Finance

When Will The IRS Accept 2017 Tax Returns?

Modified: March 1, 2024

Find out when the IRS will start accepting 2017 tax returns. Stay updated with the latest news in finance and get ahead of your tax filing deadlines.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Important Dates and Deadlines

- What to Expect for the 2017 Tax Season

- How to Prepare and File Your 2017 Tax Return

- Changes and Updates to Note for the 2017 Tax Year

- Common Mistakes to Avoid When Filing Your 2017 Tax Return

- Tips for Maximizing Your Tax Refund

- Frequently Asked Questions about the 2017 Tax Season

- Conclusion

Introduction

Welcome to the 2017 tax season! As we embark on another year of filing taxes, it’s important to stay informed about the key dates, changes, and updates from the Internal Revenue Service (IRS). Whether you are a taxpayer, accountant, or finance professional, staying up to date with the latest information will ensure a smooth and successful tax filing process.

The IRS plays a crucial role in collecting and administering federal taxes in the United States. Each year, taxpayers are required to file their tax returns, reporting their income and potential deductions, and settle any outstanding tax liabilities. The process can be complex, but with the right knowledge and preparation, it can be navigated with ease.

Understanding important dates and deadlines is essential to avoid penalties and maximize any potential refunds. In this article, we will discuss the key dates for filing 2017 tax returns, what to expect for the tax season, and provide tips for a successful filing.

So, get your tax documents ready and let’s dive into the details of the 2017 tax season!

Important Dates and Deadlines

Marking the 2017 tax season on your calendar is essential to ensure that you meet all the necessary deadlines and avoid any unnecessary penalties. Here are the key dates to keep in mind:

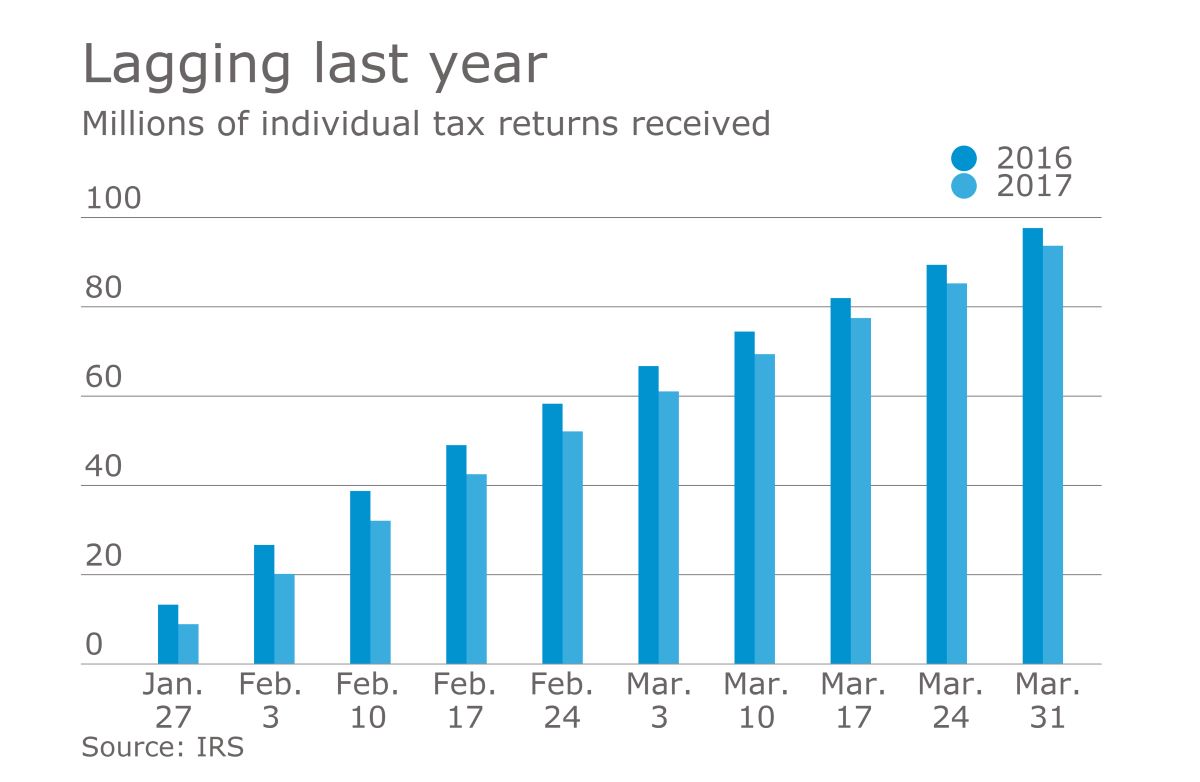

- January 23, 2018: The IRS begins accepting electronically filed tax returns for the 2017 tax year. This is when taxpayers can officially start submitting their returns.

