s financial health.

Pro forma balance sheets are commonly used in several business scenarios. Startups often rely on them to attract investors and secure funding by demonstrating the expected financial growth and profitability of their venture. Established companies may use pro forma balance sheets when considering expanding into new markets, acquiring other businesses, or making significant capital investments.

Overall, a pro forma balance sheet serves as a valuable tool for financial planning and analysis. It provides a glimpse into the potential financial outcomes for your business based on different assumptions and projections. By utilizing this financial statement, you can navigate uncertainties, mitigate risks, and make informed decisions to drive your business towards long-term success.

Importance of Pro Forma Balance Sheets

Pro forma balance sheets play a crucial role in financial planning and analysis for businesses of all sizes. They provide valuable insights and help stakeholders make informed decisions based on projected financial scenarios. Here are some key reasons why pro forma balance sheets are important:

1. Financial Forecasting: Pro forma balance sheets allow you to forecast the financial position of your business based on different assumptions and estimates. By projecting future revenue, expenses, and investments, you can anticipate potential changes in your cash flow, profitability, and overall financial health. This enables you to make strategic decisions and plan for the future.

2. Securing Funding: When seeking funding from investors or lenders, a pro forma balance sheet is essential for showcasing the financial viability of your business. It demonstrates your projected revenue, profitability, and ability to repay loans. Investors and lenders use pro forma balance sheets to assess the risks and potential returns of supporting your business.

3. Evaluating Business Initiatives: Whether you’re planning to expand into new markets, launch a new product, or acquire another company, a pro forma balance sheet helps assess the financial feasibility of these initiatives. By projecting the impact of these decisions on your assets, liabilities, and equity, you can analyze potential risks, returns, and long-term sustainability.

4. Budgeting and Resource Allocation: Pro forma balance sheets aid in budgeting and resource allocation decisions. By forecasting your financial position, you can allocate resources effectively, prioritize investments, and determine the optimal utilization of your company’s assets. This helps you make efficient use of available resources and increase profitability.

5. Mergers and Acquisitions: In mergers and acquisitions, pro forma balance sheets are used to evaluate the financial impact of combining two businesses. By projecting the consolidated financial position, stakeholders can assess the synergies, potential risks, and expected returns of the transaction. Pro forma balance sheets help in negotiating deal terms and determining the fair value of the acquisition.

Overall, pro forma balance sheets provide a forward-looking perspective on the financial health of a business. They enable stakeholders to understand the potential outcomes of different scenarios and make informed decisions to drive growth and profitability. By using these financial projections, businesses can navigate uncertainties, identify opportunities, and ensure long-term financial sustainability.

Step 1: Gathering Financial Data

The first step in creating a pro forma balance sheet is to gather the necessary financial data. This includes both historical financial information and projected data for the future. Here are the key tasks involved in this step:

1. Collect Historical Financial Statements: Start by gathering your company’s historical financial statements, including the balance sheets, income statements, and cash flow statements for the past few years. These statements provide a baseline for understanding your company’s financial performance and can serve as a reference for projecting future figures.

2. Analyze Historical Trends: Review the historical financial data to identify any patterns or trends. Look for fluctuations in revenue, expenses, and other key financial metrics. This analysis will help you make more accurate projections for the future and account for potential changes in your business’s financial position.

3. Estimate Revenue and Sales: Forecast your future revenue and sales based on market research, historical trends, and anticipated changes in your business environment. Consider factors such as customer demand, competition, pricing strategies, and market growth rates. These estimates will form the basis for projecting your future assets and liabilities.

4. Project Expenses: Estimate your future expenses, including operating costs, employee salaries, rent, utilities, and other overhead expenses. It’s important to be thorough and realistic when estimating expenses to ensure accurate financial projections.

5. Consider Capital Expenditures: Take into account any planned capital expenditures, such as investments in equipment, technology, or infrastructure. These investments will affect your asset values and depreciation expenses, so make sure to include them in your projections.

6. Factor in Debt and Financing: Consider any existing debt obligations and future financing needs. Include outstanding loans, interest payments, and any planned borrowings or investments. This will help you accurately determine your liabilities and equity.

7. Account for Other Changes: Take into consideration any other significant changes that may impact your financial position. These could include regulatory changes, new market opportunities, or upcoming contracts or agreements that will affect your revenue or expenses.

