Home>Finance>Residential Rental Property Definition, Tax Pros & Cons

Finance

Residential Rental Property Definition, Tax Pros & Cons

Modified: February 21, 2024

Learn about the definition and tax implications of residential rental property in finance. Discover the pros and cons of investing in this lucrative real estate opportunity.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Residential Rental Property: Definition, Tax Pros & Cons

Are you considering investing in residential rental property? If so, you’re probably wondering about the financial implications and tax benefits or drawbacks. In this blog post, we’ll dive into the world of residential rental property, exploring its definition, tax advantages, and potential disadvantages. By the end, you’ll have a clearer understanding of whether investing in residential rental property is the right choice for you.

Key Takeaways:

- Rental property can provide a consistent stream of income and potential tax advantages.

- Understanding the tax implications and potential drawbacks is crucial before investing in residential rental property.

What is Residential Rental Property?

Residential rental property refers to real estate that is purchased with the intention of generating income through rental payments from tenants. This property can include single-family homes, apartment complexes, condominiums, townhouses, and other dwellings used for residential purposes.

Investing in residential rental property can be an attractive option due to its potential for passive income and long-term financial stability. Whether you’re considering becoming a landlord or expanding your real estate portfolio, it’s essential to understand the tax implications and benefits associated with this type of investment.

The Tax Pros of Investing in Residential Rental Property:

1. Rental Income Tax Benefits

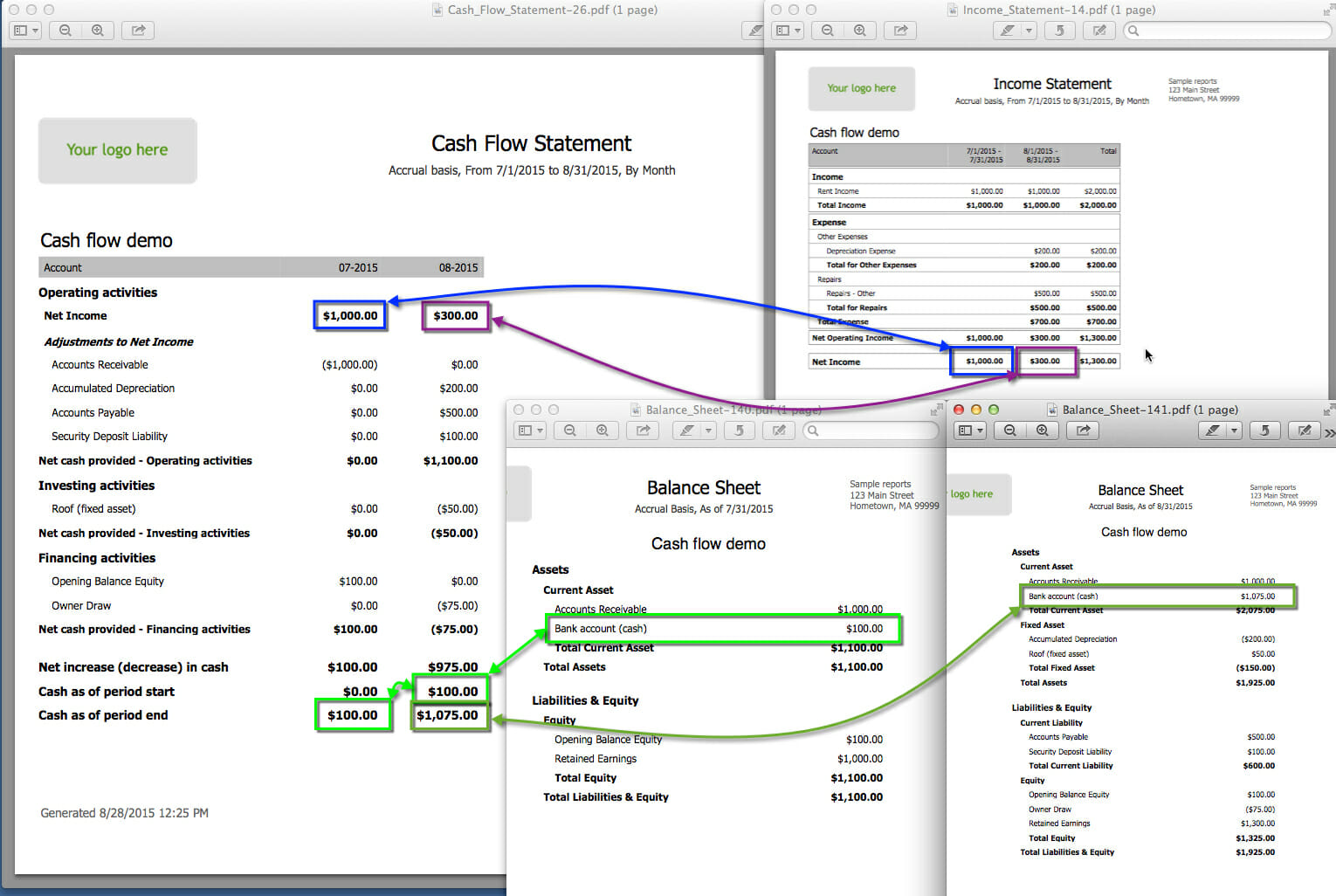

The primary advantage of owning residential rental property is the potential for consistent rental income. This income is subject to taxation but comes with various tax benefits, including:

- Tax deductions: As a landlord, you can deduct certain expenses related to your rental property, such as mortgage interest, property taxes, insurance premiums, property management fees, repairs, and maintenance costs.

- Depreciation: The value of your rental property can potentially depreciate over time, allowing you to deduct a portion of the property’s value as an annual expense on your tax return.

2. Capital Gains Tax Exemptions

If you decide to sell your residential rental property, you may be eligible for capital gains tax benefits under certain circumstances. The IRS allows for a tax exclusion of up to $250,000 in capital gains if you’re a single filer, or $500,000 for married couples filing jointly, provided that you meet specific ownership and occupancy requirements.

The Cons of Investing in Residential Rental Property:

1. Property Management Challenges

Managing a residential rental property can be time-consuming and challenging, especially if you have multiple tenants or properties. From dealing with maintenance requests to screening potential tenants, being a landlord requires commitment and organization. Consider whether you have the time or resources to handle these tasks or if hiring a property management company is a better option.

2. Market Volatility and Expenses

Investing in real estate comes with inherent risks, including market fluctuations and unexpected expenses. Economic downturns or changes in local housing markets can affect rental prices and occupancy rates, impacting your rental income. Additionally, unforeseen repairs, vacancies, or legal issues can strain your finances.

While investing in residential rental property can offer various tax advantages and the potential for steady income, it’s important to carefully evaluate the potential drawbacks and challenges. Seek advice from professionals, consider your financial situation, and conduct thorough research before making any investment decisions.

Ultimately, understanding the tax pros and cons of investing in residential rental property will help you determine if this type of investment aligns with your financial goals and risk tolerance.