- April 17, 2018: The deadline to file your 2017 tax return and pay any taxes owed. Normally April 15th is the due date, but since it falls on a Sunday in 2018 and April 16th is a holiday in Washington D.C., the deadline is pushed to the following Tuesday.

- October 15, 2018: This is the final deadline for taxpayers who filed for an extension. If you filed Form 4868 to request additional time, you must submit your completed tax return by this date.

It’s important to note that these dates apply to individual taxpayers filing their personal income tax returns. If you are a business owner or have special circumstances, consult IRS guidelines or consult with a tax professional to determine the specific filing deadlines applicable to your situation.

Missing the deadline can result in penalties and interest charges being assessed, so it’s crucial to file your tax return on time, even if you are unable to pay the full amount owed. The penalties for late filing can be quite steep, so it’s best to avoid them altogether.

Now that we have the key dates in mind, let’s explore what you can expect for the 2017 tax season.

What to Expect for the 2017 Tax Season

The 2017 tax season brings a few changes and updates that taxpayers should be aware of. Understanding these changes will help you navigate the filing process and avoid any potential mistakes. Here are a few key things to expect:

Tax Reform Impact: The Tax Cuts and Jobs Act, which was signed into law in December 2017, will have a significant impact on the 2017 tax season. While most of the changes will affect the 2018 tax year onwards, some changes will retroactively affect the 2017 tax returns. It’s important to stay informed about the new tax law and how it may impact your tax liability and deductions.

New Tax Brackets: The new tax law brings changes to the tax brackets and rates for individuals. The seven tax brackets remain, but the income ranges and rates have been adjusted. Make sure to review the updated tax brackets to determine which bracket you fall into for the 2017 tax year.

Simplified Form 1040: The IRS has introduced a simplified version of Form 1040 for the 2017 tax year. The new form will replace the previous Forms 1040A and 1040EZ. This consolidated form aims to streamline the tax filing process and make it easier for taxpayers to report their income and claim deductions.

Increased Standard Deductions: The standard deduction has been increased for the 2017 tax year. This means that more taxpayers may choose to take the standard deduction instead of itemizing their deductions. However, it’s important to evaluate whether itemizing your deductions will result in a higher tax benefit.

Health Insurance Requirement: The individual mandate, which requires individuals to have health insurance or pay a penalty, was repealed starting in 2019. However, it still applies for the 2017 tax year. Make sure to report your health insurance coverage on your tax return to avoid any penalties.

Increased Child Tax Credit: The child tax credit has been increased for the 2017 tax year. If you have dependent children, you may be eligible for a larger credit, which can help reduce your tax liability or even result in a refund.

It’s important to note that these are just a few highlights of what to expect for the 2017 tax season. It’s recommended to consult with a tax professional or review the official IRS resources to fully understand the changes and updates for the tax year.

Now that you know what to expect, let’s move on to how you can prepare and file your 2017 tax return.

How to Prepare and File Your 2017 Tax Return

Preparing and filing your 2017 tax return may seem like a daunting task, but with the right approach and organization, it can be a smooth process. Here are some steps to help you prepare and file your tax return:

Gather Your Documents: Start by gathering all the necessary documents, such as W-2 forms, 1099 forms, and any other income statements. Organize your records for deductions, such as receipts for medical expenses, charitable contributions, and mortgage interest payments.

Choose Your Filing Method: Decide whether you want to file your tax return electronically or by mail. E-filing is usually faster and more convenient, and it also reduces the risk of errors. You can choose to file through tax software, a tax professional, or the IRS Free File program if you meet the income requirements.

Use Tax Software or a Professional: If you are not familiar with tax laws or have complex financial situations, it may be beneficial to use tax software or consult a professional to ensure accuracy and optimize your tax benefits. Tax software can guide you through the process and help identify potential deductions and credits you might miss on your own.

Double-Check Your Information: Before submitting your tax return, carefully review all the information you entered. Ensure that your personal details, income, deductions, and credits are accurate and up to date. Double-checking can help avoid delays in processing and potential issues with the IRS.