Gathering accurate and comprehensive financial data is crucial for creating a reliable pro forma balance sheet. Conduct thorough research, analyze historical trends, and engage with appropriate stakeholders such as your finance team or external advisors. By ensuring the accuracy and completeness of your financial data, you set a solid foundation for the subsequent steps in creating a pro forma balance sheet.

Step 2: Organizing Assets

Once you have gathered the necessary financial data, the next step in creating a pro forma balance sheet is to organize your assets. Assets represent what a company owns and can be classified into different categories. Here are the key tasks involved in this step:

1. Identify Current Assets: Begin by identifying your current assets, which are assets that are expected to be converted into cash or used up within a year. Common examples of current assets include cash, accounts receivable, inventory, and prepaid expenses. List these assets separately on your balance sheet.

2. Determine Non-current Assets: Non-current assets are assets that are not expected to be converted into cash within a year. These assets typically have a longer lifespan and include items such as property, plant, and equipment, intangible assets, and long-term investments. Classify these assets separately from current assets.

3. Assign Monetary Values: Assign monetary values to each asset category. For current assets, use the most recent financial data available. For non-current assets, consider factors such as depreciation, market value, and the estimated useful life of the asset. These values should reflect the assets’ fair market value or any other relevant valuation basis.

4. Include Accumulated Depreciation: If you have non-current assets that are subject to depreciation, include the accumulated depreciation amount for each asset. Accumulated depreciation represents the total depreciation recorded for an asset over its useful life. Deduct the accumulated depreciation from the original cost of the asset to arrive at its net book value.

5. Calculate Total Assets: Once you have organized and assigned monetary values to your assets, calculate the total assets by summing up the values of all asset categories. This total represents the company’s total worth in terms of its assets.

6. Maintain Accuracy and Consistency: It is crucial to ensure that your asset data is accurate and consistently reported. Verify the accuracy of the financial data, reconcile any discrepancies, and ensure that all assets are appropriately classified and valued. This will ensure the reliability and usefulness of your pro forma balance sheet.

Organizing your assets is a critical step in creating a pro forma balance sheet as it provides a comprehensive picture of what the company owns and its overall financial position. By accurately organizing and valuing your assets, you lay the foundation for the subsequent steps in creating a reliable and informative pro forma balance sheet.

Step 3: Calculating Liabilities

In the process of creating a pro forma balance sheet, determining and calculating liabilities is an essential step. Liabilities represent a company’s obligations and debts that are owed to external parties. Here are the key tasks involved in this step:

1. Identify Current Liabilities: Begin by identifying your current liabilities, which are obligations that are expected to be fulfilled within a year. Common examples of current liabilities include accounts payable, accrued expenses, short-term loans, and current portions of long-term debt. Separate these liabilities from non-current liabilities.

2. Determine Non-current Liabilities: Non-current liabilities are obligations that are not expected to be fulfilled within a year. They typically include long-term debt, deferred tax liabilities, and other long-term obligations. Classify these liabilities separately from the current liabilities.

3. Assign Monetary Values: Assign monetary values to each liability category based on the most recent financial data available. Consider any interest or fees associated with these liabilities and factor them into the monetary values. These values should represent the outstanding amounts owed to external parties.

4. Include Accrued Interest and Expenses: If you have any accrued interest or expenses that are related to your liabilities, include them in the respective liability category. Accrued interest represents the portion of interest that has accumulated but has not been paid yet, while accrued expenses include expenses that have been incurred but not yet paid.

5. Calculate Total Liabilities: Once you have organized and assigned monetary values to your liabilities, calculate the total liabilities by summing up the values of all liability categories. This total represents the company’s total obligations to external parties.

6. Ensure Accuracy and Completeness: It is crucial to ensure that your liability data is accurate and complete. Verify the accuracy of the financial data, reconcile any discrepancies, and ensure that all liabilities are appropriately classified and valued. This will enhance the reliability and usefulness of your pro forma balance sheet.

Calculating liabilities is a vital step in creating a pro forma balance sheet as it provides insights into a company’s financial obligations. Accurate and thorough calculation of liabilities ensures that your balance sheet accurately reflects your financial position and aids in making informed decisions for the future.