Consider Direct Deposit: If you are entitled to a tax refund, opt for direct deposit. It is faster and more secure than receiving a paper check in the mail. Make sure to provide accurate bank account information to avoid any delays or errors in processing your refund.

File an Extension if Needed: If you are unable to file your tax return by the deadline, you can file for an extension using Form 4868. This will give you an additional six months to file your return, but be aware that any taxes owed still need to be paid by the original deadline to avoid penalties and interest.

Keep Copies of Your Tax Return: After filing, make sure to keep a copy of your tax return and all supporting documents for at least three years. This is important for reference purposes and in case you get audited or need to amend your return in the future.

Filing your tax return can be a detailed process, but by following these steps and staying organized, you’ll be well-prepared to complete your 2017 tax return accurately and on time.

Now that you know how to prepare and file your tax return, let’s explore some changes and updates to note for the 2017 tax year.

Changes and Updates to Note for the 2017 Tax Year

The 2017 tax year brings several changes and updates that taxpayers should be aware of as they prepare to file their tax returns. Staying informed about these changes will ensure that you are taking advantage of all available deductions, credits, and tax-saving opportunities. Here are some key changes to note:

Tax Cuts and Jobs Act: The Tax Cuts and Jobs Act, signed into law in December 2017, introduces various changes that will impact the 2017 tax year. These changes include revised tax brackets, increased standard deductions, and modifications to certain deductions, such as the elimination of personal exemptions. It’s important to review the new tax law and understand how it affects your specific tax situation.

Mandatory Health Coverage and the Individual Mandate Penalty: For the 2017 tax year, individuals are still required to have qualifying health coverage or pay a penalty, known as the individual mandate. Ensure that you report your health insurance coverage accurately on your tax return to avoid any penalties.

Increased Child Tax Credit: The Child Tax Credit has been expanded for the 2017 tax year. The maximum credit per qualifying child has increased to $2,000, and the income threshold has been increased, allowing more taxpayers to claim the credit. This can result in a lower tax liability or even a refundable credit if the credit exceeds your tax liability.

Changes to the Medical Expense Deduction: The threshold for deducting medical expenses has been temporarily reduced to 7.5% of your adjusted gross income (AGI) for the 2017 and 2018 tax years. This means that if your medical expenses exceed 7.5% of your AGI, you may be able to claim a deduction for the excess amount.

Revisions to Miscellaneous Itemized Deductions: Certain miscellaneous itemized deductions, such as unreimbursed employee expenses and investment expenses, have been temporarily suspended for the 2017 tax year. These deductions are no longer available, so it’s important to review your deductions carefully and adjust your tax planning accordingly.

Income Exclusion for Canceled Mortgage Debt: The provision that allowed for the exclusion of income from canceled mortgage debt on a principal residence expired at the end of 2016. Starting in the 2017 tax year, canceled mortgage debt may be taxable, unless an exception or exclusion applies.

Alternative Minimum Tax (AMT) Exemption Amounts: The AMT exemption amounts have increased for the 2017 tax year. This means that fewer taxpayers may be subject to the AMT, reducing their overall tax liability.

These are just a few of the changes and updates to be aware of for the 2017 tax year. It’s important to thoroughly review the IRS publications, consult a tax professional, or utilize tax software to ensure that you are taking advantage of all available deductions and credits while accurately complying with the new tax laws.

Now that you are aware of the changes, let’s discuss some common mistakes to avoid when filing your 2017 tax return.

Common Mistakes to Avoid When Filing Your 2017 Tax Return

Filing your tax return can be a complex and overwhelming process, but avoiding common mistakes can help you file accurately and minimize any potential issues with the IRS. Here are some common mistakes to watch out for when filing your 2017 tax return:

- Incorrect Social Security Numbers: Double-check that you enter your Social Security Number (SSN), as well as those of your dependents, correctly on your tax return. Entering incorrect SSNs can result in processing delays or even the rejection of your return.

- Math Errors: Carefully review all calculations to ensure accuracy. Simple math errors can lead to penalties or adjustments to your tax liability. Using tax software or consulting a tax professional can help minimize the risk of math errors.

- Incomplete or Missing Information: Failing to include all required information on your tax return can lead to delays and potential penalties. Ensure that you have filled out all necessary forms and schedules to report your income, deductions, and credits accurately.