Step 4: Computing Equity

Computing equity is a critical step in creating a pro forma balance sheet. Equity represents the ownership interest in a company and is calculated by subtracting total liabilities from total assets. Here are the key tasks involved in this step:

1. Gather Shareholder’s Equity Information: Begin by gathering information about the shareholder’s equity from your financial statements. This includes the value of common stock, retained earnings, and any additional paid-in capital.

2. Calculate Common Stock: Determine the value of the company’s common stock by multiplying the number of outstanding common shares by the per-share value. This represents the initial investment made by shareholders in the company.

3. Determine Retained Earnings: Retained earnings represent the accumulated profits or losses of the company that have not been distributed to shareholders as dividends. It is calculated by adding the net income (or subtracting net losses) over the years and deducting any dividends paid to shareholders.

4. Include Additional Paid-in Capital: Additional paid-in capital represents the amount received from shareholders in excess of the par value of the common stock. It includes funds raised through stock offerings or direct investments. Add this amount to the shareholder’s equity.

5. Calculate Total Liabilities: Subtract the total liabilities, calculated in the previous step, from the total assets to determine the equity. This represents the portion of the company’s assets that is attributable to the shareholders.

6. Review and Verify: Review the computed equity to ensure accuracy and consistency with your financial statements. Double-check calculations and validate the figures against relevant documentation to avoid errors.

Computing equity is vital as it indicates the value that remains after all liabilities are accounted for. It represents the ownership stake of shareholders and provides insight into the financial health and value of the company.

By accurately computing equity, you can complete the financial picture presented in your pro forma balance sheet. This step ensures that your balance sheet reflects the company’s net worth and facilitates informed decision-making based on a comprehensive understanding of the company’s financial position.

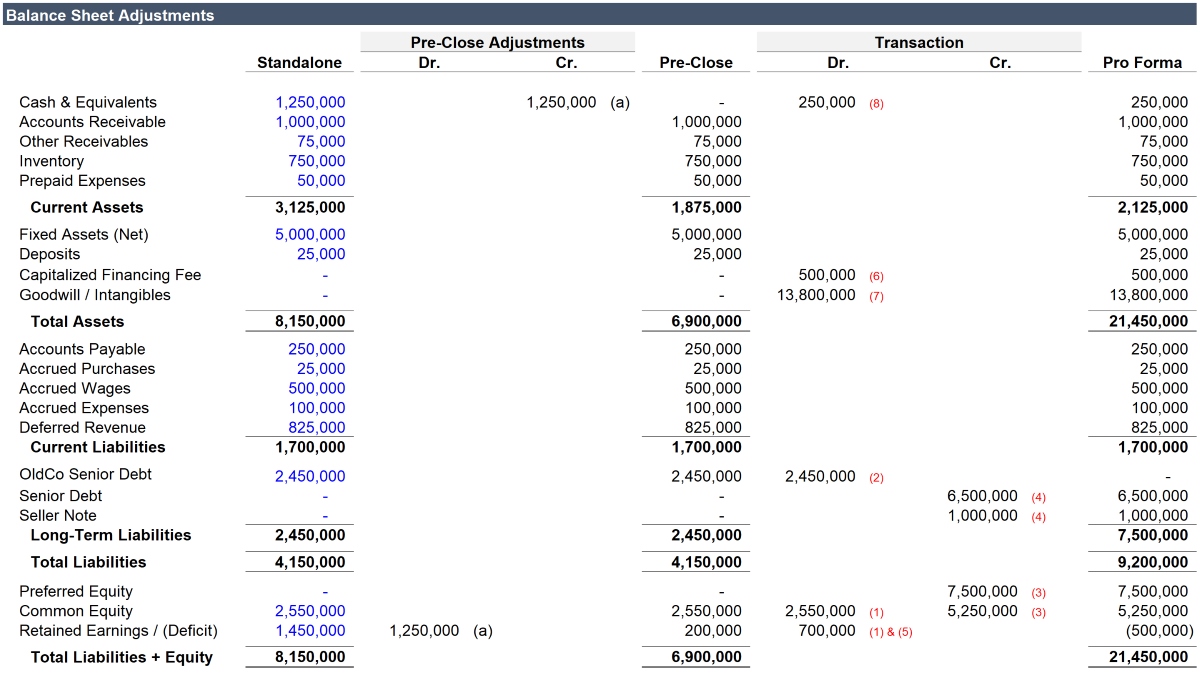

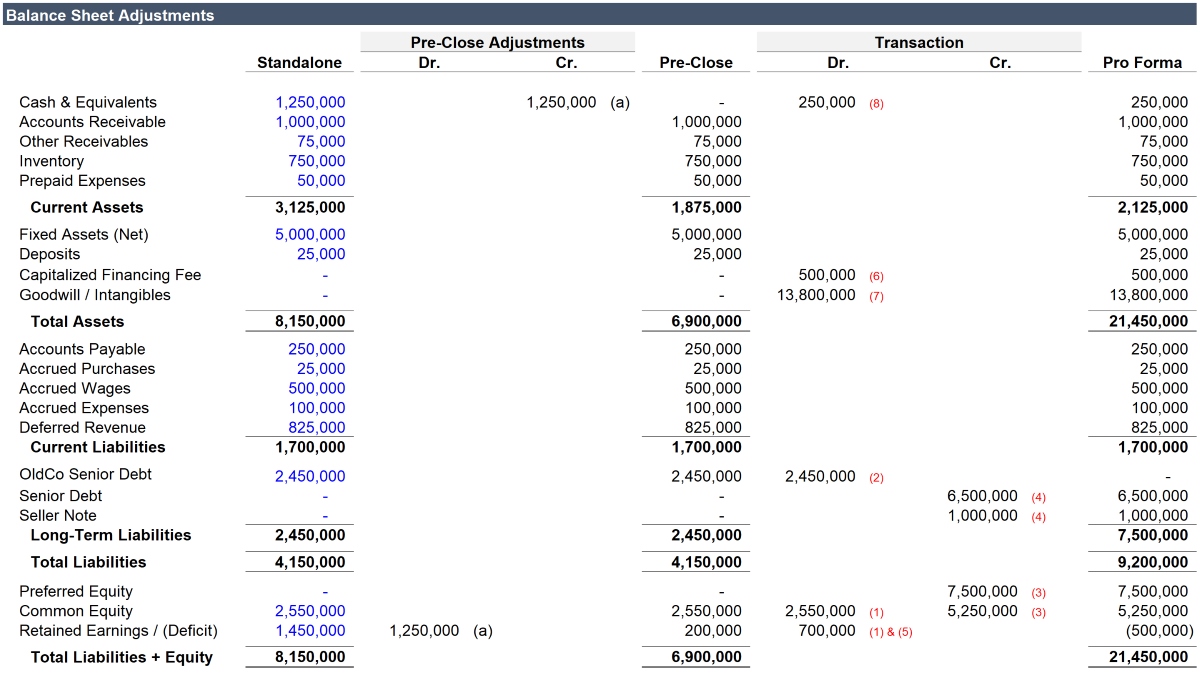

Step 5: Creating the Balance Sheet

Once you have gathered and organized the necessary financial data, calculated assets, liabilities, and equity, you are ready to create the pro forma balance sheet. The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. Here are the key tasks involved in creating the balance sheet:

1. Structure the Balance Sheet: Start by structuring the balance sheet with the appropriate headings, including assets, liabilities, and equity. This provides a clear framework for presenting the financial information.

2. List and Label Assets: Based on the values calculated in Step 2 (Organizing Assets), list all the asset categories in the assets section of the balance sheet. Include the monetary values assigned to each asset category.

3. List and Label Liabilities: Based on the values calculated in Step 3 (Calculating Liabilities), list the liability categories under the liabilities section of the balance sheet. Include the monetary values assigned to each liability category.

4. Include Shareholder’s Equity: Include the calculated equity value as a separate line item under the equity section of the balance sheet. This represents the ownership interest of shareholders and completes the financial picture.

5. Calculate Total Assets and Total Liabilities + Equity: Calculate the total value of assets by summing up all asset categories. Similarly, calculate the total value of liabilities + equity by summing up all liability categories and the equity value. Ensure that the equation Assets = Liabilities + Equity is balanced.

6. Format and Present: Format the balance sheet in a visually appealing and organized manner. Use clear headings, proper indentation, and consistent formatting to enhance readability. Consider using tables, graphs, or charts to present the information more effectively if necessary.

7. Proofread and Review: Before finalizing the balance sheet, proofread the content and review all the values and calculations. Ensure that the numbers are accurate, the formatting is consistent, and the balance sheet reflects the company’s projected financial position based on the provided data.