- Forgetting to Sign and Date: An unsigned tax return is considered invalid. Remember to sign and date your tax return before submitting it to the IRS. If you are filing jointly, both spouses must sign the return.

- Choosing the Wrong Filing Status: Selecting the incorrect filing status can have significant consequences. Take the time to determine your correct filing status based on your marital status and other qualifying factors. Using the wrong filing status can result in errors in your tax liability calculation.

- Missing or Incorrect SSN for Dependents: Make sure you accurately report the Social Security Numbers of your dependents. When claiming dependents on your tax return, their SSNs must be provided to verify their eligibility for tax credits and deductions.

- Overlooking Deductions and Credits: Take the time to review all available deductions and credits. Many taxpayers miss out on potential tax savings by failing to claim all the deductions and credits they are eligible for. Research and consult with a tax professional to ensure you are maximizing your tax benefits.

- Incorrectly Reporting Income: Ensure that all sources of income, including wages, self-employment income, investment income, and other forms of income, are reported accurately. Failing to report all income can result in penalties and unwanted IRS attention.

- Not Filing a Required Tax Return: Even if you think you may not owe taxes, it’s important to check if you meet the filing requirements. Failing to file a required tax return can result in penalties and interest charges.

- Missing the Deadline: Filing your tax return after the deadline can result in penalties and interest charges. Make sure you are aware of the due date, and if you need additional time, file for an extension to avoid late filing penalties.

Avoiding these common mistakes can help ensure a smooth and accurate filing process for your 2017 tax return. Remember to review your return carefully before submission and seek assistance from tax professionals or tax software if needed.

Now that you are aware of the common mistakes to watch out for, let’s explore some tips for maximizing your tax refund.

Tips for Maximizing Your Tax Refund

Everyone wants to get the most out of their tax return and maximize their refund. Here are some tips to help you make the most of your tax situation and increase your chances of receiving a higher refund:

- Take Advantage of Deductions: Explore all available deductions that you may be eligible for, such as mortgage interest, state and local taxes, medical expenses, and student loan interest. By itemizing deductions, you may be able to reduce your taxable income and increase your refund.

- Utilize Tax Credits: Tax credits directly reduce your tax liability and can result in a higher refund. Research and determine if you qualify for any tax credits, like the Earned Income Tax Credit (EITC), Child Tax Credit, or American Opportunity Credit for education expenses.

- Contribute to Retirement Accounts: Making contributions to retirement accounts, such as a Traditional IRA or 401(k), can have dual benefits. Not only do you save for your future, but you may also qualify for a deduction or a tax credit, depending on your income level.

- Consider an HSA: If you have a high-deductible health plan, consider contributing to a Health Savings Account (HSA). Contributions to an HSA are tax-deductible, and the funds can be used for qualified medical expenses. This can reduce your taxable income and potentially increase your refund.

- Review Your Filing Status: Evaluate the different filing statuses to determine which one provides the most advantageous tax outcome for your situation. Consider changing your filing status if you recently experienced a major life event, such as marriage or divorce.

- Take Advantage of Education Tax Benefits: If you or your dependents are pursuing higher education, make sure to explore and utilize available education tax credits and deductions, such as the Lifetime Learning Credit or the Tuition and Fees Deduction. These can help offset education expenses and increase your refund.

- Don’t Forget About Miscellaneous Deductions: Although some miscellaneous deductions were suspended for the 2017 tax year, there are still some qualifying expenses that you can claim, such as unreimbursed job-related expenses and certain investment expenses. Keep records and receipts of these expenses to support your deductions.

- File for All Eligible Tax Years: If you have neglected to file past tax returns, make it a priority to file for those years. You may be entitled to refunds for those years, but the clock is ticking. File before the statute of limitations expires.

- Review and Amend Prior Returns: Take the time to review your past tax returns to ensure you didn’t miss any deductions or credits. If you find that you did, you may be able to file an amended return and potentially receive an additional refund.

- Consult with a Tax Professional: If you have a complex tax situation or are unsure about how to maximize your refund, consider consulting with a professional tax preparer. They can provide guidance and ensure that you are taking full advantage of all available tax benefits.

By implementing these tips, you can optimize your tax situation and increase the likelihood of receiving a higher tax refund. Remember to keep accurate records and consult with a tax professional if needed.

Now that you have some tips to maximize your refund, let’s address some frequently asked questions about the 2017 tax season.