Creating the balance sheet is a crucial step as it consolidates and summarizes the financial information for stakeholders to evaluate. The balance sheet provides a snapshot of the company’s assets, liabilities, and equity, enabling stakeholders to assess its financial position.

By following this step-by-step process, you can create a comprehensive and reliable pro forma balance sheet that accurately represents your company’s projected financial condition.

Step 6: Analyzing the Pro Forma Balance Sheet

Once you have created the pro forma balance sheet, the next important step is to analyze the financial information it presents. Analyzing the balance sheet allows you to gain insights into the company’s financial health, identify trends, and make informed decisions. Here are the key aspects to consider when analyzing the pro forma balance sheet:

1. Liquidity: Assess the company’s liquidity position by examining the current assets and current liabilities. A higher ratio of current assets to current liabilities indicates better short-term liquidity. Evaluate whether the company has sufficient cash and other liquid assets to meet its short-term obligations.

2. Solvency: Evaluate the company’s solvency by analyzing the proportion of total assets financed by debt (liabilities). A lower debt-to-equity ratio suggests a stronger financial position and ability to repay debts. Consider the company’s ability to generate enough cash flow to service its debt obligations in the long term.

3. Financial Stability: Look at the composition of assets to assess the financial stability of the company. For example, a higher proportion of fixed assets compared to current assets indicates a more stable and asset-intensive business. Analyze the quality and value of the assets to determine their contribution to the company’s financial position.

4. Growth Opportunities: Analyze the equity section to understand the company’s growth potential and ability to generate positive returns for shareholders. Look for retained earnings and additional paid-in capital as indications of internal funding for future growth initiatives such as research and development, expansion, or acquisitions.

5. Ratios and Trends: Calculate and analyze key financial ratios such as the debt-to-equity ratio, return on assets (ROA), and return on equity (ROE). Compare these ratios to industry benchmarks or historical data to identify trends and assess the company’s performance. Ratios can provide insights into the company’s profitability, efficiency, and financial stability.

6. Sensitivity Analysis: Conduct sensitivity analysis by adjusting the assumptions underlying the pro forma balance sheet. Assess the impact of changes in variables such as sales growth, expenses, or interest rates on the company’s financial position. This analysis helps evaluate the resilience and flexibility of the company under different scenarios.

7. Compare Projections to Actual Results: Over time, compare the actual financial results to the pro forma balance sheet projections. This allows you to validate the accuracy of your assumptions and improve the accuracy of future pro forma projections. Identify any discrepancies or areas where adjustments may be necessary.

By analyzing the pro forma balance sheet, you can gain a comprehensive understanding of the company’s financial position, identify potential issues or areas of improvement, and make informed decisions to drive growth and profitability. Regular analysis of the balance sheet is crucial for financial planning, risk assessment, and overall financial management of the company.

Conclusion

Creating a pro forma balance sheet is a fundamental step in financial planning and analysis for businesses. It offers a projected snapshot of a company’s financial position and plays a crucial role in decision-making processes. By following the step-by-step process outlined in this article, you can effectively create a pro forma balance sheet that provides valuable insights into the projected financial health of your business.

The importance of pro forma balance sheets cannot be overstated. They enable you to forecast and plan for the future, secure funding, evaluate business initiatives, budget resources, and assess the financial impact of mergers and acquisitions. Pro forma balance sheets act as a powerful tool that aids in strategic decision-making by presenting a comprehensive view of a company’s assets, liabilities, and equity.

Each step in creating a pro forma balance sheet is critical. From gathering financial data and organizing assets to calculating liabilities and computing equity, attention to detail is vital. Accuracy and thoroughness are key throughout the process to ensure reliable and accurate projections.

Once the pro forma balance sheet is created, the analysis phase begins. Evaluating liquidity, solvency, financial stability, growth opportunities, ratios, and conducting sensitivity analysis allows you to interpret the projected financial position and make informed decisions. Regular monitoring and comparison of actual results to projections enable adjustments and improvements in future pro forma balance sheets.

In conclusion, mastering the creation of a pro forma balance sheet is a valuable skill for business owners, investors, and financial professionals alike. It empowers you to make data-driven decisions, plan for the future, and optimize the financial health and growth of your business.