Frequently Asked Questions about the 2017 Tax Season

As the 2017 tax season approaches, you may have questions about various aspects of filing your tax return. Here are answers to some frequently asked questions to help you navigate the tax filing process:

1. When is the deadline to file my 2017 tax return?

The deadline to file your 2017 tax return is April 17, 2018. This is a few days later than the usual April 15th due date, as it falls on a Sunday and the following Monday is a holiday in Washington D.C.

2. Can I file my tax return electronically?

Yes, you can file your tax return electronically through various methods. You can use tax software, the IRS Free File program if you meet the income requirements, or hire a tax professional who can e-file your return on your behalf.

3. I didn’t earn much in 2017. Do I still need to file a tax return?

Even if your income is below the filing threshold, it may still be beneficial to file a tax return. You may be eligible for tax credits or refunds, and failing to file could mean missing out on money owed to you.

4. Can I claim deductions if I take the standard deduction?

No, if you choose to take the standard deduction, you cannot itemize deductions. However, the standard deduction has been increased for the 2017 tax year, so it’s worth considering whether it provides a greater benefit than your potential itemized deductions.

5. My employer made a mistake on my W-2 form. What should I do?

If you notice an error on your W-2 form, contact your employer first to request a corrected version. If they refuse or do not respond, you can still file your tax return using the information you believe to be correct. If necessary, attach a statement explaining the discrepancy to your tax return.

6. What happens if I miss the deadline to file my tax return?

If you miss the deadline to file your tax return, you may be subject to penalties and interest charges. It’s best to file as soon as possible to minimize any potential penalties. If you need additional time to file, you can file an extension using Form 4868, but remember that any taxes owed still need to be paid by the original deadline.

7. Can I amend my 2017 tax return if I made a mistake?

Yes, you can amend your 2017 tax return if you made a mistake or need to make changes. File Form 1040X to amend a previously filed return. Be aware that you generally have three years from the original filing deadline to amend your return and claim a refund.

8. How long will it take to receive my tax refund?

The timeframe for receiving your tax refund can vary. If you file your return electronically and choose direct deposit, you can generally expect to receive your refund within three weeks. If you file a paper return, it may take up to six weeks.

9. Can I track the status of my tax refund?

Yes, you can track the status of your tax refund using the IRS’s “Where’s My Refund?” tool on their website. You will need to provide your Social Security Number, filing status, and the exact amount of your expected refund.

10. What should I do if I can’t afford to pay my taxes?

If you are unable to pay your taxes in full, it’s important to still file your tax return on time to avoid any late filing penalties. You can then explore payment options, such as an installment agreement, or consider submitting an offer in compromise if you qualify.

These answers should provide some clarity on common questions related to the 2017 tax season. However, it’s always a good idea to consult with a tax professional or refer to the official IRS resources for personalized advice and guidance.

Now that you have a better understanding of the frequently asked questions, let’s wrap up this article.

Conclusion

The 2017 tax season brings about important dates, changes, and updates that taxpayers need to be aware of. By understanding these key aspects and staying informed, you can navigate the filing process with confidence and ensure a successful tax return. From knowing the deadlines to being aware of changes in tax laws, each step is crucial in filing your 2017 tax return accurately.

Important dates such as the IRS accepting tax returns, the filing deadline, and extension deadlines should be marked on your calendar to avoid any penalties or late fees. Additionally, understanding changes is critical, especially with important updates like the Tax Cuts and Jobs Act, which impacts the 2017 tax year. Be aware of changes to tax brackets, deductions, and credits that you may qualify for.

Preparing and filing your 2017 tax return should be done accurately and diligently. Collect all necessary documents, determine the best filing method for you, and consider professional assistance if needed. Review your return for potential errors and double-check that all information is accurate before submitting it to the IRS.

To maximize your tax refund, take advantage of deductions, tax credits, and contributions to retirement accounts or HSAs. Consider consulting with a tax professional, especially if you have a complex tax situation or are unsure about available tax benefits.

By avoiding common mistakes when filing your tax return, you can save yourself from unnecessary penalties and delays. Check for errors such as incorrect Social Security Numbers, math mistakes, missing information, and choosing the wrong filing status.

Now that you have a better understanding of the 2017 tax season, including important dates, changes, and tips, you are well-equipped to tackle your tax return with confidence. Remember to consult with professionals or refer to official IRS resources for personalized advice as everyone’s tax situation is unique.

So gather your tax documents, double-check your calculations, and file your 2017 tax return accurately and on time. Good luck and here’s to a successful tax season!